Navigating the world of credit can be difficult, especially if your credit score isn’t great. When you have a bad credit score, it can feel like every door is closed when it comes to getting a gas card. But don’t worry! That’s not always the case. We have updated our list of the top seven gas cards for bad credit so that you can quickly and accurately find a card with all the features you need and none of the drawbacks that come with a lower credit score.

A gas credit card helps you save money on fuel by offering rewards and cashback, as well as improving your credit score. So, if you own a car, a gas card is a must-have for you. After all, if you have an opportunity to save money, you should definitely go for it. In this article, we are going to tell you about the seven best gas cards for bad credit.

Not only that, but we will also provide information on how you can increase your savings as well as your credit score using a gas card, eligibility for a gas card, how to apply for a gas card, and basically everything you need to know. Keep reading to learn more about the best gas credit cards for bad credit and how to apply for them today!

What are Gas Cards? (Benefits, Types & More)

Have you ever heard about gas cards? Maybe you have, but do you know what they are and how they work? A gas card is a credit card that allows the user to purchase fuel for their car. Whenever you use a gas card to buy fuel, you get rewards and cash backs. Some basic credit cards also offer 2% to 3% cash back on fuel purchases but the fuel purchase rewards are higher with gas cards. So if your credit card has a low credit limit due to your bad credit score or it does not offer rewards on fuel purchases then the best gas cards for bad credit can be a very good option for you. Not only does it make refueling easier, but there are also many benefits associated with using a gas card. Let’s take a look at some of them.

Cashback Rewards

One of the most appealing features of a gas card is the cashback rewards program. Every time you use your gas card, you will accumulate points that can be redeemed for a variety of rewards. Depending on the type of gas card and issuer, these rewards could include discounts on fuel prices or even free gasoline.

In addition, depending on your creditworthiness and spending habits, you may be able to get additional benefits such as extended warranties or travel insurance. “Gas credit cards and the role of rewards programs” study by J.D. Power and Associates (2011) has shown that gas cards are getting popular because of their high rewards programs.

Flexible Payment Options

Another advantage of using the best credit cards for gas is the flexibility it offers when it comes to payment options. Instead of having to pay for fuel upfront in cash or with a debit card, users can choose to spread out their payments over time with their gas card. This option can be especially helpful if you don’t have enough money in your budget to cover an entire tank of gasoline all at once. Plus, since most gas cards offer low interest rates, users can save money on interest fees compared to other types of credit cards.

Builds Credit Score

It is pretty obvious that your credit score is not good right now, and that’s why you are looking for the best credit cards for bad credit. All the gas cards report your credit activity to all three major credit bureaus including TransUnion, Equifax, and Experian. So when you use your gas card to purchase fuel, not only do you save money on fuel but you also build your credit score. It offers you a very good opportunity to build your credit score using the best gas cards for bad credit and then get a better credit card with higher rewards.

Convenience

Finally, having a dedicated credit card specifically for purchasing fuel can save time and hassle when it comes to refueling your car. Instead of having to fumble around for cash or waiting in line at the pump while someone else pays with their debit card, using a gas card allows you to fill up quickly and get back on the road without any delays or inconveniences. Also, many issuers offer additional perks such as discounts at select restaurants and convenience stores that are located near major highways and interstates which further adds to the convenience factor offered by these cards.

Types of Gas Cards : You Must Know

Gas cards can be a great way to save money on fuel, but how do you know which type is best for you? Let’s take a look at two different types of gas cards – gas reward credit cards and gas station credit cards – and break down the pros and cons of each.

1. Gas Reward Credit Card

A gas reward credit card gives you reward points every time you use your card, usually in the form of cashback or travel points. It is just your regular credit card that offers rewards on fuel purchases and can be used for other purposes as well. It can be any normal Visa Card, MasterCard, or any other credit card. These rewards can then be used to purchase more fuel or even other items.

The benefits are clear: you get rewarded for your purchases, plus you have access to a variety of perks such as insurance coverage, extended warranties, and more. The downside is that these cards often come with high-interest rates, so be sure to read the fine print before signing up.

2. Gas Station Credit Card

Gas station credit cards are issued by specific companies – usually gas stations – that offer exclusive discounts and deals when using their cards. These discounts can range from small savings per gallon to large savings off your total bill. The upside is that these cards typically have lower interest rates than regular credit cards, meaning they won’t cost you much in the long run.

On the other hand, they may not offer as many perks as a standard rewards card; it all depends on the specific card issuer. These are generally closed-loop credit cards, so you can only use these cards to purchase fuel from any specific gas station. If you decide to for a gas station credit card, make sure that you select a card that has multiple gas stations around your locality so that you do not need to drive to a particular gas station every time your car needs refueling.

Best Gas Cards for Bad Credit in 2024

Now that you have all the basic information about gas cards, let’s have a look at some of the best credit cards for bad credit. These credit cards will not only help you win rewards and cash back, but if you manage them well, you would also be able to boost your credit score. Here we go!

1. Bank of America Cash Reward Secured

Our Rating: 4.9/5

If you’re looking for one of the best gas cards for bad credit, there’s one card that stands out above the rest. Bank of America Cash Reward Secured is an ideal choice for users who want to save on gas and fuel purchases. Let’s break down why this card is so great for bad credit holders.

The major benefit of this secured credit card is its rewards structure. With it, you can earn 3% cash back in any category of your choice. This includes gas and fuel purchases, meaning you can save several dollars at the pump every time you fill up. You also get 2% cash back on groceries and 1% on all other purchases.

If you need more incentive, it doesn’t hurt that this card has no annual fee or maintenance charges, since it’s a secured credit card. That means that even if your application is denied due to your low score, you won’t be losing money in the process. And with a minimum deposit between $200-$5,000 and an APR rate between 26.99%, the costs are kept to a minimum while still getting good rewards from your purchases. You Can Directly apply for This Secure Credit Card By Visiting Their official Website.

But this isn’t just a good option for those with bad credit—this is also a great long-term choice for anyone looking to maximize their cashback rewards on gas and fuel purchases without sacrificing financial security or flexibility. It’s an excellent way to optimize your spending power while keeping within budget range and maintaining stability in your finances as well as your payment history.

Features

- Annual Fee: $0.00

- Credit Score: 300 to 669

- Deposit: $200 to $5,000

- Purchase APR: 26.99% (Variable)

Advantages

- You can choose any category in which you want 3% cash back.

- Great cashback and rewards.

- Zero annual fees.

- Immediate credit score update.

- Also, low fees on foreign transactions.

Disadvantages

- You will have to pay the security deposit.

- The categories are very limited for the 3% cashback.

- It has a high APR.

2. Discover It Secured Credit Card

Our Rating: 4.8/5

The Discover It Secured Credit Card is designed specifically for those with poor credit or no credit history. However, unlike other gas credit cards for bad credit, this card offers features that make it stand out from the rest. First and foremost, the Discover It Secured Credit Card offers an impressive 2% cash back on fuel purchases and 2% cash back on restaurant purchases. You also get 1% cash back on all other purchases made with this card. Plus, all of your cashback rewards will be doubled in the first 12 months of having your account! That means you can earn up to 4% cash back in rewards during your first year as an account holder.

Another great feature of this card is that there are no annual fees or monthly account management fees—just pay one security deposit and use it forever! And because of Discover IT Secure Credit Card card reports all activity directly to three major credit bureaus, using it responsibly can help improve your credit score over time.

Finally, if you have been using this card responsibly for eight months, Discover will automatically review your account to determine if you qualify for an upgrade to an unsecured card without having to pay additional security deposits. This can be beneficial as unsecured cards usually offer more perks than secured gas cards with bad credit ones.

Features

- Annual Fee: $0.00

- Credit Score: 300 to 669

- Deposit: $200 to $2,500

- Purchase APR: 25.99% (Variable)

Advantages

- All the cash backs are doubled in the first 12 months.

- 1% cash back on all purchases with no limits at all.

- Tools to see your credit score for free.

- 2% cash back on gas.

- Zero annual fees.

Disadvantages

- A security deposit is needed.

- Not more than $1000 cashback in one quarter in the fuel and restaurant category.

- High APR.

3. Discover It Student Chrome Card

Our Rating: 4.4/5

For students looking to optimize their gas expenses while building their credit, the Discover It Student Chrome Card is an excellent option when looking for the best gas cards for bad credit. The Discover It Student Chrome Card offers rewards in two forms: cash back and points. For fuel and restaurant purchases, users can earn 2% cashback up to $1000 each quarter. All other purchases made with the card will earn 1% cash back in the form of points which can be used for future purchases or converted into cash back. Furthermore, there are no annual fees associated with this card, making it a great budget-friendly option for students.

Since this is a student card, Discover does not require applicants to have high credit scores in order to qualify for the Discover It Student Chrome Card. The minimum required credit score is 580-739; any lower than that and you may not be approved for the card. However, if you’re able to maintain good spending habits over time, then you will likely see an increase in your credit score after several months of responsible use of this card. If Your’e Student Then You Can Simply Apply For This Card

The APR on the Discover It Student Chrome Card is 25.99%, which is slightly higher than average compared to other cards on the market. However, there is an introductory 0% APR period of 6 months so that users can get some breathing room while they learn how responsible use of this card can help them build up their credit score over time. This introductory period also allows users to avoid any interest payments during that time if they pay off their balance before it expires.

Features

- Annual Fee: $0.00

- Credit Score: 580 to 739

- 0% APR Period: 6 months

- Purchase APR: 25.99% (Variable)

Advantages

- Zero annual fees.

- 0.00% APR for 6 initial months.

- No credit score is required for the application.

- No fees on foreign transactions.

- Also suitable for building credit in college days.

Disadvantages

- Students are not allowed to choose their cash back and reward categories.

- Only students can apply for this card.

4. Capital One Spark 1% Classic Business Card

Our Rating: 4.3/5

If you’re looking for an affordable gas card that doesn’t require a perfect credit score, the Capital One Spark 1% Classic Business Card is the way to go as it is one of the best gas cards for bad credit. With this card, you can get great rewards and features even with a bad credit score. Let’s take a closer look at what this card has to offer.

The Capital One Spark 1% Classic Business Card offers users 1% cashback on all purchases, 5% cash back on hotels and rental cars booked through Capital One Travel, and no annual fee. This is great if you want to maximize your rewards without paying any extra fees. Additionally, if you have a good credit score, you can qualify for a higher credit limit with this card which allows you to purchase more gas with each transaction.

The Capital One Spark 1% Classic Business Card also comes with some great security features. It offers fraud protection, customer service, contactless payment options, online account management tools, and automatic alerts when suspicious charges appear on your account. These features make it easy to use your card securely while protecting yourself from fraudulent activity.

The Capital One Spark 1% Classic Business Card has an APR of 28.49%, which is slightly lower than other cards in its class. This means that you can save money on interest payments over time if you use the card responsibly and pay off your balance in full each month. Additionally, there are no foreign transaction fees so if you plan to travel abroad then this option of gas credit cards for Low credit could be a great option for saving money on gas purchases abroad as well. All in all, it is a good option & a worthy inclusion into the best gas cards for bad credit.

Features

- Annual Fee: $0.00

- Credit Score: 580 to 739

- Purchase APR: 28.49% (Variable)

Advantages

- 1% cash back on all purchases, irrespective of your credit score.

- Also provides 5% cashback on hotel and car bookings from Capital One Travel.

- High credit limit.

- Zero annual fees.

Disadvantages

- Less reward rate.

- High APR.

- Low chances of getting credit card approval.

5. Shell Fuel Rewards Card

Our Rating: 4.1/5

The Shell Fuel Rewards Card has an impressive rewards program and bonuses compared to other best gas cards for bad credit. It allows you to save up to 3 times more than other credit cards, with up to 10¢ per gallon saved on 35-gallon purchases. Additionally, you can get 10% cash back on non-fuel purchases, up to a total purchase of $1,200. This is great news for those who are looking to save money at the pump while still earning rewards on regular shopping trips. It will be a Great Option, If You want to apply Online Then You Can Visit official Shell Website.

The Shell Fuel Rewards Card has no annual fee and an APR of 26.49%, which is fairly typical for bad credit cards. However, due to its focus on rewards at the gas station, it is not suitable for those who want a low-interest rate or no interest rate on their purchases. Nevertheless, if you pay off your balance each month this should not be an issue.

The minimum required credit score for this card is 300-669, making it one of the most accessible options for those with bad credit scores. Also, you must be 18 years or older to apply and must have a valid Social Security number or Taxpayer ID number in order to qualify.

Features

- Annual Fee: $0.00

- Credit Score: 300 to 669

- Purchase APR: 26.49% (Variable)

Advantages

- No annual fees.

- Good offers as the welcome bonus.

- High cash back rewards.

Disadvantages

- High APR.

6. Chevron/Texaco Techron Advantage Card

Our Rating: 3.6/5

This Chevron/Texaco Techron Advantage Card is great for those who usually purchase their fuel from Texaco and Chevron fuel stations. With this card, you can get up to 37¢ off per gallon on your first 90 days of purchases. After this period, you’ll still get 3¢ – 8¢ off at Texaco and Chevron fuel stations every time you fill up your tank. The annual fee is $0.00, so there are no hidden charges associated with this card.

Moreover, it has a relatively low credit score requirement of 300 – 669, making it easy to apply even if your credit score isn’t perfect. Finally, its variable APR rate of 29.99% isn’t too high compared to other cards in its class. To maximize the benefits of the Chevron gas card, try to use it as much as possible during the initial 90-day period so that you can take advantage of the 37¢ discount per gallon available during that time frame.

Also, keep in mind that this is a closed-loop Credit Card so it can only be used at Texaco and Chevron Fuel Stations which means if you don’t usually fill up at these locations then this might not be the ideal option for you because there are other cards available with more flexible rewards programs such as cashback or points redemption options that offer discounts on any type of gas station or retailers worldwide.

Features

- Annual Fee: $0.00

- Credit Score: 300 to 669

- Purchase APR: 29.99% (Variable)

Advantages

- Zero annual fees.

- Good welcome bonus offer.

- Good cashback rewards.

- 0 liability for fraud victims.

Disadvantages

- Can only be used on Chevron and Texaco fuel stations.

- Also, the reward is not fixed.

- High APR.

7. Credit One Bank Platinum Visa for Rebuilding Credit

Our Rating: 3.6/5

The Credit One Bank Platinum Visa offers 1% cash back on groceries, gas purchases, TV services, cable and internet bills as well as mobile phone bill payments. You can also get free access to your Experian credit score each month with this card. Though easy to open and use, the annual fee is quite high with an APR that ranges from 26.99% (Variable).

It’s important to note that Credit One Bank Platinum Visa for Rebuilding credit card is only available to those with a credit score between 300-669. However, if you have had issues in the past such as late payments or bankruptcy it might be a good option for you. This card allows users to make their payments online or by mail from anywhere in the world. It also comes with fraud coverage protection and zero liability protection which can be especially helpful if you are worried about unauthorized charges being made to your account.

The biggest benefit of using this one of the best gas cards for bad credit is that it can help you rebuild your credit score over time as long as you make your payments on time each month. By utilizing the rewards program and making timely payments every month, your credit score will begin to increase gradually in no time. All in all, it is a good option for being the best gas cards for bad credit.

Features

- Annual Fee: $75 to $99

- Credit Score: 300 to 669

- Purchase APR: 26.99% (Variable)

Advantages

- Free credit report.

- Zero deposit is needed.

- 1% cashback on fuel, grocery, and other necessary needs.

- Immediate credit score update.

Disadvantages

- Less credit limit.

- High annual fees.

Comparison Table

To help you compare the best gas cards for bad credit, here is the table of the most important factors.

| Annual Fee | Preferred Credit Score | Deposit | Purchase APR | |

| Bank of America Cash Reward Secured | $0.00 | 300 to 669 | $200 to $5,000 | 26.99% (Variable) |

| Discover It Secured Credit Card | $0.00 | 300 to 669 | $200 to $2,500 | 25.99% (Variable) |

| Discover It Student Chrome Card | $0.00 | 580 to 739 | N/A | 25.99% (Variable) |

| Capital One Spark 1% Classic Business Card | $0.00 | 580 to 739 | N/A | 28.49% (Variable) |

| Shell Fuel Rewards Card | $0.00 | 300 to 669 | N/A | 26.49% (Variable) |

| Chevron/Texaco Techron Advantage Card | $0.00 | 300 to 669 | N/A | 29.99% (Variable) |

| Credit One Bank Platinum Visa for Rebuilding Credit | $75 to $99 | 300 to 669 | N/A | 26.99% (Variable) |

How Does a Gas Credit Card Work?

Gas credit cards work just like any other type of credit card, in that you are borrowing money from the issuer to make purchases and then paying it back with interest over time if you don’t pay off your balance in full each month. When you use a gas credit card at the pump, your purchase will be charged to your account, and then you will receive a statement each month detailing your purchases and how much you owe for them.

You can then pay off your balance in full or make payments until it is paid in full. Just like any other regular credit card, it will help you in building your credit score if you use this card properly and pay all the bills on time. If you do not pay the bill on time, it can mess up your credit score and even your entire credit report if you take too long to pay the gas card bill.

Merits of Gas Cards : You Must Know About it

Here are some of the benefits of gas cards.

1. High Savings on Fuel

While general credit cards offer just 2% to 3% rewards on fuel purchases, gas cards allow you to save up to 10% of the total purchase amount. Considering the high prices of fuel, even 10% savings or cash back matters a lot.

2. Good Sign Up Bonus

Sign-up bonuses are extra rewards and discounts that you get to avail of in the first few days or months of getting the card. Gas cards for bad credit come with a high sign-up bonus. Some gas cards even offer you up to 30% savings on your first few purchases.

3. Easy to Manage

With a gas card, you have a separate credit card for your fuel expenses. This way, you can use your other credit cards for various other purposes as well as keep a track of your fuel expenses. This is an easy and simple way to expand your credit limit without actually applying for a credit limit increase.

Demerits of Gas Cards: Consider them While Choosing

Like everything else, gas cards for bad credit also have their positive and negative points. Let’s have a look at some of the demerits of gas credit cards.

1. Limited Use

If you get a gas card, you would only be able to use it to purchase fuel. These are not multipurpose cards so you would not be able to use than for any other purchase other than fuel.

2. High-Interest Rate

The interest rates of gas cards can be as high as 28 to 29%. This means that in order to use this card without paying high interest, you will need to use the complete balance of this credit card. If you want a credit card with a low-interest rate, you can look for other options as well.

3. No Redeemable Rewards

You only get on-time rewards with gas cards. This means that you only get a discount or cash back on your current purchase and there are no rewards that you can avail of later. Moreover, you will only get rewards on fuel purchases.

Benefits of Gas Cards for People with Bad Credit

Gas cards are often easier to qualify for than traditional credit cards and come with several benefits that make them attractive to users. Let’s take a look at five of the most notable benefits of using gas cards for people with bad credit.

1. Easy Access to Fuel

The main benefit of using a gas card is that it provides easy access to fuel. Many gas stations offer special discounts or rewards for customers who use their cards, making fuel even more affordable. This can be especially helpful for those on a tight budget or those who drive long distances frequently.

2. Improved Credit Score

Using a gas card responsibly can also help improve your credit score over time by demonstrating financial responsibility and building up positive payment history in your credit history. By regularly paying off your balance on time and not maxing out your card, you can steadily increase your score until you’re able to qualify for better terms and lower interest rates when applying for other types of loans or lines of credit.

3. Rewards Programs

Another great benefit of using a gas card is the potential rewards you can earn from doing so. Most major brands have loyalty programs that offer discounts on fuel or merchandise, as well as cash-back rewards on purchases made at their stores. These rewards can help offset the cost of fuel, making it more affordable in the long run.

4. Convenience

Gas cards are also incredibly convenient for drivers because they allow you to easily pay for fuel without having to carry around cash or coins with you all the time. Plus, most modern gas cards are now equipped with chip technology that allows you to quickly swipe them at the pump without ever having to leave your car.

5. Security

Finally, another big advantage of using a gas card is security—most major brands offer fraud protection services that monitor activity on your account and alert you if any suspicious activity is detected so you can take action right away if needed. This added layer of security is invaluable in keeping your finances safe from criminals who may try to gain access to your accounts online or through identity theft schemes like skimming.

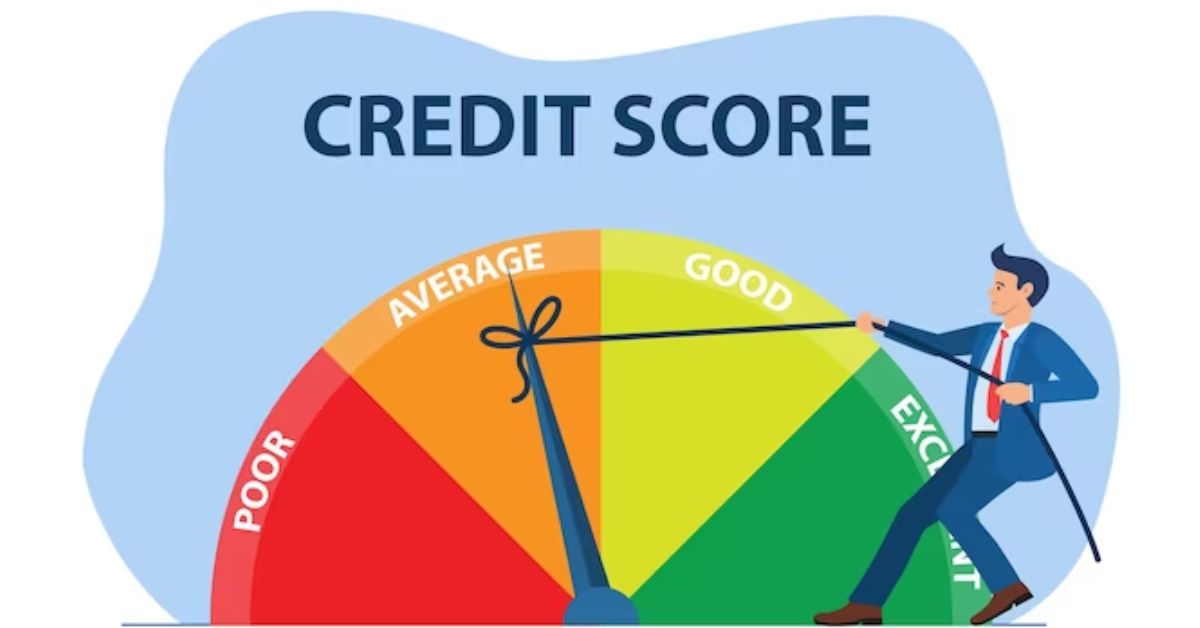

Building Credit Score with a Gas Card

Using a gas credit card is a great way to start building your credit score. These gas station credit cards for bad credit typically have lower spending limits and more favorable terms than traditional cards, making it easier for those with less-than-perfect credit to gain financial footing. As you make purchases with the card and make timely payments, your payment history will be reported to the credit bureaus, which in turn will help increase credit scores. Here are some of the best ways to build your credit score using the best gas cards for bad credit.

1. Get a Gas Card that Reports to All the Credit Bureaus

In order to build your credit score using the best gas cards for bad credit, it is important to get the right credit card in the first place. You must be aware that all the credit bureaus make their own credit report and they can vary. So make sure that you go for a gas card that reports all your credit activities to all the major credit bureaus that include Experian, TransUnion, and Equifax. Then only you would be able to build your overall credit score.

2. Pay the Bills on Time

As you know, the most important factor that helps you build your credit score is bill payment. So make sure that you pay the gas card bills on time. You can go for autopay, where the bill amount would be automatically deducted from your bank account on your bill payment date. If your credit card does not offer autopay, you can set reminders so that you do not miss any payments.

3. Keep Track of your Spending and Credit Score

It is crucial to keep track of your spending so that you do not end up exceeding your gas card limit. Also, keep having a look at your credit score so you can take precautions in using your credit card if you see a fall in your score. It will also let you know about any wrong entries in your credit report.

4. Apply for Card Updation

Most gas cards for bad credit offer updation on their proper use. It can be in the form of a credit limit increase or its upgradation from a secured card to an unsecured credit card. Whatever it is, make sure that you your credit card wisely so that you can qualify for the card updation. It will ultimately result in a credit score boost.

Qualifications for Gas Cards for Bad Credit Scores

Are you planning to get a gas credit card? If yes, then you will need to qualify for the following qualification criteria For Gas Card. These qualifications may differ from one credit card provider to another, but here is a list of some of the most common qualifications.

1. Your age must be 18 years or more.

2. Applicant must be a citizen of the U.S.A.

3. You must have a monthly income to pay the credit card bills.

4. You must have your own active bank account.

5. The applicant needs to have a Social Security Number and valid ID proof.

6. You must have an official contact number and email address.

How to Use Gas Cards Effectively to Maximize Your Savings?

Even if you are a bad credit score holder, it is easy to get the best gas cards for bad credit, but what matters is how you use your gas card. It is important to use your gas card effectively, then only you will be able to enjoy its benefits to the fullest. “The Impact of Gas Credit Cards on Fuel Purchases and Prices” study by the Energy Information Administration (EIA) (2005) has shown that gas cards have helped in decreasing the overall consumer cost of fuel purchases. Here are some of the tips that you can follow for the best use of the gas card.

1. Get the Right Card.

2. Use Multiple Cards

3. Bill Payment on Time

4. Go to the Right Gas Station

Improving Credit Score & Become Eligible for the Best Gas Cards

There are ways to improve your credit score so that you can become eligible for the best gas cards. Keep reading to learn how.

The first step is to understand what affects your credit score and how it works. Your credit score is based on five categories, including payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and types of credit used (10%). Payment history is the most important factor when it comes to improving your credit score. Make sure that you pay all bills on time, as late payments can significantly lower your score.

The next step is to reduce the amount of debt that you owe. This will help improve your “amounts owed” category, which accounts for 30% of your overall score. Start by making a list of all debts with their corresponding interest rates. Then prioritize paying off those loans or debts with the highest interest rate first, as these will cost you more in the long run. You should also take steps to reduce any unnecessary spending such as eating out or shopping too much in order to free up more money for debt repayment.

Finally, if possible, try to build a long credit history by taking out small loans or applying for a secured credit card with a low limit. This will show lenders that you are responsible for managing debt over time and help boost your “length of credit history” rating, which accounts for 15% of your overall score. It may take some time — usually six months — before this improvement shows up on your report and affects your overall score significantly but it’s worth it in the end.

How Do Gas Cards for Bad Credit Compare to Other Forms of Payment?

With the rise of online banking and digital payment options, it can be hard to know which payment methods work best for different purchases. Gas cards for bad credit are one of the increasingly popular options for those who have a poor credit rating. But how do these cards compare to other forms of payment, such as debit cards, credit cards, and cash? Let’s take a closer look at the advantages and disadvantages of each.

Debit Cards

Debit cards are linked directly to your bank account so you can use them wherever they are accepted. This makes them a convenient form of payment, especially when you don’t want to carry a lot of cash around with you.

The downside is that debit cards usually come with lower spending limits than credit cards, so you may not be able to make some larger purchases this way. Additionally, if your card is lost or stolen, there may be more liability involved than with other forms of payment.

Credit Cards

Credit cards are another popular option for making payments, though they should only be used by people who can pay off their balance in full each month in order to avoid interest fees. Credit cards also offer more protections than traditional debit cards when it comes to fraud or theft – meaning that if your card is stolen or misused in any way you will typically not be held liable for the unauthorized charges.

On the flip side, however, credit card companies tend to charge higher fees for late payments and other services than banks would charge for their debit and gas card accounts.

Cash

For many people, cash is still king – especially when it comes to smaller purchases like gas or groceries where you don’t need access to extra funds or special protection from fraud or theft. Paying with cash also means that there won’t be any additional charges added on top of what you already owe – unlike with a credit card where interest fees can quickly add up over time if you don’t pay off your balance right away.

The downside is that carrying large amounts of cash around isn’t always practical or safe; plus it’s harder to track spending habits if everything is paid in physical currency instead of being tied into a bank account somewhere.

Are Gas Credit Cards Worth it?

Many people wonder whether gas credit cards are worth it. The answer to this question depends on the individual and their spending habits. There are various types of gas credit cards available, so it is essential to compare and contrast the different offers before deciding on the right one for you.

When determining the worth of a gas credit card, there are a few factors to consider. Firstly, it is important to examine the APR (Annual Percentage Rate). This interest rate is applied to any balance carried over from month to month. Understanding how interest works is crucial before signing up for a gas credit card to avoid falling into debt.

Another consideration is the rewards program. Numerous gas credit cards offer rewards programs that allow users to earn points for every dollar spent. These points can be redeemed for cash back, gift cards, or free gas. It is crucial to ensure that the rewards program offers something that you will actually utilize, preventing you from wasting your money.

Lastly, the annual fee is worth considering. Some gas credit cards come with an annual fee, while others do not. It is important to evaluate the benefits of the card in comparison to the annual fee to determine its worth for you.

Frequently Asked Questions (FAQs)

Q1. What are the easiest gas cards to get?

Capital One Spark 1% Classic Business Card, Bank of America Cash Reward Secured, as well as Shell Fuel Rewards Card, are some of the easiest gas cards to get. If you are a student then you can go for Discover It Student Chrome Card. It comes with zero deposit and zero annual fees and is also great for building credit in student life.

Q2. What is the minimum credit score for a gas card?

There is no minimum credit score for a gas card because many companies also provide gas cards to bad credit holders. But you should have a credit score of someone between 300 to 700 to grab a good deal on the gas card. Otherwise, you will have to pay higher APR and interest. You will also get a low credit limit with a bad credit score.

Q3. Can I get a gas card with no credit?

Yes. You can get a credit card even with no credit. If you are a student then you can go with Discover It Student Chrome Card as it is one of the leading bad credit gas cards for you. Also, you do not need credit and deposit for this credit card. If you are not a student then you can go with options like the Bank of America Cash Reward Secured credit card.

Conclusion

Having bad credit can make applying for a gas card more difficult, but it isn’t impossible. There are several gas cards available that cater to people with bad credit, including the Bank of America Cash Rewards Secured Credit Card, Discover it Secured Credit Card, Discover it Student Chrome Card, Capital One Spark 1% Classic Business Card, Shell Fuel Rewards Card, Chevron/Texaco Techron Advantage Card, and Credit One Bank Platinum Visa for Rebuilding Credit. It is important to understand how a gas card works before deciding which one to choose.

Generally speaking, you’ll need an average credit score of 300-600 to qualify for the best gas cards. If your score is lower than this, you may be able to get approved for a gas card with less favorable terms. Building credit with a gas card is possible if used responsibly, and you can often increase the number of cash rewards or bonus points earned by choosing the right payment options and participating in promotional offers.

Making timely payments and limiting spending can help boost your credit over time so that you’re eligible for top-rated gas cards. Regardless of credit score, there are various benefits from using these cards, such as taking advantage of cashback opportunities or high rewards programs on fuel purchases. By researching different types of cards, understanding how they work, and making sure payments are always made on time, consumers can take control of their finances and maximize their savings when using a gas card effectively.

Author Profile

- Elizabeth Jones is one of our editorial team’s leading authors on credit card offers, services & more. With over two decades of experience in the consumer credit industry and as a nationally recognized credit expert, Elizabeth provides in-depth analysis of both traditional & alternative forms of credit. Elizabeth regularly appears on many major media outlets including NBC Nightly News, Fox Business Network, CNBC & Yahoo! Finance. She is also a frequent contributor to Forbes Magazine. As a highly appreciated author for our exclusive Editorial Team, Elizabeth strives to provide readers with a trustworthy advice on how to manage their credit accounts while staying informed on the latest offers in the marketplace.

Latest entries

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide

BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know

BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide

BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide