Are you facing problems in cashing checks at ATMs? Well, receiving a check is such a fantastic feeling, but not being able to cash it is the worst. If you are also digging for the ways through which you can actually get your checks cashed. To rectify your circumstances and to enjoy the money, we are coming up with a guide that will tell you, ‘can you cash a check at an atm?’ If so, then how to cash a check at an atm? However, we got you all covered here with our detailed & step-by-step comprehension. You just need to read it all the way through its conclusion and get your checks cashed in your account readily.

How to Cash a Check at an ATM?

If you are also struggling with the question, “can you cash a check at an atm” then this section will help you with easy steps. But you must get clear with the required basics for cash check at atm. You must know that the bank will charge some extra fees for cashing your check. Hence, you are required to have a sufficient amount in your bank account. Let’s get into it with rationally consecutive steps. Thus, first, we are going to examine the requirements that you must match for cashing a check.

What Do You Require?

Cashing a check at an ATM is not a difficult task, as you can do it on your own. Well, for this you are required to complete some requirements. We have listed below all the major things that you will require to have.

- First is the endorsed check.

- An ATM or a debit card.

- Card PIN number.

- A sufficient amount is in your account for the check cashing charge.

What ATMs Allow Check Cashing?

After the requirements, the next section that we must get into the presence of “is cash check at ATM”. The primary concern that you will come across after reading the above article is the ATMs that actually allow you to check cash. However, the question ‘can I cash a check at an atm’ has now been cleared to you. Well, cashing check is not a kind of banking service that every ATM provides. Thus, we are coming up with a list of all the bank ATMs that will allow you to cash checks.

- JP Morgan Chase

- Bank of America

- TCF Bank

- Wells Fargo ATM

- US Bank

- Citigroup

Steps for How to Cash a Check at an ATM

Now, the time has come to know about the easy steps through which you can cash check ATM. Make sure you get into the branch of your bank’s ATM to avoid extra charges for transfers and other fees. Let’s know the answer to ‘can you cash checks at atm’

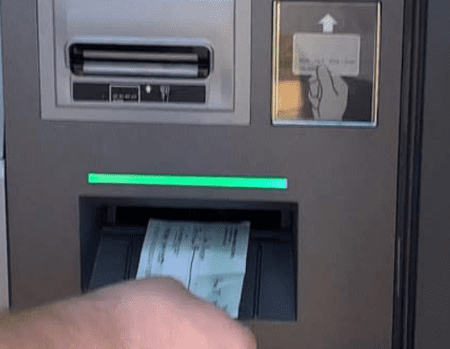

- First, you are required to search for a nearby ATM and then get into the ATM. Make sure the ATM allows you to cash the check.

- Insert your ATM card.

- Click deposit a check.

- Follow the coming wizards.

- Submit your check.

Here the process is done. Hope it has helped you to get your check cashed in your account. Moreover, the steps are quite easy to perform. If you are still having any issues while cashing checks in the ATM, then you must get into the alternative part in the below section.

Alternatives to Cash Checks

Suppose you want to cash your check at an ATM but are unable to do so due to any reason. Then this section is specifically for you. You can simply come to the alternatives. In this section, we have discussed all the possible alternatives for cash checking.

Mobile apps

Various apps are floating on the internet through which you can actually cash your checks easily. You must download the bank’s dedicated app and then continue in it. If you cannot continue with the specific app, then you must use third-party apps such as Ingo, Paypal, or Venmo. This way, you can bypass the photo identity verification as well. And get your check cash without ID easily. After depositing a check, you are required to wait for the approval, and then the cash will be credited to your account.

Third-Party Check

You can transfer your check to other people who are ready to help you to get your check cashed. It can be your family, friends, relatives, etc. You need to get into the bank and ask for the process of cashing your check in their bank account.

However, the process will be quite easy. You are required to sign your check and submit it to the bank. Bank will take some time to approve the check, and then the cash will be credited to your friend’s account. You can take your cash from them.

Visit the Bank

You are required to get into the bank to clear your check, as this process can be a bit tricky, but it will definitely work as it is the most traditional way to get the check cashed. You are just required to get into the branch and submit your check and wait for the approval. When your check is done with the approval, money will be credited to your account.

Prepaid Card With Check Cashing App

Another way through which you cash your check easily is a prepaid card. If you have a prepaid card already allotted by your bank branch, then you can do check cashing with any third-party check cashing app.

However, if you do not have a prepaid card, then you are required to make a card first. Well, you can do this with an app called Ingo money. This app is quite easy to use. You just need to download it and follow the on-screen wizards to create a card and cash a check.

Retail Stores

Retail stores are another option through which you can cash your checks easily. In the US, various retail shops can help you to have instant money against your checks. Well, these retailers are not financing firms but can help you by providing some major financing facilities. Thus, they come up with some limitations as well. Hence, you must not fully depend on retail stores for your financial needs. Here’s a list of retail stores through which you can actually cash your checks. Through these retail stores, you can even cash stimulus checks.

- Walmart

- Check Cashing Stores

- Food Lion

- Jewel Osco

- MoneyGram

Frequently Asked Questions (FAQs)

Q1. Can you cash a personal check at an ATM?

If you have a question, can you cash checks atm? Then the answer is yes. Of course, you can cash your check at an ATM without even going through a verification process. However, the process is very easy. You just need to find a bank atm that allows you to cash a check. then, insert your card and complete all the screens coming wizards after selecting the check deposit.

Q2. Can you cash a check at the ATM without a bank account?

Yes, you can do so, but it’s a bit of a difficult option. You are required to have a prepaid card. If you don’t have one, then you can simply use a third person who is ready to get your check cashed in their account.

Q3. What happens when you cash a check at an ATM?

A check will get cashed into your account. However, you are required to wait for some time to get the check approved. After the approval, you will get the cashback in your dedicated account. Also, you must possess a sufficient amount of money in your account to pay the charges for check cashing at an ATM, as it will be deducted from your account.

Q4. How big of a check can you cash at an ATM?

ATM machines can not differentiate the number of checks. Thus, it takes all the checks irrespective of the amount. You can deposit any amount of check in your bank account.

Q5. Can you cash a personal check at an atm?

Yes, you can cash any kind of check in an ATM. Well, ATMs accept every kind of check and every amount of check. Thus, you must not get confused and worried about the acceptance of your check.

Conclusion

In a nutshell, we have provided you with a full-fledged discussion on the “can you cash a check at an atm.” We have given step-by-step detailed instructions through which you can actually cash a check at the atm without ID. Also, if this method doesn’t work for you, then you can get into the alternative parts. However, the alternative section consists of 5 major ways through which you can cash your check without ID, without an ATM, and even without a bank account. I hope this guide has helped you. If you have any queries, then you can contact us anytime.

Author Profile

- Jennifer Garcia is an expert in the field of credit cards and related services. She has written extensively on a broad range of topics related to credit cards, including different types of offers and benefits, how to compare and choose the best cards for individual needs, and strategies for finding ways to use credit more effectively. She has been an invited speaker at conferences around the world to discuss her research into financial products. Her knowledge of the credit card landscape is unparalleled, with a deep understanding of how each offer or product works in relation to the rest of the industry. Jennifer’s work provides invaluable insight into how to make the most out of any credit product.

Latest entries

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice)

BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice) BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything)

BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything) BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]

BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]