Many individuals are unaware that you can get a credit card even if you have a poor credit score. These credit cards sometimes charge higher APR or provide no rewards, but will definitely help you uplift your credit score. There are so many credit card companies and financial institutions willing to provide credit cards for individuals with poor scores. However, they all have different terms and conditions. Speaking of which, Avant Credit Card is among those cards that help you build your credit.

Today, we will present the Avant Credit Card Review and discuss everything about the card. Its features, pros, cons, benefits, etc. so if you are planning to get a credit score that improves your score, this article is going to be very helpful to you.

Avant Credit Card: An Overview

Avant card is an unsecured credit card that helps in uplifting your credit score. Anyone can apply for this card, even if they have bad credit. ‘Unsecured’ means that you do not need to put down even a penny as a security deposit in order to get this card. With the initial credit limit of $300 to $3000, which can be increased, there are several other features that this card offers. The limit, however, depends upon your creditworthiness and income.

Avant is perfect for anyone who engages in foreign payments since there is absolutely no foreign fee. Having said that, the annual fee is relatively high and so is the annual percentage rate. But, regardless of its downsides, Avant will help you build a good credit score. It reports to the three major credit bureaus, thus, assisting in building good credit. One thing that Avant makes quite clear is that there are no rewards, cash backs, or even welcome bonuses. Thus, you will not get any points but if maintained and used wisely, your credit score will boost.

Your options are narrowed when your credit score is poor. Therefore, in your position, if you wish to gain some, you have to lose some as well. This means that, if you wish to get a credit card with a poor credit score, you will be able to uplift your score but you might have to sacrifice some rewards or advantages. Other than this, you will have to tackle some disadvantages. Like high annual fees and APR.

Features

Below mentioned are some characteristics or features of the Avant Money Credit Card.

Reporting

There are three major credit bureaus. The main job of these bureaus is to review your credit report and activity and evaluate your credit score. Avant Credit Card reports to all the major credit bureaus. Thus, Capital One will always keep your credit reports updated and send them to TransUnion, Equifax, and Experian for analysis and review.

Zero Fraud Liability

The term zero fraud liability basically means that any payment that takes place in your account but without your authorization will be borne by the bank. You do not need to worry about the loss as all of it will be covered by this card.

Credit Score Requirements

Most credit card companies require you to have a decent credit score. But this is not the case with this card. You can apply for this card even with bad credit. Bad credit is below 580, as stated by FICO.

Theft Protection

Avant offers to monitor all your card’s activities 24*7. In case, any suspicious activities take place, you will be immediately alerted. With 24*7 monitoring, you can know when and where your card is being used, therefore protecting it from theft. You can lock and unlock your Avant card if lost or stolen.

Emergency Replacement

In case the card gets stolen, lost, or misplaced, you can lock it and request an emergency replacement of the card. In urgent situations, you can also ask for emergency cash advances.

Credit Limit

Avant will review your creditworthiness and your income as well and give you an initial credit limit. This credit limit will be varying from $300 to $3000. However, your credit reports will be reviewed after six months. If you have maintained your card well and made all the payments on time without any defaults, you will be given an increase in the limit.

Build Your Credit

All you have to do is make all the payments on time and use your Avant card wisely. Avant will report this to the three major credit bureaus and they will give a raise to your score if no major defaults are found. However, if you miss a payment or make late payments, your credit score might suffer the consequences. The credit bureaus can knock off some points from your score.

Pros and Cons

Knowing the pros and cons of the credit card you wish to opt for can really affect your decision. Learning about both advantages and disadvantages is important in order to make an informed decision. Therefore, with this Avant Credit Card Review, we bring before you both the pros and cons of the Avant Money Credit Card.

Pros:

- You can apply even with a bad credit score.

- Helps build good credit.

- Zero liability protection.

- Emergency card locking and replacement.

- No foreign transaction fee.

- The credit limit increases after six months.

- Quick and easy application process.

- 24*7 card monitoring.

- Reports to all three major credit bureaus.

- 24-day grace period.

- No security deposit is required.

- A cash advance is allowed.

- No over-limit fee or penal APR will be charged.

Cons:

- APR is relatively higher.

- You will have to pay an annual fee.

- No balance transfer is allowed.

- A cash advance fee of $10 or 3% (whichever is greater) will be charged.

- The late payment fee is up to $39.

- No introductory APR scheme.

- No rewards, cashbacks, or welcome bonuses.

- Authorized users or joint accounts are allowed.

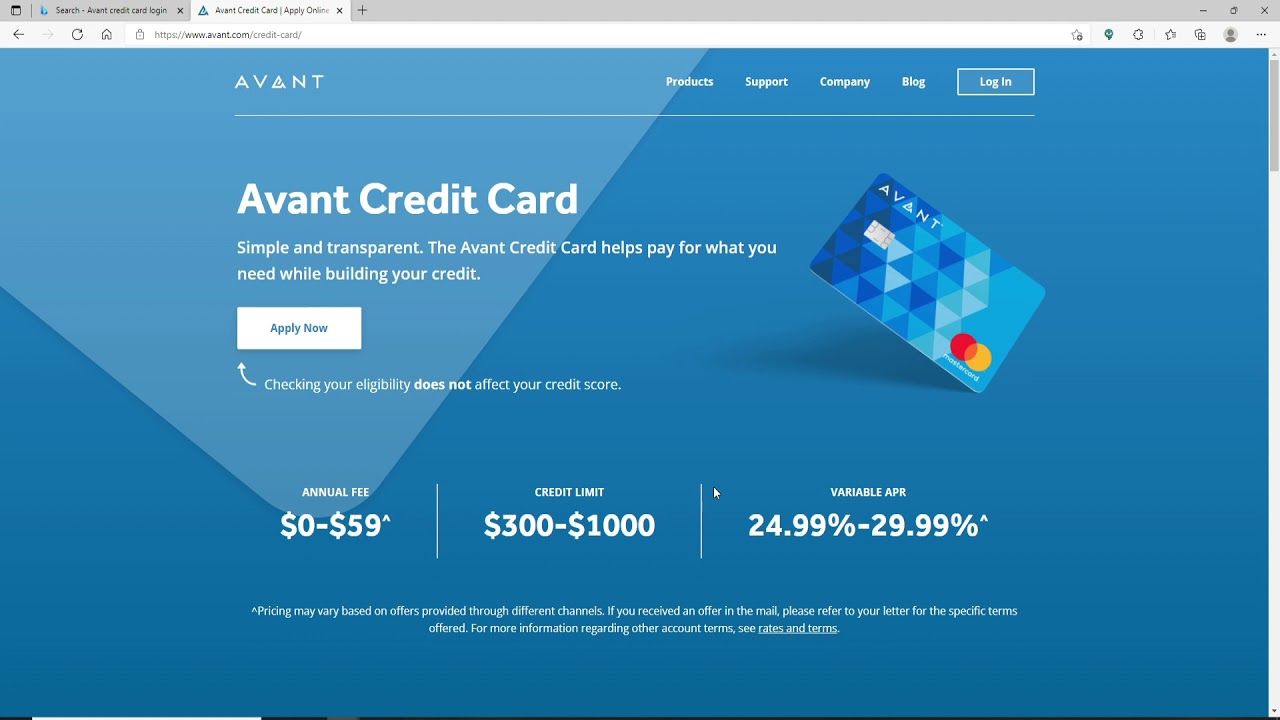

Fees and Annual Rate Percentage Structure

Fees:

Avant Money credit card charges a relatively higher annual fee. An annual fee is a charge that most credit card companies deduct from your account, yearly, in order to maintain the active status of your account. Speaking of this, Avant charges a $59 annual fee. Although there is no foreign transaction fee charged, you still have to pay other fees.

In case of late payments, you will have to pay an additional $39. Moving when, when you cash out from the ATM, you will have to pay either $10 or 3% of the amount, (whichever is higher) as a cash advance fee. However, in case you go over the limit, Avant will not charge anything for that. Additionally, no processing fee or monthly fee is charged, which is quite common in credit cards that help build credit.

APR:

Avant charges a higher annual rate percentage as compared to other credit cards. This APR range varies from 27.24% to 29.99%. However, being charged with APR is up to you. If you make all the payments on time, you will not have to pay interest on the sum. However, if you pay after the due date, interest will be charged. Therefore in order to avoid high-interest charges, make all the payments on time.

Having said that, the Avant Money credit card does not charge any penalty APR. Penalty APR is charged when you do not complete payments on time, consecutively, or if any defaults are taken place on your behalf. This will offer you a 24-day grace period.

Benefits

Services:

- Avant card helps in building credit.

- It reports to three major credit bureaus.

- A balance transfer is not allowed.

- Offers a 24-day grace period.

- Credit increases after every six months.

Protection:

- Avant covers all unauthorized payments. Therefore it offers zero fraud liability protection.

- 24*7 monitoring.

- Emergency card replacement.

- You will be reminded if anything suspicious happens.

- Emergency cash advances.

- Lock and unlock your card wherever you need to.

Mobile Application:

- You can manage your account, track your balance, record, and track all the transactions, manage expenses, pay bills, and whatnot, using the Avant mobile app.

- You can always view all your transactions and your expenses.

- 24*7 emergency assistance.

- You can make online payments via the app.

Fees:

- No foreign transaction fee.

- Cash advance fee of $10 or 3% (whichever is the higher).

- APR will be charged 27.24%–29.99%, variable.

- Late payment fee: Up to $39.

- No over-limit fee is charged.

- You will not be charged with any penalty APR.

- You will have to pay up to $59 as an annual fee.

Rewards:

The thing about the Avant Money credit card is that it does not offer any rewards whatsoever! This means no cash back, no reward points, no welcome bonus, and no introductory APR schemes. You can continue looking for another card if earning rewards is one of the reasons you get a credit card.

Avant Credit Card Application Process

Avant allows any individual to apply for the card, even if they have bad credit. However, you can only apply if you have successfully passed the Avant credit card pre approval. In this pre-approval or pre-qualification stage, you will get a clear indication of whether or not you are eligible to apply. It is barely a 5-minute procedure, where the company will perform a soft check on the details you provide. This will not affect your credit score at all.

However, if you pass the pre-qualifications, you can properly apply for an Avant money credit card. The company does not require you to have a good credit score, but it still requires you to have a stable income. You will have to go through a hard check after you have properly applied. The recruiter will check your income, your credit history, and your debt-to-income ratio, etc. they will use this data to approve your application.

Also, you need to keep in mind that whenever a company performs a hard check on you, it will knock off some points from your score. The hard checks are also shown in your credit report.

There are two ways to apply for an Avant card:

- You can apply online. All you have to do is go to their website and fill out pre-qualification and then the proper application if passed in pre-approval.

- You can also apply by responding to the invitation mail. If Avant finds you as a potential customer, they will send you mail to apply for the card. In this option, you will not have to go through pre-approval. You can directly go to their website, and add your invitation code and your social security number along with other details.

Avant Credit Card: Suitability

Avant is built to uplift your credit score. It has its advantages but it also has its disadvantages. However, it is suitable for individuals who:

- Have a poor credit score and are looking to uplift your score.

- Are not interested in earning rewards.

- Engage in numerous foreign transactions.

- Do not have enough cash to put down a security deposit.

- Do not use credit cards very often.

- Hate long application processes.

How to Do an Avant Credit Card Login?

Here is what you should do to log Avant credit card:

- You need to visit the Avant Card login page.

- Then enter the Username and password.

- At last, tap on the login button.

How to Make an Avant Credit Card Payment?

You can make the payment online and for this, there is no extra cost that you have to incur, or even you can mail them to their address or you can call customer care they will guide you and you can easily make the payment.

Avant Credit Card: Alternatives

You might not find Avant very suitable for you. However, it does not mean that all your options are closed. Below listed are some alternatives to the Avant money credit card. These alternatives may be better than Avant in certain places but may also be weaker in others.

1. Credit One Bank® Platinum Visa® for Rebuilding Credit

Just like Avant, Credit One Bank® Platinum Visa® for Rebuilding Credit will help you rebuild your credit score and does not require you to put down any security deposit. However with a higher annual fee and lower initial limit, Credit One offers a lower APR when compared to Avant.

Other than this, unlike Avant, Credit One does offer rewards and cash back. Therefore, if you are looking to rebuild your credit and earn rewards at the same time, Credit One Bank Platinum Visa for Rebuilding Credit will be a good option.

Pros:

- No security deposit is needed.

- 1% cash back on gas stations, groceries, mobile internet, TV, and cable bills.

- You might win up to 10% cash back on eligible purchases.

- Reports to the three major credit bureaus.

- Helps rebuild credit.

Cons:

- The initial credit limit is as low as $300.

- The annual fee is higher, i.e. $75 for the first year and after that $99.

- High APR, i.e. 26.99% (variable).

- You will have to pay foreign transaction fees and cash advance charges.

2. Mission Lane Visa®

Mission Lane Visa is your way of improving your credit score without paying any security deposit. The initial limit on your Mission Visa card will be low but you can increase it over time. The company will charge you annual fees depending on your creditworthiness. One good thing about Mission Lane is that it is upfront with all the charges and fees. It does not have anything hidden. You will clearly be informed of the extra changes you will have to pay.

Mission Lane Visa does not make you wait for approval. This means when you will apply, you will get to know whether or not you are approved within a few hours or minutes. Therefore you do not have to wait days or weeks for approval.

Pros:

- Reports to all three major credit bureaus

- Help rebuild your credit score

- No penalty APR or returned payment fees

- Does not charge any security deposit

- Instant approvals

- Foreign transaction fee: 0%

- Transparent fees and charges

- The credit limit increases every six months

Cons:

- APR is relatively higher, i.e. 26.99% – 29.99% (Variable).

- Lower initial credit limit.

- The annual fee varies from $0 to $59.

- The cash advance fee is $10 or 3% (whichever is greater).

- The late payment fee is up to $35.

- No reward or cash-back programs and schemes.

3. Prosper Credit Card

The Prosper card is unsecured, just like Avant cards. You will be offered a credit limit ranging from $500 to $3000. Although the annual fee of Prosper is relatively lower than Avant money credit card, you will be waived the first annual fee just by opting for Prosper credit card automatic payments.

Prosper does not charge any cash advance fee. This means you can cash out as much and as often as you wish, without having to pay additional fees. Also, if well maintained, you can increase your credit limit after inspection, every six months.

Pros:

- No cash advance fee.

- The proper application procedure is faster, smoother, and easier.

- It is an unsecured card, i.e. you do not have to pay any security deposit.

- It lets you increase the credit limit in 6 months.

- Allows you to perform foreign and international transactions.

Cons:

- Does not offer any cash back or reward programs.

- The annual fee is high.

- APR is high.

- It does not allow balance transfer.

Frequently Asked Questions (FAQs)

Q1: What is the highest credit limit for an Avant credit card?

The initial credit limit of Avant is $300. However, after every six months of review and verification, you get an increase. your credit limit can go as high as $3000. This can only happen if you use your card wisely and make all the payments on time, without going over the limit.

Q2: How long does Avant card approval take?

Avant is super fast when it comes to either application or approval. The application is smooth and easy. Coming to the approval, the fastest time is 60 seconds. Therefore you can get approved instantly, within a few minutes or hours, or maybe in 2 to 3 business days. It will not take more than this to get approved.

Q3: Where can I use my Avant credit card?

Since Avant is a MasterCard, you can use it anywhere where a MasterCard is accepted. This means it is just like any other credit card and can be used almost everywhere. It is ideal to make foreign transactions because of its 0% foreign transaction fee policy.

Q4: Who owns an Avant credit card?

Avant, LLC, formerly AvantCredit, is a private company in Chicago. The company was established in the year 2012 by serial entrepreneurs including Albert “Al” Goldstein, John Sun, & Paul Zhang. The Avant Money Credit Card, issued by WebBank, Member FDIC is an unsecured credit card for building credit.

Q5: How do I pay my Avant credit card?

You can pay for this credit card through checks or transfers. Moreover, you can also use the Avant mobile application to make instant payments through the app itself.

Q6: How to check the balance on an Avant credit card?

You can check your Avant balance by:

- Logging into your Avant account online.

- Calling customer care.

- Downloading the Avant mobile app where your balance will be visible on the home screen.

Q7: Is Avant a good credit card?

Avant is an unsecured credit card that helps in uplifting your credit score. Anyone can apply for this card, even if they have bad credit. Unsecured means that you do not need to put down even a penny as a security deposit.

Conclusion

If you wish to go for an Avant credit card, this guide will be more than helpful to you. You will not only learn about the card’s features, pros, cons, and applications but also the alternatives with this Avant Card Review. This credit card helps you rebuild your credit score without having to pay any security deposit. Although it does not offer any rewards, it offers a 24-day grace period, along with no foreign fee. Avant reports to all three major credit bureaus in order to uplift your credit score.

Avant Money Credit Card states that however the card helps build credit but has a relatively higher annual fee and annual percentage rate as well. Therefore, you may not find Avant to be suitable enough for you. If you want to know whether you are eligible enough for this card, you can undergo pre-approval. This does not require any hard checks, therefore your credit score is not affected. However, it will present you with a clear-cut picture of whether you are eligible to apply for an Avant Money credit card.

Author Profile

- William Smith is a highly respected and well-known figure in the consumer credit industry. With over two decades of experience and expertise, he is one of the most sought-after authors on credit card offers, services, and more. He has written extensively on traditional & alternative forms of credit and is a frequent contributor to Forbes Magazine, where he shares his wealth of knowledge with readers on topics such as personal finance. William can be seen regularly on major media outlets where he offers insight into the world of credit cards. He also strives to keep readers updated on the latest trends while offering sound advice on how to manage their accounts responsibly.

Latest entries

BlogApril 27, 2023Navigating the Tech Industry’s Dynamic Landscape: Insights from Amazon’s Recent Layoffs

BlogApril 27, 2023Navigating the Tech Industry’s Dynamic Landscape: Insights from Amazon’s Recent Layoffs Credit Card ReviewsFebruary 9, 2023Famous Footwear Credit Card Review 2024: Get Benefits on Footwear Purchase

Credit Card ReviewsFebruary 9, 2023Famous Footwear Credit Card Review 2024: Get Benefits on Footwear Purchase Credit Card ReviewsFebruary 4, 2023Ultimate Sephora Credit Cards Review 2024- Essential Information by Expert

Credit Card ReviewsFebruary 4, 2023Ultimate Sephora Credit Cards Review 2024- Essential Information by Expert Credit Card ReviewsFebruary 2, 2023Ultimate Kay Jewelers Credit Card Review in 2024: Finance Your Jewels Easily

Credit Card ReviewsFebruary 2, 2023Ultimate Kay Jewelers Credit Card Review in 2024: Finance Your Jewels Easily