Borrowing money through Cash App is a convenient and fast way to easily access the additional funds you need. It’s important to have a well-thought out plan before moving forward with taking out a loan, but luckily Cash App makes the process straightforward and accessible. This article will provide you with step-by-step instructions to borrow money from Cash App to receive cash in as little as 24 hours. From opening your account, to repayment options and everything in between, this guide provides all the information you need for a successful loan request. With these instructions, you’ll be able to confidently secure extra funds when you need it the most.

Eligibility Criteria

Before we get started, It’s important to know what eligibility criteria you need to meet in order to take advantage of this service. Here’s a short overview of the requirements.

| Age Requirements | To borrow money from Cash App, you must be at least 18 years old. This is a legal requirement and cannot be waived or changed. |

| Bank Account | You must also have an active bank account to borrow money from Cash App. Your loan amount will be deposited directly into your account, so having one is essential for this service. |

| Loan Amount & Interest Rate | The maximum loan amount available through Cash App is $5,000 and the interest rate is 12%. Depending on your creditworthiness and other factors, you may be eligible for lower rates. |

How to Borrow Money from Cash App?

Cash App is a popular digital payment platform that allows you to send and receive money quickly and easily. But did you know that you can also borrow money from Cash App? That’s right, with just a few taps on your phone, you can get the cash you need when you need it. If you have some urgent money requirements then you can take the help of this money-borrowing app as it allows you to borrow up to $200. You can follow the steps given below to borrow money from Cash App.

1. Download the Application

The first step in borrowing money from Cash App is downloading the application. If you haven’t already downloaded the app, then head to your device’s app store and search for “Cash App.” Once it’s downloaded, open it up and register yourself if you’re not already a user. If you are already registered, then log in using your existing credentials.

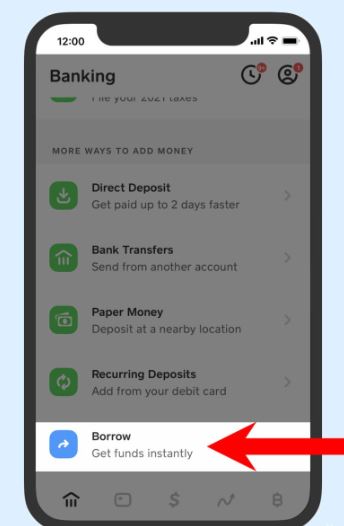

2. Tap on the Money Icon

Once you’ve logged into the Cash App, look for the money icon in the bottom left corner of your screen. This should be a dollar sign icon with an arrow pointing up—tap on it.

3. Look for the Borrow Money Option

On that page, look for a “borrow money” option and click on it. Once clicked, it will open up a window where you need to enter the amount of loan that you want from the cash app. It is important to note here that before entering the amount make sure that your credit score qualifies for availing loans from the cash app or not by checking its eligibility criteria beforehand.

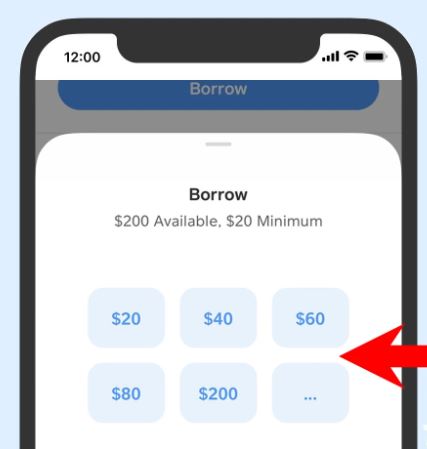

4. Enter the Amount

In this step, enter the amount of loan that you want from the cash app in order to get funds. Once done, hit confirm button and wait while the cash app calculates your credit score and other criteria as required by its eligibility criteria in order to qualify for getting loans approved by them or not.

5. Get the Fund

Once everything is done successfully, now all you need to do is wait until the cash app approves your loan request and gives you funds accordingly in your account which can be used as per requirement at any time later onwards with no extra charges whatsoever based upon terms & conditions applied over there while taking such kind of loan services offered by them only!

Though, we would like to tell you that this instant loan feature is not available to all Cash App users.

Can I Borrow Money from the Cash App?

We would like to tell you that this borrow money from Cash App feature is just a trial feature, and is not available to all the Cash App users. If you do not see this feature on your Cash App, it can be because of any of the following reasons:

- This feature is not available in the area of the U.S. where you live.

- Your credit score is low or bad.

