About six months back, I was stuck in a dead-end job. I had little to no savings. I was making a film before that. The production was about seventy percent done when we ran out of cash. To top that tasty cherry on the cake I had no credit history. I should have gotten a financer from the beginning, they told me. I hadn’t.

What to do now? Well, take up a job. Save some up and start filming again was the solution. So I did that. I found the whole ordeal more tedious than counting sheep before sleeping. A friend of mine with a start-up venture of his own talked to me about a microloan. He had taken a microloan for his business venture. Today his business venture is up and running with fifty employees. I have completed my film.

All thanks to micro loans and a man by the name of Muhammad Yunus. Well, what are micro-loans then if you’re wondering, and if you will be able to avail micro loans? Well, today we are going to spill out all the beans.

What are Micro loans?

Micro Loans were specially developed for people in economically challenged areas and economically challenged in general. If you have spent your youth away without much savings but still harbor a dream microloans might be the thing for you.

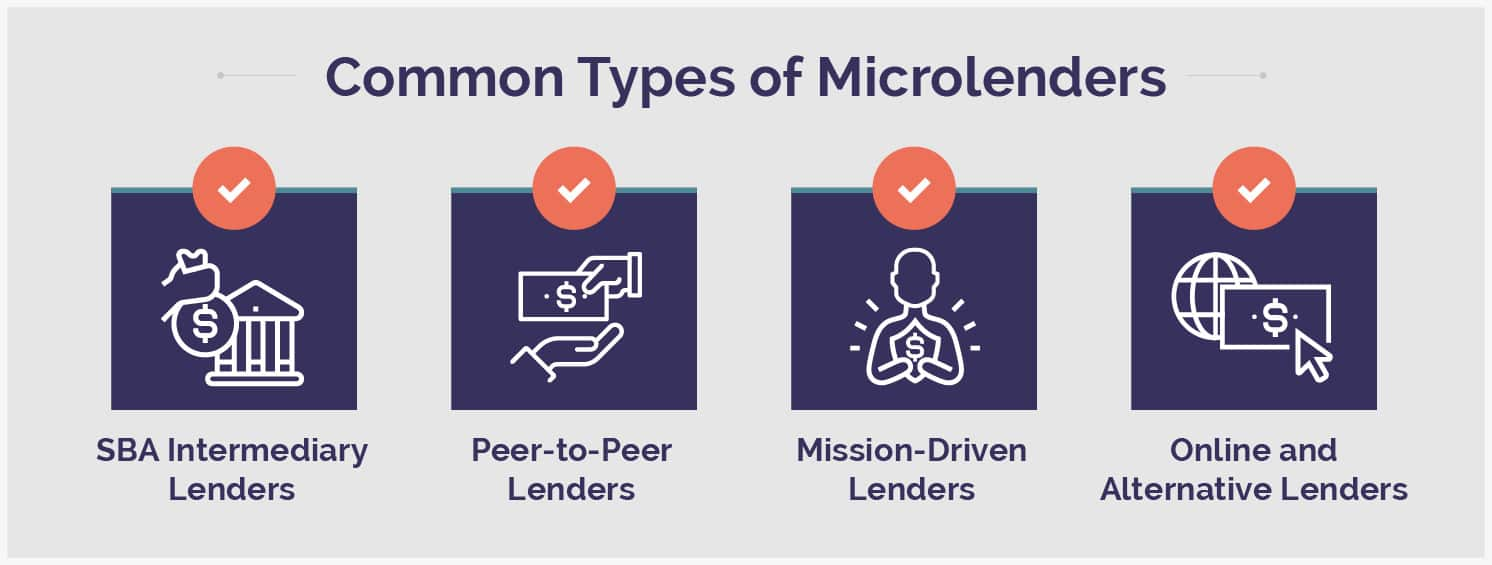

Micro loans are a constituent of the peer-to-peer economy that has become so rightfully popular these days. The problem with credit scores is once you get that into the bad credit score mark or without a history in general. Something that I had suffered from.

The whole process of getting loans from institutional places becomes nothing sort of an epic journey of struggle. Let’s not even begin with the huge chunk of papers you will embargo with. Micro loans come to the rescue just in time for that. If you are looking for a short fix of money or quick cash for some emergency or small business start-ups or to just rescue yourself from a dip in the market.

People with these problems usually head to microloans. The whole process comes in with a certain interest that you and your investor will agree upon. These agreements are often done upon the onset of the microloan.

Note: You can also get a loan for swimming pool renovation like cleaning.

This is basically what you need most to know about what are micro loans. Just follow the treaties of what you’re agreeing to. Understand and think if you indeed are in a position to pay the interest. Don’t act out of desperation. Something very common in microloan is this pertaining mistake.

History of Micro Loans

Micro Loan, the entire process was started by this professor, Muhammad Yunus, the founder of the Grameen Bank. The most popular bank in the country, he had lent his money. He saw this as an opportunity to be of some help to those short of cash. At the same time makes some profits himself. The idea caught up, and today micro-loans are one of the most popular peer-to-peer economy constituents in many places. Sounds interesting, right? Well, a micro loan just saved my dreams so who am I to say?

The Investors Perspective

People investing in micro loans usually see this as a whole host of opportunities to earn more cash. Make no mistake these people are not fools easy to run away from. These loans are generally formed by several cash inflows by varied people. Whatever may be the amount, big or small doesn’t matter. This helps in cutting down the risk of loss. Amongst other things, if you’re starting to be an investor in the universe of micro loans.

You might be interested in getting a loan of 3000 dollars quickly. Explore the guide to know how?

A good point to start is to run a thorough background check. Ask for papers, and the history of the individual you’re lending money to. Talk to them, talk to them about the reason they are in search of the micro loan. If they are starting a new business, understand what their business is all about. You probably don’t want to invest in someone acting on a whim.

Bad business or bad business plans will mean the micro loan will be hard to get back. Micro Loan is as much about investing in the business as it is about the individual you’re investing in. A brief study of character is probably good.

Have You Watched Shark Tank?

If you haven’t, Shark Tank is a very popular American television show. The show is an excellent example of a peer-to-peer economy and how your pitch about micro loans should probably be. When you know and have a thorough idea about what micro loans are, you decide to take the plunge. There might be a variety of reasons why you’re willing to decide. There might be a serious case of a medical emergency.

Your business has started to do well finally. You need an influx of money to bring in more inventories. You need to upgrade the employee list in your business. Or you need money for doing the proper advert for it to reach the masses. Whatever it may be, consider your conversation of a micro loan similar to that of a shark tank pitch.

If you’re talking about your business, make your investors understand every facet of your business. What are projected sales, what are your sales, and what are you supposed to do or think of doing once you get the money? What caused the blip in the business? If you are the investor well you will probably understand by then. These loans are a great commitment for both parties when actions follow trust.

So, What, is Your Opinion on Microloans?

Micro Loans are huge get-out-of-jail cards. When the doors of the institutions shut, these loans came to the rescue. Capitalism makes sure an individual doesn’t have many chances to fail in this world before being shunned. Micro Loans probably provide some solace in that there is still someplace to go. Keep the faith though people. If you take up a microloan make sure you pay what you agreed upon. By doing so, you will be helping someone in need the same as you.

Frequently Asked Questions (FAQs)

Q1. How to get a microloan?

An elongated search on the Internet and you will come across many micro loan investor sites and portals. The process of finding your potential microloan investor starts from here. You will quickly realize there are different interest rates at the different portals. You will have to choose the interest rates that fit your demand and abilities. Make sure you seek investment from trusted sources. There is that. They will run a thorough background. Ask for documents and papers deemed necessary. Provide them with the necessary details. Be prepared with answers for what you need the microloan for. Make sure you come across as someone who will be able to pay the microloan back on time.

Q2. Are micro loans a good investment?

Micro loans are an excellent investment opportunity as long as you are quick-footed and understand what you’re investing into. Micro Loan is as much about investing in the business idea as in the person. Run background checks, ask for papers, and don’t invest wholly at once. Use small shares of investments in different microloans. That way you cut away the risk factor.

Q3. Can I make money with micro loans?

Absolutely yes. The more you invest and moreover, invest wisely. The investments will return in the form of interest. That’s just easy math. Always remember that you invest wisely. That’s the part to look out for.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders