Getting approved for a credit card can be difficult if you have a low credit score or a bad credit history. Worse still, the majority of credit cards provided to people with bad credit come with hefty annual fees, high-interest rates, and few perks and rewards. Additionally, the reductions in credit inquiry that come with every application can future harm your credit score if you apply for a card and are turned down. Fortunately, there are still a number of ways for borrowers with poor credit to get credit cards and we have selected the most working of them. Let’s check our best preferred “Credit Card for Bad Credit” and understand how to use one when you have poor credit.

What is Bad Credit?

A person with bad credit has a history of late payments on their credit cards and a higher chance of doing so in the future. It frequently shows up in a low credit score.

A person or business with poor credit will have a difficult time obtaining credit, particularly at interest rates that are competitive, due to the fact that they are regarded as being riskier than other borrowers.

If a person has a low or negative credit score on his credit history such as loan default, foreclosure, or bankruptcy is considered poor credit. A VantageScore of less than 601 or a FICO score of less than 580 is considered bad credit.

9 Most Preferred Credit Cards for Bad Credit

1. Discover it® Secured Credit Card

Discover it® Secured Credit card wants to get a security deposit to be paid in advance when the account is opened. In any case, your deposit is completely refundable after changing to an unsecured card or shutting your credit account. The Discover it® Secured Credit card’s rewards program is perhaps its greatest selling point. Discover it secured credit card does not have any monthly or annual fees and continues to provide open-handed rewards.

Pros:

- No year-wise fee

- 2% cash back at gas stations and restaurants

- On any kind of other purchases get 1% cash back

- Dollar for dollar cash back match after a year

- Monthly free access to your FICO score

Cons:

- High APR

- The largest amount to deposit is $2500

- The maximum reward rate is $1000 quarterly

- Fines are high

2. Capital One® Platinum Secured Credit Card

Due to its low fees and ability to build credit, the Capital One® Platinum Secured credit card is one of the most commonly used secured credit cards for people with bad credit. It is a great option for borrowers with bad credit who often visit abroad because it does not charge any foreign transaction fees or an annual fee. You can use the card’s resources and tools to build or improve credit. For instance: Credit tracking/analyzing service, adjustable due dates, monthly credit score, Eno: a virtual supporter.

Pros:

- Zero annual fee

- Refund policy for security deposit

- High chance of approval odds

- Workable credit limit

Cons:

- High APR

- Must have an account in a bank

- Zero rewards program

3. Tomo Credit Card

Get a one-of-a-kind chance to quickly build credit with the Tomo Credit Card. It is an unsecured credit card for bad credit, has incredible credit limits of up to $10,000, and there is no interest because of its unique seven-day billing cycle. You use your Tomo credit card and repay it every week, or else you run the risk of locking it until the entire balance is paid off. You won’t have to worry about paying your regular bills because the balance will be withdrawn weekly from your connected bank account.

Pros:

- Cashback Rewards

- No requirement for Social Security Number (SSN)

- No security deposit

- No need for a credit check

- Insurance of mobile phone

- Report to all three credit agencies

- No annual fees

Cons:

- Required a bank account

- Payment dates are not flexible

- Cannot transfer balance

- No cash advances

- Unable to carry your balance

4. Chime Builder Secured Visa® Credit Card

The Chime Credit Builder Secured Visa® uses a novel strategy for building credit. It provides borrowers with poor credit with the opportunity to improve their credit score at a low cost and with little risk.

There are some of its most noteworthy benefits being one of the best credit cards for fair credit:

- There are no fees for the program, maintenance, annual, monthly, or even international transaction.

- This credit card does not charge any interest at all.

- Even the cash advance feature, which is extremely uncommon on credit cards, is free on this card.

Pros:

- No Annual Fee

- No Interest

- No international transaction fees

- No credit checks

- No cash advance fees through an ATM network

Cons:

- You must have a Chime account

- No rewards

- The minimum security deposit is $200

5. OpenSky® Secured Visa® Credit Card

Another secured credit card for bad credit with no deposit is the OpenSky® Secured Visa®, and when you apply for it, no credit check is required. In another way, the credit issues will not investigate your credit history or conduct a hard inquiry on your credit report, which can lower your credit score. It is a credit card with a close-guaranteed approval rate because your borrowing history will not be looked at when you apply.

To start with, it charges a yearly fee of $35, but compared to others it is somewhat low.

Pros:

- Low APR

- High acceptance odds

- Assist in building credit

- No credit checking

Cons:

- Security deposit requirement

- Cannot change to an unsecured card

- Doesn’t offer rewards

- Annual fee charges

6. Petal 1® Visa® Credit Card

It is difficult to get a credit card for people with poor credit that is unsecured as well as does not take an annual fee. The Petal 1® Visa®, a low-interest credit card with high approval rates and no annual fee, is the next option.

The Petal 1® Visa® is quite unique because you don’t have to have a credit history or even a Social Security Number (SSN) to apply. In place of this, you’ll need to get pre-approved for a Petal credit card. After that, the issuer will inform you of your eligibility to submit the application for the following:

- Petal1® and Petal 2®

- Petal 1® Credit Card

- None of the cards

Pros:

- No security deposit

- No fee for foreign transaction

- Cash back rewards up to 10%

- No credit score required

- $0 yearly fee

- Credit Cards without SSN

Cons:

- Limited cashback rewards to select businessperson

- No introductory offers

- High APR

- No cash advance

- Balance transfer not available

7. Prosper® Card

The Prosper® has a high limit for an unsecured card for bad credit. If you are looking forward to increasing your purchasing strength, this one is probably made for you. You may be eligible for a first credit range of $500–$3,000 with the possibility of credit limit boosts automatically—up to doubling your credit limit in three months—if you meet the requirements.

When the matter is about getting a high credit limit, The Prosper® Card easily surpasses the majority of bad credit credit cards. Other credit cards with bad credit typically have $200–$300 credit limits.

Pros:

- No security deposit

- Quick & simple process to apply

- No cash advance fee

- International transactions

- Increment in credit limits after 3 months

Cons:

- Annual fee of $39

- No rewards & perks

- High APR

- No introductory offers

- No Balance transfers

8. Bank of America® Customized Cash Rewards Secured

If one is having poor credit then the Bank of America® Customized Cash Rewards Secured is a giant of credit cards, particularly if you are forced to earn cash back rewards on your spending. Some of the other features provided by this credit are:

- 3% cash back on: medicines, meals, travel, gas, online shopping, or home accessories

- 2% cash back at a convenience store and bulk order

- 1% on the rest of the things

Where 3% and 2% cashback is only applicable for up to the expenditure of $2,500 once every three months, once you exceed the limits the cashback will decrease to 1%. Well, it is rare to get rewards on poor credit still this is the best offer.

Pros:

- 0$ yearly charges

- Cash back rewards up to 3%

- Reports credit to three major agencies

- Minimal foreign transaction charges

Cons:

- Need security deposit

- 2% and 3% cash back rewards only up to $2,500

- High Annual Percentage Rate

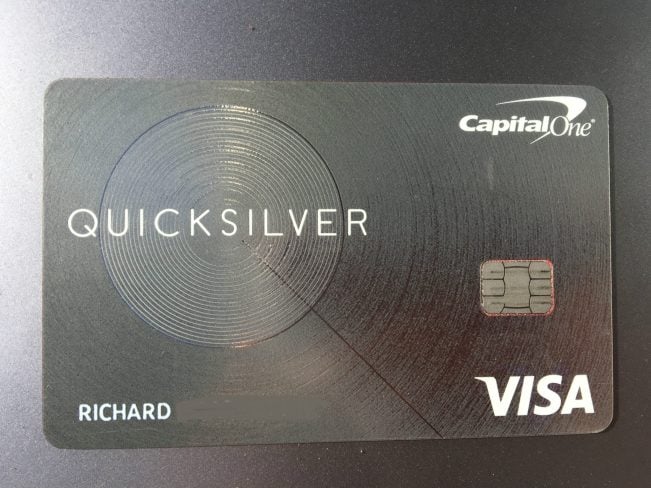

9. Capital One® Quicksilver® Secured Rewards Card

The Capital One Quicksilver Secured Rewards card makes it much more favorable by providing the debtor with poor credit tools for enhancing credit and cash-back rewards also. The Quicksilver offers the borrower credit assets such as a record of credit score, nonchargeable reports, and flexibility in due date, the same as the other Capital One secured credit cards.

In addition to that, this card gives a flat cashback on all purchases at the rate of 1.5%. These rewards can be grabbed rapidly if your Quicksilver card is regularly active. Then, you can elevate your credit score by paying your balance on the date of your choice on time.

Pros:

- No yearly fee

- Flat 1.5% Cash Back rewards

- Can update an unsafe card

- No convertibility charges

Cons:

- No welcome rewards

- Only a single account can join

- High Annual Percentage Rate

How to Get a Credit Card with Bad Credit?

If you have bad credit or no credit history, you can still get a credit card because of the number of credit cards available today.

Compared to one with a good credit score, bad credit cards have fewer options, generally offering fewer rewards and perks and worse credit agreements. To know other disadvantages of credit cards with bad credit, see below:

- Security deposit requirement

- High APR

- Include annual fees

- Low credit limits

- No credit card cash back

- Restricted rewards

Is Getting a Secured Credit Card Worth it for Bad Credit?

No, borrowers with poor credit are eligible for both unsecured and secured credit cards. The security deposit serves as collateral as opposed to insecure credit holders, secured credit cards are typically easier to obtain. Thus, moneylenders are comparatively pleased to provide secured credit lines. Additionally, your credit background will not be included in consideration when you apply for a secured credit card because some of them do not conduct credit checks.

However, individuals with poor credit can also take advantage of numerous unsecured credit cards. Be alert that unsecured credit cards for bad credit typically have fewer benefits and higher fees. For instance, a secured credit card with rewards is more likely to be available to people with bad credit.

How Can I Get a Credit Card If I have Bad Credit?

Here’s how to receive a credit card when you are facing bad credit:

Way 1: Analysis of Your Credit Score

Before submitting the application, you should understand the value of your credit score and know its capability of it.

Get the steps to get your score easily:

- Determining whether a bank or any financial agency provides free credit scores by contacting them.

- Buying your credit score from VantageScore directly or FICO.

- Utilizing scoring programs whether it’s free or paid.

- Contracting credit consultant for a non-profit.

- Contacting Experian for a free credit score.

- Obtaining a free credit report by visiting AnnualCreditReport.com. You won’t find any information about your credit scores in this report, but it will assist you to understand the position of your credit.

After getting the status of credit, you can limit your credit card choices to those you’re probably going to meet all requirements for.

You should avoid applying for multiple credit cards simultaneously, particularly if you are unlikely to be approved because applying for credit cards results in hard inquiries, which lower your credit score.

Way 2: Select a Credit Card

Choose the best credit card for you by researching all of the options. Follow the preceding list of $500 Credit cards for bad credit, or look into other options for borrowing money. For instance, If you are a very new borrower looking to get your credit history off the ground, you need to think about using credit cards to build credit.

Before applying for a credit card, make sure to read the fees and rates page thoroughly. The Schumer box of a credit card lists rates and fees. You can look for it on the website of credit card or in the Consumer Finance Credit Card Agreement Database.

Way 3: Easy Way to Apply

After deciding which credit card is best for you, now get ready to apply. The majority of the cards on this list offer immediate acceptance and simple application by online mode.

From our page, you can easily and quickly access the application portal for each credit card.

Once you get there, all you have to do is give the credit card company some details and let them address the others.

- Official Name

- Contact Number

- Email Address

- Physical Address

- Social Security number (SSN) or ITIN

- Employment status

- Salary per annum

- Running Expenses such as phone bills, rent, electricity bills, and child care.

Way 4: Activate Your Credit Card

You will frequently get an approval reaction immediately, yet you might need to stand by a couple of days if the guarantor needs to examine your data. You can anticipate getting your credit card in the mail within 14 days of receiving approval.

The just next is you will first need to contact the number given on the back in order to activate your credit card.

How Would I Pick a Credit Card Bad Credit?

Below we have informed you about those features that you should consider before choosing a good credit card for bad credit.

Fees

Find out what card fees are and whether or not you can afford them. For instance, numerous bad-credit credit cards charge a yearly fee. Unless it provides enough benefits to justify a higher yearly fee, look for one that costs less than $50 per year.

Some of the cards also charge fees each month. We have found that some credit cards consisting of fees per month are reasonably expensive. We recommend ignoring them.

Maximum Credit

The largest amount you can take to a card is its credit limit. The majority of bad credit credit cards cover low credit limits. Choose a credit card that lets you pay for the monthly expenses you plan to incur on credit without having to use up all of your available credit.

APR

The annual percentage rate (APR) of credit is its interest rate. APR is typically more on bad-credit credit cards, which means that you will pay additional interest on the remaining payment that you carry over every month. Search for an APR that is less than 25% because anything higher than that is high even for bad credit.

Abilities

Different cards offer different capacities. Check to see if a credit card lets you add official users, transfer balances, or withdraw funds using cash advances (though this is not recommended because of the high fees and interest rates associated with cash advances). If you’re thinking about getting a secured credit card, you need to also see if it can be upgraded to an unsecured one.

Security Deposits

Know how the security deposit matters if you are looking to get a secured credit card for bad credit. Check the minimum amount being asked to pay for it, what is the largest amount that has to be paid to get the higher borrowing limit, and whether the security deposit is guaranteed to be returned.

Frequently Asked Questions (FAQs)

Q.1- What is the easiest credit card to get with bad credit?

There are many such credit cards that give approval even after you have bad credit for applying. We have mentioned them below:

- Petal® 1 “No Annual Fee” Visa®

- Navy FCU nRewards® Secured

- Tomo Credit Card

- OpenSky® Secured Visa®

- Discover it® Secured

- Credit One Bank® Platinum Visa® for Rebuilding

- Bank of America® Customized Cash Rewards Secured

Q.2- How to get a business credit card with bad personal credit?

Take a look at your credit reports to find out what’s hurting your scores. AnnualCreditReport.com lets you get a free report once a year from the three credit reporting bureaus: TransUnion, Equifax, and Experian.

- On time, pay off all credit accounts.

- Reduce debt from credit cards.

- Think about getting a credit card.

- Add mobile phone records to your report.

Q.3- How to consolidate credit card debt with bad credit?

To be eligible for a debt consolidation loan, you will likely need to cover a credit score in between 600s, a history of making timely payments, and enough salary. However, each lender’s requirements are unique. Start with the following ways to increase your chances of getting approved and find the best personal loan for consolidating debt.

- Examine your credit score and keep an eye on it.

- Compare loan options from many lenders.

- Think about a secured loan.

- Work on your credit.

Q.4- What credit score is needed for a store card?

Although getting approved for a store credit card may be easier than the majority of other types of cards, there is no guarantee though.

Generally, a store credit card can be approved for you even if you have poor or average credit. This typically indicates a credit score of 600 or higher.

Q.5- How to get an American Express card with bad credit?

In order to be approved for an American Express card, you have to fulfill the official requirements given below:

- Your age must be at least 18 years old.

- You must have impressive credit.

- You must have a Social Security Number or Individual Taxpayer Identification Number.

- Your address must be in the US.

- Your monthly income must be sufficient to cover the minimum payments.

Q.6- How to Consolidate Credit Card Debt with Bad Credit?

Better financial management and a higher credit score give you more options. You must follow the same steps regardless of which debt consolidation option you select.

- Timely track your credit reports by the top three credit agencies: Experian, TransUnion, and Equifax

- Improve your credit by making all the payments with no delay and reducing the credit usage ratio.

- Apply with a co-signer who meets your selected lender’s credit score needs and has good credit.

- Compare consolidated credit card debts by looking at things like fees, interest rates, and how flexible the payments are.

- Consider getting a secured debt.

Conclusion

It can be difficult to obtain credit card approval if your credit score is below average. Additionally, if you apply for a credit card but are rejected, the lower number of credit inquiries that come with each application could hurt your credit even more. Borrowers confronting unfortunate credit actually have multiple ways of accessing credit. We have compiled a list of the best credit cards for subprime borrowers and a guide to help you get approved for an unsecured or secured credit card despite having poor credit.

Author Profile

- Elizabeth Jones is one of our editorial team’s leading authors on credit card offers, services & more. With over two decades of experience in the consumer credit industry and as a nationally recognized credit expert, Elizabeth provides in-depth analysis of both traditional & alternative forms of credit. Elizabeth regularly appears on many major media outlets including NBC Nightly News, Fox Business Network, CNBC & Yahoo! Finance. She is also a frequent contributor to Forbes Magazine. As a highly appreciated author for our exclusive Editorial Team, Elizabeth strives to provide readers with a trustworthy advice on how to manage their credit accounts while staying informed on the latest offers in the marketplace.

Latest entries

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide

BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know

BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide

BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide