For the past few years, experts and economists have been discussing various methods to make financial inclusion more achievable for all groups of society. Hence, they introduce microfinance to include the low income or unemployed groups in the financial growth. In this movement, microcredit is the focused term to improve the economical condition of the community at the base of the economical pyramid. Microfinance Institutions help to practice microfinance by lending small loans, micro-insurance and provide education related to business and finance.

The main goal of microfinance is to improve the existing financial inclusion and provide people with an opportunity to develop economic self-sufficiency. The diversified model of finance will assist to achieve more practical financial inclusion and also allow people to save.

This article is dedicated to the idea of Microfinance institutions and how they can help to improve the economic system.

What are Microfinance Institutions?

As discussed above, they are organizations that help people by providing financial services. The organizations are basically designed as financial assistance to the populations with income. Microfinance institutions help with micro savings, microloans, and microinsurance. People can also get small loans who do not have a banking account.

The interest rates on the loan are much lower in the microfinance institutions as compared to the other banks. However, the amount and procedure of the loan differ from country to country. There are different types of services providers such as microfinance gateway like community-based development, non-government organizations (NGOs), cooperatives, self-help groups, credit card and insurance companies, post offices, telecommunications, etc.

The Microfinance institutions main focus is to attract large deposits from corporate and institutional deposits from the clients. They motivate the people from lower-income communities to save.

However, other than supporting the weak financial background people, the Microfinance Institution has more capabilities. It can also assist the existing market system and help them to save too. The leading microfinance institutions are re-thinking their goal and planning to expand the organization on a large scale. They found out that they can gain the clients’ loyalty by offering savings, which will eventually help them to improve their portfolios. The organization will provide the services, protect them from financial shocks, and also allow them to keep moving towards the goal.

Hurdles for Microfinance Institutions

The idea although seems interesting, but there are hurdles to expanding the Microfinance Institutions (MFI). The following are some points that will make it more clear to understand.

- The savings accounts have high rates of dormancy.

- Structure of the Institution disproportionate to screen and evaluate the creditworthy client.

- The staff of the Microfinance Institutions are more focused on the sales of credit. MFIs are not much interested in managing savings that do not make any profit.

- Training provided to the staff of Microfinance institutions is not much of a concern to save. They are trained to focus on the credit processes.

- The frontline staff of the organisations design the program to reward sales of loans. They are least interested in promoting the savings.

What are the Potential Solutions for Microfinance Institutions?

There are a lot of hurdles in the path of the Microfinance Institution that are needed to solve. The following are some actions and structures that may help microfinance institutions to overcome the problems.

-

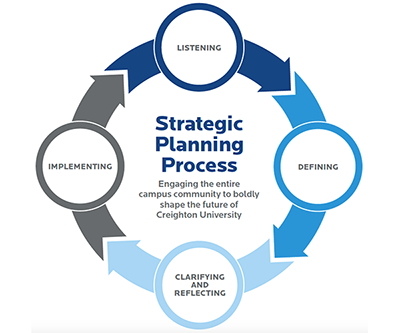

Strategic Direction from Top Management

It is a way to increase awareness and commitment. A much stronger system of microfinance gateway can be formed through workshops and signings of agreements. With the help of Strategic direction, the MFIs can involve the board members and the senior management team. The higher authority can then teach the staff a better value of saving in their institution.

-

Awareness-building and training of staff

The actions should be taken from the very beginning of building a team. A well structured and planned training will help the staff to know more about the microfinance institutions, microfinance insurance, etc. and can learn the importance of money-saving.

As most of the biggest institutions do not pay much attention to loans and promoting savings. Hence it is essential to educate the salesperson and frontline staff to encourage saving, and also convince the client to do the same. With workshops and training the objective is easy to achieve.

Also read, Upgrade the Existing Financial Inclusion

-

Adequate Structure and Monitoring

Along with educated and trained staff, consistent monitoring is also necessary. Therefore, it is essential to manage the saving products according to the proper goals, processes and monitoring.

It is concerning that in most of the institutions the money-saving management is at low priority while the team is more curious and focused on the loan performance. This basically happens because the staff do not get any benefits or rewards for encouraging or promoting the savings. In most organizations, sales monitoring is given much more attention than savings. Therefore, it is important to create well-defined saving goals.

-

Easy Access and Services

Along with implementing the new guidelines and model, it is equally important to ensure that the customers have a good experience.

The system and the services must be easy to access and efficient. Microfinance institutions should be able to inspire the clients to achieve loyalty. It is important to ensure that the customers are receiving the best services to manage and meet their financial requirements.

Clients often opt for informal ways to save money despite being risky. They prefer the informal mode because those are readily available and easy to access. The Microfinance Institutions should consider making the services efficient, user-friendly, and with an effective customer service facility.

-

Adequate Communication and Branding

Proper communication inspires the client to save. The staff of the microfinance institution should use direct and clear conversation and make them understand the saving methods. Branding and promoting the ideas behind the service is also essential to encourage people. The institutions should also educate their clients with clear and direct messages

Take Away!

The above are a few ways and solutions that can improve financial inclusion. Now it is time to end the article. Hopefully, this article was informative and helped you to gain some crucial knowledge about financial inclusion and microfinance institutions.

Share the blog within your friend circle and make them aware too. You can also check other articles on our website.

Author Profile

- Jonas Taylor is a financial expert and experienced writer with a focus on finance news, accounting software, and related topics. He has a talent for explaining complex financial concepts in an accessible way and has published high-quality content in various publications. He is dedicated to delivering valuable information to readers, staying up-to-date with financial news and trends, and sharing his expertise with others.

Latest entries

BlogOctober 30, 2023Exposing the Money Myth: Financing Real Estate Deals

BlogOctober 30, 2023Exposing the Money Myth: Financing Real Estate Deals BlogOctober 30, 2023Real Estate Success: Motivation

BlogOctober 30, 2023Real Estate Success: Motivation BlogOctober 28, 2023The Santa Claus Rally

BlogOctober 28, 2023The Santa Claus Rally BlogOctober 28, 2023Build Your Team – the Importance of Networking for Traders

BlogOctober 28, 2023Build Your Team – the Importance of Networking for Traders