If you want to purchase a piece of home furniture and are seeking a credit card that can provide you with different financing choices, use the Home Depot Credit Card. We’re going to give you a thorough evaluation of the Home Depot Credit Card login in this article. We will go over their costs, incentives, advantages, application procedures, substitute choices, and other things. Stay tuned to learn everything.

What is a Home Depot Credit Card?

Home depot credit card is basically a store card that you can use at home depot stores & on its website for purchasing any item for your home. It also offers various incentives, you can return the item or unique financing options like auto equity loan. But, due to fewer rewards, it is not much used by consumers. Few offers provided by this card:

- Home Depot Commercial Credit Card.

- Home Depot Commercial Revolving Charge Card.

- Home Depot Project Loan.

Important Points:

- Welcome Bonus: $25-$100 off

- Credit Score: 580–739

- Purchase APR: 17.99%–26.99% (variable)

- Annual Fee: $0

- Rating: 2.5/5

- Card issuer: Citibank

- Can be used at Home Depot stores and websites.

Pros:

- The annual fee is $0.

- It has a return policy.

- Different financing.

Cons:

- The APR is very high.

- Zero rewards.

- Plans with a high risk of default.

Few Other Information:

- On promotional offerings, distinct financing for 24 months.

- For cardholders, 365 days are available for returns.

- After the initial purchase gets a $25–$100 discount.

- If you purchase for more than $299 then you can get different financing for six months.

Home Depot Project Loan Card

If you are in the mood for a big renovation then you can go for a project loan card as it is not a card but a type of installment loan. Let’s see how you can use this card:

- If you want a loan for $1,000 to $55,000.

- Then you have six months to make a purchase using this card.

- You need to return an agreed amount every month.

Project loan card has an agreed APR and it will be based on your payback period. Look at the rates mentioned below:

- For 90 monthly payments: 16.24% APR

- For 114 monthly payments: 19.96% APR

- For 66 monthly payments: 7.42% APR

- For 78 monthly payments: 12.86% APR

Benefits

Let’s have a look at some of the benefits of a Home Depot Credit Card:

1. Interest Rate

You have three options for choosing the interest rate that suits you:

- Special financing APR: 0% for 6–24 months

- Minimum interest charge: $2

- Regular APR: 17.99%–26.99% variable

It usually has a huge interest rate and it differs according to the creditworthiness. However, as part of its unique financing arrangement, Home Depot provides uncertain interest to cardholders.

2. Special Financing

It’s a distinct financing plan for users who use this credit card with zero interest rate for a particular period of time. 2 kinds of distinct financing:

-

Six-month No-Interest

If you purchase items for more than $299 then you will get six months of free financing with no interest rate. In case you fail to pay the amount then they will charge interest for that period and you have to pay it on the APR rate.

-

Special financing promotions

Additionally, promotional financing with prolonged no-interest periods is available with the Home Depot credit card. Only specific products are eligible for these incentives. For instance, Home Depot might run a promotion offering 0% APR for 24 months on generator sales.

Any of the following time periods may be covered by special financing offers

- 12 months

- 18 months

- 24 months

Visit the “website’s Credit Services Center” and scroll down to “Consumer Credit Card Offers” to view the most recent Home Depot credit card incentives.

3. Hassle-Free Returns

Those with the Home Depot credit card can use this policy. As they are allowed to return the item if they don’t find it suitable and they will get the full amount back.

4. Credit Reporting

We have mentioned that Citibank launches this card. “Equifax, Experian, and TransUnion” are the 3 credit bureaus. In order to establish credit, “credit reporting” is crucial. It is a perk of the Home Depot credit card payment that your activity will be disclosed to credit agencies because lenders are not legally required to record your credit activity.

Is the Home Depot Credit Card Good for Me?

It is only good if you often do home renovations and want to make use of the advantages that it offers. To pay Home Depot credit card doesn’t have any login/maintenance charge, that’s why it is a very low-cut card that one can have. Also, it provides various other benefits for those who pay their whole amount without any delay.

But, due to zero rewards, you can’t use it for many purposes, and the very high APR makes it a bad option for users. You should only use this card in case you want to wider your holdings & make use of the distinct financing options with extra care.

For Whom is this Card Intended?

This card is mainly used for 2 purposes:

- Credit Builders with fair credit: If you want to boost your credit score though it doesn’t have a bad score then Home Depot is one of the cheap ways to increase it.

- Home Renovators: You might use the distinct financing scheme to lessen the current financial load if you plan a significant home improvement project.

Alternative Credit Card Options

Let’s have a look at some of the cards that are close to the Home Depot credit card:

1. Lowe’s Advantage Credit Card

Our Rating: 3.9/5

The Lowe Advantage credit card is more or less the same as the Home Depot card but it offers rewards up to 5% which is not given by Home Depot.

Important Points:

- Credit Score: 580–739

- Annual Fee: $0

- Purchase APR: 26.99% (fixed)

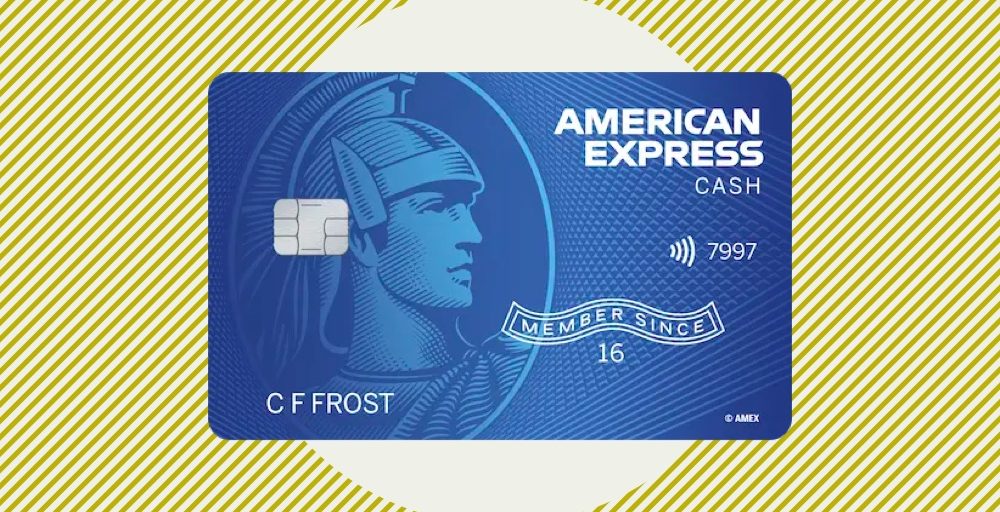

2. American Express Cash Magnet® Card

Our Rating: 4.2/5

By using American express cash magnet card you will get cashback whenever you buy anything and the rate is 1.5%. For this card, you need a good credit score.

Important Points:

- Required Credit Score: 670–850

- Annual Fee: $0

- Purchase APR: 17.74%–28.74% (variable)

- 0% APR Period: 15 Months

3. Petal® “2 Cash Back, No Fees Credit Card”

Our Rating: 4.4/5

If you are looking for a low-cut credit card then Petal 2 cashback card is best for you. You will get 1% to 5% rewards on the purchases that you made. It also helps in minimizing your home repairs cost.

Important Points:

- Credit Score: 300–669

- Annual Fee: $0

- Purchase APR: 15.99%–29.99%} (variable)

Conclusion

We hope that now you can identify if you should go for a Home Depot Credit Card or not. It has all the good and the bad but it totally depends on you. If you do major renovations at your home then you should go for it. It is a very good option for you. We have mentioned everything about it & if you want to ask anything then you can always seek assistance from us.

Frequently Asked Questions (FAQs)

Q1. How do I get a Home Depot card?

Ans. The Home Depot Consumer Credit Card and other products that are owned by, co-owned by, or otherwise associated with The Home Depot may be applied online.

Q2. Is it hard to get a Home Depot credit card?

Ans. It is a little bit hard to build a credit card application as the proper investigation is done in order to confirm the consumers.

Q3. Are there Home Depot credit card rewards?

Ans. No, there are no benefits like cashback, lost fees, or discounts offered by the Home Depot credit card.

Author Profile

- Elizabeth Jones is one of our editorial team’s leading authors on credit card offers, services & more. With over two decades of experience in the consumer credit industry and as a nationally recognized credit expert, Elizabeth provides in-depth analysis of both traditional & alternative forms of credit. Elizabeth regularly appears on many major media outlets including NBC Nightly News, Fox Business Network, CNBC & Yahoo! Finance. She is also a frequent contributor to Forbes Magazine. As a highly appreciated author for our exclusive Editorial Team, Elizabeth strives to provide readers with a trustworthy advice on how to manage their credit accounts while staying informed on the latest offers in the marketplace.

Latest entries

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide

BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know

BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide

BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide