Are you wondering how to recharge and reactivate your Cash App card because you have a low balance? If yes, worry not. Cash App is an excellent platform for receiving and sending money. You can pay using Cash App and cash app balance literally anywhere you want to, be it Walmart or a medical store. They come with exciting rewards and cashback too.

If you want to add cash to the cash app, it does not require a fee for opening the account, you can open your Cash App account with $1 or less. It is a totally free service and as the account is not directly linked to the bank account people sometimes wonder how they can add their money to the Cash App account, but do not worry, with your Cash App account, you can either use another card or by making paper money deposits to the shopkeepers.

So, “Where can I load my cash app card?” I hope you now know what we will be discussing here. You can either use another card or try making paper money deposits to the retailers. According to the survey, platforms like Cash App have had steep growth among users in the USA, with around 26% of U.S. adults having been reported using Cash App. If you are wondering how to add money to a cash app card, then in this article, we will provide you with in-depth information about what is Cash App and how can you reload them.

Where Can I Load My Cash App Card?

There are various quick ways for Cash App loading and if you are thinking about questions such as how to load cash app card, how to activate cash app card, and how to add money to cash app card in store, then the following information will clarify a lot of things for you.

- You can transfer a certain cash app balance from your checking account to Cash App using your Cash App account. You must connect your main bank account to the app to achieve this, and you must connect your main savings account to the app. Regular and Rapid bank account transfers are available using the Cash App. Normal transfers cost nothing but may take a day or two. With a charge, Quick Deposit moves your money in a short amount of time.

- Setting up a regular payment, i.e., monthly, weekly, etc., through your bank account is another option for recharging your Cash App card. Each moment you want to send money, you must first conduct a lump sum transfer. On certain days, recurring deposits regularly transfer money from the linked account. As long as you don’t select the Quick Transfer feature when setting up recurring deposits from the linked bank account to your Cash App account, there are no costs to add cash to Cash app.

- You can also ask a friend or family member for money to refill your Cash App card. This is effective if you owe them money for whatever reason. Ask your family, friends, or other Cash App users to send you money using your specific Cashtag by simply contacting them.

- Referring friends to the program is another way to replenish your cash app balance. Cash App offers a referral program where you may earn up to $15 each time a friend you recommend registers for the service. Keep in mind that before you are rewarded, your referrer must complete a qualified transaction. It’s quite simple, though. Merely request a $5 transfer from your referral, which you can then either cash out or send back.

- The ability to set up a direct payment to your Cash App card is provided by Cash App. Payroll deductions from your job, government benefits, or any other source of income that offers direct deposit are all examples of sources of direct deposits. You can access the setup instructions by choosing the direct deposit pop-up menu in the Cash App.

- You can add cash to cash app onto your Cash App card at a number of retail establishments, pharmacies, and supermarkets. To make the deposit, you’ll probably need to stop by the store’s customer service desk. Please be aware that adding cash to the Cash App card at authorized stores has a cost. This charge fluctuates, but it often amounts to $4 for each transaction.

- You can indirectly increase your balance with Cash App’s Boosts feature. Boosts provide savings at the locations where you make use of your Cash App more frequently. On your subsequent trip to your preferred coffee establishment, for example, you might discover a 15% discount. Boosts are exclusive to particular categories of stores. You might notice a Boost, for instance, in a grocery store or coffee cafe. However, the stores in which you can utilize the Boost categories are restricted. There are many boosts available on your Cash App account, but only one boost can be active at once. But, you are free to change Boosts whenever you like.

How to Locate the Closest Location for Cash App Paper Money Deposit?

To locate the nearby participating retailer, utilize the Cash App mobile app. First, go to the Cash App home screen and select the “Banking” menu to add cash app balance. Choose the “Paper Money” option under the “Banking” menu. You will see local locations on the app. Also, you can use the search bar to look for nearby participating locations by entering an address.

Cash App offers users the option to request instructions from their favorite map app once they have located the desired destination.

How to Activate Cash App Card?

If you are wondering how to add money to cash app card in store, there are several ways you can activate your card. Your Cash card should arrive around 10 business days after placing your order. If you are wondering how to activate cash app card then, it’s incredibly easy to activate your Cash App Card once you get it:

- On the Cash App’s home screen, click the Cash Card tab.

- Choose your Cash Card’s image.

- “Activate Cash Card” is chosen.

- When your Cash App requests authorization to use your camera, select OK.

- Detect the QR code.

- As an alternative to scanning the QR code, you can input the 3-digit CVV code and the expiration date.

Where Can I Put Money on My Cash App Card?

If you are wondering where can I load my cash app card for free, then the following merchants already offer Cash App cash deposits:

- KwikTrip

- Speedway

- H-E-B

- GoMart

- Rite Aid

- Walgreens

- Dollar General

- Walmart Customer Service Desk and Money Centers

- Thorntons

- Duane Reade

- 7-Eleven

- Family Dollar

- Sheetz

Do you Need an ID to Deposit Cash?

Whenever you buy a CashCard, attempt to purchase and trade Bitcoin or try to invest in stocks through the Cash App, you will be prompted to prove your identity.

Your account’s security will increase and the extra features will become available once you have verified your identification with Cash App.

Your identity will be confirmed only if you are 18 years old, possess a social security service, and specify your birth date. Your Cash App account would be more secure after your ID has been validated, and you’ll be allowed to register for a Cash Card, purchase and trade bitcoins, or make stock investments. Also, you’ll be qualified for an improvement in sending restrictions.

How to Add Money to Your Cash App Card without a Debit Card?

If you are wondering how to put money on cash app card, then there are numerous ways to fund this app. You must, however, possess your bank debit card connected to Cash App if you want to use the app to add cash to cash app from a bank account. You don’t require funds in the Cash App balance to utilize the Cash App, which is something to keep in mind.

If you have a linked bank account you can make payments directly through the Cash App. The bank account that you have linked in Cash App can be used to transfer or deposit your Cash App funds to your bank account, even though Cash App enables you to link your bank account via Plaid or manual verification without a debit card.

How to Put Money on Cash App Card at ATM?

You can use an ATM to put physical cash into your Cash App account if you don’t want to or are unable to visit retail locations. Keep in mind that to do this, one will need a standard bank account. There are several ways to withdraw money using Cash App, but if you are wondering how to put money on cash app card at ATM, then use an ATM to deposit money into your main checking account. The branch of your local bank is probably the closest ATM deposit location.

Be advised that a basic deposit won’t result in an immediate transfer; instead, customers will have to wait a few working days to see the cash in your bank or pay a charge to receive it right away. Still, if you are thinking about where you can load your cash app card for free, then it is not possible at an ATM as when you withdraw cash through Cash App via an ATM, you must pay a $2.50 fee. Moreover, the ATM provider may impose fees. But, for the 31 days that follow a qualified Direct Deposit, you are eligible for limitless ATM payouts and cost-free ATM withdrawals if your monthly Direct Deposit is at least $300.

What Do You Mean by Cash App?

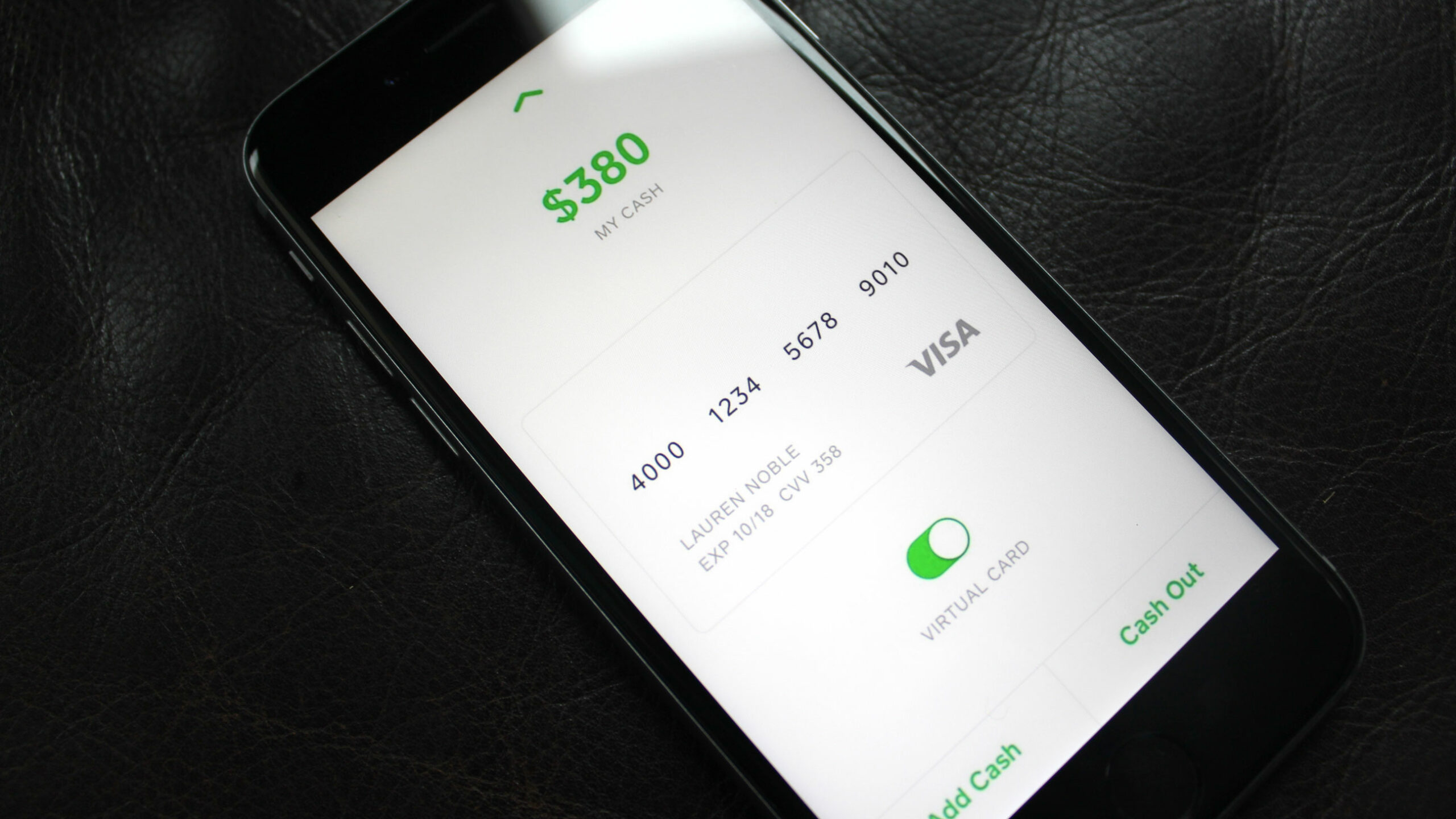

Cash App is a digital financial service platform that lets you send and receive money, similar to platforms like Venmo and Paypal. You can use Cash App for various transactions around several stores. You can utilize it while paying for products and services, you can borrow money from the cash app, etc. Both online and physical stores across the United States accept it as a form of payment because it comes with VISA processing payments.

This card also comes with other features like Bitcoin investing and stock. With Cash App, you can invest for as little as $1 for each trade, allowing you to purchase proportionate shares of stock. Stock market investing is completely free, but using Cash App to trade Bitcoin will cost you money. You can use Cash App for things like adding money to Venmo, filing your taxes, etc. Also, order a Visa Debit card that transforms the Cash App into a bank account for online and offline purchases, as well as ATM withdrawals.

Probable Risks and Drawbacks Associated with Cash App

Scammers and fraudsters aiming to steal peoples’ hard-earned money frequently target payment apps. This was covered when experts evaluated the security of Venmo and PayPal, and Cash App is comparable in many ways.

- Scammers rapidly filled the gap left by Cash App’s diminished staff during the pandemic by providing phony phone support numbers. The con artist would demand sign-in information, Cash Card information, or any other crucial details over the phone that they could use to steal money through Cash Apps or commit identity theft.

- In order to steal money, scammers often employ fake grants and programs. For instance, a con artist might get in touch with you via social media and promise you a prize if you get the COVID vaccine. Nevertheless, you’ll need to transfer a little sum of money before you can claim the prize. As there are genuine programs that are identical to these fake ones, they seem plausible.

- It is simple to understand why this kind of fraud is so prevalent, given the rising expense of living. Via social media, con artists get in touch with their victims and pitch them investment opportunities that might turn $10 into dozens or even hundreds of dollars. They claim they will grow the money by investing it, possibly in cryptocurrencies or NFTs, however, this is just a ruse to get people to pay them money.

- Cash App is particularly susceptible to frauds who utilize phony product listings, but have no intention of delivering to customers. These scammers are common in internet marketplaces, where they sell goods but only accept Cash App or cash app balance. Due to the lack of buyer protection, Cash App is one of the preferred payment apps. If the item you ordered doesn’t arrive, there isn’t much you may do to receive your money back.

Bottom Line

Cash App is a very good option if you want to buy or carry out your transactions in various retail shops, as it comes with a wide range of discounts for online transactions. If you have a negative credit history and have problems checking into a traditional bank account, it is a good option but in the long run, switching to bank accounts is the best option. Although platforms like Cash App come with a wide range of advantages, you can also get scammed easily for using such platforms. So, you should always do your research and handle your money safely before signing out of such a platform.

Frequently Asked Questions (FAQs)

Q1. Where to load the Cash app card for free?

Ans. You can add money Cash App for free in the following places Walmart (Customer Service Desk/ Money Centers), Walgreens, Kum & Go, Duane Reade, 7-Eleven, Family Dollar, GoMart, and Sheetz.

Q2. How much does it cost to load a Cash App card?

Ans. Standard transfers to your bank accounts and Quick Deposits to your connected debit card are both offered by Cash App. Normal deposits cost nothing and show up in 1 to 3 business days. The price for Instant Deposits ranges from 0.5% to 1.75% and is applied immediately to your debit card.

Q3. Can I load my Cash App card at the ATM?

Ans. To make a deposit into your primary checking account, use an ATM. The nearest ATM deposit location is generally the branch of your neighborhood bank. Please be aware that a simple deposit will not result in an instant transfer; rather, clients will need to wait a few business days to see the money in their bank or pay a fee to receive it right away.

There is a $2.50 fee when using the Cash App to make an ATM cash withdrawal, so it is not one of the places if you wonder, “Where can I load my cash app card for free?”

Q4. Are there limits to how much you can deposit?

Ans. The maximum amount that may be deposited via Cash App in one go is $500. Moreover, a deposit cannot be less than $5. Also, there are rolling weekly and monthly limits. Clients may not increase their balance by more than $1,000 per week or $4,000 in a single 30-day period.

Author Profile

- David Garcia is a nationally-recognized consumer and money-saving expert who helps people make smart decisions with their money. He has been featured on NBC’s Today Show, Good Morning America, ABC News, and CNBC as well as in The New York Times & other media outlets. With more than 13 years of experience in the personal finance space, David is an experienced writer and researcher. He has written for major publications where he provides readers with actionable advice to save money on groceries, insurance, and more. With his work for various publications, David is an active contributor to the Credit Card Insider blog where he shares insights into credit cards such as rewards programs and interest rates.

Latest entries

Loan App ReviewsApril 30, 20235K Funds Review: Analysis of the Online Loan Platform

Loan App ReviewsApril 30, 20235K Funds Review: Analysis of the Online Loan Platform BlogApril 30, 2023Top 5 Cheapest States to Live In 2024: A Comprehensive Guide

BlogApril 30, 2023Top 5 Cheapest States to Live In 2024: A Comprehensive Guide BlogMarch 21, 2023How Much is 6 Figures? How to Make a 6 Figure Salary?

BlogMarch 21, 2023How Much is 6 Figures? How to Make a 6 Figure Salary? BlogMarch 20, 2023What is Chime Spot Me? Features, How to Use & More

BlogMarch 20, 2023What is Chime Spot Me? Features, How to Use & More