It has become quite difficult to get a big loan these days. There are many options like instant cash apps, direct lenders, or payday loans that provide instant money, but the problem is that the amount of money they provide is less. You can’t pay your college fees with $250.

If you need a big amount of money then banks and credit unions are the remaining options, but their lengthy procedure and paperwork take days to complete. That’s when Oportun comes into the picture. We are going to give you one of the best Oportun reviews on the basis of some parameters.

Oportun was launched in 2005 to help people with their finances, who could not take loans from banks or credit unions because of their bad credit. The head office of Oportun is based in San Carlos, California. This online service provides various kinds of loans, like student loans, car loans, small business loans, payday loans, etc.

Honest Oportun Reviews

You must have read many Oportun reviews online, but here we have covered all the aspects of Oportun in detail, be that good or bad.

Advantages

- Quick money deposit

- Helps in building credit

- Provides loans even on bad credit or no credit at all

- Provides affordable annual percentage rate for borrowers or low credit

Disadvantages

- The high effective annual interest rate for borrowers of good credit.

- You can only get money up to $10,000.

- Charges tax stamp fee or processing fee.

Oportun Features

1. Oportun Fees and Rate

Now, we will tell you about their fees and rates. There is no membership fee or subscription fee as such but depending on the state, some taxes may be applicable. This fee differs from state to state and Oportun deducts it as a percentage, depending upon the deposited money.

An annual percentage fee is applicable on private loans. Some lenders may also ask for extra fees from the borrower. Before going for it, you should check the final sum of money that you will have to pay. The Interest rates of Oportun are much higher as compared to other private lenders.

2. Oportun Safety and Security

At this best Oportun review, we would like to tell you that Oportun is considered ordinarily safe. There are no special security features and your information can be used for website analytics, targeted advertisements, or even promotion. You can stop this by changing your privacy settings on their website. They do not share your private information with any third party.

3. Customer Support

As per the Oportun reviews by their previous customers, their customer services are quite good. They solve the queries of their customers via email as well as on call. You can find their customer support email address and phone number on their website. If you have any query regarding the Oportun loan payment, it can also be resolved by customer support.

Regarding Oportun credit cards, they do not have any particular app for their credit cards, neither for Android nor for iOS.

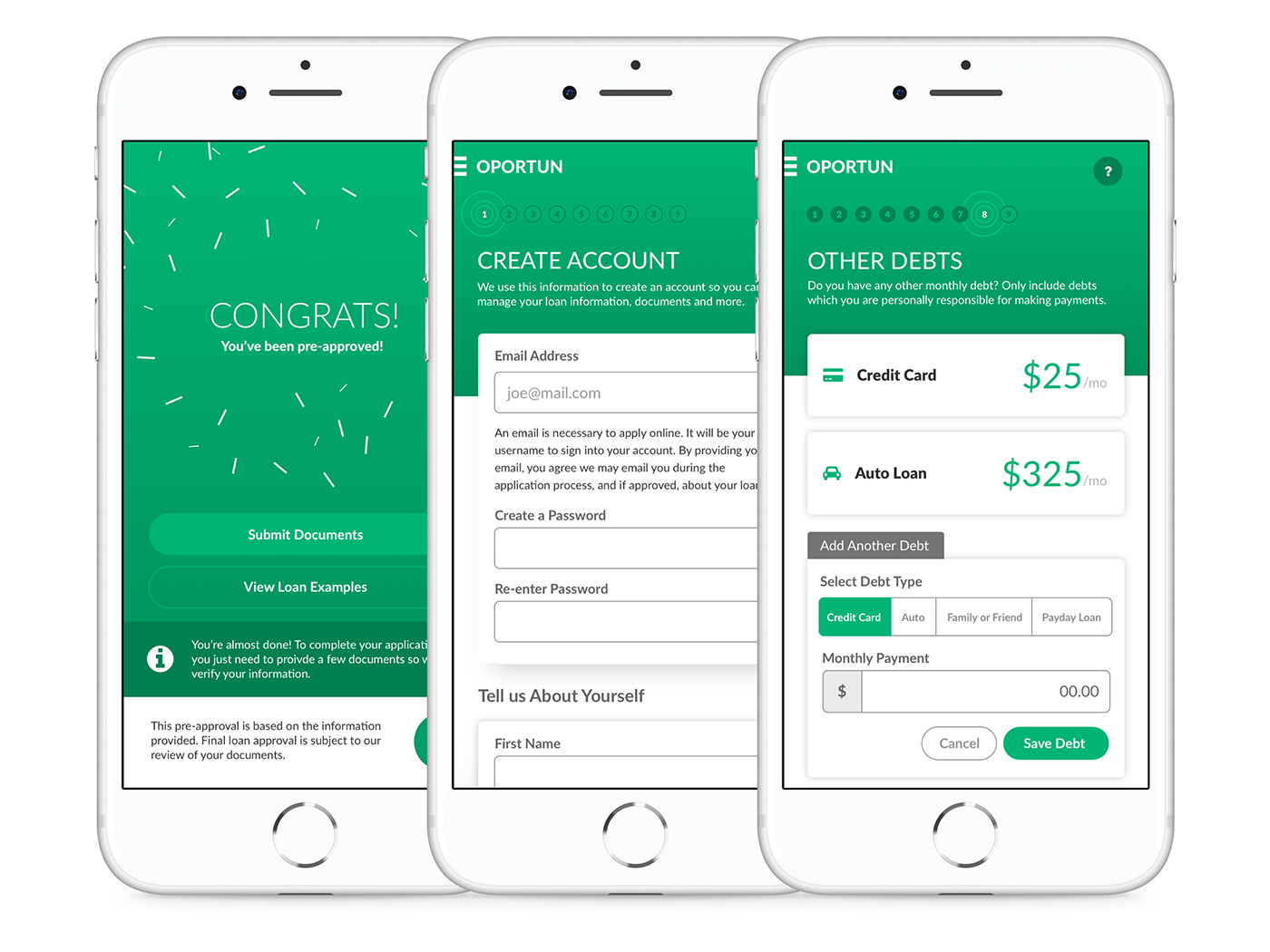

How Does Oportun Work?

To get a loan from Oportun, you have to go on their website and make your profile. Once you have made your profile, you need to link your active bank account with your Oportun profile. After this, you need to fill in your details, like what you do, your monthly income, and your credit rating, and submit your documents. After this, you can select your loan type, and as soon as your loan application is approved, the requested amount will be deposited into your bank account. It is one of the best loan-providing apps.

How Much Money Does Oportun Provide?

Oportun provides up to $10,000 of deposit. You will need a credit rating of between 300 to 700 points to get a loan of $10,000. The higher your credit score is, the lesser interest you will have to pay. Even though you have a bad credit rating or no credit at all, Oportun will provide you with a loan, but at high-interest rates. They give a minimum deposit of $300.

Loan Types That Oportun Provides

Let’s see what kind of loans they provide and their features.

1. Private Loans

Oportun online payment provides small private loans for various things like medical bills, car repairs, vacations, repaying borrowed money, rent, etc. You can use this loan for any purpose. Though there are certain restrictions on these private loans like you cannot use them for educational purposes or small businesses.

2. Small Business Loans

You must have read many Oportun reviews, but here we would like to tell you that Oportun also provides special loans for small businesses. Small business owners can use these loans to start their businesses or expand an already existing business.

With the help of this particular loan, you can pay for daily work, business equipment, and other business-related commercial assets. To get a business loan, you will have to explain to them first how you will be using the deposited money, then only Oportun will approve your small business loan.

3. Student Loans

Oportun also provides loans to students. Students can use this loan for all kinds of educational expenses, like paying their college fees and buying textbooks, a computer, or a laptop. Students can repay this loan after a few months of their graduation when they start earning.

4. Car Loans

These car loans can only be used to buy a new car or pay the mortgage of an existing car. You need to repay this loan within the decided period otherwise Oportun can even confiscate your new car. You should also check your state tax before finalizing your car loan.

5. Mortgage Loan

In case you want to buy a house but you cannot pay the whole amount at once then you can use the mortgage loan provided by Oportun. This loan helps you with the finances when you are already paying the down payment of your house and falling short on money.

6. Payday Loan

It is easy to get a payday loan from Oportun.

Things you will need:

- Valid ID

- 18 years of age

- Active bank account

- Profession

You need to apply for a payday loan on their website. If you miss the repayment on your payday then the loan will be extended.

Recent Oportun Controversy

Other Oportun reviews might not tell you about this but recently Oportun was involved in a scandal. During the Covid-19 pandemic, Oportun filed several legal complaints against their borrowers, threatening them to continuously pay their high-interest loans.

Frequently Asked Questions (FAQs)

Q1- What is Oportun?

Oportun is a money-borrowing company that provides loans to people. It was founded in 2005 and the head office is based in San Carlos, California. Oportun provides a loan of up to $10,000. It provides various kinds of loans like personal loans, car loans, mortgage loans, and student loans.

Q2- How long does Oportun loan take to deposit?

Oportun loans are known for their fast deposits, as soon as your loan request is approved and your application is completed, in a maximum of one business day they deposit the requested amount in your bank account.

Q3- Is there an app for Oportun credit cards?

No, Unfortunately, there is no app for Oportun credit cards, neither for Android nor for IOS. However, you can manage your card online by logging into your Account.

Final Words

If you need $10,000 urgently and you have a good credit history then Oportun can be a good option for you. If you have bad credit then you will get a loan but at a very high-interest rate. Their interest rates are comparatively higher than other lenders. It is your final choice if you want to go for Oportun or not.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders