Financial emergencies don’t knock on your door before coming. There can be times when an emergency comes but you don’t have money and need emergency cash immediately. You might have lost your job, or might be facing some medical emergency or some big expense might have arisen out of nowhere. If you’re facing any such issues then we got you covered, here we’ll tell you some ways by which you can get urgent cash immediately even with bad credit.

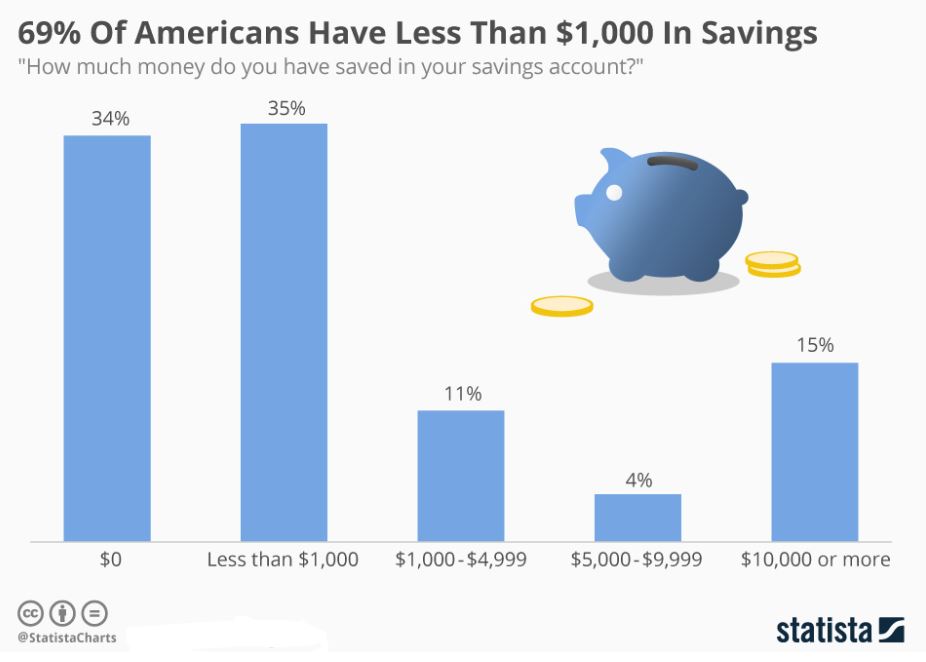

As per Statista reports, around 43% of Americans don’t have any emergency funds and some have less than $1000 in their emergency fund. You should always save a certain percentage of your income for your emergency fund and you should keep it in a different bank account or somewhere else in cash so that you have some money for emergencies.

I Need Emergency Money Now, How Can I Get it?

Do you need emergency cash immediately but do not have any money in your emergency funds? Calm down, you do not need to worry, there are many options available in the market that would provide you an emergency loan without checking your credit. You can check out the list given below for the best loan options.

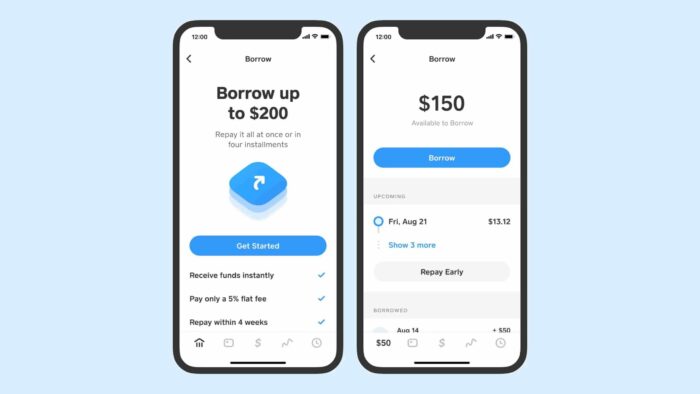

1. Money Borrow Apps

There are many money-borrow apps that provide you emergency cash immediately. They have very low-interest rates and provide emergency same-day loans. So if you need money today then you can move ahead with any of the borrow money apps. Some of these apps don’t even check your credit before offering you a loan, so even if you have bad credit, you can get emergency cash immediately from any of these apps.

Most money-borrow apps offer small-term loans like payday loans, but some might also offer you long-term loans. These loans also come with certain negative factors such as, if you are unable to repay the loan then you would have to pay a very high-interest rate. Also, most of the borrow money app loans do not help in improving your credit score.

But you if you are planning to get a loan from a money borrow app then need to be cautious. Actually, there are two types of borrowing money apps, Direct and Indirect. The direct ones lend the money to the borrowers themselves, whereas the other acts as a link between the lender and the borrower. If you go for the second type, just make sure that you read all the terms and conditions properly, because they may vary from lender to lender.

