Uncertainties exist in all the dimensions of life — related to family, friends, health, professionals, finances, and whatnot. You never know what will happen to you the next moment a while later. So, life is unpredictable.

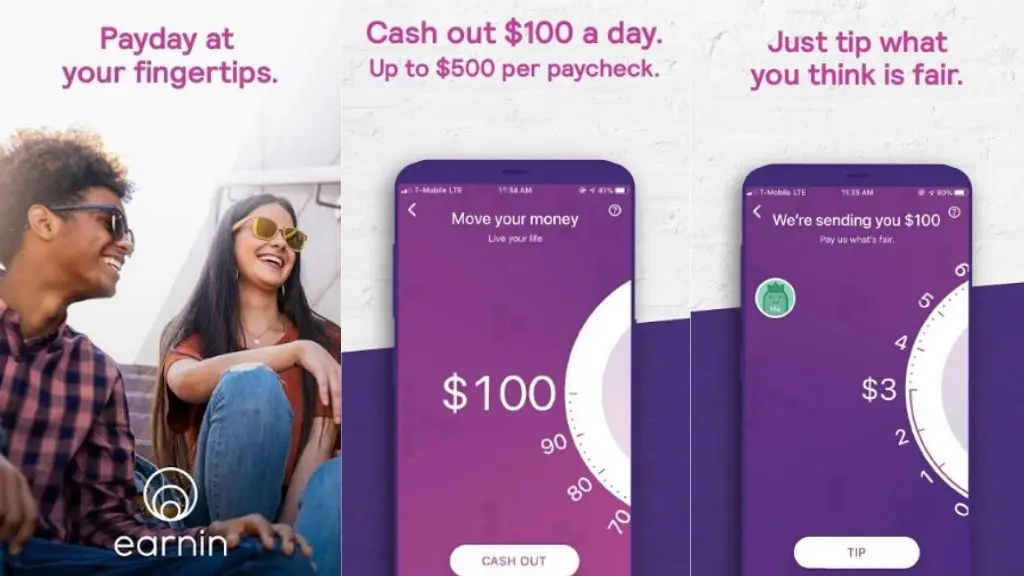

Especially, in regards to financial matters, we happen to come across people getting richer overnight and sometimes pauper. And people who are dependent on payday checks or monthly wages, digital loaner apps are quite a savior such as the Earnin app.

Earnin is great in many ways by offering its competitive services and features. Hence, it is imperative and essential to review the services, features, and cash-out limits available on the financial app.

What is Earnin?

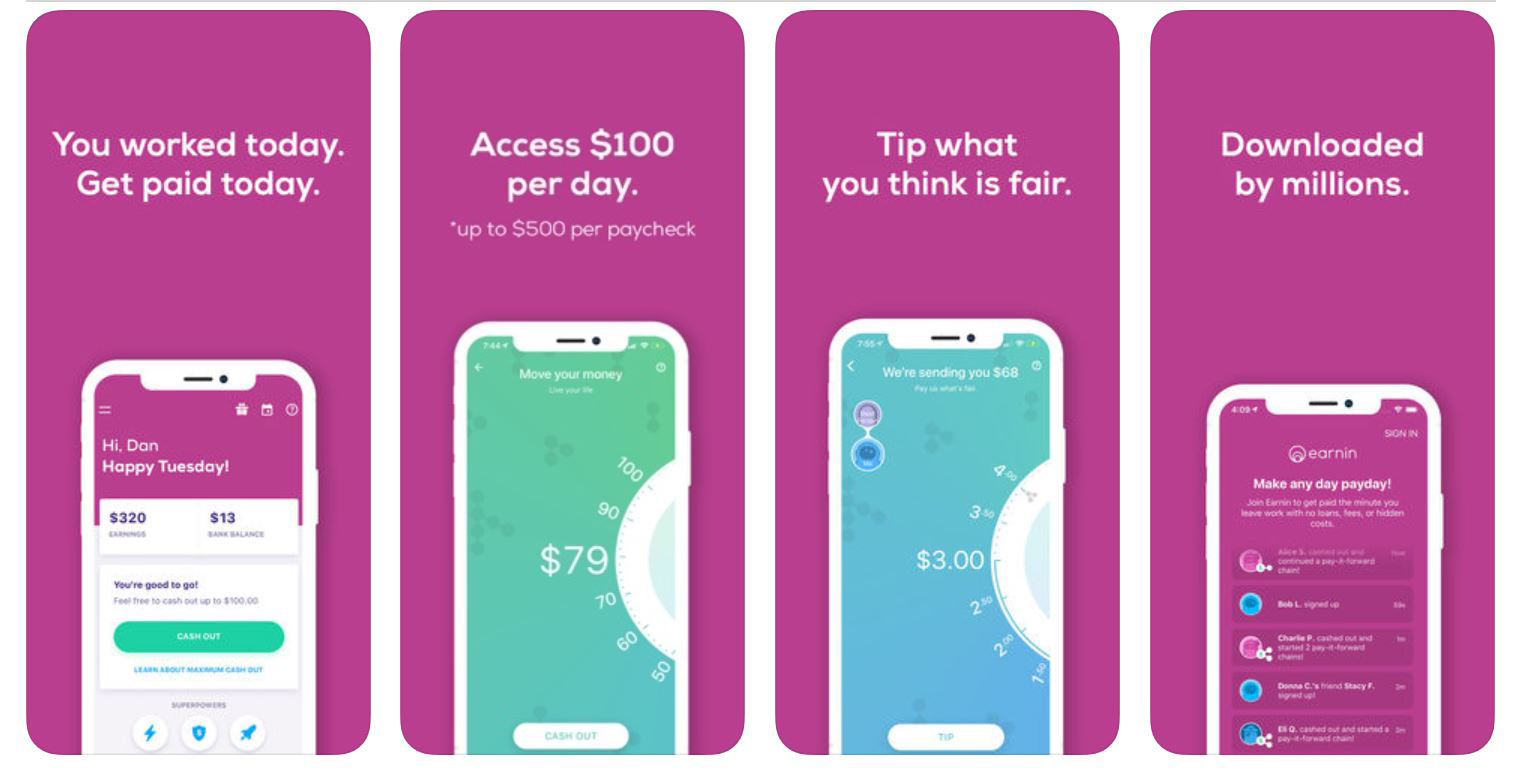

Well, Earnin is a financial or digital app that provides advance cash or loan to workers before their paydays or the work they have earned for. This app requires your bank account synched to its platform along with your debit card and other personal details. The best part is it gives money up to $100 per day. It can even give up to $500 depending on the successful relationship.

Advantages & Disadvantages of Earnin App

Earnin changed the budgeted spending and the nature of finances as it gives access to the payday check before it is paid or the same day you work. It is a great financial cash builder app for your daily requirements for expenditure. It will help you to get advance cash on a daily basis in case you are worried about how to meet up your day-to-day expenses instead of waiting until payday.

There are some advantages as well as disadvantages of the Earnin App. You need to be aware of those merits and demerits alike.

The most prominent advantages of using the Earnin App are:

- There is no mandatory fee applied to the platform.

- Earnin will not impose any interest.

- It delivers loans immediately after you apply; it releases same-day funds.

- You save money as you do not pay interest and mandatory fees.

- You can track your budget more effortlessly.

- In case you face any issues with your bank and its platform, Earnin mediates very swiftly and its cooperation is guaranteed.

Alongside its advantages, there of course some disadvantages that you need to be aware of, such as:

- Earnin requires access to your bank and your bank-related personal information.

- You will gradually imbibe the bad financial habit as it will trigger your mind to have an implicit nature of spendthrift.

- It provides low borrowing limits and hence not much helpful to cover some of your expenditures or high budget expenses.

- Low tips mean high APRs because its tip option is fewer.

The Way Earnin App Works: How Earnin Works?

Now if it interests you, the question might crop up, “how does Earnin work?”

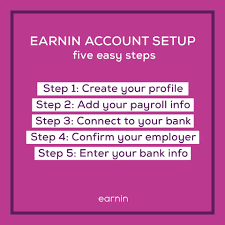

Well, not just easy but it is quick in installing. After you have installed it, you will need to provide your personal information, bank account details, and debit card information. Once you specify all the information and link the bank details, you need to verify the existing and linked account in order to receive the deposit and advances.

The foremost thing you need to keep in mind is you should keep at least half of your deposits cashed in your checking account. Your work schedule should normally be weekly, biweekly, or monthly.

There is another thing you should remember. Earnin will track your work location to keep track of your work and activity. An hourly worker needs to upload a photo of the hourly schedule while a freelancer needs to add a photo of the receipt.

After you complete all the formalities of filling up the form and bank details, you are now up and running using its feature. However, Earnin will first confirm your account, debit card, and the working hours of each day you work. When it finds everything in its place, you can get a loan of up to $100.00 per day, a maximum of up to $500 loan for the paycheck (you will finally receive it from your employer). You can also tip the application in case you wish to use it.

Consequently, it will withdraw the money you have borrowed from your checking account after your paycheck is credited to your account. In other words, Earnin will pull off the amount you have borrowed from its app.

An Insight into Earnin Features

Giving a review for anything is not as easy as it might seem for some people. Because you need to analyze so many merits, demerits, and features included in any particular thing when reviewed. The same goes for giving Earnin app reviews on transparency, affordability, and charges for using its platform.

However, when it comes to Earnin app features, it is quite user-friendly. Earnin has built its features keeping in mind the requirements of its clients.

They have added some updated features due to recent obstacles in the financial world owing to the Pandemic. One such feature is a GPS-enabled tracking system to track the number of hours worked by its clients. They are also allowing unemployment benefits through the Earnin app for those people who are eligible for such benefits.

With its user-friendly interface, it has gotten high-quality products and services, and its terms and conditions are fair and transparent. Due to these features and factors, it makes the platform more convenient for its clients to receive funds more conveniently, swiftly, and quite immediately.

Advance Cash Out

You want to take your family to a restaurant but you are partly short of some bucks. No worries! Earnin is there to fill the ceilings in your wallets.

You need some bucks now, but your payday has not yet arrived. Earnin is there to help you.

Hence, it is a great Advance Cash App to meet up your immediate financial gaps. You can borrow as much as $100.00 per day. You can link your bank to its system. It has associations with the banks such as Bank of America, Wells Fargo, TD Bank, Chase, Navy Federal Credit Union, PNC Bank, USAA Bank, etc.

Overdraft Management

You don’t have to start to panic when it comes to being skeptical about an overdraft. It will immediately notify you about your balance through a push notification in case you are nearing an overdraft.

Lottery Like Jackpot

Earnin App has gotten a unique feature of its own which is a brand for its platform. It presents you to try your luck similar to a lottery. You will invest $10 in the Tip option opening you a chance to win as close as $10.00 million in cash.

Calendar for Budgeting Payday

If you want to know in advance what your payday is, it will help you so effectively. It will provide a balance report protecting you from overdraft fees and obligations.

GPS Tracking and Management

Being GPS-enabled, it is very effective in handling your work schedule and the number of working hours. You get money according to your work completed.

No Fees and Rates for Services Used

There is no application of any fees nor any interest in using the services. However, you can pay tips for using their applications and services. It is voluntary and you can pay any amount you wish.

Apart from this, you don’t require to pay anything for signing up for its membership or monthly fee. There is no hidden fee as well.

Initially, you will be able to cash out an amount of $100.00 per day. This limit will increase up to $500.00 per day depending on your successful relationship with the organization.

Safety and Security of the App

The important thing is that you need to keep in mind it requires your Social Security Number and other personal details. Earnin understands and strives to maintain its reputation. Hence, its reputation comes from how well security and protection it tries to give to its client’s data. Therefore, Earnin App takes utmost priority and responsibility for the safety and security of your financial information and personal data.

For more information, you can read their Safety, Security, and guidelines on their platform.

Hence, as far as Earnin reviews go, it is quite recommended for those people who need immediate money without paying interest and additional fees.

Earnin Apps Trustworthiness & BBB Rating

As per the rating system, Earnin has received a BBB rating. This implies that it is a legitimate application. It is a secure app. It has received 4.5/5 stars on the App Store and there are as many as 117 reviews. Many people are happy with its simplicity, transparency, and loyalty.

Deployability and Accessibility of Earnin & Customer Service

If you have a smartphone connected to the internet, you will readily be able to deploy it on your phone. It is compatible with both Android and iOS platforms. If you think you don’t like using a smartphone, you can use it on your PC or tablet after you have installed it there.

Support Services of Earnin App

Like any other customer service, Earnin support is live 24/7 and you get your issues fixed with them any time you feel.

Is Earnin App a Good Fit for You?

It depends from person to person. It is a good companion for meeting up on short-term finances. If you want to cover your emergency expenditures on a day-to-day basis, it will come per your expectation. It is good for those whose credit score is on the negative side. It does not check the credit score before releasing cash.

The important things to note: First, if you are unable to trace your financial transaction on your own, you might land in trouble. Second, if you don’t have any regular income, it is not for you.

Earnin Vs Other Apps Like Earnin

There are many loaner apps like earnin in the market such as the Brigit app and the Dave app, which provide almost similar features. You can compare Earnin App with the following mentioned other financial apps.

| Features/Services | Earnin | Dave | Brigit |

| Loanable Amount | $100 – $500 | $5 – $250 | $50 – $250 |

| Rate of Interest | Tipping | Varies, 16% | Not charged |

| Time to Dispatch | A few minutes, sometimes, 1-3 business days | 1-3 business days; 8 hours for additional pay | $9.99 Monthly |

| Membership Fee | Tip Option | $1 Monthly | $9.99 Monthly |

Frequently Asked Questions (FAQs)

Does Earnin give you $100?

Yes, it can. It can provide a loan of up to $500.00 if you build up a successful relationship with it.

How long does it take to get money from Earnin?

You can get money in a few minutes with a high-speed bandwidth — lightning speed. Without this, it might take 1-3 business days to get the cash.

Conclusion

Based on its number of features, Earnin financial app is a good option to choose. As discussed earlier, if you need immediate financial backup or short-term finances, Earnin stands out among others. It is a user-friendly app and transparent in its services. It can save your earnings as there are no extra fees or interest.

Hence, the Earnin app is a good financial backup application for people who rely on daily work and paydays.

Author Profile

- John Davis is a nationally recognized expert on credit reporting, credit scoring, and identity theft. He has written four books about his expertise in the field and has been featured extensively in numerous media outlets such as The Wall Street Journal, The Washington Post, CNN, CBS News, CNBC, Fox Business, and many more. With over 20 years of experience helping consumers understand their credit and identity protection rights, John is passionate about empowering people to take control of their finances. He works with financial institutions to develop consumer-friendly policies that promote financial literacy and responsible borrowing habits.

Latest entries

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide Low Income GrantsSeptember 25, 2023Dental Charities That Help With Dental Costs

Low Income GrantsSeptember 25, 2023Dental Charities That Help With Dental Costs Low Income GrantsSeptember 25, 2023Low-Cost Hearing Aids for Seniors: A Comprehensive Guide

Low Income GrantsSeptember 25, 2023Low-Cost Hearing Aids for Seniors: A Comprehensive Guide Low Income GrantsSeptember 25, 2023Second Chance Apartments that Accept Evictions: A Comprehensive Guide

Low Income GrantsSeptember 25, 2023Second Chance Apartments that Accept Evictions: A Comprehensive Guide