Do you want to bling but run out of money? Well, what if we say you still can adore yourself with kay jewels? If you get super excited after hearing this, this article is for you. Fortunately, we have found a way for you through which you can maintain your class and elegance without spending money on a go. Well, this way is a kay jewelers credit card. If you don’t have a good credit score, then you must not panic as it is a credit card that doesn’t focus on your credit score much and comes with very low requirements.

You can get this credit card in no time and without being consumed by using it. But the huge questions are how to get it? Is it a really good way to go? And everything you need to know. Read the given article all the way through its conclusion to get a better rationale for using kay jewelers credit card genesis.

What is Kay Jewelers Credit Card?

Kay jewelers card is basically a store retail card, allowing you to finance your purchases with different plan durations. Through this, you can simply make the whole purchase today but pay later at your convenience. In addition, its flexibility will allow you to make purchases further as well without worrying about the installments. If you are maintaining your installments in a disciplinary way, then you can purchase the jewelry as much as you want.

However, this card is offered by the huge diamond jewelry brand Signet jewels’ subsidiary firm called Kay Jewellers. But this card only applies to the real stores of their brand and on the websites only. Thus, if you are looking for instant cash, then this won’t be the right fit for you. Let’s check the further articles to know if this card is for you or not.

Rates and Rewards

In this section, we are going to cover the rates and rewards associated with the kay credit card. One must know all the related cash rewards and rates of annual fees and interests to get a better understanding of your card, as you will need to pay all that fees later on. Let’s check all the rates for the card.

- Credit Target: Poor Credit, Limited Credit

- Card Type: Personal

- Annual Fee: 0

- Regular APR: 29.99%

- Required Credit Score: 604

- Grace Period: 25 Days

- Financing Duration: From 6 to 36 months

Features

- Offers great financing options: This card gives you four different financing duration options. You can choose any one of them at the convenience of your paying capacity. You can select pay overtime options. These options are available from 6 months to 36 months.

- Have options to match your personal needs: It has three types of cards through which you can choose any one of them: Kay Jewelers Comenity Bank credit card, Lease purchase program, and Installment loans. You can choose any option that suits your needs. One must keep in mind that this option will offer you different rates. Thus, you must read them all before applying for any.

- Easy Approvals: The kay credit card genesis will get easily approved in no time. There are few rules and regulations for getting approvals, as it won’t check your old credit histories. They just require a little surety that you can pay the amount later or not.

- Comes with incredible offers like birthday benefits: This card will give you extra offers on your special days. You can get up to $100 off on your purchases if it’s your birthday or your marriage anniversary. Moreover, you can avail of this discount for the entire month.

- No Annual fee: This card doesn’t charge any money in the name of annual fees. You can simply complete the kay jewelers credit card application and pay only interest.

- Identity theft protection: You can be protected from theft easily. This card will assure your privacy and work for your protection. Thus, you can simply identify if any theft has occurred with your credit card.

Pros and Cons

Now, the time has come to know more about credit cards through their pros and cons. Pros and cons will give you a better rationale about the whole concept of kay jewelers card. However, you must have a credit score of at least 640+ then, and only you can buy this credit card. If not, then you must check our other list of no-credit-check credit cards.

Pros

- Vast Jewelry Stores: Kay jewels has a vast range of jewelry in their showroom or on their websites. You can check this brand’s website, and you will get to know everything about it. Moreover, it has a good number of showrooms in the US. Thus, you can make your purchase anywhere in the world easily.

- The size of purchases doesn’t matter: Purchases of what amount you are making won’t matter much, you can simply finance them all easily with a credit card. If you want to purchase an expensive jewel, then also you can purchase it without worrying about payment.

- Fast Approvals: Approvals for a credit card are quite fast. Your credit card can be approved within 24 hours if the requirements match the lenders. And the good thing about it is that lenders don’t ask you for many details and requirements. One can easily fulfill them all with a normal credit score.

- Good Customer support: you can take 24/7 customer support from the company—this is one of the best advantages on the list. You can simply go for customer support whenever you get a little confused about your policy. Thus, if you are looking for a beginner credit card then also your search will end as you can have continuous support from customer support.

Cons

- Not a Traditional Card: The card is not a traditional credit card through which you can get instant cash or fulfill every type of money requirement. It can only be applicable in the jewel shop of this particular brand.

- Higher Rates of Interest: The interest rate is quite higher than the other credit cards in the market. There is a 25 days grace period for which you are not required to pay interest. But if you pay the installments late for any reason, then you will be charged for it. However, there are various other lenders providing you with credit cards for fair credit options.

- Lackluster history: For your information, kay credit card has a history of lackluster. This means that you may be tricked while applying for the credit card, and many users have already been tricked; thus, you are required to be more careful while applying for it.

- Only useful in kay stores: The biggest con of using this credit card is that it can only be used in the stores of kay jewels. You can not use it anywhere like other traditional credit cards.

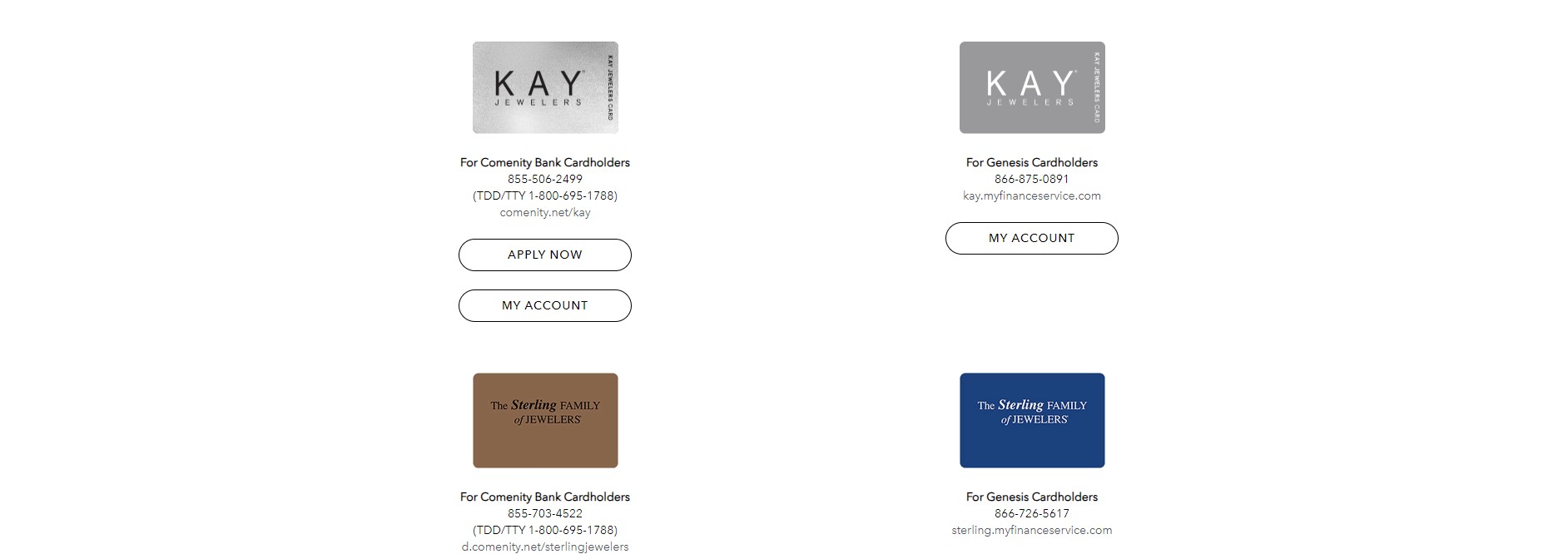

Types of Kay Jewelers Credit Cards

There are mainly two types of credit cards under Kay jewelers; the only difference is the lender. One is the Comenity bank, and the other is by Genesis FS Card Services. All the features and rewards are similar. However, the best part of it is– it offers a lot of perks, such as you can get offers on your special days, you will get two huge offers in a year, and you can access to Sweepstakes as well.

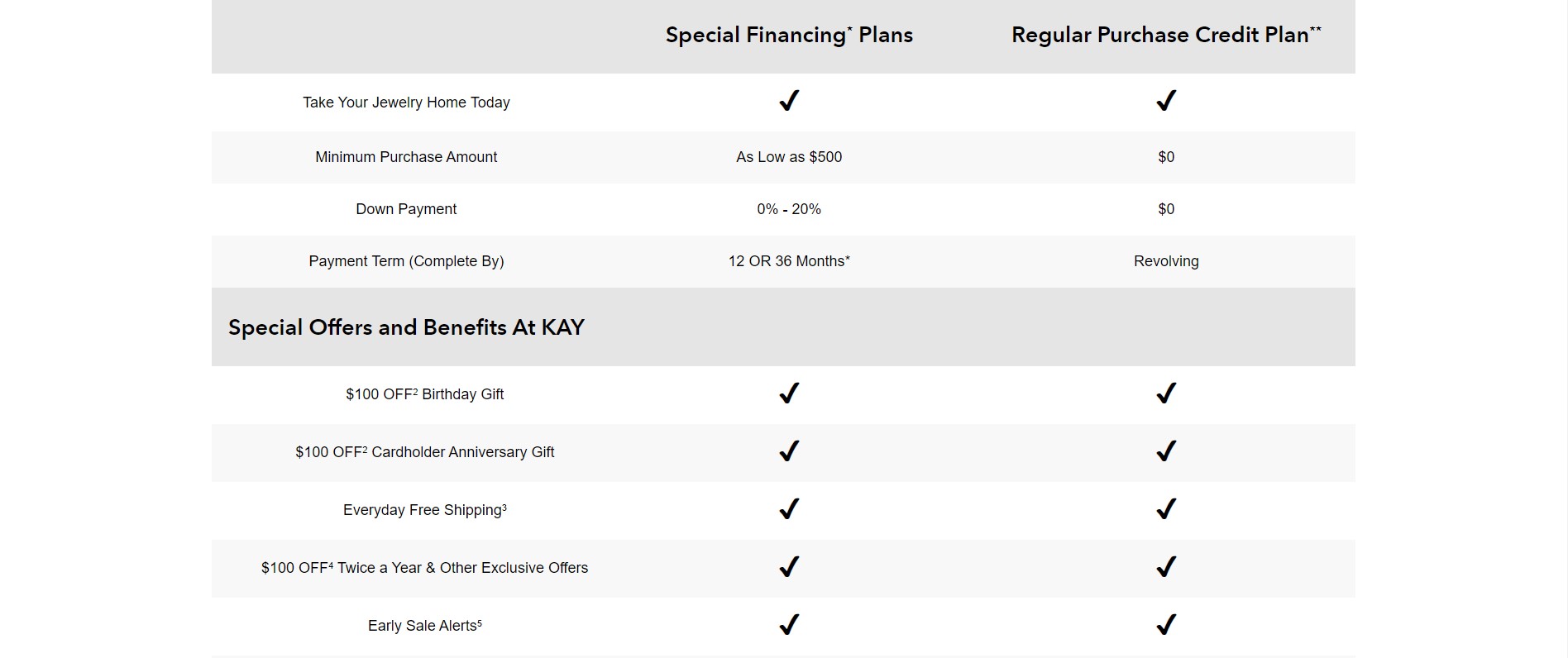

Financing Plans of Kay Jewellers

There are a total of 4 plans available to you for getting your jewelry financed by credit card lenders. You can simply choose anyone’s plan at the time of purchasing a piece of jewelry. You must check all the details of the plan you are choosing before getting actually in it. Here in the below section, we are providing you with the proper user information for these four financing plans. However, you must keep in mind that these plans can be varied according to new offers and perks. Thus, you must ask for all the latest rates while choosing the plan.

6-month Special Financing

If you want to have six monthly plans, then you must have a minimum purchase of 300 dollars. If you pay all the installments on time, then you will not be fined for any late fees. Moreover, you will not be required to pay any interest rate. This is one of the best plans you will ever have with the genesis kay card. However, you must make a down payment at the time of purchase.

12-Months Special Financing

In the 12 months financing plan, you will have to make the minimum purchase of $750 and pay it within the period of 12 months. Similarly, like other plans, you will have to pay all the installments on time. If you make any late payment, then it will result in added late fees. Furthermore, this plan doesn’t consist of any interest rate.

18-month Special Financing

The 18-month finance plan is nothing different from the above-mentioned plans. In this plan, you just need to make a minimum purchase of 3000 dollars. This way, you will not be required to pay any interest, and you must make all the installments within the decided times. Else the late fees will be deducted directly from your account.

36-Months Special Financing

This plan is a little different from the above three plans. With this plan, you will have to make purchases of at least $1500, and it includes APR as well, even if you pay the installments on time. You will have to pay the apr, which is 16.99% in the first year and 29.99% in the second year.

How to Apply for KAY Jewelers Credit Card?

After reading the above part of the blog, if you have made up your mind about the Kay jewelers credit card application, then you must visit the official website of kay jewelers card. Here you will see an option for an easy application named “Apply now.” Click it and continue by filling up your details as naked by the lender and get done with the process. After completing, click continue and wait for the approval. When the lender passes your credit card request, you will get notified, and your credit card will be delivered to your place within a few days.

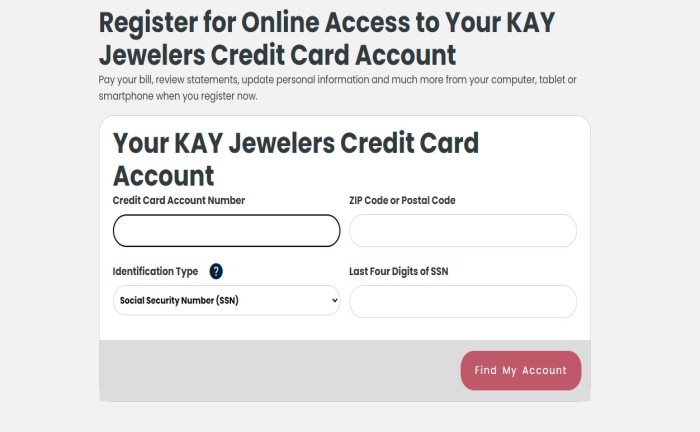

How to Make Kay Jewelers Credit Card Payment?

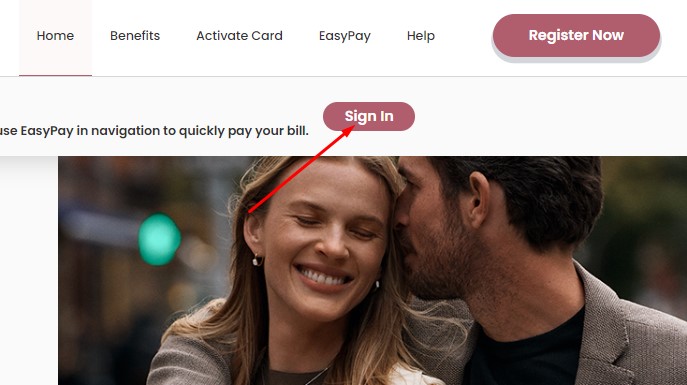

You can simply make a kay credit card payment online from their websites. You just need to make kay jewelers credit card login first on their official website with your username and password detail. If you don’t have these details, then you will require to register yourself first. In registering, you will need some details like card number, zip code, etc. And here you are, ready with the username and password. Now, let’s see what you will require to do after it actually makes the kay credit card payment. Let’s check the below steps to complete the payment.

- Get on to the official site and get done with the kay credit card login.

- Now, you have set up your account. After that, you will need to link your bank account with the genesis kay card website.

- Once you are done with the above two steps, then you will be ready to make payment of any amount at any time.

One thing that you must keep in mind while making the payment, you must complete the payment by 6 PM on the due date. Else, you can get changed for late fees.

Frequently Asked Questions (FAQs)

Q1. What credit score do you need for a Kay credit card?

For the Kaycredit card, you are required to have at least a 640+ credit score. Then only your request for the credit card will be sanctioned. Otherwise, you will not be able to get approved for it.

Q2. How do I pay my Kay card?

There are various ways through which you can make a kay card payment. The easiest and most trustworthy way is to pay through their official website. You can check how to do so in the below steps.

- Go to the official website and log in with your user details.

- Link your bank account and get done with the payment.

This way, you will be able to make payments for your credit card easily anytime and anywhere.

Q3. Who issues Kay Jewelers’ credit card?

The card is basically store based credit card as it can be used in retail shopping from kay jeweler, but actually, it is issued by Comenity bank.

Q4. Can I use my Kay credit card anywhere?

No, you can not use a kay credit card anywhere as it is a store-based retail credit card. Thus, it is only applicable in the kay jewelers stores. You can not purchase anything other than jewelry. However, if you are looking for a traditional credit card, then this option is not for you.

Q5. Is Kay Credit Card Worth Applying for?

Kay credit card is worth applying for; you can avail a lot of benefits through this card. The only con to this credit card is that you cannot use the card anywhere else. This card is only applicable to the kay jewelers store and their website. However, the card is quite good as it comes with various other perks and rewards that you can enjoy with this card. Well, the card has various other features too that you can enjoy, such as financing options without interest. In addition, if you love to bling with different jewelry pieces, then this card will be a good way to go for you.

Author Profile

- William Smith is a highly respected and well-known figure in the consumer credit industry. With over two decades of experience and expertise, he is one of the most sought-after authors on credit card offers, services, and more. He has written extensively on traditional & alternative forms of credit and is a frequent contributor to Forbes Magazine, where he shares his wealth of knowledge with readers on topics such as personal finance. William can be seen regularly on major media outlets where he offers insight into the world of credit cards. He also strives to keep readers updated on the latest trends while offering sound advice on how to manage their accounts responsibly.

Latest entries

BlogApril 27, 2023Navigating the Tech Industry’s Dynamic Landscape: Insights from Amazon’s Recent Layoffs

BlogApril 27, 2023Navigating the Tech Industry’s Dynamic Landscape: Insights from Amazon’s Recent Layoffs Credit Card ReviewsFebruary 9, 2023Famous Footwear Credit Card Review 2024: Get Benefits on Footwear Purchase

Credit Card ReviewsFebruary 9, 2023Famous Footwear Credit Card Review 2024: Get Benefits on Footwear Purchase Credit Card ReviewsFebruary 4, 2023Ultimate Sephora Credit Cards Review 2024- Essential Information by Expert

Credit Card ReviewsFebruary 4, 2023Ultimate Sephora Credit Cards Review 2024- Essential Information by Expert Credit Card ReviewsFebruary 2, 2023Ultimate Kay Jewelers Credit Card Review in 2024: Finance Your Jewels Easily

Credit Card ReviewsFebruary 2, 2023Ultimate Kay Jewelers Credit Card Review in 2024: Finance Your Jewels Easily