We all know how important credit cards have become these days. They are an easy solution for all your urgent money needs. The best part is, most of them come with many rewards and benefits. If you are a car enthusiast and purchase a lot from the Tires Plus store, then you should definitely get a Tires Plus Credit Card. It will make all your Tires Plus transactions easy and hassle-free. Now let’s get to know this credit card better.

What is a Tires Plus Credit Card?

Tires Plus is a store credit card, which means that you can only use this credit card to make purchases from the Tires Plus Store. If you are someone who makes frequent purchases from the Tires store then you should definitely get this card. Tires Plus has all the essentials for your car, so if you love your car(s) and you keep modifying or repairing your car then what better place would you find to do it other than the Tires Plus store?

If you are a car owner then this card is going to be very useful for you. At some point, you might think that this card is useless. After all, you can just use it for your car, but we would like to tell you that it helps you improve your credit score as well.

Plus, it is a credit card with no annual fee, so you will not have to pay any fee to keep this card, and it will help you increase your credit score, so basically there is no harm in keeping this card for your car needs. Though the APR is high, you will have to make sure that you pay all your credit card bills on time.

Important Points

- Annual Fee: $0.00

- Required Credit Score: 650 to 850

- Returned Payment Fee: Up to $38

- Purchase APR: 28.8%

- Late Payment Fee: Up to $38

Advantages

- There is no annual fee.

- Fair credit holders can easily get this credit card.

- Good card for credit building.

- Ideal card for all your car purchases.

Disadvantages

- The APR is high.

- They do not offer any rewards or cashback.

- There is no intro bonus or offer.

Benefits

If you make car equipment purchases of $149 or more in the first six months of owning this card, then there will be no interest for the initial six months. Additionally, if you modify your car and use custom paint or some other modifications of $249 or more within the first 6 months of owning the car, then also, there will be no interest charges in those 6 months.

Here are some of the other benefits of using the Tires Plus Card, let’s have a look at them.

1. Zero Fraud Liability

If you become a victim of monetary fraud or identity theft and someone else makes any purchases using your card without your knowledge then you will have zero liability. Tires Plus would pay for all your losses and the bill.

2. Boosts Your Credit Score

Do you know that Tires Plus card reports all your credit card activities to all three major credit bureaus including TransUnion, Equifax, and Experian at the end of every month? So it helps you increase your credit score.

3. You Earn Points on Purchases

Whenever you make any purchases from the Tires Plus Store using this credit card, you earn points for that purchase depending upon the amount of purchase. You can later redeem those points to get a discount on a purchase or avail of any other offer that is available. Tires Plus gives different offers in exchange for points like free car equipment or free car services.

How Does a Tires Credit Card Work?

As we told you, Tires Plus is a store credit card, so it can only be used to make purchases from Tires Plus Stores. As you make purchases for your car from the Tires Plus Store, they offer you points on your purchases. You can use these points later.

When you have earned enough points through your car purchases, you can redeem those points to get a discount or take any other advantage that they are offering in exchange for your points. They offer different things like some special car equipment or some service for free in exchange for the points from time to time.

But before getting this card, just keep in mind that you can use this card only for your card purchases and that too if you purchase something for your car from the Tires Plus store. You can not use this card for any other purchases like grocery shopping or dining.

How to Apply for the Tires Plus Card?

For Tires Plus Credit Card apply, you will have to follow the steps given below:

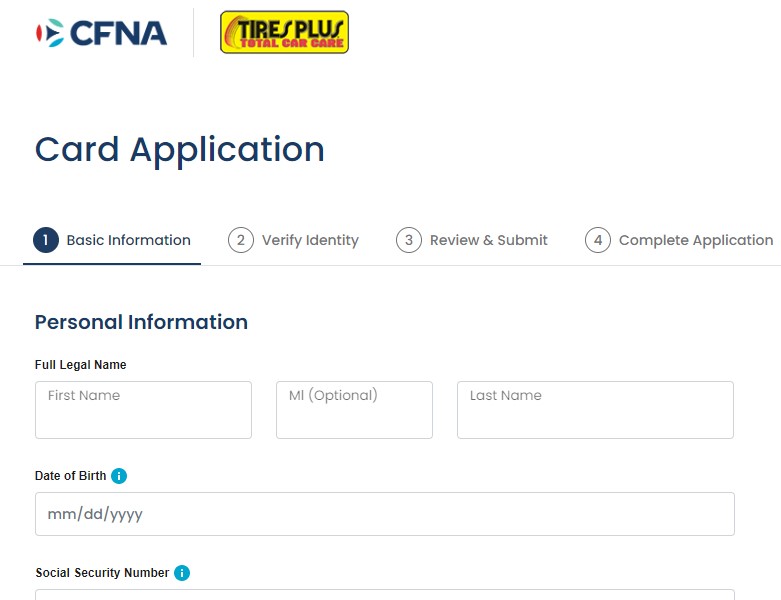

- First of all, go to the official Website of CFNA and tap on the “Apply Here” option. First, you will have to create your account here.

- Now you will be reverted to the Tires Plus card page, Below the image of the credit card, you will see a tab saying “Apply Now”. Click on it.

- After this, an application form will open. Fill in all the Tires Plus Credit Card requirements in that form. It will ask you for some basic personal details like name, age, address, etc. If it asks for some documents like identity proof or income proof, attach those documents.

- Once you are done with the form, scroll down and you will find a “Continue” tab, click on that tab.

- Now an intent box will open, click on that box and then again tap on the “Continue” tab.

- After this, a page will open where all the terms and conditions of the credit card would be mentioned. Make sure that you read all those terms and conditions very carefully. If you are okay with those terms and conditions and are ready to accept them in order to get this credit card then click on the “Submit Application” tab.

- After this, your application will be sent for approval. To check the progress of approval you can make a Tires Plus Credit Card login and check it.

And just like this, your credit card application process will complete. See, as we told you, the application process is pretty simple.

How to Register Tires Plus Card for Online Payments?

When you register this credit card online, you get the opportunity to pay the credit card bill online. You even get the chance to check your balance and credit score online. To register this card for online payments, you will have to follow the procedure given below.

- First of all, go to the official website of CFNA.

- Now look for the sign-in option.

- Once you find this option, click on it and create your account by entering your username and password. Make sure that you note that password so that even if you forget it later, you can look for it.

- Now you will have to login into your account using the username and password that you entered for sign-in.

- After this, you will have to turn on the online payment option.

How to Pay for the Tires Credit Card?

There are 3 major ways to pay the bill of your Tires Credit Card.

1. By Calling on Customer Care

For this, you will have to call on the customer care number of the credit card and tell them that you want to make your Tires Plus Credit Card payment. They will tell you the bill amount and will guide you through the payment procedure. You can follow them and make your bill payment.

2. Online

Hands down, this is the simplest way to pay your Tires Plus card bill. For this, you will have to go to the official website of CFNA and then log in to your account. There you will find an option for “Bill Payment”. Click on it and you will find the payable amount. Now grab your other debit card or credit card and pay for the credit card bill.

Other Alternatives

If you do not like the Tires Credit Card, you can also go with any of the cards mentioned below.

1. Discover It Secured Credit Card

Hands down, the Discover It Secured Credit Card is one of the best gas cards out there. It provides 2% cash back on all your gas purchases. And the best part is, you can use this credit card to make all the purchases like groceries, hotel bookings, bill payments, etc. It gives 1% cash back on all eligible purchases. But since it is a secured credit card, you will have to make a security deposit in order to get this card.

Important Points

- Annual Fee: $0.00

- Credit Score: 300 to 669

- Deposit: $200 to $2,500

- Purchase APR: 25.99% (Variable)

Advantages

- Zero annual fees.

- 2% cash back on gas.

- 1% cash back on all purchases.

- One of the best credit cards for bad credit holders.

Disadvantages

- High APR.

- A security deposit is needed.

2. Discover It Cash Back Credit Card

If you are looking for a credit card with tons of rewards and cashback then Discover It Cash Back Credit Card is the right choice for you. This card is specially made for people with average to good credit scores. You can make all your purchases like fuel, groceries, daily use items, etc, using this card. Also, there is no annual fee.

Important Points

- Annual Fee: $0.00

- Purchase APR: 13.49% to 24.49% (Variable)

- Balance APR: 13.49% to 24.49% (Variable)

- Credit Score: 660 to 850

Advantages

- No annual fee.

- No foreign transaction fee.

- A security deposit is not required.

- 0.00% APR for the first 14 months.

Disadvantages

- Slightly high APR.

- A high credit score is needed.

3. U.S. Bank Visa Platinum Credit Card

If you are someone with a high income and an excellent credit score then we would recommend you to go with U.S. Bank Visa Platinum Credit Card. It needs a credit score of 720 to 850, but it will give you rewards and cashback on many purchases. Also, they offer 0.00% APR for the first 18 months.

Important Points

- Annual Fee: $0.00

- Purchase APR: 13.99% to 24.99% (Variable)

- Balance APR: 13.99% to 24.99% (Variable)

- Credit Score: 660 to 850

Advantages

- No annual fee.

- 0.00% APR for the initial 18 months.

- You can choose the date of payment.

Disadvantages

- Not for bad or average credit holders.

- High APR.

Frequently Asked Questions (FAQs)

Q1. What credit score do you need to get a Tires Plus credit card?

To get a Tires Credit card, you will need a credit score of 650 to 850. This card is especially for car enthusiasts with average to good credit scores.

Q2. Where can I use my Tires Plus credit card?

You can use this card to make purchases for your card, but only from Tires Plus stores. There are several tires plus stores in the country that sell car equipment and provide other car repair and car modification services.

You cannot use this card to make other purchases like groceries, bill payments, fuel, daily use items, rent, fees, etc. It can only be used for cars. So you should only get this card if you have a Tires Plus store near your house and you make frequent purchases for your car from there.

Q3. Who issues Tires Plus credit cards?

These cards are issued by Credit First National Association. It is basically a credit card company that issues CFNA credit cards for its affiliates. Tires Plus is an affiliate of Credit First National Association

Q4. How long until I receive the Tires Plus credit card?

The application process for this credit card is pretty easy and fast. So once you apply for this card, you will get to know whether your application is approved or not within a week. If your credit card application is approved, you will receive the credit card within 5 to 10 business days.

Q5. How to pay for my Tires Plus credit card?

There are 2 main ways to pay for this credit card bill. You can call on their customer card number and they will guide you through the payment procedures. Or you can simply just go to the official website of CFNA and log in to your account and pay the bill online.

You can also pay the credit card bill through the mail but that process is very lengthy and risky. For this, you will have to send the bill amount in the form of cash to the official address of the Card Card’s head office through mail.

Q6. How to cancel the Tires Plus credit card?

If you want to cancel your credit card, you will have to call the customer care number of Tires Plus and tell them that you want to cancel your credit card. They will conduct an inquiry into the dues and once you clear all the dues, they will cancel your credit card.

You can also cancel your Tires Plus Card in your online account. Just log in to your account and apply for credit card cancellation. They will let you know if some dues are there. As soon as you pay all the dues, they will cancel your credit card.

Conclusion: Should I Get Tires Plus Credit Card?

At last, we would only suggest you go for the Tires Plus Credit Card if you are a car enthusiast and make purchases from the Tires Plus Store frequently. Because it is a closed-loop credit card, you can not use this card to make any purchases other than at the Tires Plus Store. You should only get this card if you have a Tires Plus store near your house and you make frequent purchases for your car from there.

If you are looking for a better credit card that you can use for other purchases as well then you can go with Discover It Secured Credit Card or U.S. Bank Visa Platinum Credit Card.

Author Profile

- William Smith is a highly respected and well-known figure in the consumer credit industry. With over two decades of experience and expertise, he is one of the most sought-after authors on credit card offers, services, and more. He has written extensively on traditional & alternative forms of credit and is a frequent contributor to Forbes Magazine, where he shares his wealth of knowledge with readers on topics such as personal finance. William can be seen regularly on major media outlets where he offers insight into the world of credit cards. He also strives to keep readers updated on the latest trends while offering sound advice on how to manage their accounts responsibly.

Latest entries

BlogApril 27, 2023Navigating the Tech Industry’s Dynamic Landscape: Insights from Amazon’s Recent Layoffs

BlogApril 27, 2023Navigating the Tech Industry’s Dynamic Landscape: Insights from Amazon’s Recent Layoffs Credit Card ReviewsFebruary 9, 2023Famous Footwear Credit Card Review 2024: Get Benefits on Footwear Purchase

Credit Card ReviewsFebruary 9, 2023Famous Footwear Credit Card Review 2024: Get Benefits on Footwear Purchase Credit Card ReviewsFebruary 4, 2023Ultimate Sephora Credit Cards Review 2024- Essential Information by Expert

Credit Card ReviewsFebruary 4, 2023Ultimate Sephora Credit Cards Review 2024- Essential Information by Expert Credit Card ReviewsFebruary 2, 2023Ultimate Kay Jewelers Credit Card Review in 2024: Finance Your Jewels Easily

Credit Card ReviewsFebruary 2, 2023Ultimate Kay Jewelers Credit Card Review in 2024: Finance Your Jewels Easily