Checks are a part of our day-to-day life. We use them almost every day for several reasons like paying our employees, making payments, cashing out from banks, and even gifting someone. They are a convenient way of payment. When you write a check to someone and hand it to them, they can go to their bank and cash out the amount. But most of you do not consider checking because you will have to hand it to the receiver physically or post it through the mail.

The biggest concern here is that the check might not be delivered on time which can cause a nuisance. In such situations, you start to wonder can you email a check? In this article, we will discuss how technology and modernization have made it easier to use checks. But before we get into it, let us start from the start.

Can You Send the Check Online?

Most of us are busy in our life and work. Therefore sending checks by post or physically handing them over can not only be hectic but also time-consuming. Most of the time we fail to meet deadlines because the check did not reach on time. There are situations like these when you wonder if can you send a check through email? Having said that, technology has innovated a solution for this too. You can now send your checks online through emails and the receiver would receive them within minutes. The checks by email are classified into two types, which are:

- eCheck

eCheck is also known as electronic checks and it is not like traditional paper checks. It is basically electronically transferred through an automated clearing house (ACH). Although it is not similar to the paper check contains the same value and can be deposited into your bank just like you deposit a traditional check.

- Digital Checks

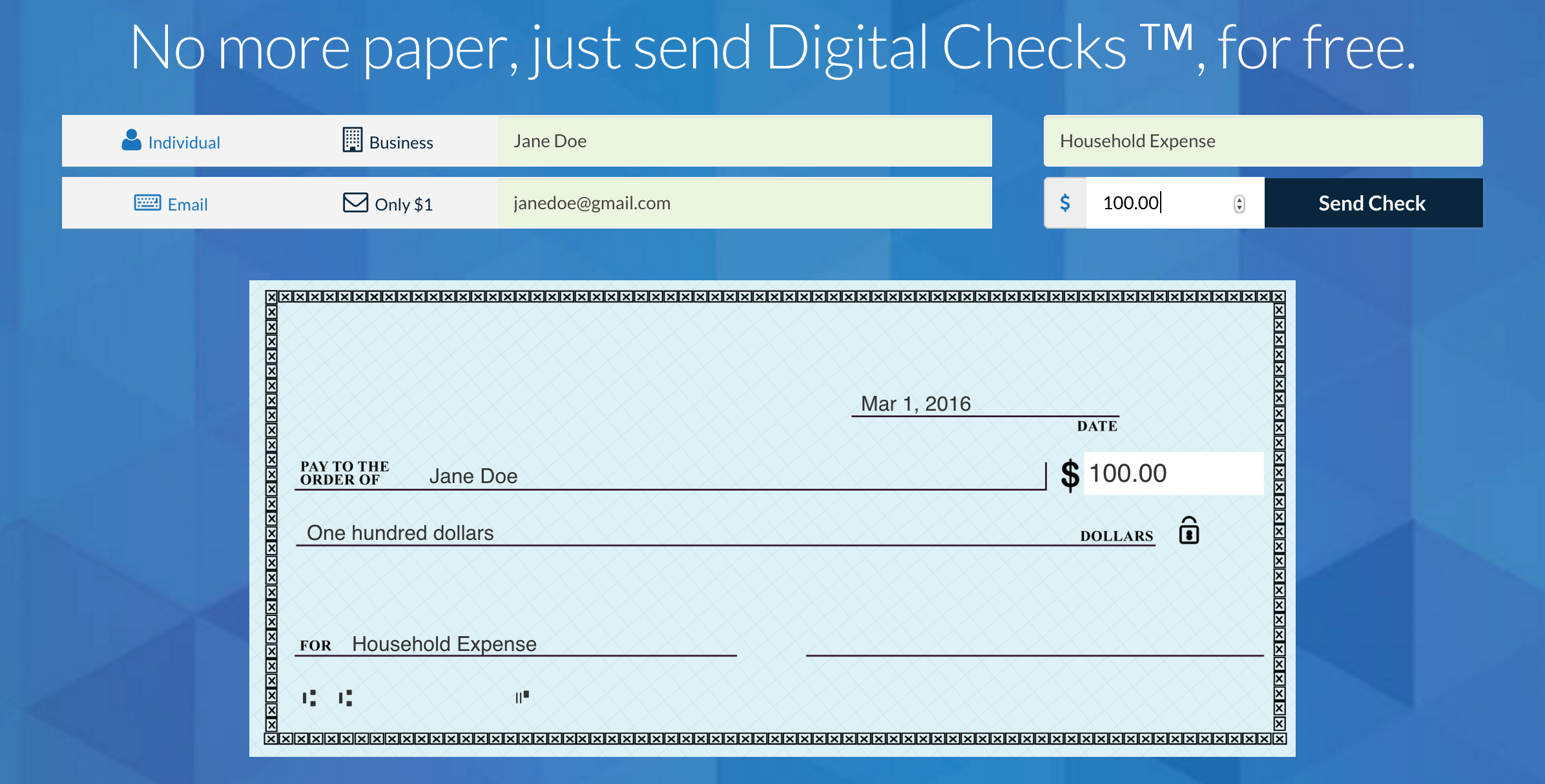

Digital checks are similar to paper checks with only one difference. The paper checks are hardcopy and the digital checks are soft copies. Both contain the same information. Digital checks are basically emailing a check that you normally use.

What is the Difference Between eCheck and Digital Check?

We already know the answer to the question “can someone email you a check?” But, most of you think that any checks sent through an online channel are digital checks. However, all the checks you send online are not digital checks. Those checks are of two types, i.e. eCheck and digital check. But what is the difference between the two?

Delivery

The digital checks are sent by email. These are just like a traditional paper checks but are digitized. On the other hand, eChecks are usually acquired via a link that the person whom you are paying will send over an ACH network.

Input

In a digital check, there are all the same inputs that you write on a traditional paper check. Nothing is different here. However, an eCheck requires you to not only add your account number and the sum of payment but also your routing number.

Sender

The sender of digital checks is the payer. If you are paying someone, you will send them a digital check. However, in the case of an eCheck, the payee will send you the form or a lion to the form wherein you add all the details.

Processing

Both digital checks and eChecks are processed through different networks. A digital check is processed through Check 21 processing. Wherein your check will be scanned and transferred to the Federal Banking System in a digital format. Once it is processed, the payer’s account will be debited and funds will be credited into the payee’s account. On the other hand, eChecks are processed through the ACH network, where the check will start moving from the payer’s bank to the clearing house and then finally to the receiver’s bank.

Security

You can send digital checks by email and therefore will be protected under the email’s secure encryption technology. However, in terms of security, eChecks are not so secure. There is no such encryption to protect your data and it is the responsibility of the receiver to keep it safe.

Time Taken

A digital check is sent through an email and is delivered instantly speeding up the internet speed of both sending and receiving parties. It then can either be deposited by converting it into a virtual card or printing it and depositing it into the bank. The entire process is instant. However, eChecks tend to get lost in the entire network’s realm and will take around 3 business days to complete the settlement.

How to Send a Check Via Email?

It has already been made clear that the checks we send through email are not eChecks but digital checks. eChecks are sent through the ACH network. Now, most of you must be wondering, can you send checks through email? Yes, as unreal as it sounds, you can send digital checks via email. With time, technology has brought up innovative ways to tackle our problems. The major issue with traditional paper checks was that they took time to deliver and therefore we would sometimes miss our deadline.

With modernization, we have come up with a solution to this and that is digital checks. These are exactly like paper checks but are transferred digitally. You can then deposit this to the bank or cash a check at the atm. The receiver will receive the check immediately and no longer have to worry about missing any deadlines for payments. This further raises the question of how to send a check online?

There are two different ways that can be used to send checks by email. You can either use a digital check app or you can scan or take a picture and send it.

Using Software Or Application

There are different applications or software that will register your checkbook and then you can send digital checks through the digital checkbooks you registered with these apps. When you look up such apps, you will find a lot of different applications. But how do you decide which one to opt for? There are certain factors that you should keep in mind. These are:

- The features of the app

- Your requirements

- Is the application legit?

- Is the software paid? If yes, is it under your budget? Or is the price you are paying for the app worth it?

Before you opt for any application, make sure you read its customer reviews. You will also have to precisely read their terms and conditions. Lastly, you need to ensure that the app is safe because you will be registering your checkbook with it and you do not want it to get into the hands of someone who will misuse it. Some of the applications for digital checkbooks are GNUCash. Spendee, WalletWhiz, and Moneydance.

The functioning of such apps is quite simple. Download the software, and add details of your checkbook and yourself. Follow the application’s lead thereafter. After completing registration, you will be emailed a check through it.

Scan Or Click a Picture

The easiest way to send check online via email is to scan it or take a picture of it and email it to the receiver. Basically, you will have to fill out your paper check. Then, click or scan its front and back and send it to the receiver through email. However, before you go forward with this make sure the receiver’s bank accepts this form of payment.

Advantages Of Emailing a Check

Sustainable

Emailed checks are very sustainable. It eliminates the use of paper. Everything is done digitally and therefore digital checks are eco-friendly.

Cost Friendly

Using a paper check means you will have to bear the cost that is charged to issue you a checkbook. Additionally, you will have to bear the cost of posting and traveling to deliver the paper check. However, there is absolutely no charge to send check online.

No Mistakes

When you send a paper check, you cannot recheck it after it has been posted. You will know about Any mistakes in the check after it has been bounced or returned. This can cause consequences. However, in the case of digital checks, you can refer to the email that you sent. It will have all the details and you can recheck them. Therefore using digital checks is less prone to blunders.

Simple Process

Using a paper check involves a lot of different steps. You first have to fill it out, then post it. Then it will take at least a week to reach its destination. If anything goes wrong, the check will bounce and the entire process is repeated. Emailing a check simplifies the process. The check reaches its destination immediately and you can always send a new mail in case anything goes wrong.

Secure

When you post a check, there are chances of it getting lost. It can get into the hands of someone who might try to misuse it. But when you send check online, there is a direct connection between you and the receiver and there is no chance of it getting lost in between.

Convenience

Digital checks are way more convenient than paper checks. All you have to do is write a check, click a picture, and email it. Or you can send it through a digital check application.

Disadvantages of Checks by Email

Risk

Although sending checks online is more secure than paper checks but in case if a hacker hacks into your email, then you will end up losing all your sensitive information. Since you have used this email to send checks, all your bank details and personal information will be hacked as well.

Not Accepted Everywhere

Although sending checks by email sounds appealing but one thing you need to know is that not all banks accept this payment mode. They will accept traditional paper checks but they might not accept printed checks or pictures of them.

Email Scams

If you are using email for checks, your ID becomes more prone to scammers. Scammers can disguise themselves as bill collectors or investors to steal your personal details or your money. Moreover many apps used for digital checks can be fake and when you enter your details, it can be used for ill purposes.

How to Send Checks Electronically?

If eChecks has its advantages, it also has some setbacks. For example, one of the drawbacks is that sending eCheck is not as easy as writing a traditional paper check. Traditionally you just take out your checkbook, enter the details, sign it, and hand it off to the receiver or mail it. However, where traditional paper checks take longer to deliver, eChecks will be delivered almost immediately. Another drawback is that not everyone accepts eChecks. Therefore you will have to confirm with the receiver first.

Those who accept payments through eChecks have a portal dedicated to eChecks specifically. The payee will send you the link to this portal. You can then add all the details like your name and contact information. Along with this, you will be adding the invoice number provided by the payee themselves. Additionally, provide the check amount, bank account details, and other specifics.

How Do Digital Checks Work?

Now that you know how to send a check online, you must be wondering how such checks work? It is quite simple to understand the mechanism of digital checks. These are just like paper checks and work in a similar way. Just like you deposit a paper check in the bank or cash it out from the ATM, you can use a digital check in the same way.

These checks can be depicted online or physically in the bank or you can simply print them out and cash it from the ATM. There is absolutely no difference between paper checks and digital checks except for their mode of transferring and their delivery speed. Both are cashed out in similar ways. However, not all banks accept digital checks. Therefore before you make payments by emailing a check, make sure the receiver’s bank accepts it.

How to Deposit an Emailed Check?

You already know the answer to the question: “can you email a check?” but, If you are new to this whole digital check concept, then you must be wondering how to receive or deposit this check? Those of you who are receiving a digital check, you must provide your email address, the person to whom you want the check to be addressed, and the amount of the check.

Now you can opt for any one of the two “how to email check” ways. You can either send the link of your application to the person making the payment and they can fill out the details. Moreover, another way is that they can send you a picture of the paper check after filling out all the information. But you will have to make sure that the other person sends clear pictures of the check where all details are visible.

Payment can be digitized in various ways like digital checks whereas paper checks are sent by email. You will also have to ask for a certified check and a personal check for more security. Payment can be sent through money order or it can be made via apps.

You do not need to do anything in case you receive an eCheck. The payment will be automatically deposited into your account after the eCheck is processed through the clearing house. However, in case you receive digital checks via email, you will have to take them to your bank or your financial institution. But before you do this, make sure to inquire with your bank. You will have to ensure that your bank accepts printed checks or a picture of the check.

If they do, deposit the check and you will receive the cash in your account. However, in case your bank does not accept such checks, you can ask for payments via mobile deposits.

Is Emailing a Check Safe?

Now that we have answers to almost all our questions like can you email a check, how to email check, how to deposit an emailed check, or how to send a check via email, we can finally discuss if it is actually safe. The email itself is a secure system and most of us use it almost every day for work and many other purposes. But to your surprise, emails are not always safe.

While your mail is traveling in a network between you and the receiver, it can be stolen or get lost in the network due to a glitch. If an email containing all your bank information and a check are stolen and land in the hands of someone mischievous, they can use it for their own benefit or ill purposes.

When you deposit a check into a bank, it is uploaded to a completely secure system and destroyed soon after. Therefore the chances of data theft or scams are very low. However, if you are on the internet sending your checks online, many scammers can send you emails disguised as bill collectors or investors and they can steal your information or worse, they can hack into your email ID. Once they hack your ID, they have access to all the sensitive information.

Adding on to this, another major risk is if the recipient is not careful. The same can happen from their side when a scammer can hack into the account and they will not only get your information but also the receiver’s details. All your personal, bank and contact details will be in the hands of the scammer or hacker.

If you wish to avoid such consequences, you can:

- Send a check through an encrypted PDF. this PDF will be secured and no one other than you and the receiver can read it. No third party can mess with it. However, you will safely need to provide its password to the receiver.

- Send checks through files protected by a password. Only those who have access to the password can read the file. Therefore you will have to be careful with the password and to who you provide it. The less you share, the better.

- Fax the check. Although faxing has been discontinued, you can still get your hands on this from old printer shops. You can securely fax your check.

What is a Check?

There are different methods of payment, check in one of them. They are written documents that you can use to pay. Basically, it is a paper that contains a few of your bank details and you have to enter the receiver’s name and amount and sign it to make it valuable. Without your signature, a check is useless. Every bank issues its unique checkbooks for its customers. You can use the checks from these checkbooks to make payments. When you add your details and sign the check and then hand it over to the receiver of the payment, they can cash out the check from their bank.

Features of a Check

- Only the person whose name is on the check can cash it.

- If you do not enter the dare into a check, it is not considered valid.

- Each check is valid only for three months after the date of its issuance.

- There is a nine-digit MICR code at the bottom of each check. This code ensures the clearance process of the check.

- You will have to write the amount in both numerals and words.

- The signature of the person who is writing the check, i.e. the drawer, must be clear and there should not be any overwriting.

- You should properly write the receiver’s name on the check.

- One cannot clone a check because of the unique watermarks, holograms, and inks that are used to produce them.

- There is no requirement of stamping a check like the bill of exchange.

- Any check payment involves three parties which are: the person who is paying the amount (payer), the financial institution (drawee), and the receiver of the payment (payee).

- You or the receiver of the payment can access and use a check only if you both have a bank account.

Benefits or Uses of a Check

A check can be used in several situations. It is a mode of payment and has its own benefits. These are:

- You do not have to carry large amounts of cash. Instead, you can carry a single check.

- It is better to carry a crossed check rather than an uncrossed check. This is because the former cannot be cashed out and only deposited into the bank.

- In case you lose a check or it gets stolen, or any such activity, you can block or stop the payment.

- You can write a post-dated check in case you want to make a future payment. That check can be used in the future.

- Check is a secure mode of payment because the receiver has to show proof of identity while depositing it.

- You can transfer large amounts through one single check.

- Checks prevent physical loss of cash.

- They can be used as identity proof.

- You can trace crossed checks. Therefore prevents fraud activities.

Frequently Asked Questions (FAQs)

Q: Can I deposit an emailed check?

A: There are two ways to deposit an emailed check. But before you do that, you need to confirm with your bank if they accept it or not. If not, you can opt for other methods but if yes, you can either print out the check and deposit it. Or provide an emailed photo of it.

Q: What is the safest way to send a check in the mail?

- Use password-protected files

- Encrypted PDFs

- Fax

Q: How do you tell if an emailed check is real?

- Check if the domain name matches the sender’s email, then it is real.

- Make sure that the domain name is spelled correctly. There can be minor changes that are indistinguishable. If the domain name is spelled correctly, it is legit.

- If the email is poorly written, then probably it is a fake one.

- If the email included unnecessary attachments or links that are even a little suspicious, it might be fake.

- If the message establishes a sense of urgency, you might want to look into it. It can be fake.

Takeaway

Just when checks were starting to disappear, technology rose and introduced digital checks or eChecks. These are the checks that we can send instantly through an online network. While eChecks are processed and transferred through ACH, digital checks are transferred via email. This method has made payments very simple, easier, and faster. Although these checks have taken a toll on innovation it still has their own drawbacks.

If you wish to get familiar with everything related to digital checks and eChecks, you can refer to our article above. We have put together full-fledged information and a detailed guide to help you learn about this service. You can learn how everything is, works, and will be. We hope all your doubts regarding these checks are resolved.

Author Profile

- Elizabeth Jones is one of our editorial team’s leading authors on credit card offers, services & more. With over two decades of experience in the consumer credit industry and as a nationally recognized credit expert, Elizabeth provides in-depth analysis of both traditional & alternative forms of credit. Elizabeth regularly appears on many major media outlets including NBC Nightly News, Fox Business Network, CNBC & Yahoo! Finance. She is also a frequent contributor to Forbes Magazine. As a highly appreciated author for our exclusive Editorial Team, Elizabeth strives to provide readers with a trustworthy advice on how to manage their credit accounts while staying informed on the latest offers in the marketplace.

Latest entries

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide

BlogSeptember 26, 2023How to Block Payments on Cash App: A Comprehensive Guide BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide

BlogSeptember 21, 2023How to Add Money to Apple Pay: A Comprehensive Guide BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know

BlogSeptember 20, 2023PayPal Gift Cards: Everything You Need to Know BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide

BlogSeptember 20, 2023How to Add an Apple Gift Card to Wallet: A Step-by-Step Guide