Thankfully! My credit score rose 100 points overnight. Sounds good! Congratulations Finally! You got it. Wait! How did you do that? I don’t believe it; Possible. It is something like eating food without putting it into the mouth. Many times! I have searched for the answer to improve credit score, but I never got this kind of response, even going several ways for years.

If this conversation you have made with anyone, you are in the right place to confirm this theory. Because it is a false commitment completely notwithstanding, wait for it with patience. There is no question about getting it like a piece of cake.

Let us understand the entire concept thoroughly.

How to Improve Credit Score?

That’s a serious question for most borrowers, or even; for the future planner thinking of loans as assistance. Now, if you have something, you can earn more. What if you don’t have anything to increase or start? That’s more serious than before. Then you have to begin from the start. Let’s take a plant to make it a tree. Could you say that you can do this without effort? NO!

Similarly, you require- a plan, a perfect plan to start and continue the journey until it lasts perfectly. Meanwhile, one must not forget that your score also must not get affected by unnecessary and baseless factors of your financial lifestyle. How to improve your credit score is a question that includes the answer to the efforts you put into making yourself strong in the financial market.

Is Credit Score Crucial to Increase?

Yes, it is crucial! Otherwise, you may not get the notification, like raise credit score by 100 points overnight. Because everybody knows it is paramount in your economic life journey. That’s why they capture you in a trap making the debt history unstable and losing your confidence and controlling your mind.

A credit score helps with a credit card, loan approval, and mortgage. These three digits ensure creditworthiness whenever you want to join financial institutions in your financial crisis. Moreover, the interest rate is the second prime point when you get stuck deciding on the correct money lenders for your loan and credit card issuer. The higher credit score will determine the lesser interest rate for the borrower.

It is like a first impression to know about your financial condition for the money lenders, but that’s not the whole truth, exceptions can be there because you have never tried to maintain professionalism.

Improve Credit Score: Cut the Myths

There is a myth; if you have bad credit, you can never get a loan from any financial institution. Yes, of course, the possibilities are fewer, but you are also part of this financial community, and still many networks help you develop your credit score with time. Everything is for money. If the money lenders engage you with the fund, they will get the interest amount back from you to run their business. On that note, they want to be sure whether you are capable of repayment or not.

Like a human being keeping different thoughts for the same object, money lenders, too: are not similar to fixing one universal credit score. You may be a good client for one company or unfit for another. That’s the theme of the game. Now even if you are satisfied with this concept and think that I don’t have any need now to improve credit score because I can also benefit from bad credit, you are in the myth again. You can get an emergency online loan for bad credit but still, the ball is not in your court.

A bad credit score gives a loss more than a profit. The highlight is the interest rate. You may get the loan notwithstanding paying a high APR affecting your monthly budget and shrinking your daily necessities.

Are Time and Patience Necessary?

Human nature is the same everywhere. Every time we see- something that is not necessary for today, we don’t act on that, notwithstanding others are hitting us to do a particular task desperately. We do make efforts even knowing that it is not possible instantly, like raising credit score by 100 points overnight.

Now, let’s come to the point. Yes, time and patience are necessary to raise creditworthiness. Nothing is possible overnight. You have to act consistently as soon as you do your mental makeup. We have mentioned the factors that can affect credit scores. When planning for it, keep them with you and then act accordingly. Seek the loan types and their numbers in your life and prefer to control them.

Furthermore, try to increase your income & decrease your expenses and make spending when you really need it. Keep the credit loan amount usage within a limit. Never cross it.

Know Factors that Restrict Improving Credit Score

Numerous factors work around to affect your credit score. One should keep considering them while making efforts in this direction. Let us take some of them below with a description.

- Repayment is the way to improve credit scores. Whenever you take a loan or credit card, try to make monthly payments on time, even though you have to cut down some of your daily life expenditures. Late or no repayment will be frustrated shortly with a bad credit score.

- If; you have taken any credit card and don’t know how to utilize it, that can be a terrible portion of your FICO score. Experts say that never use your loan credit for more than 30% of the total amount. Contrary, keep it to less than 30%.

- The credit history should be long because what sometimes happens at the initial level is the borrower keeps reminding everything to show the credit bureaus of their activities. However, as time passes, they start forgetting everything that affects their FICO profile. That is the reason money lenders prefer old credit history over a new one.

- Miscellaneous credit history or present statement about the loan are the following points where your credit scores get affected but less compared to others. The types of loans you acquire screen an image before the money lenders to calculate your repayment capability. However, successful monitoring helps you improve your credit score.

- Last but equally important. Never check your credit score much and make inquiries from time to time because this will impact your FICO score or credit score. It will show that you need the money badly and don’t have sources to cut down the financial crisis, at least on the initial level.

Suggestions to Stable the Credit Score with Improvements

Again those who need one or two steps to achieve their goals can do it easily. Yet, those who are very poor must work hard. Most methods can not reveal the desired result even though you do a lot of hard work. However, you can do it consistently without hoping for the needed result, at least for some time. Let’s find some suggestions for stabilizing the credit score with improvements.

Keep an Eye on your Credit via Authorized Sign Up

Your credit accounts require proper monitoring to stabilize your image before credit bureaus, money lenders, or financial institutions. Here, one can sign up for authorized and Free services and restrain any future disputes with fraudulent activities. The changes will be immediately before your eyes with this sign-up process. Not only that, you may make a complaint to the credit bureau about the fraud and remove the mishaps.

Maintain the Progress

Excess is Bad: yet you must check the credit report from time to time in a systematic manner to maintain progress. Whether you have one account or more than one, a new account or old enough, borrowers must manage every single one to cater to the financial issue or credit management. If somehow anything happens, disputes are resolvable within 30 days to not affect the FICO score.

Summarize the Credit Amount

Sign-in and progress maintenance is possible by holding the hands of summarization of the credit amount. The summary will help you separate the amount of every creditor to pay it on time. Don’t go fast. Better pay the lowest amount first and raise it to the highest. This technique will help you stable your confidence and keep standing in the battleground to relieve yourself from all the debts of past and present times. Meanwhile, one should control the expenses and credit utilization less than the prescribed limit.

Credit Limit Increase Query

If there is a question that your credit utilization can not come in limit because it is already less. Make a credit limit increase query to the creditors. The higher limit will assist you in keeping the utilization under 30%. Moreover, be ready with every aspect while making this query because a hard check of the creditors can negatively affect the credit score.

Interest Rate Role to Improve Credit Score

In many instances, one can see where the borrowers never come out of the debt for long because of the higher interest rate imposed by the money lenders. On that note, one should try to negotiate for the APR or interest rate so that it doesn’t destabilize the monthly budget and repay the principal amount on time to improve credit score. Take help from an experienced person to negotiate the rate.

Autopay System

If you have to pay interest for a single loan or credit, the possibilities are; you can pay it on time with exceptions. On the other hand, multiple loans, mortgages, and credit card repayments create issues with their proper management. With the evolution of the autopay system: it is manageable. Borrower power is secure with this repayment consistency.

Yes, it is not the prime reason to stabilize the payment & credit score, but helpful enough. Notwithstanding, you don’t have enough money in the bank account to settle the monthly interest or repayment.

Authorized User

Becoming an authorized user is like having heaven & hell together. Suppose you have found someone ready to pay every debt on time along with a long successful, and positive history. Holding the hand here would benefit you more than your thoughts or imagination. On the other hand, let’s say; the same person appears to you with bad debt; that can be a terrible situation for you. Always make a prudent decision while becoming an authorized user on another person’s account.

Split the Amount and Pay it Every Two weeks

In case you have a sizable amount for repayment. Instead of giving it in a single settlement, pay it every two weeks of the month. This way- it makes you light and helps you raise or improve your credit score.

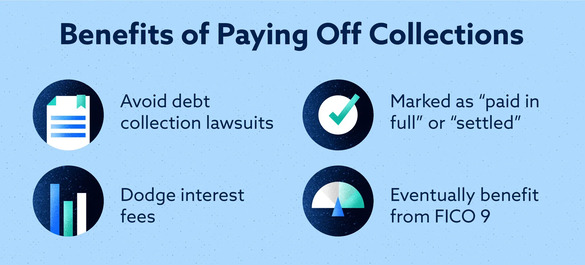

Does Paying Off Collections Improve Credit Scores?

A collection account is a term; practical to report your debt history to “Credit Reporting Agencies.” This entry emerges as your default in your past-time obligations. Furthermore, the creditor has passed over the debt: causing a non-remittance from your side to the agency which exists as a buyer for the default collections.

Now! if you ask- does paying off collections improve credit score, then the answer is divisible into two parts. Firstly, new models, like FICO’s credit score & FICO 9, and Vantage Score credit score (3.0 & 4.0). They take no notice of collections having zero balance.

Secondly, if somehow; you are dealing with a mortgage, the older model will work and take notice of the collection having zero balance.

The overall answer will be that it is a good idea- settling all your collections for a good credit score, but that also can not go higher like usual. However, as soon as time passes, you may; again start improving your payment style by focusing more on it and paying as per the mutual consent of debtors and creditors.

This time! You have to take the loan that is in your capability for repayment. More than your strength can create a second setback in your personal or financial life.

Frequently Asked Questions (FAQs)

Q.1 How to Improve Credit Score Fast?

There is no fast model to improve credit scores, yet it is possible with time, patience, discipline, consistency, and the correct guidance.

Q.2 Is an Improved Credit Score Necessary?

Yes, it is necessary to negotiate with the money lender while deciding the interest rate based on the loan type. Furthermore, you can raise the credit limit increment using a good credit score.

The Bottom Line

Improve credit score! But smartly. Don’t be a fool of marketing. The article has added numerous suggestions to work on them dedicatedly. Yes, everything is possible! However, don’t realize you’re all set- when raising your credit score with online assistance. Take it professionally! If possible, after this article’s thorough study. For more such help, contact us by mentioning your query in the comment box.

Author Profile

- Jennifer Garcia is an expert in the field of credit cards and related services. She has written extensively on a broad range of topics related to credit cards, including different types of offers and benefits, how to compare and choose the best cards for individual needs, and strategies for finding ways to use credit more effectively. She has been an invited speaker at conferences around the world to discuss her research into financial products. Her knowledge of the credit card landscape is unparalleled, with a deep understanding of how each offer or product works in relation to the rest of the industry. Jennifer’s work provides invaluable insight into how to make the most out of any credit product.

Latest entries

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice)

BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice) BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything)

BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything) BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]

BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]