Credit cards are the interest of every American nowadays. However, very few of them are mindful of the exact certifier of the card issuance Companies; who they deal with. That is why when you go through your credit report for analysis and action for mistakes, you trigger the CFNA credit card terms unrecognizable and disputable. Yes, Of course! It is acceptable to challenge every matter you haven’t dealt with in your credit history.

However, missing the complete information while applying for the company to issue a credit card can be a daunting experience sometimes. So, in this article! We will cover everything you have missed about who is affiliated with your credit card company and on what terms. Make sure to join our thorough guide.

What is a CFNA Credit Card?

The abbreviation stands for Credit First National Association which is active in affiliating companies to issue credit cards to qualified applicants. It is similar to the CBNA credit card inclusion on your credit report because of affiliation to Shell Fuel Rewards cards, and Best Buy Visa cards issuance on your name. Furthermore, if you have applied for credit cards from Firestone, Tires Plus, Bridgestone, and more, you would get your report printed with a CFNA OR CFNA credit card.

CFNA is a bank that doesn’t directly serve its consumers. Instead, it coordinates with consumer credit branches to lend credit cards to thousands of users of automobile and tire services locations. With this card, the cardholder can deal with sudden and planned maintenance of their vehicles. They can quickly control their finances to travel as early as they want.

List of Affiliates of CFNA Credit Card

Multiple consumer credit branches have affiliated with CFNA to give you quick financing services nationwide. You may report CFNA on your credit report if you have ever dealt with any of them mentioned in the list below.

- Firestone Complete Auto Care (CFNA Firestone Credit Card)

- Gateway Tire & Service Center

- Southern Tire Mart

- Peerless Tires 4 Less

- Wheel Works

- Commercial Tire

- Tire-Rama

- Best-One Tire & Service

If you want to know more about the company and its affiliations, you can switch to its official web address. That way, you will find a more comprehensive answer about its services before accepting and rejecting its presence on your credit report.

Is CFNA Legit?

Yes, CFNA is an organization that deals with and affiliates international brands in the automobile sector. Without its affiliation, the Companies, like Firestone and Bridgestone, can’t give you a credit card as you have applied for your vehicle’s repair financial management. If something is written on your credit description related to CFNA- That means, you have attempted a CFNA credit card login. Apart from that- you have applied for a credit card, and Credit First National Association has checked your credit or debt repayment performance with other money lenders.

Though- CFNA is legit, and there is no threat from its presence on the credit description. However, sometimes, it can be because of other illegitimate acts done to your identity. Before coming to any conclusion! Make sure to inspect; whether you have any connection with affiliated companies or CFNA itself.

CFNA Firestone Credit Card Login

You can Sign up for the Firestone CFNA credit card login to manage account services. The card allows you to get almost 5% off on certified purchases. You may get various other benefits for your auto repair with Firestone Complete Auto Care. Let’s see how you can log in for it to get a 0% annual fee service.

- To check the credit card balances, transactions, and other records, visit cfna.com to go to the Firestone login page.

- Fill in the details asked in the login box.

- After typing the details, click on the “Log in “ option added to it.

- Now, check your transaction history, repair date, or discounts.

How to Reset the Username in CFNA Credit Card Firestone?

To recover your username for the CFNA Firestone credit card login, you can follow these simple steps.

- Click on the Sign-in Link on the CFNA website.

- Hit the “Forget Username” Link.

- Type your email address in the username recovery box and hit the “Continue” button.

- Open your email ID and follow the instructions added to the mail received from the company.

- Finally, set the new username and password. Use the same process (if required) to log in on the Firestone credit card.

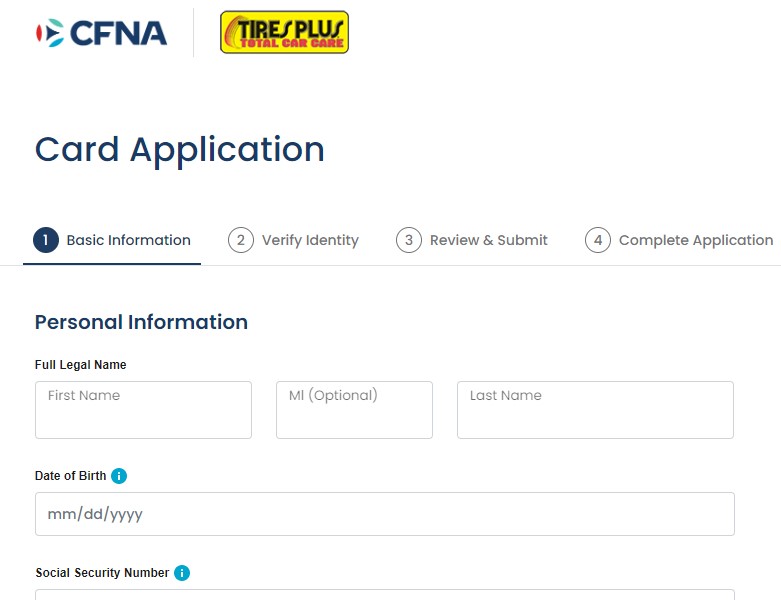

How to Create a Firestone CFNA Credit Card Login Account?

- Visit the cfna.com website.

- Select the “Apply Now” option.

- Launch personal credentials, like your full name, contact number, and communication address.

- Now, create a “Username and password” and share income proof and debt history documents to fix the credit card limit.

- Read the terms and conditions, share the payment method, and click on the “Submit” button to create a Firestone CFNA credit card login account.

Like the CFNA credit card, If you want to get a JPMCB Card can visit its official website to create the account.

Know Why the CFNA Credit Card is on Your Credit Report?

You can dispute the CFNA when you know that you haven’t enjoyed any services from Credit First National Association. However, we would like to describe some reasons to determine why it is there on your credit report.

-

Credit Card Application

Before issuing any card to any consumer, CFNA goes through all the inquiries, which require checking the applicant’s eligibility. As you have created an account on the CFNA website or given income proof and another credit history, It will help you get the credit card qualification and non-qualification report. However, you must be mindful that these inquiries may or may not affect your credit score and print on the monthly statement.

If you have applied for the CFNA credit card, then the Credit First National Association will check the relevant documents and mention them in the suitable report for the analysis of credit bureaus. Whether you qualify or not, it will be there as a hard inquiry against your credit card issuance application.

Furthermore, if you haven’t applied for the credit card and still get the mail from the company; That means they have done a random check on your profile and made suggestions for you. The best part of this soft check is it will not put a red mark on your credit scores.

-

CFNA Credit Card Login

You had an active account with CFNA or dealt with that for enough time. Even if you have deactivated the account, and not using the credit card for any payment regarding your automobile services, still it will appear on your credit score or report. As per the credit report policy, the statement issued from any legitimate money lender to credit bureaus can stay on your credit reports for 7 to 10 years.

CFNA remains active on your record for 10 years if you have a good debt history or complete credit settlement. On the other hand, a 7-year stay can be seen when you have a delinquent account with a CFNA credit card login or other consumer service branch.

-

Authorized User

Sometimes you can’t take credit cards because of minor age or other legal issues. In that case, you can find any person who has a good credit score and can help you build your credit score by setting your name as an authorized user. That person will be the primary cardholder and help you increase and drop the credit score on your name. If you have ever requested any person to add you as an authorized user on the CFNA account, you can see CFNA written on your credit report.

You can be added as an authorized person for this account by your Father, Mother, Wife, Husband, Friends, Children, or business partners. Now, you have to check whether you have allowed them for this or not! If not, then you can file a dispute against CFNA.

-

Unauthorized Access

That is the last and most important thing to notice when you find that you haven’t contacted CFNA via any of the above-given methods. It is the illegitimate way someone has chosen to name you for CFNA credit card services. You should act strictly here because it is a hard inquiry done by the bank, and it will remain the same at least for 7 years. Now, you can contact CFNA to tell them you haven’t made any inquiry and ask them, who has done it against you.

Moreover, you have to report this activity to the Federal Trade Commission or FTC for action. After all this, you can ask the credit bureaus to re-verify your details given by the company and make necessary changes along with a credit report freeze.

What CFNA Factors Affect the Credit Score?

- Multiple causes affect your credit score with CFNA credit card login. One such is an inquiry made against your credit card application. If you initiate the credit card application, a challenging search will be there and affect the credit score at the month’s end. The soft check will not affect the credit score.

- You have opened the account and there is a balance for repayment you have attempted for the account closure, the credit report will be there with a negative mark. If- that gets proven from the company side, you can’t dispute the company analysis.

How to Dispute CFNA Credit Card Inquiry for Credit Report?

There is an Act that protects consumers from Fraudulent reporting released by any of the credit bureaus. You may take the help of the Fair Credit Reporting Act to dispute the inquiry made and shared by the company for the credit report. There are multiple grounds, you can highlight while making a dispute with a money lender, the credit card issuer (CFNA), FTC, or credit bureau. However, before initiating anything, you should be ready to answer all questions asked by the dispute redressal party. It is crucial because the company, bureau, or any other authority may reject your application or close your file if you can give sufficient cause or proof for the dispute.

Points to Remember

- You can find the verified email id of Credit First National Association, FTC, and all three credit bureaus to send them a dispute letter.

- In your dispute letter, you can mention that you have an objection to a particular thing the company or bureau has mentioned in the report.

- Suppose you have an issue with the delinquent account, then you can write to them to re-verify your status with the documents added with your dispute letter for evidence.

- In some cases, the creditors mistakenly share another person’s debt performance in another person’s name. That affects the credit Report. If CFNA has made this mistake, you can add the documents that show your actual identity that proves the error in the report.

- Apart from that, You are open to sending the dispute letter copy to all the connected parties to ease the inquiry. CFNA and 3 bureaus directly connect to prepare your credit description here, you must share the authentic duplicates with these parties.

- You can find free templates to prepare dispute letters or dispute forms to share with the respondents.

- If you can’t do this on your own for whatever reason; find a credit repair company to work on your behalf. These companies are well-versed in relevant laws and statutes. You don’t have to pay the charges until you find your dispute settled and get the new and error-free report.

Frequently Asked Questions (FAQs)

Q.1 What credit score is needed for a CFNA credit card?

You must have a fair credit score or above 630 to apply for a CFNA credit card.

Q.2 Where can I use my CFNA card?

The CFNA card can be useful at authorized dealer service locations.

Conclusion

A CFNA credit card helps you manage your finances for your automobile repairs. You can find the relevant services nationwide. It reports your payment performance to credit bureaus. That is why you see this term written on your credit report. We have summarized everything about CFNA in this article. You can read the content thoroughly and take a dispute letter if CFNA has mistakenly affected your credit score.

Author Profile

- Elizabeth Jones is one of our editorial team’s leading authors on credit card offers, services & more. With over two decades of experience in the consumer credit industry and as a nationally recognized credit expert, Elizabeth provides in-depth analysis of both traditional & alternative forms of credit. Elizabeth regularly appears on many major media outlets including NBC Nightly News, Fox Business Network, CNBC & Yahoo! Finance. She is also a frequent contributor to Forbes Magazine. As a highly appreciated author for our exclusive Editorial Team, Elizabeth strives to provide readers with a trustworthy advice on how to manage their credit accounts while staying informed on the latest offers in the marketplace.

Latest entries

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide

BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know

BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide

BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide