Gone are the days when you used to go through several documentation processes to know whether one is eligible for a loan or not. Loans are for the people, but sometimes people become available for the loan but are stressing too much about approval. Thankfully, Personal loan pre-approval has handled the situation wonderfully to shorten the documentation time only to know the prequalification or pre-approval.

However, these terms may confuse you at some time of departure. To clarify the perplexity, you should look at the article to know anything or everything about it. Let’s inaugurate it.

Overview of Personal Loan Pre Approval

This chance is for those who prefer to take loans via online mode. The standardization of every company doesn’t get affected due to the discomfort of the client, customer, or borrower. In the same way, when you visit the old or local bank or credit unions, they take time to check your credit score with hard pull/hard inquiry. After comprehensive & time taking documentation, the institution lets you know about your eligibility for the desired loan amount.

Helpful article- Get emergency loans for bad credit

Provided you are applying for the online institution giving you the option to review yourself for a loan, like a small short-term credit card, installment loan, and more. The crux of pre approval personal loan is that it doesn’t go against your credit rating decided by three prime rating agencies of America. It is like a mock of the time of loan approval and afterward. There is no negativity in the process of prequalification.

Meanwhile, both parties can assume the upcoming situation. The borrower can know the expected loan amount approval, repayment terms, APR, and other terms and conditions compared to other money lenders with a soft check.

The creditor can know the payment sources, debt history, credit score, repayment capabilities, etc. Because the money lender is in a business where he is there to acquire the profit with interest amount distributing loan to several eligible or competent borrowers. If that is not happening for whatever reason, it can go into heavy loss. This case is more drastic to bankers because the country’s economy rounds around the bank.

Distinctness Between Personal Loan Pre Approval & Prequalify for a Loan

Get preapproved for a personal loan. If this kind of notification, you receive on your phone means; you can track your eligibility for the personal loan besides affecting your credit score. The same day or a few hours of screening is the next point where you can not miss the chance of getting approved even with no need for original approval. One of the three credit bureaus, Experian, has revealed a statement saying- prequalified and pre-approved are most arguably synonyms for several money lenders.

Let’s get the original site of both of them before moving toward the big platform.

- Prequalifying for the loan means the creditor will give a check to your professional or personal status. Here, you have to mention in the particular checkbox your job profile, working duration, salary, gaps in the job change, etc., to make a fixed opinion about you. Not just that, your expenses also will matter here because they will confirm the repayment capabilities.

Want quick loans? Here are some loans like spotloan you may consider.

- Pre approval for a personal loan is similar to prequalification. You and your creditor can come to a bright conclusion about eligibility and ineligibility for the particular fund. Again, you must reveal information about your professional or financial lifestyle, age, debt history, and more.

How to Get Preapproved for a Personal Loan?

By the merger of pre-approval and prequalification, the answer is easy to understand because- in most cases, the lenders work similarly. Furthermore, the service should be available for the particular lender.

- If any creditor provides the services, it will notify it on its website. On the website: see your rating regarding the loan amount, type, or tenure.

- Personal loan pre approval demands some information, like professional status, payment sources, current job duration, when last changed job, etc. Other than that, you may get asked by the creditor about the monthly expenditure and debt history to confirm the repayment capabilities.

- Receiving the information will verify the overall check to complete the pre-approval process. It will not affect the credit score besides a mortgage. Meanwhile, you can choose several websites to compare the present companies’ status.

- FreedomPlus (7.99%-29.99%, 620), Lending Club (7.04% – 35.89%, 600 to 640), Payoff (5.99% – 24.99%, 600), Prosper (6.99% – 35.99%, 640), SoFi (7.99% – 23.43%, 680), Avant (9.95% – 35.99%, 580).

How Do You Know if You Prequalify for a Loan?

You can know the prequalification for a loan by a letter issued by the lender to your home address or your personal email id. The letter usually appears as the title prequalification or personal loan pre approval. Meanwhile, consider that the letter doesn’t mean that the creditor will definitely recognize you for the loan offer. It is a letter only, not the loan approval.

Do you have good credit? Want a personal loan? Here are some best personal loans for good credit. Check out.

Moreover, a general early bird perception is necessary. The letter contains 30 to 60 days to apply for the loan or before the expiry date. So, if you want to seriously; get preapproved for a personal loan, you should make a pre-plan for it or take action within the time limit.

Credit Score Gets Affected by Personal Loan Pre Approval

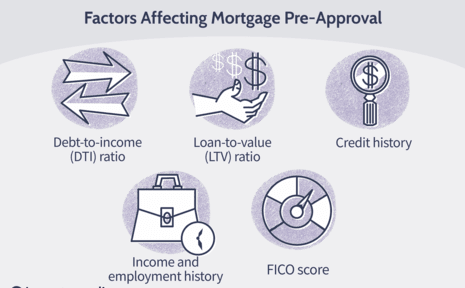

Always go for the soft pull or soft credit check money lender while applying for pre approval for a personal loan. In this case, you may not lose the credit rating or get all the relevant information required to finalize one particular creditor of your necessity. Besides, you apply for a long-term or weightage loan like a mortgage, home loan, auto loan, car loan, etc. Mortgage loans make it compulsory for the lender to go for a hard check or inquiry by contacting the three prime rating bureaus.

That process can damage the credit score by a few points. But they are recoverable with balanced management by the side of the loan applicant or the borrower. There is one more choice if rejected by one money lender due to any reason, make it amended. And apply for more such types of creditors within the same period- this way, it will not affect the score much.

Can You Get Prequalified for a Loan Online?

Yes, you can get prequalified using this information, like your name, DOB, and complete address. Monthly or annual income sources/amount, Loan type, loan purpose, loan amount, debt history, etc.

Poor credit score? Here are the best how to repair credit guidelines. Check them out.

As soon as; you get qualified from several creditors, you may compare them following the norms.

- See which creditor is providing you the required amount with all other conditions. The loan amount should be satisfactory because mainly; you have to use it to remove financial stress.

- In the next step, compare the annual percentage rate and find the lowest possible to pay on time with no credit rate effect. If you need to adjust the loan amount for any reason, decide with patience.

- Following the third point, one should consider for what duration you want to acquire the loan and which lender is fulfilling the need. Choose the best suits you.

- Deciding on these factors entirely, move towards the extra fees added by the company. This can be a prepayment fee or penalty, origination fee, late fee, process fee, and more. Take your time and then apply for the suitable one.

Frequently Asked Question (FAQs)

Q.1 How do you know if you prequalify for a loan?

You will get a prequalification letter from the money lender. In some cases, the website takes the same day or a few hours to qualify you for the loan amount with conditions.

Q.2 Can you get prequalified for a loan online?

Yes, you can get prequalified using employment status, identification documents, and personal information on the website.

The Final Verdict

Never predict your financial condition or eligibility based on some documents and their verification by someone else. You actually know your traits. Your ups and downs will be your responsibility. The lenders will need their interest amount, monthly EMIs, and final fund settlement at the end of the term. Personal loan pre approval is just an imitation. Go slow to go fast.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders