A credit card is a bundle of responsibility, not a piece of cake after settling financial disputes or other due bills using it. Many credit card holders ignore this certitude while spending money via it. They don’t feel the requirement to ask themselves how to pay off credit card debt. But a time comes when they become stressed receiving so many calls and messages from the credit card issuers to pay off the debt.

Warren Buffet- “Chains of habit are too light to be felt until they are too heavy to be broken.” It fits the best for credit card holders.

However, you may still gain the power to settle the debt altogether and make yourself debt free. Let’s deal with the situation.

Some Facts About Credit Card

Before knowing the solution, let’s see some facts relevant and worrying conditions of Americans like you.

- The German proverb (He who is quick to borrow is slow to pay) is perfect for Americans in cases of Credit card Utilization. Out of a total of 332.4 million (3rd largest population in the world) population! About 170 million are vulnerable to credit cards.

- On average, an individual holds at least 1 credit card out of 170 million population.

- For not paying on time- the total pay off credit card debt in the US is about $887 Billion. Meanwhile, You should consider adding you- the average “American credit card debt” is $3,540.

- And the total statistics of credit cards in America is 549,870,000.

- Not just that, with an average of $1,613.11 credit card balance, about 51% of the population has acted to increase their credit balance because of COVID-19.

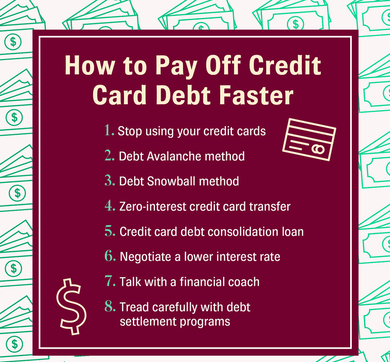

How to Pay Off Credit Card Debt Fast?

2.19 is the average number of adult credit cards, and 8.0 is the delinquency percentage after more than 90 days. Now you know that you are not the only parrot in the cage, it will be a little easier to accept the condition and act on it. Let’s figure out the steps to know the fastest way to pay off credit card debt.

- Make a plan and act on it because until one doesn’t know how much is in debt from its side, one can’t manage the scene.

- Stay at it and arrange money for the lowest one.

- Try to pay as much as the principal amount- to lower the simple or compound interest.

Best Way to Pay Off Credit Card Debt

Money-to-money dealing can resolve your issue in this condition. But that is your responsibility- to not include yourself in 29% of cardholders who are paying minimum or less than the required debt monthly. Once you dedicatedly calculate your extra income to the pocket of a creditor with a high-interest rate. You will also show dedication to the ways possible for a debt-slave-free lifestyle.

Debt Consolidation

Similar to pay off credit card debt, debt consolidation also demands the total amount calculation as debt so that you can apply for the loan. The merger will help make you ready for a personal loan that is a little bit light from the credit card load. Yes- a credit score is a feature point here because you may negotiate for yourself with a star mark.

Moreover, again your credit history, repayment capability, income source, and professional status will matter. Because- if that is not there, you can not fly like a free bird in the air with any money lender. However, after loan approval, a fixed interest rate will heal the wound caused by the non-timely repayment of credit cards.

On a noteworthy point, we can say that this is a chance where you can control your expenses and give relief to you faster with this debt consolidation loan too.

Points to Remember

- The process is easy because money lenders have eased the services. However, the origination fee is unignorably by several creditors.

- You can merge the credit into one amount, but it will take years to get relief from it.

- Credit score will decide the loan amount approval and monthly interest rate for the repayment. If; any drop is there in the credit score! Make a mindset to mend your credit history.

- Debt consolidation will not erase the image you have created in the past. It will take time for the amendments.

How to Pay Off Credit Card Debt with Balance Transfer?

A Citi Simplicity Card can help you with a balance transfer with a 0% interest rate for about one and a half years. However, one will pay five dollars for the balance transfer charges. The charges will vary according to the service provider. The minimum to the maximum percentage for the transfer fee is 3-5%. Still, it is ok. Because you will save enough with the lowest interest rate.

Helpful guide- Using 401k loan to pay off debt

Apart from that, with about 2-years of the no-interest rate grace period, one can save much to pay only the principal amount.

Start with the Minimum Amount

This method works best in most cases. How to pay off credit card debt should get answered with the suggested minimum amount settlement first. Because if you give excuses for paying heavy credit card money first, you can not settle anything for many years, even trying hard. Yes, the exception can be there when you suddenly get a high source of income and fix the issue immediately.

But that is a rare chance. Income growth also demands time, effort, and skills. With this high pressure on your mind, you cannot do such activities freely. You will initiate paying a credit card issuer first rather than investing in the skills. But that can also be a good option; if adopted smartly.

In the end, arrange the credit card amount in ascending order with their payment date to get out of the debt jailhouse.

Frequently Asked Questions (FAQs)

Q.1 Is it worth paying off credit card debt?

Yes, because it will improve your credit score if shattered due to non-payment or delinquency. Furthermore, it will allow the new creditor to give you a loan in future emergencies.

Q2. How much will my credit score go up if I pay off my credit card debt?

Your credit score will certainly differ if you pay off the debt, but how many points you gain will depend on the credit bureau. However, in general, one can figure out an 8-12 points increase in the credit score.

The Final Note

How to pay off credit card debt question doesn’t include one single way for every credit card holder. You had decided to consume the service. That can be for any reason. Maybe you needed it to pay your utility bills because of the instability of the income date. Moreover, you used to think that my credit score may go high with the allocation of this card in your wallet. Apart from that, you will notice living a luxurious life spending anywhere without any thought. The abundance of reasons can justify you being a credit card holder & also a bad credit card debtor. But the relief method will take its own time. Just follow our resolutions and you will make your financial life better.

Author Profile

- Jennifer Garcia is an expert in the field of credit cards and related services. She has written extensively on a broad range of topics related to credit cards, including different types of offers and benefits, how to compare and choose the best cards for individual needs, and strategies for finding ways to use credit more effectively. She has been an invited speaker at conferences around the world to discuss her research into financial products. Her knowledge of the credit card landscape is unparalleled, with a deep understanding of how each offer or product works in relation to the rest of the industry. Jennifer’s work provides invaluable insight into how to make the most out of any credit product.

Latest entries

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice)

BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice) BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything)

BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything) BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]

BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]