Nowadays, digital credit is crucial for small business operations as various SMEs provide offers, which can be essential for creating the base of global economies. Especially in the context of developing countries, digital credit can bring in a lot of financial access to all the poor sections of the population. With specific lenders like M-Pawa, M-Shwari, and so on digital inclusion operations can be brought in among the low-income groups of these developing nations.

With the provision of feasible banking services, these countries can quickly increase the overall financial access to the low-income groups of society. All these services use specific kinds of small loans which can be anywhere between $5-$10. Consumers can use various mobile services to get funds. These specific loans can be termed Nano loans as through this process any consumer can get access to real-time funds very quickly.

Within the digital age, various SMEs do have the option to get access to loans within a short period of time. These kinds of short-term funds can be crucial for businesses and individuals who are facing a cutdown of funds in emergency times. Thus digital credit operations can be essential for SMEs, especially in developing nations. However, there are client risks as well in these loan operations as these need to analyze as well as other kinds of customer protection problems. This is where the importance of Smart Campaign is vital for identifying all these customer protection issues.

Within developing nations, these digital credit products can bring in a lot of financial inclusion as it is essential to mitigate all these customer protection issues so that a standard care service can be delivered to these Sub-Saharan African populations. Now before we move ahead, let’s have a look at the basic features of Nano loans to understand how these loans can increase financial inclusive operations in these developing countries.

What are Nano Loans?

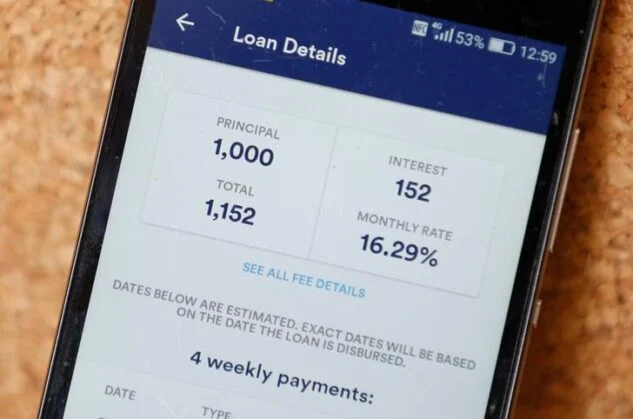

Several lenders like Jumo, Eazzy Loan, Timiza, and other services can offer small amounts of funds within a very short period of time to SMEs as these loans can be termed as small or nano loans. Through this process, various users like small-time business managers can borrow small amounts of funds as these are crucial for getting access to funds with a lower interest rate.

- It is a financial technology and its main goal is to restructure financial services with the help of the latest technologies.

- Nano loans can offer faster services than other loans as the approval operations take no more than a few minutes.

- With the help of digital technologies, these Nano loans services can be spread out to every part of the world where low-income do need financial assistance within a short period of time.

- The overall interest rates of these loans are very low compared to the other kinds of traditional loans.

In the case of the African low-income population, these Nano loan services can bring in more numbers within the financially inclusive population. As part of the query, G2P and gender when will Pakistani women be able to withdraw their own money? With the help of these loan services, more and more people can be brought into banking services. Thus, this kind of loan can make banking more sustainable for these low-income groups.

In addition to this, the low-interest rates and the quick access to funds can also help out these people in certain emergency situations when they might need quick cash. The usage of simple mobile services can also help these lenders to reach out to a more remote section of the crowd. With the help of these Nano loan services, these groups of people can get access to funds within a very short amount of time frame as this can really help them in their emergency situations.

Challenges Microfinance Institutions are Facing to Offer Nano Loans

As discussed above nano loans can be suitable for various SMEs as they are smaller and much quicker to access. Microinsurance can the Cinderella of financial inclusion join the global ball; however, there are a couple of issues that are badly affecting microfinance institutions. And because of that they are not delivering any kind of nano loan offers. The main reason these MFIs not offering any nano loan services is the profitability factor.

In the case of providing traditional loans, MFIs are much more into it because they can cover the cost of the evaluation and application process. Microfinance institutions can rely much more on these long process of traditional loan processes as the cost can be much more fixed than the Nano loans. This is one of the main reasons why microfinance institutions are not into using Nano loans that much as the overall cost can fluctuate quite a bit.

The flexibility of the repayment of loans is also another major issue for microfinance institutions as this can create more variables for them to manage. In every Microfinance institution, loan officers are essential for their overall customer experience. So, this kind of flexible repayment option can make it harder for the officers to manage these operations.

So now that we have understood the exact issues that microfinance institutions face in order to provide Nano loans, let’s have a look at how can they mitigate these issues.

What are Some of the Solutions Microfinance Institutions Can Take for Nano Loans?

Microfinance institutions can focus on the overall behavioral data in order to deliver the Nano loan services to the users. This type of data can be the best source to understand creditworthiness. By working through apt processes these nano loans can be transformed into a feasible one for all the clients as well as the users as well.

- One of the major ways microfinance institutions can start offering Nano loans without risk is to target pre-approved users. In this way, the institutions can start giving nano loan options to their pre-existing customers who have a good repayment history. From the above discussion, you already know what is financial capability. Microfinance institutions can save a lot of cost in this way as they are not required to find new customers as the riskiness of it is much lesser than new users as well.

- The flexibility of the repayment options is also another key area that the microfinance institution can work at as a fixed price can set up good loan management on the part of the user. In this way, the MFIs can give early repayment bonuses to the users.

- The other way MFIs can start offering Nano loans to all users is to associate the loan amount with the repayment capacity of each individual. This kind of process can easily provide Nano loans for every user. It also does not have any kind of expiry date as well as the user can be eligible for it when there is an emergency situation. In this case of requirement, the loan can be provided instantly.

The Role of Digital Credit in Enhancing Financial Access

In the current age of the digital revolution digital credit is seen as an essential step toward financial inclusion especially in developing countries like Africa. These financial technologies of Fintechs can bring in a higher rate of financial inclusion in developing countries. With the help of advanced technologies, these services can make baking more feasible for all low-income people in society. The initiation of digital technology can definitely help these services to save a lot of infrastructure costs in these developing nations.

Improving Financial Access

Digital credits can easily improve overall financial accessibility as is already evident in the case of the African population. Lenders like Eazzy Loan, Eco CashLoan, and Timiza have already generated much interest among the common people in baking services. With more general knowledge of baking, and services provided overall financial accessibility can be easily enhanced within these developing nations. The usage of simple digital mobile devices is also one of the main reasons why digital credit services can improve the overall financial inclusion rate among these low-income people in Africa.

Advocates for More Sustainable Banking Processes

The usage of simple mobile devices in digital credit operations can bring in a sustainable method in baking procedures. In this way, banking can be transformed into a more feasible operation for the low-income population of society. In the context of the African population as more people have a smartphone this procedure can help them to get into sustainable banking.

It is clear that digital credit is the way to go for future baking services, especially in the context of a developing country like Africa where more people have access to a smartphone than sufficient day-to-day funds.

Reducing Infrastructure Costs

The other main role of digital credit operations is also to cut down the extra infrastructure costs that may have been the reason why not a lot of the population is not into banking at all like the financial literacy for professional athletes. With the help of the latest technologies, digital credit can bring down the overall cost as well as underwriting as more people can get attracted to formal banking processes.

In this way also digital credit can bring more people into the financial inclusion bracket. With more people using banking services, the overall financial inclusion rate can automatically be improved.

Segmenting the Customers in Multiple Categories

All the fintech companies can use the latest analytics, credit data as well as overall algorithms to segment customers into different groups. In this way, the companies can cater to all their potential customers as well as their insurance and deposits. Various needs and wants of each customer can be delivered with more accuracy as this can help in the overall goal of enhancing financial inclusion.

Promotes Sustainable Economic Growth

Digital credit is essential for every country for meeting sustainable development goals. Especially after the effect of the Covid-19 pandemic, the importance of digital credit has grown even more. So achieving more sustainable economic growth is the only way to go about things. In this process, all the developing nations can reduce their overall poverty rate as this can promote financial inclusion among the low-income groups of society.

Even though digital credit overall advocates for financial inclusion in developing countries there are certain client protection risks that are also prevalent in these services. The role of The Smart Campaign, in this case, is crucial as they are constantly monitoring these risks that are growing in the digital credit space. Especially in the context of data privacy and informed consent.

What are Some of the Risks Clients Face Within Digital Credit Operations?

By using Mobile technologies digital credit operations can be spread out to various sections of society like post offices fill financial inclusion gaps. However, this also increases the chance of a data breach and pushes marketing trends. So apart from the risks of informed consent and high-interest rates, there are other risks of digital credit operations as well.

As the Smart Campaign has conducted research for the identification of customer protection issues. Now with the help of Client Protection Principles, one can get a clear idea of all the consumer protection issues that will need much more mitigation strategies to mitigate them.

Pushy Promotion Strategies

As most of the digital credit services can be delivered by mobile technologies the overall promotional strategies used by these lenders can cause some issues for the users. These mobile lenders sometimes can use push marketing strategies as a bulk load of SMS can be delivered to the users.

In the context of more developed counties, this issue can be solved with the help of Client Voice research as it can identify the messages that users do not like. However, in the case of new borrowers, this can lead them to the over-borrowing stage. These unsolicited offers can be a big issue, especially for new borrowers as an opt-out option can definitely help them to counter this issue.

Blacklisting of the Bad Credit Bets

In the context of the early digital credit lenders, they will need time to tweak certain things in underwriting algorithms. In this case, if the lender is a bad credit bet and if he is approved, then he can be blacklisted by the credit bureaus. If they do not have the confidence that the customer cannot pay the fund back on time, then he might get blacklisted.

It is clearly evident in the cases of thousands of Kenyan customers as they have been blacklisted by the credit bureaus as they can not pay back the amount. In this context, a lot of customers in Kenya were unable to get good mobile loan offers that were no more than $2.

Discrimination of the Big Data Services

In the case of delivering digital credit services to thin-file consumers, these services do use Big Data analytics in their credit underwriting stage. Even though this kind of algorithm can be used to enhance the overall financial accessibility to these customers can also have some issues as well. Specific discrimination can also be aroused in this kind of algorithm as all the lenders use predictive models of their customers.

This model can be based on mobile activity and demographics, and so on. Thus this discrimination can be created on the basis of the consumer’s religion, ethnicity, age, and so on. This is also another major customer protection issue that needs to be mitigated for uninterrupted and equal digital credit service delivery.

Lack of Transparency and Breach of Client Data

One of the main customer protection issues that have been found by the Smart Campaign in their research is the lack of transparency from the mobile operators as well as the breach of user data. However, it is not clear who will focus on the protection of the branching of any private data to third parties. Smart Campaign has taken certain steps to mitigate all these issues as in the context of push marketing strategies, it is currently working on the definition of aggressive sales in the context of digital credit services.

In terms of the bad credit-bets also, Smart Campaign is focusing on reevaluating the guidelines of adverse reporting done by the credit bureaus that are affecting the clients who are not able to repay the amount due to insufficient appraisal. And in terms of the discrimination issue, The Smart Campaign is monitoring how the data analytics are creating protections to counter this discrimination issue.

Frequently Asked Questions (FAQs)

Q1. What is a digital Nano loan?

In this age of digital disruption, various SMEs do have the option to get access to funds within a very short period of time as this kind of loan can be termed a Nano loan. Various lenders like Eazzy Loan, Jumo, Timiza, and so on can provide a small number of loans to various small businesses or individuals. The overall low-interest rates make these Nano loans really advisable to start-up business owners when they require it in an emergency time.

Q2. How does digital credit work?

Digital credit can be specified as a short-term loan as you can access it almost instantly on the basis of your urgent needs. Any borrower even without a credit history can get a sufficient amount of funds instantly with the help of digital credit. This is even in the case of any remote areas of the population as digital credit is the way of the future for this population of borrowers.

Q3. Can digital credit help in financial inclusion?

Digital credit is the first official step toward financial inclusion, especially for all developing nations. With the help of the latest technologies, banking facilities can be transformed toward a more feasible one for all low-income people as this can help in enhancing the financial inclusion rate. Digital credit can definitely help in the cause of more financial sustainability as it can be fruitful for the case of any developing economy like Africa.

Final Thoughts

Digital nano loans can be the way to financial inclusion as they can make traditional banking services more sustainable for the general population. Especially in the case of Sub Saharan economy where the majority of the population is a low-income group it is essential to spread them sufficient financial services so that they can conduct their day-to-day activities.

With more MFIs offering Nano loans to these groups or businesses, the financial inclusion rate can be taken toward more growth in the coming years. Most of these people do prefer a feasible banking solution as this can advocate for them about the financial inclusion rate like calling all innovations in financial capability.

Author Profile

- Jonas Taylor is a financial expert and experienced writer with a focus on finance news, accounting software, and related topics. He has a talent for explaining complex financial concepts in an accessible way and has published high-quality content in various publications. He is dedicated to delivering valuable information to readers, staying up-to-date with financial news and trends, and sharing his expertise with others.

Latest entries

BlogOctober 30, 2023Exposing the Money Myth: Financing Real Estate Deals

BlogOctober 30, 2023Exposing the Money Myth: Financing Real Estate Deals BlogOctober 30, 2023Real Estate Success: Motivation

BlogOctober 30, 2023Real Estate Success: Motivation BlogOctober 28, 2023The Santa Claus Rally

BlogOctober 28, 2023The Santa Claus Rally BlogOctober 28, 2023Build Your Team – the Importance of Networking for Traders

BlogOctober 28, 2023Build Your Team – the Importance of Networking for Traders