2. Small Personal Loans

Small personal loans are provided to customers for a short period of time to meet their emergency money now needs. You can get these loans from banks or credit unions when you need money now. For these loans, you have to file a loan request in the bank and if your loan request gets approved then you can get a loan from the bank after completing all the paperwork.

But the only problem with getting a loan or credit union is, you need to have a good credit score and the whole loan approval and deposit process may take up to 2 weeks. So if you are looking for a personal loan and want to get a loan today then you can also get a small personal loan from direct lenders or money lending websites.

Small personal loans are great for your small immediate needs like car repair, rent, house repair, medical bills, credit card bills, etc. You can also go to credit unions for your small emergency loans. And you know what is the best thing about small personal loans? You can use that loan amount anywhere, you do not need to tell anyone, why you need this loan. Most lenders do not put any restrictions on the usage of the small personal loan amount until you are using it for legal purposes only.

3. Payday Loans

These loans have gotten so much popularity in recent times, nowadays many people go for payday loans instead of traditional bank loans or credit cards because of the fast procedure of payday loans and their capability to provide emergency cash immediately. If you are looking for same day emergency loans then payday loans are ideal for you.

Payday loans are basically those loans that help you to survive till your next payday. On your next payday, the loan amount is automatically detected from your bank account. These are short-term loans, the loan term may range from two weeks to 40 days. The loan amount depends on your income. In order to get a payday loan, you need to have a stable monthly income, which can be even in the form of unemployment benefits or retirement benefits.

You can take payday loans from direct lenders as well as money-borrow apps. They provide easy payday loans, without a lot of paperwork and hassle. Though if you are going for a direct lender then you must read all their terms and policy, because though they provide the money immediately, there can be some or other charges in the form of hidden fees. All in all, payday loans are a good option if you want to get money today. Also, as per the National Survey of Payday Borrowers by the Pew Charitable Trusts, 70% of people believe that payday loans should be more regulated.

4. Credit Card

If you already have a credit card then you can get your emergency cash immediately from your credit card. As per the Inside 1031 survey, 49% of Americans depend on credit cards to cover their emergency needs, and not only in America but worldwide, many people use credit cards because they’re easily available and are very easy to use.

A credit card is basically a card that allows you to make payments, even if you do not have the money right now. At the end of the month, you need to pay the credit card bill completely. If you are not able to pay the bill on time, you might also have to pay a higher interest and a late fee. Credit cards come with a specific credit limit. If you use and manage your credit card wisely, it can boost your credit score as well.

Mainly there are 2 types of credit cards, secured and unsecured credit cards. For secured credit cards, you need to pay a security deposit depending on your credit limit and credit score, whereas, for unsecured credit cards, there is no security fee at all. The best part is, many credit card companies provide both secured and unsecured credit cards to bad credit holders as well.

Additional Ways to Get Emergency Cash!!

-

Emergency Cash Loans Direct Lender

You can contact the lenders directly or through apps like PayDaySay and ask if they can give you a loan, they generally provide you with a loan, be that 300 dollar loan or 1000 dollar loan. But before deciding to go for a particular lender, check all the important things like their terms and conditions, their interest rate, whether are there any hidden charges, etc. After seeing all these things, see which lender goes best with your needs and then make the final call.

Here you can get emergency cash immediately even with a bad credit score if you are able to find the perfect lender for yourself. But as we told you, read all the terms and policies and then only sign the deal. You should also check their other reviews and ratings from their previous customers. Do your complete research and then only make a proper decision.

-

Direct Express Emergency Cash

You can get this emergency cash immediately if you have some kind of income benefit, if not proper income, be that disability benefits or welfare benefits. Here the creditors will be assured that you can repay the taken money so they’ll issue a direct express emergency money advance.

You can go to any financial institution and ask for quick money assistance. They will conduct a credit inquiry, and they will also check your money source and if you will be able to pay the debt with that money or not. And if they are satisfied, they will give you the loan or money that you need.

-

Friends and Family

If nothing, don’t forget that friends and family always got your back. You might feel a little embarrassed but you can go to your friends and family to ask for money. Just make sure that you don’t take it for granted and that you don’t make it a habit. Pay back the money as soon as you can.

Also, if the amount that you need is too much, then it is better to go for an actual lender than your friends and family. Make sure that your need does not degrade their lifestyle.

-

Non-Profit Organizations

There must be several non-profit organizations in your area. Most of them can provide you a loan in emergency situations. You just need to any such organizations and present your case to them. If it is an emergency then most probably you will get a loan. They provide loans in case of emergencies like medical needs and funerals.

Emergency Cash Loan: What is it?

An emergency cash loan is a type of short-term loan that is designed to provide quick access to funds in case of an unexpected financial emergency. These loans are usually unsecured, meaning that they do not require collateral, and they are generally intended to be repaid within a short period of time, such as a few weeks or months.

Emergency cash loans are often used to cover unexpected expenses, such as medical bills, car repairs, or other unexpected costs that may arise. These loans are usually available to people with a range of credit scores, but they often come with higher interest rates and fees than traditional loans. If you need money ASAP then these loans are ideal for you.

Where can I Use Emergency Cash Loans?

Most lenders do not put any restrictions on the usage of emergency cash loans. So you can use the loan amount for multiple purposes like:

- You can use the loan amount to pay your medical bills

- It can be used to pay your rent

- Vacation

- House maintenance or decor

- Wedding

- Pay off any existing loan

- To pay your college fees

- To buy fuel or pay for car repairs

- Funeral expenses

How to Choose the Best Emergency Loan?

In this section, we are going to tell you about all the important factors that you must consider to get the best emergency loan.

Check for Fees

There can be many types of fees with an emergency loan. It can cost around 1 to 10% of your total loan amount. Check for the late fee, in case you do not pay the loan on time, how much you will have to pay? There can also be some hidden charges, ask the lender about all the fees and hidden charges.

Compare Interest Rates

Different banks and different financial institutions provide loans at different interest rates. Compare all the available options, check which one works for you, and select the one with the least interest rate.

Calculate the Monthly Payment

If you take a loan, then most probably you will be paying it in installments, until it is a payday loan. Go for that option where the monthly installment does not harshly affect your way of living. You can compare the installments and terms of all the loans and go with the one that works for you.

Ask for Fast Funding

There are many options that can provide you the money immediately, just within a day or two, but they might also ask for a speed funding fee later. Clear this with your lender. Ask them clearly, if they charge any extra fee for fast funding.

How Can I Get the Loan Immediately?

If you need emergency cash immediately then follow the step-by-step process given below.

1. Take a Look at Your Credit Score

If you are looking for a loan then your credit score matters the most. Take a look at your credit score and look for the options that can lend you the needed money on that credit score. You can check the collective report of your credit score at AnnualCreditReport.com

2. Research

Now that you know your credit score, do your complete research. Make a list of all the available banks, lenders, etc., that can provide you a loan on your credit score. This way, you would get an idea about the potential lenders that can offer you a loan.

3. Compare

Compare the interest rates, APR, monthly installments, and everything else that matters. Go for a loan with low-interest rates and fees. Moreover, make sure that you also check their fees and everything, because some lenders may offer low-interest rates with very high fees.

4. Apply for the Loan

After following all the steps given above, we hope that you know which option you have to go. Now you just need to collect all the important documents and everything and apply for the loan. As soon as your loan request is approved, you will receive the loan funds in your bank account.

Emergency Cash Management Tips

Whenever you are stuck in a financial emergency, it becomes very important to use and manage your money wisely. Otherwise, you will stay stuck there forever. If you are lacking in money then you can follow the tips given below for emergency cash management.

1. Create a budget

The first and most important thing is to create a budget. It helps you to determine your income and expenses. This will help you identify areas where you can cut back on expenses and save money. This also allows you to keep a track of your expenses and spend your money only whenever it is necessary.

2. Prioritize Your Expenses

Prioritize your expenses and pay for essentials such as rent/mortgage, utilities, and food first. This will help you ensure that you have the most important things covered. Make your budget in such a way that you keep 50% of your salary for your essential expenses.

3. Cut Back on Non-Essential Expenses

Cut back on non-essential expenses such as dining out, entertainment, and travel. This will help you save money and reduce your overall expenses. Whenever you are in a financial emergency, try avoiding unnecessary shopping, repair, etc.

4. Look for Ways to Increase Your Income

Look for ways to increase your income such as taking on a part-time job, freelancing, or selling items that you no longer need. This way, you would be able to make more money than usual. This will help you to get out of the emergency faster.

5. Seek financial assistance

If you are facing a financial emergency, seek financial assistance from family and friends or local community organizations. But if you take money from your friends or relatives, make sure that you return the money as soon as possible. Otherwise, this can create differences in your relations.

6. Avoid high-interest debt

Avoid taking on high-interest debt such as payday loans or credit card debt as this can lead to a debt spiral that is difficult to get out of. If you are stuck in a situation where you are like, I need a loan now, compare all the loan options and then go with the one with a lower interest rate. Also, do not forget to check the prepayment fee, late payment fee, etc. Because some lenders may offer you a loan with a lower interest rate but high fees.

7. Build an emergency fund

Start building an emergency fund as soon as possible. This fund should ideally cover 3-6 months of your living expenses and can help you get through financial emergencies without having to rely on high-interest debt. Even if you are financially stable, make sure that you put 20% to 30% of your monthly salary. This will prevent you from taking unnecessary loans.

Remember, the key to emergency cash management is to stay calm and focused. By following these tips and making smart financial decisions, you can weather any financial storm. Also, make sure that you keep building your emergency fund so that you can avoid high-interest loans in case of an actual emergency.

Step-by-Step Guide to Building Your Emergency Fund

Building an emergency fund is an important financial goal that can help you prepare for unexpected expenses and financial emergencies. It is very crucial to have your own emergency fund so that you do not need

1. Set a Savings Goal

Determine how much you want to save in your emergency fund. You should have enough amount in your emergency funds to survive for at least 6 to 7 months without any income. So keeping your expenses in mind, decide the savings amount that would be perfect for you.

2. Prepare a Budget

The next in the process is to make your budget. Review your income and expenses to identify areas where you can cut back on expenses and free up more money for savings. This will help you to decide your priority expenses. This way, you would be able to see where you are wasting your money.

3. Start Small

It is completely okay to start your emergency funds with a small amount. If you don’t have a lot of extra money to save, start with a small amount and gradually increase your contributions over time. You can start by saving even 10% to 15% of your income. Then you can increase it gradually to up to 30%.

3. Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund savings account each month, as soon as you receive your salary. This will prevent you from using your savings for any other purpose. Later when any emergency arises, you can use these funds.

4. Use Windfalls to Boost Your Savings

If you receive unexpected money, such as a tax refund or work bonus, consider using a portion of it to add to your emergency fund. Moreover, if you have lesser expenses in any month, add that money in your emergency fund. This will help you in reaching your savings goal faster.

5. Keep Your Emergency Fund Separate

Keep your emergency fund in a separate savings account, and avoid using it for non-emergency expenses. Otherwise, knowingly or unknowingly, you might end up using your emergency funds.

6. Re-Evaluate Your Emergency Fund Regularly

Review your emergency fund regularly to ensure it is still adequate based on your current expenses and financial situation. This will help you to keep a track of your emergency fund.

All in all, building an emergency fund takes time and discipline, but it can provide peace of mind and financial security in the event of unexpected expenses or emergencies.

Alternatives to Emergency Cash Loans

In this section, we are going to tell you about some of the alternatives for emergency cash loans. If you need emergency cash immediately, you can go with any of the following loans as well.

1. Secured Loans

Secured loans are those loans where you have to give collateral in the form of security in order to get the loan. The loan amount is generally equal to the value of the collateral. If you fail to repay the loan on time, the lender has the right to keep your collateral. Secured loans come with a lower interest rate because here the lender is secured that he will get his money back, either in the form of loan repayment or by selling the collateral.

2. Auto Title Loans

Auto title loans are also a kind of secured loan where the borrower has to give his car or vehicle as collateral. the loan amount is equal to the value of the car and if you are not able to repay the loan on time, the lender can keep your car. Auto Title loans are low-interest loans.

3. Credit Card Cash Advance

Some credit cards also allow you to withdraw cash from an ATM or bank. So if you need emergency cash immediately then you can also go for a credit card cash advance. But you need to be very cautious because this cash advance comes with a very high interest and fee. So it is important for you to repay the borrowed money as soon as possible.

Frequently Asked Questions (FAQs)

Q1- How to get emergency loans with bad credit?

If you need emergency cash immediately but you have bad credit then you can go for borrow money apps. They do not check your credit if you need a small amount of money but if you need a larger sum of money then you can either go for a personal loan or payday loan according to your need. If you already have a credit card then you can use your credit card as well.

Q2- How to get emergency cash from direct express?

If you don’t have a regular income and you want to get emergency cash immediately from direct express, you must have some kind of income or monetary benefit, it can be anything like a welfare benefit or disability benefit. If the creditors are satisfied that you can repay the taken money then they’ll approve your direct express loan.

Q3- How to get cash in an emergency?

It totally depends on the amount of money you need and your credit. If you have a good credit score there are various options available for you but if your credit is not good then you can go for options like personal loans, borrowing money apps, or direct lenders.

Q4- How much cash can I take in the case of an emergency?

It totally depends on, whom you are going to for an emergency loan. If you go to borrow money back then you will get a maximum loan of $1000-$2000, that too, if you have a good credit score. But if you go to a direct lender, then you can easily get a loan of up to $8000.

Q5- What qualifies as an emergency loan?

Different financial institutions consider different things as emergencies. But things like job loss, death, and medical emergencies are included in the emergency category by most organizations.

Final Say

You should always have a savings account or emergency fund to meet your emergency needs but if you don’t have one and you have bad credit then for the best emergency loans, you can go with options like small personal loans or borrow money apps. It will help you to pay rent or pay medical bills, whatever you need money desperately for. But don’t forget to read all the terms and conditions before taking the emergency cash immediately.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders