Are you too in some kind of a financial problem and need some kind of financial help? You might be hearing about a lot of personal loans that are currently really popular nowadays. But are you not really sure what and how to do it? Then this is the article that would clear minds about how you can get a loan even when having a weak credit score. Let’s now get started to understand how can you get personal loans for a credit score under 550.

What are Personal Loans?

A personal loan is a type of loan that provides you with a loan without any security or collateral along with easy and minimum documentation. These types of loans are used by people whenever they land in a situation where they require some financial assistance. They do charge an interest which depends on multiple factors like your credit history, income, tenure, etc. All in all, it provides its customers with the easiest ways to get a loan without all the complicated documentation.

This has made it very much popular among the people. Whenever people now land up in a situation where they need financial assistance or help they reach out to get a personal loan for themselves. There are a lot of online working companies that provide such offers to their customers. The concept of a personal loan is quite clear but now let’s dive in and get to know about a personal loan with 550 credit score.

What is a Credit Score?

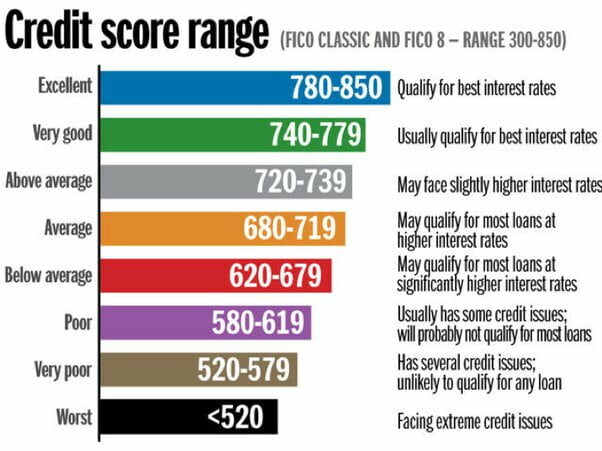

A credit score is basically a three-digit number that is determined by your credit history and loan repayments. It defines how much creditable a borrower is to a lender. It ranges between 300 to 850.

Where your credit score lies determines if you have a good credit score or a bad one. If you have a credit score ranging from 720 or higher then you have an excellent score. If your credit score is between 690 to 719 then that is considered a good credit score. And if your credit score lies between 630 to 689 then you have a fair credit score. At the bottom, if you have a credit score below 629 then you have poor or bad credit.

If you have a good credit score it would let you enjoy many benefits such as easy availability of loans etc. But having a bad score can land you in a situation where you would find yourself struggling to get a loan as the companies that offer such loans demand a specific amount of credit and lenders usually do not provide loans to people with bad credit.

Now, this might make you think, can you get a personal loan with a credit score of 550? But there are a few lenders that offer loans to bad credit too but you can improve your credit score

What Really Means Having a Credit Score under 550?

Before you get to know how you get a personal loan credit score 550 then first understand the cause for having such a low credit score. If you have a credit score that is under 550, then it means that you have a bad score. That lies almost in the last category of credit score. There can be a lot of reasons for having a bad credit score which might include:

- Lack of credit history

- Delayed and missed payment

- Maxing out credit card

- Only paying the minimum each month

By avoiding such things you can easily maintain your credit score and hence have no problem getting a personal loan.

Get Personal Loans for Credit Score Under 550

Whenever you get into a situation where all you need is a loan for your personal needs, low credit becomes one of the hurdles in getting a personal loan. But don’t worry, here are some ways through which you can manage to get a loan even with credit as low as 550. Let’s see what are the ways to get a personal loan for a credit score under 550.

Although not many companies provide loans for bad credit scores to people, there are a few companies that allow you to get a loan with bad credit. Let’s look at such companies in the following part:

-

MoneyMutual

MoneyMutual is a service provider which offers you short-term loans. It provides a very quick service to the user by providing the loan amount in less than 24 hours after the approval. It allows people who have poor credit scores to get access to a loan. If you too are looking for something that provides a personal loan for credit score under 550 then you should give this a try. The interest rate varies and you can get up to a $5,000 dollar loan amount.

-

CashUSA.com

One of the other options for getting a personal loan for a credit score under 550 is CashUSA. This connects you with lenders who offer loans up to $10,000. The interest rate lies between 5.99% to 35.99% with a loan term lasting from 3 to 72 months.

-

BillsHappen

This is the service provider which helps you find a personal loan ranging from $500 To $5,000. It allows you to get a personal loan with credit under 550. The interest rate and loan term vary. But this is quite helpful when you are having low credit but still require a personal loan.

Frequently Asked Questions (FAQs)

Q1. Can I get a personal loan with a 550 credit score?

Having a 550 credit score means you have a very poor credit score that limits your options to get a personal loan as most providers demand an average or good credit score. But there are a few providers that offer personal loans without bothering about the credit score and some of those are :

- CashUSA.com

- Bad Credit Loans

- MoneyMutual

- BillsHappen

Q2. Is a 550 credit score good?

No, 550 is not a good credit score, moreover, it is counted in the bottom line of credit score and hence considered as a very poor credit score.

Conclusion

Although it’s not easy to get your hands on personal loans for credit score under 550, there is always a way to get your things done. This is how you get through such a situation. The above article explains every detail about the things related to low credit and how it affects your choice. But it offers you an opportunity how to get a personal loan with credit score under 550. If you too are in such a situation where you need to have some financial help but your bad credit is coming your way. No need to worry now you have all the keys to unlock your ways to get a personal loan for a credit score under 550.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders