That’s the story of every borrower; When you plan to take a personal loan for numerous purposes. The feel-good tale becomes sad at the end when they don’t attend to your requirements. Does a personal loan affect your credit score? The answer is quite impressive because you (the borrower) only can claim its positive and negative effects on your life. Nobody can give a straightforward answer.

Because when you see the people doing good and seeming peaceful, they have done everything with some loan. What they have done is they have secured their repayment strategy.

The article will help you categorize your establishment to get wind of the fact. Let’s embark on it.

How Does a Personal Loan Affect Your Credit Score?

Yes, it does affect the credit score. But your actions are the ones responsible for your fate. How you intended, you got the result. It applies in every case of life. Let’s take two terms here into consideration. The first is a hard credit check, and the second is a soft credit check.

Until you think, but don’t act even with a random google check. You and your credit are safe and constant. There is no need to ask, does a personal loan affect your credit score? However, if you go to any bank, credit union, or online company. Something happens here. Let’s look at them as pointers.

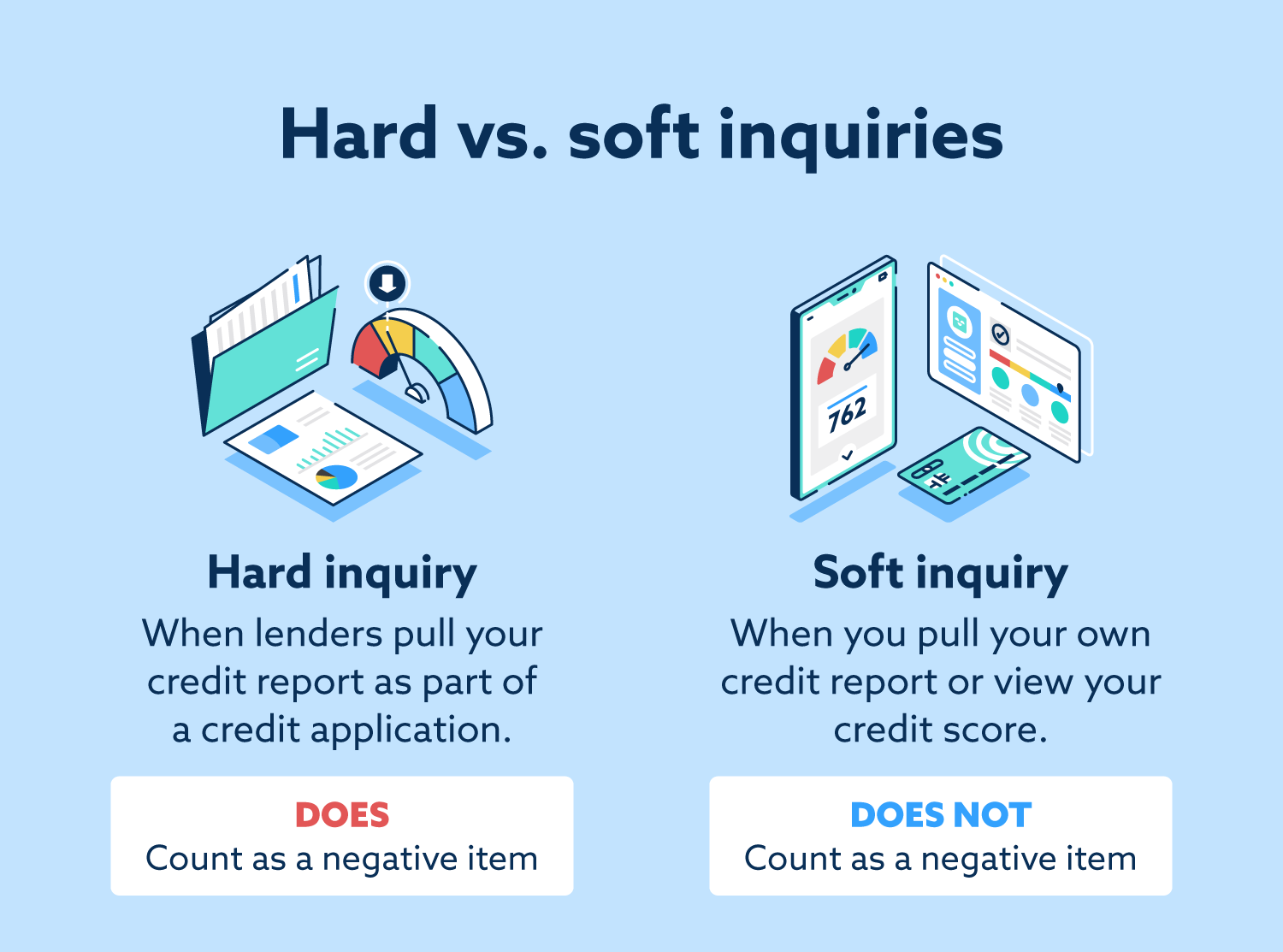

Hard Credit Check

- If you apply for a loan, the money lender does a hard credit check. (Be it for a credit card, personal loan, installment loan, refinancing, etc.) And communicate with the agencies responsible for preparing the credit report of every person eligible to take debt.

- As a result, agencies; like Equifax/Experian/TransUnion reveal the borrower’s status to the inquirer money lender. That gets professionally named as hard check/hard pull.

- So it is not just positive-negative effects. It is about everything you and the lender will plan for each other. Whether planning will work or not is also crucial here.

- Furthermore, when a single lender inquires about your loan application- chances are; you may miss 5-10 points out of the credit score. It may reveal a short answer for how much does a personal loan affect your credit score.

- However, the multiple inquiries in a short period with various lenders- only to find the best interest rate or loan amount can be less damaging to your credit score.

Soft Credit Check

- A soft credit check/soft pull is not an issue for the credit score, personal loan, or any other loan. Some borrowers get a loan approval without giving any application.

- You prequalify here even without any effort.

- There is another side to this soft check theory where you too apply for the loan, but few online money lenders give you a chance for prequalification with a Soft credit check on your own.

Does Applying for a Loan Affect Your Credit Score?

Yes, applying for a loan affects the credit score. There is a significant rule for every success you should be ready for your action’s result. Make timely payments without any gaps; Then you won’t have to ask this question. Yes, minor mistakes are ignorable in every case. But, don’t take it as a pass for approval for big mistakes. The report gets prepared by the well-classified bureaus. You can’t beat their actions. However, one can make itself strong to succeed in their reporting.

The changes will be there, whether the loan got approved by hard pull or soft pull. However, initial level hard pull damaged points or even soft checks are curable with the timely settlement of every single penny.

Factors Involving the Question of How Does a Personal Loan Affect Your Credit Score

- When you only inquire or shop for the personal loan for interest rate, repayment term, loan amount, and much more crucially relevant to a single bundle of the fund. If you go to the local banks and credit unions, you may lose something from your credit score. Online money lenders or financial networks can give some relaxation with a soft check. Better! Prefer them.

- With the Second factor, you apply for a personal loan and allow the money lenders to coordinate with the credit agencies. That time a hard credit check is obviously in the line affecting at least 5-10 points but manageable after the approval, or finally full fund repayment. FICO’s Hard check report comes from one-year reporting. Yet it leaves its prints for about two years.

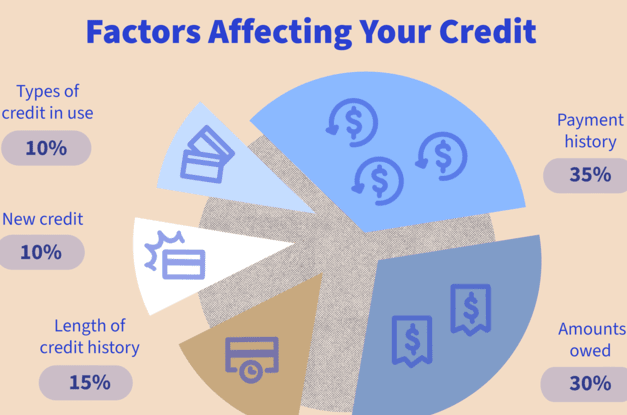

- The third factor is your joining the lenders. How you repay the loan amount is one of the prime figures here. Because two models, like FICO & Vangate score, work thoroughly on your repayment history. The overall percentage goes up to 35% from repayment history for the final credit score. Repayment is not ignorable at every stage of your life. Either you will repay or destroy your image entirely.

Casualty in Loan Repayment

You may consider that a few mistakes are forgettable even by the credit bureaus. Some days Loan repayment casualty is acceptable. However, if it gets missed for more than a month, agencies are liable to drop the credit score by 11 to 15% of the last credit score. If the credit score is 800, it can go from 90 to 100 points down.

Does a Loan Modification Affect Your Credit?

Whenever you sign a document for a loan amount, make sure that you have joined hands with complete trust. Your interest is prime to your money lenders. It has clearly mentioned everything to you. You and your lender are in a professional bond, so it should be clean with terms. Because in case something wrong happens in the future, the creditor can do something good for you, affecting less in the context of credit score.

A loan modification is a condition where your mortgage demands term modification for the same fund. That’s how the borrower can feel little newness or freshness in the debt journey. Now, the new terms may or may not affect the credit score. Why this? If the borrower still follows the same backward norms, possibly! Credit scores may get influenced.

Furthermore, there is a point one should never miss about lenders. Credit agencies coordinate with your money creditor to reveal the loan creditworthiness about you in the future. You must not ignore how the company reports your activities regarding the loan and its interest to Equifax/Experian/TransUnion.

Never joke with the creditor by giving half payment of the principal amount and interest amount. Because- it is better than refinance, bankruptcy, or foreclosure. Bankruptcy and foreclosures affect credit scores more than loan modification.

Should I Take a Personal Loan Ignoring a Question: Does a Personal Loan Affect Your Credit Score?

Again, the answer is yes, you may have several reasons to take a personal loan, if you need it, with no options available. Suppose you think you can manage things because you have sources to make repayments. Still, you are under the influence of the question of the personal loan credit score effect. How can you manage your other high priorities because they are pending because of this one decision? Go to the final step if you are fully ready with repayment sources, good or excellent credit scores, and debt history. (if any)

On the other side of the coin, you should most probably ignore the plan if you have no repayment sources. Bad credit scores and less impressive credit history are ignorable in some cases. But if you don’t have money, you can’t survive on this most complicated journey. Foreclosures and bankruptcy are terrific for future peaceful life and ok, fine, good, and excellent credit score.

So, if you are taking a loan, never miss these things:

- Timely Repayment.

- Debt consolidation, if you have numerous loans.

- Pre-qualification with soft check/soft pull.

- Realize! how your money lender reports your payment record to the credit agencies.

- The credit utilization ratio should be less than the approved amount or maybe 30%.

Debt Consolidation

Debt consolidation is a point that sometimes leads to the question; does a personal loan affect your credit score? In case- you have various loans, like credit cards, personal loans, student loans, car loans, home loans, and medical loans, you can merge them all. The merger will be debt consolidation for a single personal loan with a lower APR and limited credit utilization. At the initial level, it will affect the score, but later On: with timely payment and finally full settlement- it will come in a similar place.

Again, debt consolidation may or may not affect the credit score depending on one-on-one.

Will Prepayment Affect Credit Score?

That depends on the money lenders because some charge penalties for the prepayment. You have taken a loan from a company that doesn’t accept the loan payment or monthly EMIs before the due date. Its report about your payment history may impact your credit score. On-time is a term that is the significance of your win in the score game. You may do prepayment but may not see the desired or quick results. Paying off a loan early means- you are choosing two sides, positive (marking-10 years on the report) & negative (marking-7 years).

Number of Personal Loans and Credit Scores

There is no surprise with the multiple numbers of personal loans, as expenses are multiples. Again among various options of lenders, few will favor adding one more debt fund to your list of numerous personal loans. The outcome is- the approval will affect fewer scores on the downward side. The rejection will source more points downwards and will get multiplied by the increase of queries and loan applications.

Frequently Asked Questions (FAQs)

Q.1 Does applying for a loan affect your credit score?

Yes, applying for a loan affects the credit score, but that doesn’t mean you get affected by it permanently. At the initial level, you may miss about 5-10 points if the loan got approved, or in case of rejection, some points can add to this drop. However, the final payment may fix this issue permanently.

Q.2 Does a loan modification affect your credit?

Yes, it can! If you pay the loan amount on time with a modified term and the creditor has given a positive report to the credit agency, there is no issue with the credit score. It is better than bankruptcy or foreclosure.

The Final Words

Finally, the borrowers can understand- if they can repay the entire amount on the termed date, there is no question of credit score affected. You can level up yourself in the mid of the term even if you have missed one or two payments. Because in the end, you have settled all the amounts as per your responsibility.

Author Profile

- Jennifer Garcia is an expert in the field of credit cards and related services. She has written extensively on a broad range of topics related to credit cards, including different types of offers and benefits, how to compare and choose the best cards for individual needs, and strategies for finding ways to use credit more effectively. She has been an invited speaker at conferences around the world to discuss her research into financial products. Her knowledge of the credit card landscape is unparalleled, with a deep understanding of how each offer or product works in relation to the rest of the industry. Jennifer’s work provides invaluable insight into how to make the most out of any credit product.

Latest entries

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions

BlogFebruary 17, 2023Why is My Debit Card Declined When I Have Money – Reasons & Solutions BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice)

BlogFebruary 16, 2023Where Can I Cash My Stimulus Check? (Get Experts Advice) BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything)

BlogFebruary 16, 2023Can You Cash a Check at an ATM? (Know Everything) BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]

BlogFebruary 15, 2023How to Add Money to Venmo Account? [5 Best Methods Explained]