What is a Bad credit score? It is a question that defines your debt payment capability to a lender. Moreover, you may know that this is the chance where you have to work on yourself. It indicates your mistakes made in the past while dealing with the potential lender. However, the next one can help you generate the maximum points for your account.

The complete article relates to the aspects of the words relevant to bad credit scores, the elements, and loan issues with it. Let’s join the borrowers’ guide.

What is a Bad Credit Score?

A bad credit score is a somewhat sad story because you have to adjust more than compared to the good or excellent credit scores of many Americans. Let’s see it in numbers. 580 to 669 are scores, making many US citizens worried about their future financial goals getting fulfilled via loans. It shows that if at the current time, you go to a lender, it may reject your loan application. It is because of the bad credit score recorded on your name from the FICO (Indulge in credit scoring services).

The difficulty increases when you get the chance for loan approval from some online fintech. Yet they charge high APR. Traditional banks and credit unions will not deal with you with this credit score. However, the third option will work for you but give an undeniable pain for finishing the term of the loan. The below standard score reflection is evidence for the lender that you are not a responsible person for debt payments in the past.

And it will or can continue in the coming future.

A person or a company (Both) can face neglect from the money lender or the credit card issuer. It is the answer to What is considered bad credit? Risk is with both secured and unsecured loans for bad scores.

Who Calculates Your Credit Score?

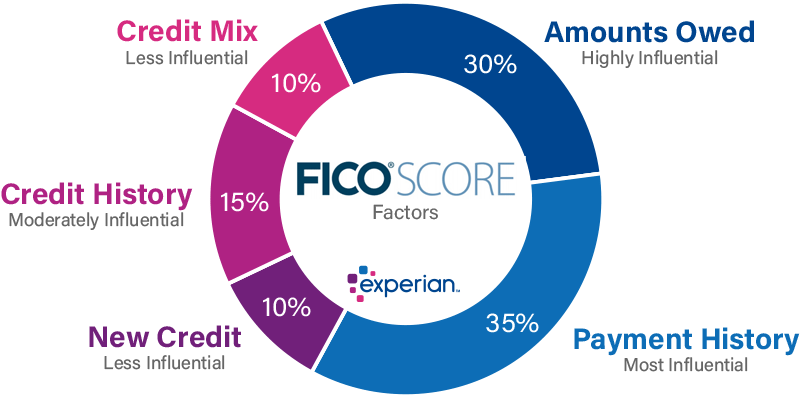

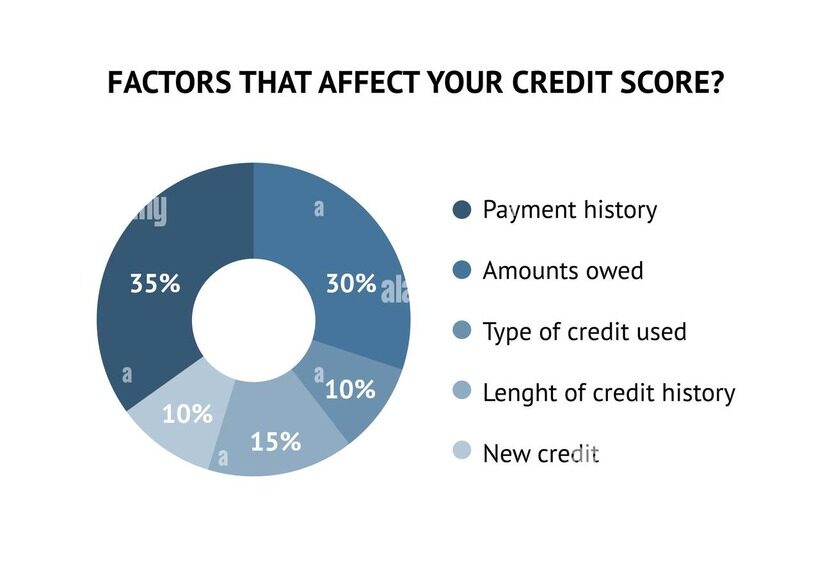

These are divided into two parts. First is credit bureaus, and the second is Credit scoring models. Five factors work for these two credit scoring service providers or bureaus. They take details from the lenders and put them together to understand the exact figure of your financial lifestyle or debt repayment system. These scores, in return, are practical for the lender’s final decision regarding the borrowers’ loan amount demands.

One can understand the bad credit with the file existing in your name. The three major credit bureaus (Equifax, Experian, TransUnion) keep different credit files. In that file, they mention how much money you have taken from the lender or credit card amount, the payment timetable, credit types, and multiple loans. Your good or bad starts from your payment capability and the response provided by your lender to these credit bureaus.

Furthermore, the FICO and VantageScore are two credit-scoring models that manage and control your credit score on different levels. Though these five bureaus and models work on similar aspects your good or what is considered bad credit varies.

Five Major Elements to Calculate Credit Score

- Payment History:- The Payments history of a borrower covers about 35% to calculate a credit score. It is the most weightage part of the credit score calculation. The credit bureau or models definitely add a delinquent period to this scoring process. How much money haven’t you paid or since what time? Credit card payments are also there in this percentage.

- Total Amount Owed:- What amount one owes includes several loan types, like home loans, car loans, credit cards, mortgages, bill payments, and payday loans. Not just that, even the court judgment is also part of this 30% calculation. Moreover, credit limit utilization (over 20-30%) is also responsible for your what’s poor credit score.

- Credit History Length: How long one has survived with the credit amount is responsible for the 15% of good or bad credit score. The success will raise the rate higher, and the oldest opened credit card will be a plus for the credit card holder.

- Credit Types Mix- How responsibly you handle all your debt types benefits 10% in the credit score calculation. If you haven’t missed any loan repayments and timely managed them, your creditworthiness will increase before money lenders.

- New Credit: New credit adds 10% to your credit file. It shows that you have applied for the new credit somewhere & what was the response to the hard inquiry? A borrower should be aware of this factor because- as many times you apply for the loan, it saves in the credit file and results in a poor or bad credit score.

However, they are not constant. The scores change with time and your debt repayment performance. You can start from various stages even though you are less than other Americans.

Factors Affecting the Credit Scores

Some small and big factors are responsible for bad or poor credit scores. Let’s consider some of them to give a clear picture of your difficult financial life.

- Late or Missed Payments: It is clear from the above content that payment history is responsible for 35% of the score calculation. That is why a borrower should consider this factor carefully because- according to FICO- 30 days late/missed payment leaves a negative effect.

- Credit Limit Utilization– Many borrowers think- to have enough to spend on necessities. However, they forget that all five credit bureaus and credit score models notice the credit utilization from your side. Bureaus and models suggest using less than 30% of the credit or 10% even better. Excess of 30% affects the credit score or drops less than 669.

- New Credit: New credit adds or subtracts 10% from the credit score. It is always a better idea- not to apply for several loans in a short time. That shows you don’t have a good source of income. So you apply for a loan for every need. The dire financial situation will affect the credit score.

- Address Changes: One is changing the addresses repeatedly and witnessing the instability in life. If; she is not staying in one place! He/she is not serious about their career and income growth and does not deserve a good amount of loan.

- Multiple Debts: Multiple debts include a weighting amount of credit, and when someone goes to the lender for the amount means! It is already a burden. Maybe you can be a defaulter.

- Defaulter: A defaulter is responsible for a bad credit score. Some statements like foreclosure/Charge-Offs/Settled Accounts/Bankruptcy are a harsh reality of your financial life and debt repayment history.

Consequences of Bad Credit Score

The credit score is a three-digit statement revealed by the major credit bureau agencies of America. FICO, VantageScore, Experian, Equifax, and TransUnion. The scorecard starts from 300 and Finishes at 850. One can take 300-579 as very poor, 580-669 as Fair, 670-739 as good, 740-799 as very good, and 800-850 as Exceptional. Good exceptions don’t require discussion. The consequences of bad credit scores are hard to face.

- An American citizen can not get a loan at competitive rates. It cannot negotiate with different lenders because it hasn’t managed its past debts well. Moreover, if it really needs cash to survive the financial crisis, it will have to pay higher interest rates than others.

- Furthermore, the interest rate is not the only one haunting you for bad credit. The place you are willing to live can be in question. When you see rent accommodation, the landlord can ask you for your credit score to know whether you can pay the rent on time or not. Your past debt history should be clear because you may not be entitled to the desired place accommodation.

- The utility bills will have to be paid in advance because no service provider will trust you. Whether; it is – grocery bills, telephone bills, water bills, rent, home appliances, and more. A deposit will be in demand and troublesome for you.

- That will be disheartening to listen to the job because of a bad credit score. Your employer may not trust you with a lower grade in debt payments.

Frequently Asked Questions (FAQs)

Q.1 Is 600 a bad credit score?

Yes, 600 is a bad credit score in the eyes of various major credit bureaus and models. They add several elements to calculate this final score for an individual.

Q2. Can I get a loan if my credit score is low?

Yes, you can take a loan even though you have a bad or poor credit score. However, a high-rate interest amount can be imposed on you.

The Final Verdict

Good finance is the key to driving your life cycle peacefully. Every time you try to move further, your past debt history makes you worry. Don’t take the stress and find ways to not ask the same question again and again- What is a bad credit score? With us, no more bad credits but it is time to take on your life with some good credits now.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders