We must have noticed that all mothers are not able to perceive a child with natural processes. But, we have an alternative for that which is through surrogacy. The costs associated with paying the surrogate mother will soon be realized by future parents as they find out how difficult the financial process will be. So, keeping that in mind there is a facility of grants or surrogacy loans that parents can make use of. Let’s have a look at what loans for surrogacy are available and compare them with distinct financial options. Let’s go.

Surrogacy Loans Overview

The most common dilemma that parents face while demanding a loan is having no income or bad credit. Different lenders try to provide the lowest rate possible to the borrower so that they can afford to take a loan. Expected parents can also go for surrogacy if they are receiving a salary but from outside the country or if they are independent. Then in this case you will be asked to show your recent bank statement or tax return.

The surrogate loans are provided by different lending companies. You can search for them online if you want to apply for a surrogacy loan. But before applying you must see the type of loan, the interest rate, and the ability of the institutions to repay it. Loans are commonly used by expected parents to cover surrogacy costs.

Surrogacy Loans for Bad Credit

Surrogacy loan providers accept applications from people no matter what their credit score is. It doesn’t matter whether you have perfect or bad credit, you are eligible for a loan. However, lenders also calculate surrogacy loan rates based on this factor even when they give loans to borrowers with poor credit. You can make your dream a reality by applying for no-credit personal loans online. Consider repaying your existing debt and keeping your balance on your credit card low if you are still preparing for a surrogate plan.

Why Do People Take Out Surrogacy Loans?

Taking a personal loan is a helpful option for those parents who find it difficult to get a child through surrogacy. It includes agreed monthly installments and reasonable loan rates.

There are numerous purposes for which surrogacy loans can be used, which is why many borrowers choose to apply for them. In general, private lenders and fertility financing organizations borrow online and issue loans shortly thereafter.

Surrogacy Loan Cost

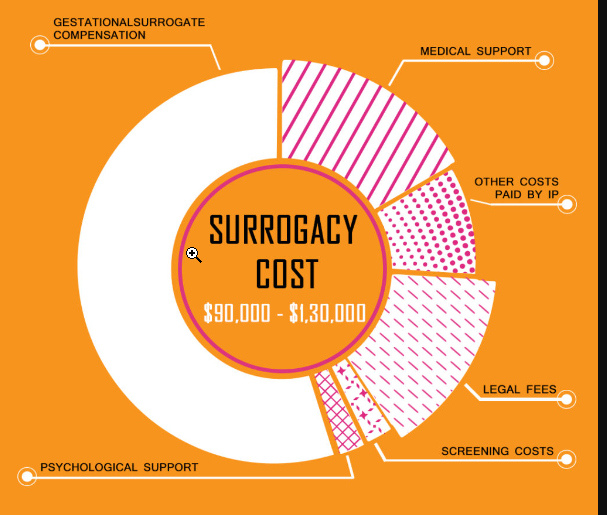

While applying for a loan you must look for the factors:

- Legal payments

- Agency fees

- Financial repayment for the surrogate

- Medical bills

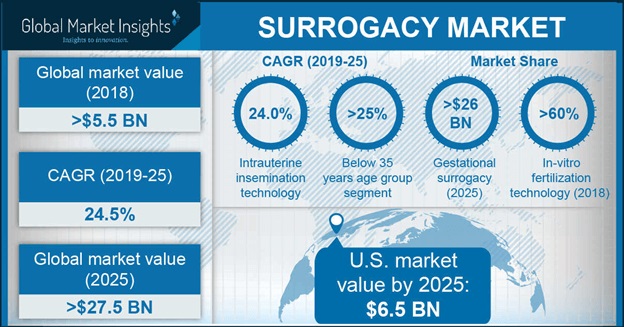

You should do deep research so that you can aggregate and select the plan which you can afford. If we talk about the approximate cost which is $49,000 to $200,000. Therefore, you must ensure that your credit score and income qualify you.

Finding the Right Surrogacy Loan

Most private lenders allow money transfers, also you can apply online and you can withdraw from the borrower a/c. You may think these are minor facts but they are important when you choose to take out a loan for surrogacy. Choosing a lender is just as important as choosing a surrogate.

Helpful guide- Loans for unemployed single mothers

In order to get a loan for surrogacy you should keep money circumstances in your mind. You can review the website of lenders so that you can see the interest rate, modest payments, and affordable loan conditions.

Method for Applying for a Surrogacy Loan

Your online application for a loan is extremely based on the borrower’s information and it is the same as a medical loan. You need to write your name, contact number & email. After that move towards economic statements so that you can determine APR. You can negotiate loan conditions and get the relevant credit.

Financing for Surrogacy Points to Consider

There are methods for financing surrogacy rather than taking a loan. Let’s have a look at different options:

- A grant from a state foundation.

- A surrogacy agency financing plan.

- Borrowing from family and friends.

- Credit cards and Insurance.

If you are interested, you can also read about 4000 dollar loan

However, surrogacy loans offer an advantage over other options.

- There are only some companies that offer insurance plans.

- If you borrow from your family & friends then you feel clumsy.

- Although credit cards give you zero percent at the initial period it is very short to return the loan.

- The maximum award for foundation grants is also $10000.

- Loan plans made up by private lenders cover all expenses, not just legal and agency fees.

Few Ways to Reduce Surrogacy Costs

Here are some ways that you can reduce surrogacy costs:

- Make sure you seek the advice of a lawyer early on so you are aware of your legal rights as a future parent.

- Choose SET (Single Embryo Transfer). As a result, you won’t have to worry about rising expenses for the baby since the surrogate mother will likely only have one child.

- To save money on transportation, find a surrogate who lives nearby. Do not choose a surrogate abroad either in this case.

Frequently Asked Questions (FAQs)

Q1. What is the cheapest way to get a surrogate?

- WIN Fertility Treatment Program.

- ARC Fertility Program.

- Heart for Heroes Program.

Q2. How much does it cost to have someone carry your baby?

The cost of a surrogacy loan can range from $49,000 to $200,000.

Q3. How many times can you be a surrogate?

Having more than five previous pregnancies is not recommended by medical professionals.

Conclusion

We have mentioned all the information that one should know before going to take surrogacy loans. So, try to go for a better option. However, if you have any queries then you can call us as we are here for you 24*7.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders