An Aristotle quote, “Well begun is half done,” can not even work in the case of loan movements. Why because! You never know what can happen next, even though you started with paycheck security and promised to settle it with dedication. Still, you default on a loan. You could not meet your and the money lender’s expectations because something expected or unexpected happened. Why “Expected” because a point was before you but ignored in overconfidence!

Let’s consider your supposition with this article and fix these mishaps now.

What Does It Mean to Default on a Loan?

When the borrower doesn’t pay the loan amount for a continuously fixed month/time, it appears as a defaulter in the eyes of the money lenders or the credit card issuer. But make sure! It is not the first stage where you become suspect before the loan provider- it is the last title given to the borrower. Under the nose of default on a loan, delinquency happens when you miss “On-Time Payment.”

Default on a Loan Vs Delinquency

- Delinquency happens when something unexpected happens in your life, and you miss the loan payment on time to manage other financial issues. No issue! It is coverable by the late fee imposed by the money lender, and you can continue with the initial level of dedication. You are delinquent only. Lenders will chase you to release the payment giving you a minimum to maximum. (30-90 days) Depending upon the company’s term, the period can exceed.

- On the other hand, even crossing the grace period, if the borrower doesn’t pay the pending loan amount- the lender attempts collection. You got titled as default on a loan. The collection agency uses its norms to settle the loan amount from the borrower.

What Happens When You Default on a Loan?

What will happen will be answerable by the loan type taken by you. When you apply for a loan, there will be a purpose & that purpose will engage your approval from the money lender. Default is a solid term that can snatch so much from you like a debt collection agency will start following you every single time. Your personal and professional will get destroyed by paying the default charges. Not just that, credit score & future loan facility get affected, and property seizure (secured & unsecured) happens when you default on a loan.

Let’s check the loan type to determine the happenings of default.

1. Federal and Private Student Loans (Unsecured Loans)

Student loans divide into two parts first for federal students and second for private students. If the federal student is a defaulter, he has to pay the loan instantly. The delinquency time for a federal student is 270 days/9 months. In case- the student doesn’t use the delinquency period for coordinating with the service provider or tries to restrain from default: He-She faces the consequences. All the facilities provided by the government get stalled. (tax refunds and other benefits)

The collection agency will take action, suing the borrower to settle the loan. Moreover, the borrower has to bear the trial fee. However, the student can rehabilitate via “The U.S. Department of Education.” Apart from that, the credit score and future loan facility get infringed.

The Private student loan delinquency time is 120 days/4 months, and the collection department follows the same process as for the personal loan & credit cards.

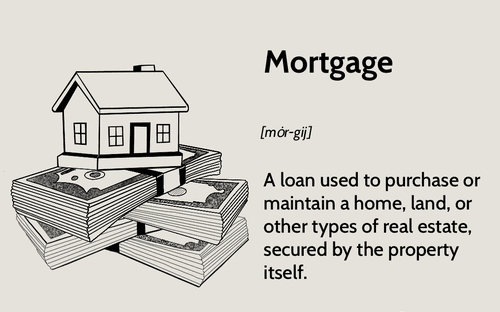

2. Mortgages (Secured with Collateral)

The Mortgage loan defaulters have to face the worst situation of life when the amount didn’t pay as asked or determined in the mortgage terms. It is a secured loan and approved using collateral. The money lender or homeowner can lead to foreclosure. Using collateral/secured loan, the lender can sell the home to settle the losses incurred. It includes collection expenses.

Foreclosure is the last option where the lender can go to fix the issue. However, it is avoidable by communicating with the lender for refinancing. Moreover, HARP (Home Affordable Refinance Program) can help eligible borrowers coming out of the situation.

Is the US running out of money? What happens if the USA people running out of money?

If you miss the payment for more than 30 days and the financer doesn’t allow the grace period, you become a defaulter immediately.

The report goes to the credit bureau, and credit score points start dropping. You may not make future plans with loan benefits. In most cases, the foreclosure, bankruptcy, or loan default title remains a lifetime.

3. Credit Cards (Secured & Unsecured)

If you don’t have a good credit score (No credit history), you can apply for a secured credit card by depositing the security amount. The most practical option is a Fixed Deposit. Moreover, a good credit score with a credit history demands nothing like this. But that is not the evidence of your half work done. Still, you would have to work hard to pay back the credit card amount with interest. One late payment can be an exception from the credit card issuer.

If the grace period of 6 months or 180 days passes away and the cardholder doesn’t cooperate with the collection team, he has to face aggression. Many calls, and messages, will make you fade up. There will be no peace even though you try hard for it. Your debt will come under bad debt, and the collection agencies can sue you for wage garnishment. And they never leave you in mid until they settle their issue with you with even a single penny.

Useful guide- How many credit cards should I have to build credit?

They can even give you the threat of police and family harm with a $35-$40 late fee charge and credit card point drop. It is hard to save yourself from the credit card collection team. However, if you talk to them peacefully, they can settle the issue with negotiation.

4. Personal Loan & Business Loan (Secured & Unsecured)

Personal loan & business loan default time starts after 30-90 days. Its grace period and consequences vary according to the secured and unsecured loan and the lenders’ terms. If the business loan got approved on a personal loan guarantee, the credit card score drops & the collection department takes action to seize the company revenue or make it bankrupt.

Also Know about- Funeral loans

Personal loan repayment settles on collateral seizure in the case of secured loan, and unsecured personal loan leads to wage garnishment. The “In House Collection Department” can file a case against you and your property. One can not neglect the court order. So take action before judicial interference.

5. Auto Loans or Car Loans (Secured Loan)

What happens when you default on a loan (car or auto loan)? The repossession or the car seizure is the consequence. The way is possible to resume repayment within 6 months with a car finance payment holiday. Your car will go to auction for the outstanding amount of the loan. Lenders have no concern about your problems. They will do what they can to settle the issue as soon as possible.

Do you want to take a loan to repair your auto? Here is a quick guide on auto repair loans to help you.

Moreover, the remaining amount will be your responsibility to pay if the car auction is insufficient. The car comes in the depreciation item list. That’s because the value drops and in most cases, the resell is not sufficient.

Can a Lender Default on a loan?

Yes, the lender can make you a loan defaulter for your accompanied mistakes or uncontrollable situations. Life is a challenge when you surpass the loan facility. Now, the condition comes to this point because chances are you have many loans to pay in a single month. However, you have done everything but can not manage the single one from the above list. Other than that, other finances have stopped you from working in this direction, like medical expenses, emergency time, sudden unemployment, etc.

Additionally, the borrower may not wish to continue loan repayment and ignore the terms signed initially. Your situations are your responsibility to deal with. However, every money lender gives you a chance to continue your promise during the delinquency period. That is not for all, but some ignore this delinquency time or grace period and face default on a loan.

How to Prevent Being Default on a Loan?

If you wish, you can prevent this. Your goal and intention should be clear and on point here. Missing the chance may lose a crucial part of your assets and time. Fix the finances if possible and chase the target with dedication.

-

Lender Communication

Lenders are efficient in their profession. They know you can overlook your responsibility for various reasons. Forget about yourself- the money lenders or credit card issuers are also at a loss if you don’t make payments. It is like you would have triggered a loss if the lenders wouldn’t approve your loan. Similarly, they are doing what they should do to take their money back.

If you communicate with them, they will understand you and negotiate the possible way. Many choices they can provide to go ahead. Try this first.

-

Debt Consolidation Loan

Debt consolidation is better than going default on a loan. With debt consolidation loans, you can consolidate numerous loans with a single payment or take debt for a single credit too. The choice is practical when you sense becoming a defaulter unable to manage multiple loans altogether. For executing this plan- you may find a creditor who identifies you as eligible due to a good or average credit score.

Complete the hard or soft credit score check, and after approval, transfer the money into the bank account of old creditors with the lowest interest rates.

-

Deferment or Forbearance to Restrain: What Happens When You Default on a Loan

That is not possible with every loan type. But few personal loans and, most importantly, student loans can adopt this method. In this situation, you may get some time to get back on the financial track to start repayment. For federal students, rehabilitation is a facility from the “The U.S. Department of Education.”

-

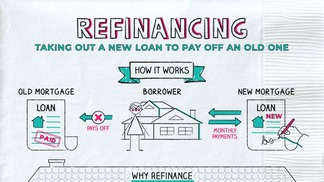

Refinancing

Refinancing is better than applying for a new loan. The interest amount will be lower than before by extending the repayment time. However, everything depends on the qualification/what time you have decided to adopt this method. Be sincere in following any procedure. Don’t divide yourself into multiple options. Otherwise, you may lose time without getting anything in your hand.

What Happens If I Close My Bank Account and Default on a Payday Loan?

You may call it the “Never Follow path.” Yes, many defaulters or delinquents do follow this process. They think they can save themselves from any action. But they forget that they themselves have given various other ways to capture them. The most harassing part is- you have taken a payday loan- remember that! The Annual Interest Rate is already high, and if you close your bank account and the lender tries to withdraw the loan amount, the penalty charges will increase.

- You and your family will start getting continuous calls, messages, emails, and threats from creditors.

- Police arrest is the next threat that is legal in some cases. However, you have informed and negotiated with the creditors.

- A court case is another way- by which the creditor can impose various obligations on you.

The Final Verdict

Default on a loan becomes a curse for most borrowers. They can never get out of the situation once they enter into it. Because lenders call, message, or threat, don’t let the defaulter live in peace. Not just that, the continuous aggression from the creditor or collection department makes the bad debtor stubborn in not paying anything back. So, to be an ideal person in society, everyone should try to manage things primarily before this curse.

Frequently Asked Questions (FAQs)

Q.1 Can a lender default on a loan?

Ans. Yes, the lender can put you on default if you don’t make the payment on time, even after delinquency or a grace period.

Q.2 What does it mean to go default on a loan?

Ans. It means you become liable for the collection agency’s aggressive actions for repayment. You start living in fear of losing your assets.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders