Getting a loan is something the majority of people prefer nowadays. Life at some point in life brings up situations where you lack financial resources for the satisfaction of your needs. In such situations, the only thing that comes to your aid is getting a loan. As getting a loan is no not only limited to banks rather it can also be accessed through instant online loan providers.

Having so many options laid up to source out a loan overwhelming for an individual at times. There are a lot of technical terms which might confuse you about which loan you should go for. For such situations, you have a loan calculator to help you calculate the whole cost of the borrowing process when provided with the essential information. Sounds interesting right, how would it ease your load? The following article provides you with in-depth information about this very useful tool.

Loan Calculator | An Overview

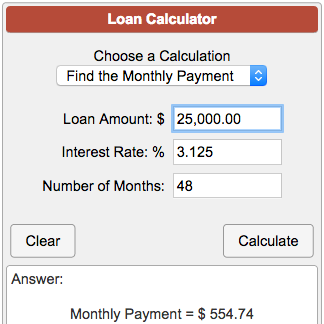

Loan calculators are those tools that help you to figure out if the loan that you are thinking of getting has a fair cost or not. It allows you to do this by filling in the loan amount, loan term, and interest. Just analyzing these things would get you the overall cost that the loan might have on you. But there might be different things that need to be in your head as different types of loans have different elements.

Are you looking for a personal loan? Read our best affordable loan company list that lends loans for good credit.

To get detailed information about loan calculators and how they work for different types of loans follow the instructions given in the further part of the article.

Different Types of Loan Calculators

Following are various kinds of loan calculators:

1. Car Loan Calculators/Auto Loan Calculators

There are a majority of people who get a loan whenever they buy a car which leads them to a situation where they would need a Car loan calculator. These are called Auto Loan Calculators. This will allow you to calculate what your monthly payment would be after you provide the price, interest, and loan term. It would also inform you how much you have to pay extra other than the car’s price as interest. This will let you have an idea of how much you are going to spend overall and help you figure out the monthly payment that you would have to pay.

Useful guide- How to improve credit score

2. Home Loan Calculators

Home loans are one of the most taken loans by people as it is an expensive investment and you need a financial backup. They are also commonly named mortgage loan calculators. This provides the user with an idea of the monthly payment along with the other financial expenses. Determining these calculations will maintain your financial well-being as you will sort all the payments you need to make under a home loan.

3. Personal Loan Calculators

A personal loan calculator is a tool to calculate the monthly payment you need for your loan and sum up your total cost. The calculator adds up all your expenses made during the repayment of a loan and analyzes it to calculate everything that you need to spend.

How to Use Loan Calculators for Payments?

The process of calculating loan payments is not consolidated. You need to enter every single detail calculator asks for in order to get the right and trustworthy results. You need to enter true information to avoid mistakes. The calculator will ask you for these details:

- Your loan amount.

- Percentage of interest rate.

- Possible fees.

- Total Duration of the loan in months.

- Monthly payments.

You may also like to read about some reasons to get a personal loan.

After filling in all the details, you need to click on calculate and everything will come up. Through this, you can calculate the actual amount you are repaying. It can help you to decide whether the loan is really profitable to you or not. You can calculate many more things online such as comparisons, repayments, etc.

Advantages of using Loan Calculator

The loan calculators are a tool to help you out with the better management of your finances so they are very advantageous for the user. Other than that, it also offers us many other benefits that you will read below:

- Calculate Interest Rate

The loan calculator gives you the advantage of calculating the total money you would be spending including interest on your loan. This helps you to get an overview of the amount that you would be spending extra than the borrowed amount.

- Informs about the Loans Eligibility

It lets the user know if he/she is eligible for the loan. The information you have gathered will tell you if you can qualify for a specific loan or not. This would be very time-saving as you would then only be applying for the ones you are eligible for.

- Helps in Financial Planning

Getting all the required information beforehand is something that would help the user to better manage the finances. With the help of a loan calculator, you would be able to know about each expense that you are going to make in the whole process. Now once you know your expenses, you can plan how you are going to manage finances for each of them. This would not only make things easier for you but it would also manage your repayment process most smoothly.

Frequently Asked Questions (FAQs)

1. How long to pay off the loan calculator?

If you want to know how long it would take to pay off the loan, you can use a loan calculator to get this information. It will use your current loan balance, annual percentage, and current monthly payments to get the time you have to pay off your loan calculator.

2. How to pay off a car loan faster calculator?

Calculate your pay-off time from the loan calculator. Then you can make sure you have collected enough resources to make an early payment. This early payment will help you pay off your car loan faster and also reduce some of the amounts that you would have paid further stretching the loan.

Conclusion

Taking a loan involves a lot of things from selecting the right loan and the right source to the whole repayment process till you are all done repaying the loan. This might be very much to handle for an individual so to manage this whole loan process we have a helping hand called the loan calculator to manage our finances by estimating the monthly payments. If you too want to organize your life, check the above article to learn about this handy tool.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders