What is a Budget? It is an obligation to your financial lifestyle. Your income and expenditures are related to each other in various ways. That is the cause you must understand what is better for you to achieve for yourself and your loved ones. Because if your income is stable and expenses are in control, then only you can dream big or shiny in the upcoming months or years. Otherwise, that six alphabet word absence from your activity can move to lose your target.

Now, without wasting time anymore, let’s understand the deep dive theory behind the budget.

What is a Budget?

It includes controlling unnecessary expenses, stabilizing your income, and finding ways to arrange money for future goals. Moreover, it can refer to several other things when you don’t even do it without using its practical methods. There are numerous types of budgets, and this is why one should never fear planning for them. In most cases, people ignore this formula because they think that this way, they will have to leave their luxurious life. No, that’s not entirely true. You can even achieve a more luxurious life than before with budgeting.

The easy-to-understand meaning of what is a budget is to plan your spending. You don’t have to deprive yourself of a peaceful and free financial life. You have to admit the mistakes you were making till now and transform them as per the circumstances that arise before you. Yes, the record is crucial here because that will indicate moving in the right direction. Moreover, it depends upon you only which theory you need to admire in your life.

A budget should be strict until it benefits you and holds flexibility to adapt to the changes. The negative mindset about the budget will not help you anymore.

The Working of a Budget

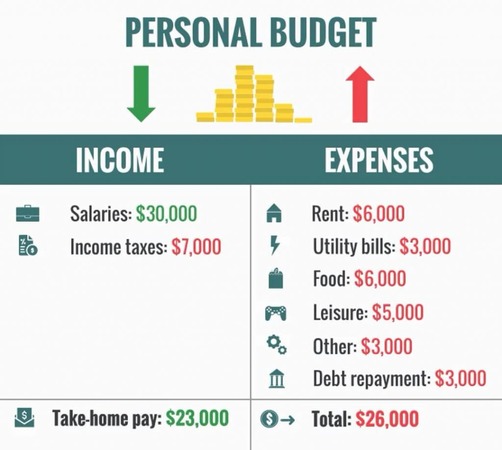

Spending plans to demand a systematic theory where you add or subtract something on the report or the time. You can divide the soft and hard budget. Digits are a necessary part of any type of budget. An inspiring picture of any budget is when it really changes your way of life. The traditional method is familiar to everyone where you figure out or separate your stable monthly income, other income sources (stable or unstable), and expected or unexpected expenses.

However, you may find some professional types to give a proper understanding to you and your family members if you have planned for it recently. Let’s start it.

Envelope Method

Your financial lifestyle (income or expenditure) may change- still, some old formulas will work for you. The envelope method is the same-where you put the same category amount into a particular envelope, tapping a name over it. That’s how you can save enough time. In this formula, you can, on the initial level, part the category of various expenses and make a group.

As you receive the particular month’s income, put the category-wise money in the envelope and spend it without making a mesh of the budget.

Refrigerator Method

In this method, the person can feel a sense of giving up an unnecessary explanation on the board. It should be crisp and clear so that you can know what really is coming for this particular or next month. In a clear concept, in the first line, write down the dates from starting to the end of the month. Furthermore, mention the amount received on the left side or the expenditure in the following right-hand sideline. Addition and subtraction are crucial to know the balance in your hand.

In case, you have less amount in the saving category. You can carry forward flexible expenses for the next month. That is important so that you don’t need to take any debt on your head for this tiny cause. Not just that, if this formula suits you or helps to refrigerate a fixed amount in your hand every month, you can adopt it for the whole year.

Pay Yourself First Method

It is always a great choice to put yourself first when it is necessary to do so. Here too, one has to seek changes in the monthly income and expenses. Saving is crucial besides paying a high-income debt. The question arises, why not other expenditures; Because that will help you generate a handsome amount in your hand at the month’s end. If you have already paid the required amount, then it is time to fix the savings from the discretionary income received in your bank account.

50/30/20 Plan

This formula is best for those who can not leave out their discretionary or luxury expenses. That is crucial- because a complete cut-off of the discretionary income can lead to living a stressful life due to a strict budget. Not just that, you don’t have to go for researched knowledge about budgeting. A thick line is sufficient to manage your target. See the following.

- At the initial level, one can calculate necessary expenses, mindful of the income source and amount. And keep them at 50% of the total paycheck amount. Yes, of course, it is flexible. One can increase and decrease the percentage by managing the expenses. A decrease is good, but the increase can lead you to face trouble. So better to give a timely revision of the figure.

- Moreover, you can completely transform your life while spending on discretionary or luxurious expenses- like a restaurant, traveling, movies, and more. It can get set to 30% of the total income every month. Here again, it is replaceable with the remaining percentage. But not with the previous one.

- For- the remaining part (20% of the total paycheck), you can consider the retirement benefits and other debt settlements. 30% and 20% are interchangeable.

For a better understanding, stick to this ratio for a year so that you may not miss saving due to a crucial part of a budget.

Advantages and Disadvantages of Budgets

Take a look at the advantages and disadvantages of a budget in your personal financial goals.

Advantages

- If you have decided to manage your income and expenditure, then a budget is a helpful weapon to cut the undesired line. It gives a strategy to live your life and take action whenever required. Not just that, but the management or control will restrain the loan application trend for any payment. The savings will be there to counter emergencies.

- Your spending habits are the prime cause of the financial crisis. It is the answer to when should a person make a budget. Budget will help you notice the unnecessary expenses and assist in replacing them with savings.

- Do yourself a favor by living to your standard. Don’t overstretch yourself because it will entirely cut down the peace of your life. Take the help of old or new budgeting methods to have unexpected benefits.

- It is a guide where you may not lead yourself in the wrong direction. Proper paper-based budgeting will show the waste of money and admire the changes with the savings and space for discretionary spending.

Disadvantages

- Most probably, it is for the upcoming month or years. And that’s why you may go with assumptions that really don’t exist. It is a disadvantage of what is a budget.

- Although you try hard to make it flexible or less strict, that is not possible due to the difficult format of most budget types. You can not counter desired changes in the whole document.

- There are numerous types & it is hard to consider the best for you. Adopting changes in these types ruins time and gives stress to the person contrary to the financial relief.

- For most of the budget system, one should be knowledgeable, and it takes full attention to mention every single detail of the monthly expenses.

Frequently Asked Questions (FAQs)

Q.1 When should a person make a budget?

It is good to have every time to recognize the function of your income with expenditure. However, start it immediately when you can’t achieve your goals on time.

Q.2 Why it is important to control your budget?

- It helps to manage the income and expenditure to work in the right direction or the goals.

- The budget controls the savings.

The Final Note

Any method you choose for budgeting should be appealing to your financial lifestyle and time management. It takes time however, a wise decision can help you gain more than your expectation for the future. Savings are part of every budget. If- somehow, one doesn’t find this element in the budget type, fix it immediately.

Author Profile

- Jennifer Garcia is an expert in the field of credit cards and related services. She has written extensively on a broad range of topics related to credit cards, including different types of offers and benefits, how to compare and choose the best cards for individual needs, and strategies for finding ways to use credit more effectively. She has been an invited speaker at conferences around the world to discuss her research into financial products. Her knowledge of the credit card landscape is unparalleled, with a deep understanding of how each offer or product works in relation to the rest of the industry. Jennifer’s work provides invaluable insight into how to make the most out of any credit product.

Latest entries

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice)

BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice) BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything)

BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything) BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]

BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]