Because a credit card is an essential tool for building credit and making large payments, having one is necessary. But having a bad credit score can hinder approval. Furthermore, if you have an unstable income and are not willing to put money up as collateral for a credit card, an unsecured card would be the right choice to opt for. If you have poor credit, it will assist you in rebuilding it. To pay off the debt or credit, consequently, you must have a reliable source of income. If not, it will negatively affect your credit rating and introduce additional obstacles to your financial lifestyle. Hence, we always advise improving your credit score.

If you are looking for an Unsecured Credit Card, you are at the right place. Worry not! We have got you covered. After considerable research, we identified 5 credit cards with better acceptance rates. Thus, an unsecured credit card would be your best choice if you have a poor credit rating.

Best Unsecured Credit Cards for Bad Credit

Let’s see some of the best Unsecured cards to tackle with your bad credit score or credit history.

1. Credit One Bank Platinum Visa for Rebuilding Credit

This credit rebuilding card gives you a minimum $300 line of credit to revise your credit report statement. It comes with higher approval odds or an instant approval process with no security deposit like a secured credit card. However, the Credit One Platinum Visa card can’t go for annual fee-free services. As a consequence! You must pay $75 to $99 to utilize the card effectively. First-year, you have to pay $75. The charges will vary- subsequently. If you make eligible purchases, like gas, mobile phones, grocery stores, internet connection, and cable tv, you can earn 1% cashback.

Yes, that may be a little less, but you have to manage it because of your bad credit score between 300-669, based on which you qualified. Furthermore, the big turn is with your credit limit and annual fee link. The initial credit limit is $300, and the first-year annual fee is $75. Now have only $225 as your spending limit. If you have any issues with your credit limit, you can either choose another service provider or a secured credit card to increase the credit limit with a fixed security deposit, as you know now well.

Furthermore, you claim to pay 26.99% (variable) for your spending. That is quite high- so be ready to pay on time by spending under the approved limit. You can use a free online payoff calculator to understand the monthly amount arrangement from your income and expenses chain. Apart from these benefits, you can get cash advances from the card with a payoff of 26.99% APR. For the Foreign transactions fee, you need to pay either 3% or $1 (Whichever is greater). Follow our words and pay the bill before the due date; otherwise, you will have to lose a maximum of $39 from your wallet as a late fee.

Eligibility Criteria: A credit score of 640 and above.

Pros

- No security deposit

- 1% cashback or rewards

- Bad credit approval

- Line of credit increase

- Credit building

Cons

- Annual fee up to $100

- Higher APR

- Deficient credit limit

- Foreign transaction fee

- Late fee

- Low cashback

2. Petal 2 Cash Back, No Fees Visa Unsecured Cards for Bad Credit

It is a good start for the overall management of your financial lifestyle. Petal 2, one of the best Unsecured credit cards for bad credit gives its services to limited or almost no credit people. Furthermore, it is comparably good to the last card with a 0$ annual fee because it will save you money though tiny. You can easily avoid security deposits with Petal 2 Cashback card, No fees Visa. The card applicant doesn’t require a perfect or excellent credit score. It can benefit even with 300-669 credit points. Once you cross the pre-approval process for this card, you can efficiently replace the burden of annual or monthly charges, late payments, program fees, and foreign transaction charges. Instead, you can earn from 1-2% cashback or rewards on eligible purchases.

Not just that, you can even secure 2% to 10% cashback for selected merchant payments. The credit limit is a minimum of $300 and a maximum of $10000. So, you can retain that limit without any collateral and other payments. Only your credit score, income, repayment capability, or income proof will matter the most for the determination. You can make your mindset for this card because it is a fantastic choice for the overall growth of your money management system too. A balance transfer is not allowed. APR on purchases can be a negative point for you, with 16.74% to 30.74% just to secure your credit score or to deal with a financial crisis.

However, You can get other benefits by being 18 years of age, and an authorized resident of the USA. Apart from that, you would have to submit a social security number (SSN), Individual Taxpayer Identification Number (ITIN), and employment status or income proof. With an ITIN number, non-US citizens can get this card.

Eligibility Criteria: No credit score is required, as this card is best for someone who is building their credit.

Pros

- No deposit required

- Free from annual, monthly & foreign transaction charges

- Cashback and rewards (1-10%)

- No membership fee

- Limited/No credit history

- Higher credit limit

- Partnership with multiple merchants

- No late fee

Cons

- Higher APR

- No benefit from “Introductory APR.”

- Not for all

- No balance transfer

- No cash advance

3. Prosper Card

If you prefer or can afford autopay monthly bills, then this can be a good investment idea. The Prosper card has a higher limit, even if it is one of the unsecured cards for bad credit. With your fair credit score between 300-669, you can secure a $500-$3000 credit limit. Not just that, it will facilitate your automatic credit limit increase with the timely payment of your monthly due. If you can’t activate autopay before the initial month statement, it will cost you $39. Otherwise, you can reserve a $0 annual fee feature for the first year. There is no eligible or non-eligible purchases cashback or rewards system. It may hit your interest with the card.

Furthermore, the potentially higher interest rate starting from 22.74% to 33.74%, can make you more worried about your selection for this card. Indeed, it is a good way to increase your credit score. To deal with it efficiently, spend under credit utilization rate with full settlement of the monthly due payment. Currently, the card service is not available for PNC banking customers. There is hope for change in the future. When you apply, there is no hard inquiry for your credit history or score to send the approved report on your mail ID. As a result, you don’t have to work on your credit score again because there is no drop, even a single point.

Prosper card has a link with TransUnion to share your debt information. Each month information will be analyzed and reflected on your credit report. The report will include your timely payment or even low credit utilization when you fear not spending more because of higher APR or no rewards to adjust your bill amount. You can source the TransUnion credit report from any official credit monitoring website as Prosper card doesn’t facilitate this service. With zero fraud Liability for unauthorized purchases, Coastal Community Bank (a Member of FDIC, Mastercard International Licensed), issues this Smart chip and signature card.

Eligibility Criteria: A credit score of 640 and above.

Pros

- No security deposit

- Fair credit approval

- The application doesn’t affect credit

- Reporting to credit bureau Transunion

- Autopay system acceptance

- 0$ annual fee for the first year of autopay

- No cash advance fee

- Speedy Application

- Credit limit increase

- Foreign transactions available

Cons

- Higher APR

- Higher Cash advance APR

- No bonus, reward, or cashback

- $39 annual fee

- No intro offers and welcome bonus

- Membership fee

- Foreign fee

4. Total Visa Card

Total Visa Credit Card is also one of the best Unsecured credit cards for bad credit among the others on this list. Anyone above 18 years and stable higher income can apply for the Total Visa card with a credit score from 300-669. Yes, it will go through the complete verification process- so there is no cent percent guarantee for the credit card approval. Moreover, it definitely contributes to high approval odds for most of its applicants. You can instantly get a credit card without any security deposit for your line of credit or credit limit. You can count it as an expensive card because of the one-time program fee of $89 while opening the new account.

Furthermore, you are liable to pay $75 for the first year and $48 afterward as an annual fee, 0$ for the first year, and $6.25 for the upcoming year as a monthly fee. In this expensive card statement, it is good to add a higher APR of 34.99% on all purchases with a credit limit of $300. Like Credit One Bank Platinum Visa, it deducts a $75 annual fee and allows you only $225 for spending. It is really an expensive card to meet your financial requirements with only $225 or $300. Most probably- it will not satisfy your requirement. Instead, it will cause a burden on your pocket. However, if you can handle these charges because of well-settled income sources and want to create a credit history, you can undoubtedly apply for the card.

You don’t have a choice to restrain the charges. However, it allows you to decide the design of your card from its specific options gallery. These options or designs are of dogs, flowers, cats, An American Flag, and a beach scene. It competently builds your credit score- because it shares your account information per month with three credit bureaus. You can review the report for your timely payment performance and spending according to the credit utilization rate.

Eligibility Criteria: A score of 750 and above.

Pros

- No Security deposit

- Instant approval

- Bad credit Qualification

- Credit limit increase

Cons

- Monthly fee

- Higher APR

- Rewards and cashback

- Annual fee

5. Petal 1 Visa Credit Card

This card resolves your financial stress with a $300-$5000 credit limit with limited or bad credit. You can easily switch from a refundable fixed amount security deposit secured credit card. Petal 1 Visa credit card is best in unsecured cards for bad credit which allows non-US citizens to without, Social Security number.

However, they would have to deal with 23.74%-33.24% APR with no balance transfer because of fair credit and the limited history available against your name. The cash is expensive however, it is relaxing to get 2 to 10% cashback from the selected merchants.

Eligibility Criteria: A Recommended credit score of (300-649).

Pros

- No security deposit

- No annual fee

- Foreign transaction fee-free

- Cashback and rewards

Cons

- Regular APR

- No balance transfer & cash advance

What are Unsecured Credit Cards for Bad Credit?

Unsecured cards for bad credit are for those who can’t pay a security deposit because of poor credit score/history. Moreover, your credit card application will be approved based on your income and repayment capabilities. The card issuer may also apply relatively higher interest in conjunction with additional costs and complicated terms, for example, regular APR ranging from 13.99% to 24.99%, to make the borrowing mechanism look expensive in lieu of security deposits.

To illustrate, some unsecured credit cards include annual fees that are debited straight from your credit line. The Total Visa Card, for instance, charges an annual fee of $75 the first year and $48 each year following. A one-time cost for creating an account is also a must before using an unsecured credit card. For example, the First Access Visa Card has a $95 program fee.

Conversely, you can get the credit amount to fix your emergency expenses, provided that you act according to the card issuer’s guidelines. They will decide your credit limit based on your creditworthiness.

Most of the time, you will face only application rejection, and if somehow you fetched the approved application, that will be a significant compromise with your money and negotiation rights. Yes, you will deal with the money only on the due statement. There is no fear of losing the collateral to hold secure credit cards. Unsecured credit cards are always good if you have a good or excellent credit score/credit history, but bad credit scores make it worse for the cardholders. Now, if you take any credit from the market, whether in the form of a loan or credit card, you should always try to repay the same on time to increase your credit score.

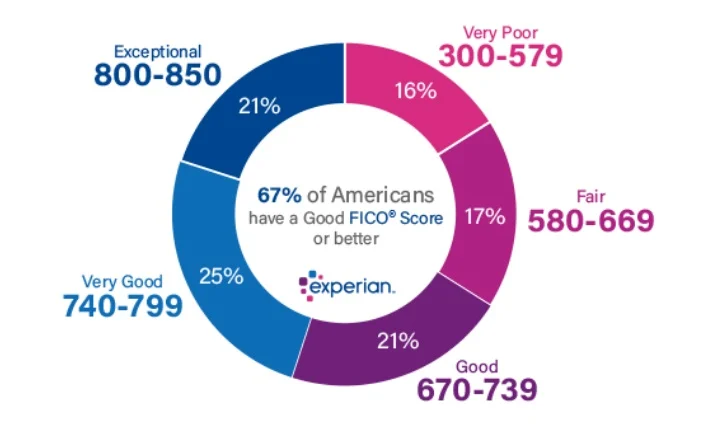

Likewise, if you take even a secured credit card with collaterals or a secured deposit, you can convert that card into an unsecured credit card if the service provider facilitates this under its policy. The whole chunk of peaceful use of loans and credit cards is the credit scores. These three integers, “300 to 850,” can decide your financial future. So, unsecured credit cards are always better when you have a good credit score. A bad score is always a cause of concern or absolutely a burden on you except for settling your emergencies.

Pros

- No collateral required

- Secured assets

- Open-ended financing

- Quick verification

- Only income and creditworthiness required

- Credit history and credit score

- Inform credit bureaus

- Resolves financial crisis

Cons

- Generates revenue to card issuer only

- No savings from income

- Higher interest rate

- Risk

- Bad terms and conditions for credit of line

- The low or limited credit limit

- Bad spending habits

Benefits of Best Unsecured Credit Cards for Bad Credit

There are multiple benefits of unsecured credit cards. One should always prefer choosing these cards. However, when bad credit adds to it, bad credit credit cards unsecured automatically become a problem. Let’s see some of the benefits of leaving bad credit aside.

- No Collateral Required

Unlike secured credit cards or loans, you don’t require collateral or a security deposit for approval. The application process or some basic details and documents are similar to secured cards. However, you will be eligible for unsecured cards based on your credit score and income-expense balance, not the amount you deposited in the card issuer’s bank account. All in all, you are safe with your assets and hard-earned money. However, you can be uncomfortable with higher interest rates and another additional fee.

- Asset for Settlement

If you haven’t given any asset to get the credit card because of bad credit or other reasons like being blacklisted, there is no fear of losing your asset for the loan settlement process. In almost all cases, the money lender or credit card issuer uses your collateral or asset when you have a delinquent account or become a defaulter.

- Approval Process

In most cases, the best Unsecured cards for bad credit applications get rejected because they don’t have any security to trust to invest in you again. Traditional banks or other credit groups solely rely on your credit history and score released by authorized credit bureaus and credit agencies. However, few fintech companies take a chance on these types of borrowers and rely on their income and repayment capabilities only. There are higher chances of approval if you give them the identity documents they want for your line of credit verification.

- Credit Building

Once you get approved for unsecured cards for bad credit, you have one more chance to build your credit score. If you’ve used any of your credit, you’ll need to pay it back on time, plus any applicable interest or other fees are shown on your account and statement. Before giving any application, you should check whether the company informs your debt repayment performance to the credit agencies or bureaus. That information will help Experian, Equifax, or TransUnion to analyze and publish the credit report for proper monitoring from your side and making the required changes.

- Free Credit Score Report

Not all but most companies help you get a free credit report every month directly on their platform or in partnership with other service providers. You should ask the company about it before signing the acceptance letter for your credit card in response to application approval. You have bad credit, and no company is interested in investing in you so it is always better to check whether now you can secure your financial image in the market or not. That is possible when the company you deal with links its works with credit monitoring authorities. That is quite hard to find but it starts with you.

Who Qualifies for an Unsecured Credit Card?

Unsecured credit cards are best for applicants who have high enough credit scores to get approved for offers with reasonable rates and fees. Generally speaking, those with a FICO score of at least 670 will qualify for most unsecured cards. However, it’s important to keep in mind that different issuers will have their own criteria when it comes to approving applicants.

What is the Difference Between Secured and Unsecured Credit Cards?

The signified difference between secured and unsecured credit cards is their security for the line of credit. Line of credit security is required in secured cards. On the contrary, you don’t have to choose a security deposit amount from the prescribed slot to get unsecured credit cards or even unsecured credit cards for bad credit. You can use your money by paying first to another with the secured card. It is refundable, though.

The thing is the opposite with unsecured cards. Here you use others’ money to pay it later. That’s another thing that you repay or return with heavy interest or charges. No! A hefty interest rate is not the play of only unsecured cards because of bad credit or else. The company charges higher interest rates for secured cards also. Yes, credit score and company type and its features or your income sources and credit history are also the factors that work in the background.

Whatever you choose, the fundamental to leading in the game is timely repayment to establish good credit history and credit score for the best credit report. That is possible when you have a stable income to deal with the ups and downs of these cards in the form of the security deposit, collaterals, APR, cash advance charges, balance transfer APR and more. Choose a secured credit card if you want to feel (actually, it is not) happy playing with your own money rather than getting it from others’ hints for the secured credit card.

Contrarily, choose unsecured credit cards when you can deal with evil and hectic terms and conditions, fearing sudden change as well. Secured credit cards are convertible into unsecured cards.

When Should You Avoid an Unsecured Credit Card?

If your FICO score is below 670 and/or if you’ve had trouble managing debt in the past then it’s probably not wise to apply for an unsecured card just yet. Doing so could actually do more harm than good since getting denied too often can further damage your credit rating. Instead, it might be better to start off with a secured card first as this type of card requires no minimum credit score and its payments are still reported to all three major bureaus every month. Once you feel confident that you can manage debt responsibly then you can apply for an unsecured card later on down the line.

How to Boost Your Credit Score with an Unsecured Credit Card?

Here’s what you need to know about using unsecured cards to build your credit score.

Choose the Right Card

When looking for an unsecured card, it’s important to choose one that will help you build your credit score. Look for cards that have low fees and competitive interest rates, but more importantly, look for cards that report activity to all three major credit bureaus (Equifax, Experian, and TransUnion). This is key since your payment history accounts for 35% of your FICO score. You’ll also want to make sure the card has no annual fee so you don’t end up paying more than you should.

Monitor Your Spending Habits

A big part of building a good credit score is having responsible spending habits. Make sure you only use the card when necessary and pay off any balance at the end of each month. Try not to max out the available limit as this can lower your overall utilization ratio and hurt your score. Finally, always remember to make payments on time in order to avoid any penalties or late fees which can further damage your credit.

Understand Your Rights

As a consumer, it’s important to understand what rights you have when opening a new line of credit such as an unsecured credit card. The Truth in Lending Act requires lenders to provide customers with clear terms so they understand exactly what they are signing up for—including fees and interest rates. Be sure to read all documents thoroughly before signing anything and if something doesn’t seem right speak up.

Getting Approved for Credit Cards With Bad Credit

Having bad credit can be a major obstacle when it comes to getting approved for credit cards. Fortunately, there are ways to get around this issue and still get the credit card you need. Here are some tips on how to get approved for credit cards with bad credit.

Check Your Credit Report

The first step to take when trying to get approved for a credit card with bad credit is to check your credit report. This will give you an idea of where your score stands and what needs to be improved in order to get approved. You can obtain a free copy of your report from AnnualCreditReport.com once a year, or you can pay for one from any of the major credit bureaus.

Look for Secured Credit Cards

If you have bad credit, it’s likely that you won’t be eligible for traditional unsecured cards. However, there are secured cards available that require a deposit and often come with higher interest rates and fees than regular cards do. The upside is that if you make all of your payments on time, they will help build up your FICO score over time and eventually lead to better offers in the future.

Apply With a Co-Signer

Another option is to apply with a co-signer who has good or excellent credit. This person will need to provide their personal information along with yours when applying, so they will be responsible if you don’t make payments on time or default on the loan entirely. It’s important that both parties understand the risks involved before signing any agreements or contracts.

How We Selected the Best Unsecured Credit Cards for Bad Credit?

Finding the best unsecured credit cards for bad credit can be a difficult task—after all, there are hundreds of different options out there. But don’t worry, we’ve done the hard work for you! We’ll outline five factors that we used to determine which unsecured credit cards are best for users with bad credit.

1. Cost

The first factor we considered when choosing the best-unsecured credit cards for bad credit has cost. We wanted to make sure that the cards were affordable and that users wouldn’t be stuck with exorbitant fees and interest rates. We looked at annual fees, late payment fees, over-the-limit fees, balance transfer fees, and interest rates to ensure that they were fair and reasonable.

2. Credit Bureau Reporting

The second factor we considered was whether or not the card was reported to major credit bureaus such as Equifax and TransUnion. This is important because it means that your payments will be reported to these bureaus and will help build up your credit score over time. We only included cards that report to major bureaus in our list of the best unsecured credit cards for bad credit.

3. Eligibility

The third factor we looked at was eligibility requirements. We had to be sure that users didn’t have to jump through too many hoops in order to qualify for a card. We made sure that the eligibility requirements weren’t too strict or too lenient; instead just enough so that users with bad credit would still have a chance at qualifying for a card but also so that they wouldn’t be taken advantage of by predatory lenders.

4. Bonus Features

The fourth factor we looked at was bonus features. Many unsecured credit cards offer bonus features such as cash-back rewards programs or travel benefits. We wanted users to have access to these features without having to pay exorbitant fees or jump through too many hoops.

5. Security Features

Finally, we considered security features such as fraud protection and identity theft protection services when choosing the best unsecured credit cards for bad credit. It’s important that users feel secure when using their cards and know that their information is safe from malicious attackers online or offline. All of our chosen cards offer some form of security protection services so users can rest assured their information is safe while using their card online or in person.

Frequently Asked Questions (FAQs)

Q.1 What are the best Unsecured credit cards for bad credit?

- Credit One Bank Platinum VISA to Rebuild the Credit

- Petal 2 Cash Back, No Fees Visa Best Unsecured Credit Cards for Bad Credit

- Capital One Platinum Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Discover it Student Cash Back

- AvantCard Credit Card

Q.2 How to apply for an unsecured credit card with bad credit?

- First, finalize the best card for you and apply for it by visiting the authorized web address of the credit card company.

- You can also download the mobile app to register for the credit card application for unsecured cards for bad credit.

- In the application, you can fill out the full name, income & expense details, credit score information, residential address, email address, and SSN.

- The credit card issuer will verify your details within the prescribed time and send you approved and unapproved reports against your application.

Q.3 How to get approved for an unsecured $1,000 credit limit card with bad credit?

You can get approved for an Unsecured $1000 credit limit card with bad credit with the following methods.

- Bank statement to show your creditworthiness

- Repayment capacity on time

- Higher-income sources

- Balance income and expenditure statement

- Down payment for the desired limit approval

Should You Go With These Credit Cards?

We have gone through various factors above including fees, approval odds, terms and conditions, APR, rewards and cashback, annual fees, and more, to recommend Unsecured credit cards for bad credit. To follow the standard of the full credit report, you have to mend your bad repayment habits. You can do this with the reduction of your expenses and usage of your card under the credit utilization rate. For any queries and suggestions, you can always get back to us.

Author Profile

- Elizabeth Jones is one of our editorial team’s leading authors on credit card offers, services & more. With over two decades of experience in the consumer credit industry and as a nationally recognized credit expert, Elizabeth provides in-depth analysis of both traditional & alternative forms of credit. Elizabeth regularly appears on many major media outlets including NBC Nightly News, Fox Business Network, CNBC & Yahoo! Finance. She is also a frequent contributor to Forbes Magazine. As a highly appreciated author for our exclusive Editorial Team, Elizabeth strives to provide readers with a trustworthy advice on how to manage their credit accounts while staying informed on the latest offers in the marketplace.

Latest entries

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide

BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know

BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide

BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide