In today’s busy world where people merely have time for anything, managing financial requirements is a really tough job to do. Not everything works how we plan and it hence makes us undergo difficulties. In such situations, all we need is some borrowing. Now borrowing money or lending money from banks is not what everyone likes to get into. Because of the heavy paperwork and high interest rates, people are not much interested in going for this option.

Now to free you from such a dilemma you have many loan providers which offer short-term loans in very favorable conditions. One such very popularly used solution is Spotloan. If you too need some loan to handle your expenses and don’t want to get into the bank’s lengthy and costly procedures. You will get everything you need to know about other alternatives which are better than that.

What are Direct Lenders?

Before getting any information about spot loans and other loans, you should know what these direct lenders really are and what service they provide you. As the name suggests, these provide business or personal loans directly to the user without anyone in the midst of the one that provides money and the one that borrows it. Direct lending is a very modernized process and people are very much into it as it has the following benefits:

- Hassle-free process

- Offers you a loan at less interest rate

- You can customize the terms and conditions according to your needs

- No involvement of any kind of a middleman

- It’s a quick process without much paperwork

An Introduction to Spotloan

The market is filled with direct lenders and one of the most used and appreciated keys of this is Spot Loans. If you also have heard this term many times and want to know what really is the hype about it then you have come to the right place. Let’s get into every detail of this direct loan provider.

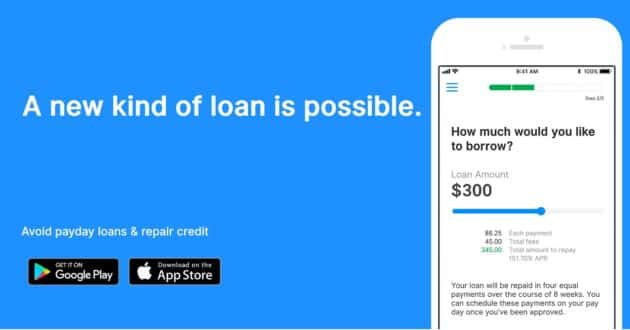

Spot loans are basically those loan providers who bring you the opportunity to have your short-term financial needs solved in the quickest way when you want Emergency Cash Immediately. You get flexible terms and conditions which you can set according to your needs. Spot loan customer services are also very user-friendly as they are very transparent and easy to access. If you are in need of a personal loan and are unable to rectify your eligibility for traditional loans then a spot loan is your go-to option.

How to Get Your Spotloan?

- Before getting started, you need to install the application for a spotloan online.

- Now start the process of logging into the application.

- For spotloan login, you need to fill in the following details :

- Name and full address

- Birth Date

- Email address

- Bank account details

- Social Security number

- Employer detail

- After you are done with the spot loan login, you will be provided with all the available terms and conditions. You now have to go through them and agree to or approve the one that caters to all your demands.

- After all, these steps just wait for some time to get your loan approved and here you are all set with your loan money in the quickest way.

Why Should You Use Spotloans?

Sometimes you may get this thing in your head why should you prefer loans like spot loans.

Here are the answers to all your queries regarding why you should go for spot loans. Following are the reasons that will make you choose spotloan over every other option:

- Being the quickest provider is one of the most talked about things about spot loans. As soon as you agree to the terms and conditions, without taking much time you will be provided with your requirements.

- No paperwork and documentation make the process of spot loans the smoothest. The thing that makes it very much easier than the bank is the no requirements of heavy paperwork.

- People with low credit and almost no collateral can also access loans, as spot loans make it easier for users.

- Being user-friendly and providing the best spotloan customer service is one of the qualities of spot loans that people enjoy very much. This is observed by the positive spotloan reviews. These reviews make it very much clear how people enjoy spotloan customer service.

Alternatives for Spotloan

If spot loans are not catering to all your demands or their terms and conditions are not favorable for your situation then no need to worry, you have other options too. Here we have mentioned some of the alternative money borrowing apps that can be in the place of spot loans to get your loans. Given below is the list of some of those apps:

- Lend up

- Opp Loans

- Possible Finance

- Check into Cash

- Lendly Loan

Here is detailed information on all these five alternatives for spot loans.

Lend Up

This is an app that provides you quick loans. Acts as a credit educational resource and in some states can also improve credit. It can allow low as well as high amounts of loans as it’s flexible in its providing. Some notable details about this are :

- Loan amount: $150-$250

- Turnaround time: could be as soon as the next working day

- Loan term: 7 to 30 days

- Interest rate type: variable

OppLoans

This is an installment loan provider that can offer you funds at the lowest cost possible. It also helps to bring up your credit score. One of the best things about this is that you can change the date of dues if you are unable to make the payment. It rates 60% at cap which is one of its many pros. This may although require a relatively high income and also you should get paid with a direct deposit. Features of this service are :

- Loan amount: $500-$4,000

- Interest rate type: Fixed

- Turnaround: one working day

- Loan term: 6 to 18 months

Possible Finance

With possible finance, you get access to instant cash with a $400 to $800 credit limit. It doesn’t check for security or check credit requirements. You can change and modify your payment date. Works very effortlessly for fast funding as well.

Detailed information that you need to know before working with possible finance:

- Loan amount: Upto $500

- Turnaround: one working day

- Loan term: 2 months

- Interest rate type: fixed

Check into Cash

Get your loans from direct lenders without any hassles through checking into cash, this is a great alternative for spot loans. The speed at which they work is just tremendous, it would not take you more than 60 seconds after you have submitted your application to get your lender’s match. And with one or two working days you will have your loan money in your account. Let’s look at other features of checking into cash that is very important for a person before borrowing money:

- Loan amount: $50-$1,000

- Turnaround: one to two working days

- Loan term: varies differently in different states.

- Interest rate type: fixed

Lendly Loan

Here we have the last alternative for the spot loan called a lendly loan. It is an online running platform that provides small loans to people with the lowest credit. It is a fast-running application along with quick funding. Loans like lendly are very much accessible due to it being so flexible and easy to work with. It is a great option for when in small financial needs and that too very urgently. If other platforms are denying your loan request because of your credit score then a lendly loan is the one for you. Let’s see more such details that lendly loan provides:

- Loan amount: up to $2,000

- Turnaround: one working day

- Loan Terms According to your residential state

- Interest rate type: fixed

Conclusion

To bind up all the plethora of information given above, we would like to mention that with the help of such technological advancement borrowing money is now easy and on the go. But trusting such apps or choosing which one to go with can sometimes become tricky. To ease up such problems in your life, the above-mentioned details are formed. The article given above answers all your questions regarding direct loaning and spot loans. Make your financial arrangements easy to access through apps such as spot loans and other loans easily.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders