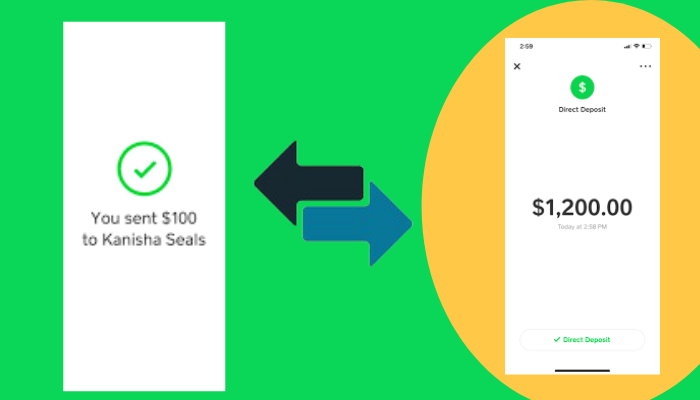

Chime is one of the most popular apps in the country. To use its full potential, you should know how to transfer money from a Chime account to a cash pp account. A Cash App account helps you send money to others, shop, pay bills and recharges, pay someone back, etc. A Cash App account acts as an online wallet from which you spend money, and Chime is an online bank that funds your e-wallet.

Well, we have broken it down into easy steps on how to send money from chime to Cash App. We have also mentioned cash limits, the time it takes to send cash, and the steps to avoid online fraud. So, let’s get started.

How to Transfer Money from Chime to Cash App?

Now, we will explain how to transfer money from Chime to Cash App and how to link Cash App to Chime. However, to proceed with the transfer, you will need a chime debit card and a Cash App account. So, let’s proceed with the instructions:

- You have to have an account in Cash App. You can do this with your tablet and smartphone.

- Tap on the My Cash tab, which you will find in the bottom corner of your screen.

- Tap the option “Add Bank” and find Chime Bank. You have to put in your account number and 3-digit security code, which you will find on your Chime debit card. Finally, the Zip code is linked to your card.

- By doing this you will have linked your Chime account with the Cash App. Now, tap on the “Add Cash” option and type in the amount you want to transfer to your Cash App.

- Tap the “Done” option, after typing in the amount.

- The Cash App is known for its speed, the money will be transferred in seconds. However, check the amount you are sending to avoid any mistakes.

Steps to Transfer Money from Chime to Cash App (Without a Debit Card)

Now, if you are someone who does not carry a Chime debit card, there is nothing to worry about, as you can still transfer money from Chime to Cash App. To send money from Chime to CashApp you will still need to link your Chime bank account with your Cash App. However, the process changes.

In the beginning, you will have to log in to your Chime account, and select profile settings. Where you will have to type in your Cash App credentials. After that, the process follows as:

- Login to your Chime bank account on your Mobile phone, PC, or Tablet.

- Select the “transfer money” option, type in the amount you want to transfer, and tap the proceed option.

- You must type in your Cash App credentials such as account name, Contact number, and email ID.

- After filling in the credentials tap on the “Pay” option and the amount will be transferred to your Cash App account. To check if the transaction was a success you can narrow your balance.

How Fast Do You Receive Money Through Chime App?

To transfer money from Chime to CashApp it takes around 1 to 3 days. If you want an instant transfer you can select the instant transfer option on your Chime app. However, it will cost you around 1.5% to 3% of the amount that is to be transferred. If you are in need of an emergency fund, then we recommend you take the instant transfer service. If that’s not the case then you can skip the option as it is expensive.

How Much Does it Cost to Use Chime App?

The cost of each transfer depends on which option you choose. There are two options for transferring money, regular transferring and instant transferring. In the case of instant transfer, the Chime app will charge 1.5% of the amount to be transferred. Whereas regular transferring is free of cost. The advantage of choosing an instant transferring option is that the money will be transferred between Chime to CashApp immediately, whereas, in the case of regular transferring it takes around 3 days for the money to transfer.

Transfer Limits Of Cash App and Chime Account

If you are wondering, can you send money from Chime to CashApp? Yes, you can. However, there are certain cash limits to using the Cash App and Chime account. If you have an unverified account in Cash App then your cash limit is $250 weekly and $1,000 monthly.

A verified tag is given to someone who is of public interest, such as a global brand or a celebrity; having a verified tag increases your Cash limit. To get an account with the Cash App, you have to disclose your Social Security Number and personal information.

You have a 3-transfer limit of about $1,000 per day and $10,000 per month, which comes under the Cash load option. The Chime Credit Builder option does not have any credit limit imposed so it does not matter how much you send.

Is Chime a Bank?

Chime is a private Fin-tech company that provides financial services to its users. It was founded in 2012 by Chris Britt and Ryan King. This is an American financial app that provides financial support through a mobile app. Chime does not have physical buildings like banks usually have. They do not charge any monthly or low balance fee.

Chime has set up its headquarters in San Francisco, California. With its 8 million plus user base, Chime is a huge fintech company in America. Users can use the app on their mobile phones, tablet, or PC. It supports both android and apple operating software. In addition to this, it provides FDIC insurance of $250,000 per user. Making it safe to use.

Chime is not a bank, it has banking partners that are FDIC-approved, such as Bancorp bank and The Stride bank. Chime app works as a money-saving app as well, they provide a round-up and automated saving feature. You can create checking accounts that have no minimum balance fee and early wage access. If you are wondering, does chime work with Cash App? Yes, it works just fine. It works with other fintech apps as well like chime work with Zelle.

The account comes with a Visa Debit card that can be accessed with more than 30,000 ATM centers. There are certain payday loans that accept chime. For transferring money to other Cash Apps you can connect your Chime debit card with other Cash Apps such as Cash App, Google Pay, and PayPal. PayPal is used by more than 200 countries and is one of the best money transaction apps. So, can you send money from Chime to CashApp, Yes!

Documents Required to Open a Chime Account

When you are about to open a Chime account, there are some documents that are required to open one. The bank offers two types of accounts, a savings account, and a checking account. So according to the account you want, the documents required vary.

These documents are needed irrespective of any account you are about to open.

- Social Security Number (SSN)

- Government-issued ID

- Your Current Physical Address

So, to answer your query Can you send money from chime to Cash App? Yes, you can but first, you have to add these documents and you have to go to the main webpage of Chime. You have to fill in your personal details such as your email ID and your contact number. To open an account you need to Upload the documents after it has been verified. You can access your chime account on your Mobile phone via the Chime App.

Is Chime a Trusted Financial Platform?

Yes, Chime App is a secure financial platform that is used by over 8 million+ American users. Chime is not a usual bank; it has banking partners such as Bancorp bank and The Stride bank. They are FDIC-approved banks. Chime App provides FDIC insurance of $250,000 per user. FDIC is a Government body of the United States that ensures protection to depositors’ money if a bank collapses or goes bankrupt.

If you face any problem with the Chime app, you can call their customer service agency which is open 24/7, or you can email them your query at the email address available on their website. There is even a facility to chat via the mobile app with Customer service. All these make Chime App a trustable financial platform.

How to Transfer Money to My Chime Account?

To add money to your Chime account, you have to share your account number and Chime routing number with the person who wants to send you the money. If that person uses the Chime app then only your account number will do the job. If you are wondering, does chime work with Cash App? Yes, you have to link your Chime account to the Cash App, and it will work perfectly.

To share your account number and routing number, you have to select the move “money option”, then settings where you will find your credentials. If you want to transfer money from other bank accounts to your Chime Bank account, you can link both accounts. To link the account, you will have to select the move money option, then transfer.

After this, you have to type in your bank credentials to link both accounts. The Banks you can link are such as Chase, Bank of America, Citi, Wells Fargo USA, Navy federal, etc. On top of this, you can transfer money to your chime debit card from another payment card. The process is similar to how you send money from one debit card to another via the internet.

Frequently Asked Questions (FAQs)

Q1. Is It safe to send money between Chime and Cash App?

Yes, it is safe to send money from CashApp to Chime. Both the Cash App and chime have security features that protect you from fraud. The Cash App has encryption technology, whereas, the chime app offers FDIC-insured insurance of about $250,000 per user.

Q2. How to protect yourself from frauds and scams?

To protect yourself from scams you should follow the following steps:

- Double-check for typo errors and sensitive information in your Cash App and chime emails.

- Never reply to Untrusted emails from financial institutions or a person.

- Avoid sending Sensitive information like your Social Security Number via mobile phone or email.

- Never share your Pin with anyone.

Q3. What is the fastest way to transfer money from Chime?

When you transfer money from your CashApp to your chime account, you get two options to choose from for the transferring speed. The two options are, Regular transferring and instant transferring. Regular transferring takes 1 to 3 business days to transfer, whereas instant transfer sends the money instantly. However, instant transferring charges a fee of 1.5% of the amount to be transferred.

Q4. Does Chime allow international transactions?

Yes, you can make transactions internationally by using the Chime VISA card that is accepted in most countries. To activate this feature, you have to enable the option “International Transactions” in your settings.

Bottom Line

Well, the Chime app can transfer money to the Cash App, and the process is quite easy as we have mentioned above. You can use the Chime app on your Mobile phone, PC, or tablet, whichever is convenient for you. Chime gives FDIC Insurance of up to $250,000 per user, making it safe if you face any type of fraud. Chime does not have any physical branches, but its customer support team works 24/7. You can reach them for any query via phone or mail.

Author Profile

- David Garcia is a nationally-recognized consumer and money-saving expert who helps people make smart decisions with their money. He has been featured on NBC’s Today Show, Good Morning America, ABC News, and CNBC as well as in The New York Times & other media outlets. With more than 13 years of experience in the personal finance space, David is an experienced writer and researcher. He has written for major publications where he provides readers with actionable advice to save money on groceries, insurance, and more. With his work for various publications, David is an active contributor to the Credit Card Insider blog where he shares insights into credit cards such as rewards programs and interest rates.

Latest entries

Loan App ReviewsApril 30, 20235K Funds Review: Analysis of the Online Loan Platform

Loan App ReviewsApril 30, 20235K Funds Review: Analysis of the Online Loan Platform BlogApril 30, 2023Top 5 Cheapest States to Live In 2024: A Comprehensive Guide

BlogApril 30, 2023Top 5 Cheapest States to Live In 2024: A Comprehensive Guide BlogMarch 21, 2023How Much is 6 Figures? How to Make a 6 Figure Salary?

BlogMarch 21, 2023How Much is 6 Figures? How to Make a 6 Figure Salary? BlogMarch 20, 2023What is Chime Spot Me? Features, How to Use & More

BlogMarch 20, 2023What is Chime Spot Me? Features, How to Use & More