Every individual can dispute credit reports. That’s the answer when putting a query for willingness to take a loan and credit score is a hurdle in your way. However, in such a circumstance, you must be sure that there is definitely an error from the credit bureaus. That’s ok for not to notice it when you couldn’t feel the need for it. More or less. But now you are open to acting on it. That is good. Because if one ignores this time, it will make you feel stressed for not having enough sources of financial stability.

Let’s take a brief look at this issue and try to understand it fully.

How to Dispute Credit Report?

In one way or another, if you got to know about the error in the credit score report, take a step further to make it correct. It is not easy to do. You have to clear the dispute about it in several ways. If you think it is a tiny issue, you are wrong because by ignoring it, you are standing against your financial peace.

The official source, the Federal Trade Commission, has evidence from the 2012 report that out of 4-5 consumers, at least one encountered an error in the credit report. With a corrected description, possibilities are getting the desired loan amount at a negotiable interest rate. Otherwise, with bad credit, you will be financially hurt. As per the “Fair Credit Reporting Act,” each financial institution (Banks & Credit bureaus) is to provide an error-free report.

That’s not all. You think that even after getting an error in the report, nobody is in a credit report dispute. That is because many Americans face the same issue and are not well aware of their righteousness. They pay for the services that are absolutely free for US citizens. Moreover, the credit report is disputable for duplication, account errors, identity, and much more, which is responsible for the point drop.

Whatever the consequences, the dispute is necessary. Winning is the consideration of the process followed by the applicant. However, to begin with, one has to acquire an official copy of the credit report from any of the credit bureaus responsible for it. That is available free of cost. So there is no need to waste your money on commercial credit services.

How to Dispute Credit Report and Win?

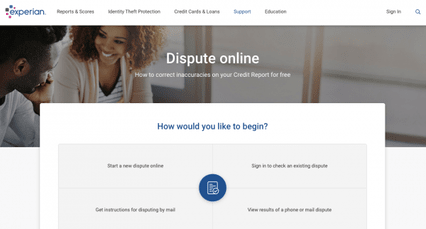

One can order the annual credit report from the official website of three major credit bureaus, Experian, Equifax, and TransUnion. Now, if you want to know how to file a credit report dispute, then be sure to complete it with the official websites of the agencies.

Do you know almost 75% of graduate students do not have knowledge about finance? Financial literacy is an important aspect that has direct involvement in the growth of an individual. Know more about it.

Do some preparation before starting the procedure.

- One has to collect and figure out the required material as per the requirement of the credit rating agency.

- Acquire the report where the error is apparent, and the bureau has to correct it with your debt payment records and other documents.

- Decide whether you want to go for the furnisher or bureau with what understanding.

- Online Method or Email Method.

These points will help you know the better place to start and win the fight against your disappointments. There is a difference between furnishers and bureaus for legal or non-legal rights. Whatever path you go! It should be well planned because it doesn’t require money but hard work and time to win the dispute. You must seek changes if others’ debt is affecting your credit score.

Steps to Follow to Dispute Credit Report and Win

Follow these steps to remove the error from the credit report:

1. Give a Call to the Bureaus Via Online mode or Mail

CFPB, or Consumer Financial Protection Bureau, suggests that as you are open to correcting the error, you should choose any of the two ways. One is an online mode, and the second is Mail. Equifax, Experian & TransUnion will accept your request if it is bonafide.

Online Dispute

- For the online option, you should visit the official website of the concerned bureau and fill out the dispute form. It is accessible via downloading it or directly on the website process.

- For credit report dispute, one has to give some personal contact information for the procedure. Moreover, some documents are necessary to justify your concern.

- What you can do is! Take the printout of the document to mark, upload, and show a clear picture of the negative points against you.

- Only you can win the dispute when everything is in your favor with evidence. Give a clear explanation of something you want to add to your application.

- For Equifax– Equifax PO Box 740256 Atlanta, GA 30374-0256

- For TransUnion– TransUnion LLC Consumer Dispute Center PO Box 2000 Chester, PA 19016

- For Experian– Experian PO Box 4500 Allen, TX 75013

2. Move on to the Furnisher

It is up to you whether you want to go for this option or not because it will not give you legal rights. The consumer financial protection bureau also makes recommendations to go for this procedure. Banks, Fintechs, credit card issuers, and other financial institutions work in this field. The applicant can use the address from the produced credit report.

3. Wait for the Response from Both Parties

From the initial stage! We recommend genuine and powerful documents. Because- the bureau and the furnisher (both) take enough time to investigate the application. 30 days are the minimum period to investigate the matter. After a required verification and investigation, the bureau will inform you within five days about its decision.

You might also be interested in – Best debt payoff app

Moreover, both inquiries will result at some point, but the furnisher will not make any changes to its report. However, the credit bureau will make official changes in the credit report because it will give the legal right to the individual. In case of a frivolous dispute credit report, the credit bureau will disregard your submissions.

4. Evaluate the Investigation Report or Response

Two results one may get for a dispute credit report. First is the positive response favoring the individual who files the complaint. Secondly, the investigator may declare it a frivolous dispute. No matter- what the situation is! It will send a report copy in its response. If- you win the contention: the credit bureau will give you information about the sources of the elements added to the error report.

Like the furnisher’s name, official address, and communication details to inform it about the changes. This way- the furnisher will investigate the matter and confirm the correction on your behalf for a better credit score.

5. Confirm the Screening of Correction

Now, if you have won the dispute credit report, you must keep your eyes on the corrected credit score. The official screening is crucial to take a loan from any recognized money lender. In an investigation response! Remember the proper fixation of the changes and wait. Contact the bureau if changes don’t appear on the credit score.

Best Dispute Reason for Collections on Credit Report

If the credit report shows an error, you can adopt ways to restrain it by the following. Here are some of the best dispute reasons for collections on credit reports.

- You have complete repayment documents, but you receive a call from the collector. You have 30 days to deal with the situation. One can ask for the original credit amount, its date, and creditor name and use it for the dispute credit report.

- Debt collectors try to re-age the debt amount, but you can ask them to let you verify the existence of the debt and deny the payment. It should not go beyond five years.

- One can show the goodwill you acquire from the various lenders for your past debt payments.

Frequently Asked Question (FAQs)

Q.1 How to remove a dispute from credit report?

- Open the concerned credit bureau website and find the dispute resolution form with complete and required personal information.

- An investigation needs an authentic document to prove your concern. If the pieces of evidence don’t support your view, the dispute will get declared- frivolous.

Q.2 What happens if a credit dispute is denied?

Some chances you may get even if the credit dispute is denied. However, they will create bigger issues than before if you don’t pursue your target. A lawyer is the last option to resolve the dispute credit report.

The Final Note

The sooner you initiate a dispute credit report, the better it will benefit you. Many Americans don’t know about their rights to free credit reports. Similarly, they don’t recognize the error in the credit report or the score and dispute rights against it. But several sources may inform, but it can be late, like applying for a loan or who has conducted the hard inquiry and denied it. In this case, one can take help from several online sources to guide itself in this direction- similar to this article. If the issues persist longer, one must take professional assistance.

Author Profile

- Jennifer Garcia is an expert in the field of credit cards and related services. She has written extensively on a broad range of topics related to credit cards, including different types of offers and benefits, how to compare and choose the best cards for individual needs, and strategies for finding ways to use credit more effectively. She has been an invited speaker at conferences around the world to discuss her research into financial products. Her knowledge of the credit card landscape is unparalleled, with a deep understanding of how each offer or product works in relation to the rest of the industry. Jennifer’s work provides invaluable insight into how to make the most out of any credit product.

Latest entries

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice)

BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice) BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything)

BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything) BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]

BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]