- You are not an active Cash App user.

- You have not signed up for the direct deposit.

Cash App Features That Will Save You Money

Cash App is a popular mobile payment app that allows users to send, receive, and store money. But did you know that in addition to these features, Cash App also offers several unique perks that can help you save money? Here are some of Cash App’s most helpful features.

Cash App Card

The Cash Card is a Visa-sanctioned debit card that can be used anywhere Visa is accepted. What makes the Cash Card so great is that it offers greater control over your funds than a standard credit or debit card—you can easily monitor your spending, set budget limits, and even turn off the card if it’s ever lost or stolen. Plus, you get 1% cash back on all purchases made with the card. Till now, there are 13 Million+ Cash App card users.

ATM Access

If you have at least $300 directly deposited into your Cash App account each month, then you’ll be able to withdraw cash from any ATM using your Cash Card—all without paying any additional fees.

Cash Boost

With this feature, you can get “cash back” when making purchases with your Cash Card at participating coffee shops, restaurants, retail stores, etc. All you have to do is select the applicable promo code before checking out and you’ll instantly save some cash.

Direct Deposit

With direct deposit, you can easily receive up to $25K per deposit & up to $50K within 24 hours. As soon as direct deposits are received, the money is available for immediate use—no waiting around for days for your funds to clear.

How Does the Cash App Borrow Feature Work?

If you’re looking for a short-term loan, Cash App Borrow might be the perfect solution. It offers loans from $20 to $200 and allows users to pay them back over four weeks at a 5% flat fee. This fee is significantly lower than what’s typically offered by payday loans but still higher than the 36% APR limit for personal loans in most states. Let’s take a closer look at what you get with Cash App Borrow and how it works.

How Does It Work?

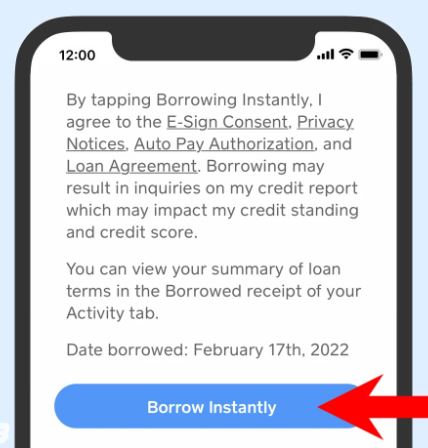

If you meet the eligibility criteria, all you need to do is open up the app and tap “Borrow” on the Cash Card tab. You can then select how much money you want to borrow (up to a maximum of $200) and review your terms of payment. Once everything looks good, just hit “Confirm Borrowing” and your loan will be sent directly to your Cash App balance within minutes.

When it comes time to make payments, they can be made directly from your Cash App balance or through an external bank account connected to your account. Keep in mind that if you don’t make a payment within four weeks of taking out the loan, you may be charged an additional 1.25% late fee per week until it’s paid off in full.

| Loan Amount Eligibility (Minimum) | $20 |

| Loan Amount Eligibility (Maximum) | $200 |

| Payment Timeline | 4 Weeks |

| Overall APR | 60% |

| Late Fees Interest | 1.25% Per Week |

Eligibility

Cash App Borrow is available only to U.S.-based customers who are 18 or older and have an active Cash App account in good standing for at least 90 days prior to requesting a loan. Additionally, prospective borrowers must have access to both direct deposit and bank transfer features on their accounts as well as valid government-issued identification numbers such as Social Security numbers (SSNs). For those who don’t meet these requirements, there are other options for taking out short-term loans such as traditional payday lenders or credit unions.

States Eligible With Cash App Borrow

Depending on your state of residence, you may be eligible for Cash App Borrows. The following states are eligible for Cash App borrowing:

| Alabama | California | Georgia | Idaho |

| Illinois | Indiana | Iowa | Kansas |

| Louisiana | Michigan | Mississippi | Missouri |

| North Carolina | Ohio | Tennessee | Texas |

| Utah | Virginia | Wisconsin |

Why Can’t I Borrow Money from a Cash App?

If you are not able to borrow money from a cash app then it might be because of certain things not running according to the demands of the app.

If you ever face such an issue then check the following things in your app :

- Sometimes the app only allows borrowing options in a certain area and you might be not residing in that area.

- If your account is running low on balance then your cash app would not allow you to borrow money.

- A glitch in the app might also cause this, so try updating it again.

- Your repayment history might also be one of the reasons that are causing you to not be able to borrow money.

Is Cash App Safe?

The Cash App, like its competitors Venmo and Zelle, is a popular way to pay for products and send money to friends, family, and co-workers. But how safe is it? Is your data secure when you use Cash App? Let’s take a look at what makes Cash App a safe platform.

Encryption of Data

Cash App encrypts all data in transit with industry-standard 128-bit encryption. All data stored on their servers is also encrypted. This means that only the intended recipient of your payment can view the information you sent them. In addition to this, Cash App can claim PCI-DSS level 1 certification. PCI stands for Payment Card Industry Data Security Standard, and this certification ensures that companies are taking the necessary steps to keep customer data secure.

Two-Factor Authentication

Another measure Cash App takes to protect customer data is two-factor authentication (2FA). With 2FA enabled, when you log in to your account from an unknown device or browser, you will be required to enter a code that will be sent to your phone number via SMS or voice call before you can access it. This adds an extra layer of security on top of your username and password so that no one can access your account without having access to both your username/password and physical phone number.

When Should I Borrow Money From Cash App?

You should only borrow money from Cash App if you need money now. Reasons being:

- You only get a loan of up to $200.

- You need to repay this loan within a month.

- This feature is not available for all Cash App users.

- The fees are high:- a 5% flat fee, and a 1.25% late fee.

If you need a bigger amount of loan, or you do not qualify for Cash App borrow money feature, then you can apply for a loan at other cash advance apps. Moreover, they have 44 million+ active monthly users which prove that they offer good services.

Risks Associated with Borrowing from Cash App

With the rise of fintech and payment apps, borrowing money is easier than ever. One popular app for borrowing is Cash App, which is used by millions of people around the world. But before you borrow from Cash App, there are some risks that you should be aware of. Let’s take a look at what those risks are so that you can make an informed decision about whether or not to borrow from Cash App.

Interest Rates

One of the primary risks associated with borrowing money through Cash App is interest rates. Depending on your credit score and other factors, you could end up paying a very high interest rate on your loan—sometimes as high as 20%. If you’re not diligent about making payments on time and in full each month, this interest rate can quickly add up and become unmanageable.

Late Payment Fees

Another risk associated with borrowing money through Cash App is late payment fees. If you fail to make your loan payments on time, you may be charged a late fee by the lender. These fees can range from $15 to $50 depending on the lender and the amount borrowed. Furthermore, if you fail to make multiple payments on time and in full, your credit score will suffer as a result, making it even more difficult for you to access loans in the future.

Privacy & Security Risks

When using Cash App, it’s important to be aware of privacy and security risks associated with sending your financial information over the internet. While Cash App does use encryption technology to protect its users’ data, there is still a potential risk of hacking or fraud when dealing with sensitive information online. Be sure to take extra steps like setting up two-factor authentication for added protection when using online services like this one.

Credit Score Implications

Finally, it’s important to understand that using a Cash App for borrowing money can have a negative impact on your credit score. When lenders check your credit score before approving a loan application, they will see any outstanding loans that have been taken out through Cash App and may decide not to approve your loan due to their concern over repayment risk. This means that if you take out multiple loans through Cash App in quick succession without paying them off quickly enough or missing payments altogether, it could significantly damage your credit score over time and make it harder for you to get approved for additional loans down the line.

Prepayment Penalty With Cash App

Cash App has made its personal loans accessible and affordable for everyone by not charging any prepayment penalty. This means that borrowers have the freedom to pay off their loans as soon as possible without worrying about additional fees. By being able to pay off the loan early, users can save money in interest payments since they won’t be charged any extra fees.

Also, Cash App also offers competitive rates on its loans which makes it easier for users to find an option that fits within their budget and repayment goals. The company also offers an array of payment options so that users can choose the best option for them based on their financial situation.

Borrow Money Easily If You Fail Cash App Eligibility

If you don’t qualify for Cash App due to credit or other financial issues, there are other options available. Read on to learn about four alternative ways to borrow money if you don’t qualify for the Cash App.

1. Personal Loans

One of the more popular alternatives to Cash App is taking out a personal loan from a bank or credit union. Before applying, make sure you know the terms of the loan and what kind of interest rate you’ll be charged. A personal loan can be an ideal solution if you need money quickly and have good credit since most lenders will approve your loan in as little as 24 hours and deposit the money directly into your account.

2. Cash Advances

Another option is to take out a cash advance from your credit card issuer. This type of loan allows you to access funds up to a certain amount against your available credit limit. The main benefit of cash advances is that they’re usually processed quickly and without any credit checks or lengthy paperwork. However, they also come with high-interest rates and could end up costing more in the long run than other loans.

3. Peer-to-Peer (P2P) Lending

P2P lending networks are another popular alternative for those who don’t qualify for Cash App. These networks match borrowers with investors who are willing to lend them money at competitive rates of interest. With P2P lending, borrowers can often get approved within hours, with funds being deposited into their accounts within days or even hours after approval. Moreover, as per a survey by OnePoll and Forbes Advisor, 47% of adults in America use Cash App and other such applications for bill payment, bill split, etc.

4. Credit Card Loans

If you already have a credit card, then you might want to consider using it to get the funds that you need instead of applying for another type of loan or cash advance. Credit cards usually come with much lower interest rates than other types of borrowing methods, so this could be a great way to save money in the long run while still getting access to the funds that you need right away.

Alternative Options

If you do not qualify for a Cash App loan then you get a loan from apps like:

-

Earnin

Earnin is a mobile app that allows users to access their earned wages in advance. When a user downloads the app, they are given the option to connect their bank account and provide their employment information. Once this information is provided, the user can access up to $100 of their wages per day without paying any interest or fees. The money is directly deposited into the user’s bank account within minutes.

To make sure that users are able to pay back what they borrow, Earnin will collect a “tip” from its users based on how much they borrowed and when they plan on returning it. For example, if a user borrows $100 and plans on returning it in two weeks, then Earnin will collect a tip of $10 from the user when they repay the loan. This helps ensure that users are able to make timely payments without incurring any additional costs or penalties for late repayment.

One of the biggest benefits of using Earnin is that there are no interest charges or hidden fees associated with borrowing through the app. This means that users can borrow money without worrying about having to pay back large amounts of interest over time. Additionally, since there is no credit check required when signing up for Earnin, anyone can use the app regardless of their credit score or history. This makes it ideal for those who may not have access to traditional forms of credit such as loans or lines of credit.

-

Dave

Dave is a budgeting app that allows users to set up an account and transfer money without any fees. The app also offers additional services like overdraft protection and early access to paychecks, as well as other features such as budget tracking, bill pay reminders, and more.

The biggest advantage of using Dave over CashApp is the lack of fees associated with the service. With CashApp, users can expect to pay fees when they send or receive money while with Dave there are no fees at all. This makes it much easier to track your expenses and budget accordingly without having to worry about hidden costs. Additionally, Dave offers its users early access to their paychecks before payday arrives so you don’t have to wait until their next paycheck arrives in order to get the funds they need right away.

Dave also offers an overdraft protection feature which can help protect against unexpected charges or accidental purchases when your bank account balance is low. Finally, the app also has built-in budget tracking tools which allow users to monitor their spending in real time so they can make better decisions about how they spend their money.

-

PayDaySay

If you’re looking for a CashApp alternative with more features and security, look no further than PayDaySay. Offering an easy-to-use platform with a comprehensive suite of tools, PayDaySay is an excellent choice for individuals and businesses who want a reliable payment solution. Let’s explore why PayDaySay is the perfect alternative to CashApp.

PayDaySay offers multiple payment options to help you get paid faster and easier. Our secure platform allows users to send payments via ACH transfers, debit cards, credit cards, eChecks, and more. Additionally, our mobile app allows users to accept payments on the go from anywhere in the world. You can also set up recurring payments for subscriptions or automatic bill pay.

The security of your financial information is a top priority for us at PayDaySay. We use advanced encryption technology and follow industry best practices for data protection and privacy compliance. We also have fraud protection measures in place to ensure that all transactions remain safe from any malicious activities. Plus, we are always monitoring our systems to ensure that they remain secure at all times.

PayDaySay offers advanced features that make it easy to manage your finances on our platform including invoicing tools, account reconciliation, financial reporting, and payroll processing services. Plus, you can access powerful analytics tools that will provide insights into how your business is performing financially so you can make informed decisions about how to grow your business in the future.

-

MoneyLion

If you’re in search of a money management app with no hidden fees or tricky strings attached, MoneyLion could be the perfect fit. This financial app is designed to help you save, manage, and invest your money all in one place. Read on to learn more about why it could be a great alternative to CashApp.

MoneyLion offers plenty of features that can help you make the most of your financial goals. It allows users to link their bank accounts and track their spending for free, so they always know where their money is going. The app also has automated savings and investing options that can help users grow their wealth over time. Plus, it has interest-free loan products that come with a 5% cash reward when you pay back the loan on time.

MoneyLion offers plenty of benefits that set it apart from other financial apps like CashApp. For starters, its automated savings and investing features are completely free—no hidden fees here! Additionally, MoneyLion provides personalized advice and tips based on your individual financial situation, so you can get the most out of your experience with the app. Lastly, the app has several bonus rewards programs designed to help users earn extra cash each month just for using the service.

-

CASHe

CASHe is an online payment platform that allows users to transfer money quickly and securely. It’s designed with convenience in mind – all you need is a bank account or debit card and the app itself. CASHe also offers its own virtual currency called “CASHEcoins” which can be used for transactions without exchanging actual currency.

One of the biggest benefits of using CASHe as your payment platform is its security features. All transactions are protected by end-to-end encryption technology which means that your data is safe and secure at all times. Additionally, there are no hidden fees or charges associated with using CASHe – you only pay what you use! Finally, it’s incredibly easy to set up an account with CASHe – all you need is your name, email address, and phone number.

Another great thing about CASHe is its versatile features. The app supports multiple currencies including USD, GBP, EUR, AUD, and more so you can easily make international payments without worrying about exchange rates or fees. You can also send money directly from your bank account as well as use the app’s own virtual currency – CASHEcoins – for transactions without transferring actual funds. Plus, with its built-in budgeting feature users can easily keep track of their spending habits without needing to manually track their expenses every month.

Cash App Scams | The Reality

Cash App scams are typically less common than payday loan scams, and in general, represent an area of financial services with relatively lower risks. The prevalence of cash app scams and other digital payment systems is limited, due to their reliance on accurate payment information, immediate transfer of funds, and secure platforms. Also, they generated $12.3 billion in revenue in 2021, so it is very clear that Cash App is genuine.

Moreover, when users are aware of the risk factors in using these services and how to recognize and avoid potential fraudulent activities, such as ransomware attempts or phishing schemes, they are even better equipped to make informed decisions about their money management habits. As digital payment solutions like Cash App continue to gain more widespread adoption among consumers, there is greater confidence that these services will remain secure for the long term.

Frequently Asked Questions (FAQs)

Q1. Why don’t I have the borrow option on the cash app?

Cash app is one of the leading money lending apps that allows the user to borrow money. But if you are facing problems in reaching the borrow option on the app, it might be a glitch due to the following reasons:

- You might be running negative on balance.

- Violations of terms and conditions of the app.

- The app needs to be updated.

- Inappropriate residential address.

Q2. Can you borrow money from the cash app?

Yes, you can definitely borrow money from Cash App. You just need to download the app and then you will have to register yourself and fill in the required details. Once you are done with all this, you can apply for a loan. The loan amount will deposit in your account within 1 to 2 business days. But if you need a bigger loan like 3000 Dollar loan or a $1000 loan then you will have to look for other options, because this app only provides a loan of $200.

Q3. Can anyone apply for the borrow feature on Cash App?

Yes. If you have a good credit score and you need a small amount of money then there are several options for you. You can apply for the borrow feature on any of the borrow money apps. But if you do not have a good credit score then you have limited options, and you will also have to pay high interest on them.

Q4. Why can’t I borrow money from Cash App?

There can be many reasons why you cannot borrow money from a cash app, but the most obvious one is that you have bad credit. You can talk to the customer support of the cash app and they will tell you, why they rejected your loan request.

Q5. How much can I apply with Cash App borrow feature?

Cash App provides a maximum of $200 loan, so you can only apply for a loan of $200. If you need a bigger loan then you will have to look for alternative options.

Q6. Is Cash App borrow loan feature safe?

Yes, Cash App is totally safe, and you can take loans from it.

- Cash App passes the PCI Data Security Standards which are considered the strongest security standards for any financial institution.

Q7. Does borrowing money from a Cash App help your credit?

It may add up to your credit score if you repay the loan on time.

Conclusion

If at any time, you need money now and don’t know what to do? Just simply get your hands on the Cash App to help yourself with such situations. Life is very unpredictable and so are the requirements of life, so it’s better to have some alternative options to save your days in need of many. If you need money desperately, borrowing money from Cash App can be your go-to option.

Currently, the Borrow money from Cash App is only available for selected users, but in the future, we can expect this feature to open for all the Cash App users.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders