In this fast-paced world, everyone, from the rich to the middle class, can experience budget fluctuation at some point or another. Even rich people can run out of money and have their wallets go flat because the world is full of financial uncertainties. People who depend solely on the money they get from their daily or monthly jobs are more prone to financial crises.

Under such a circumstance, apps like MoneyLion can help us avoid budget problems or other financial crises. As technology has improved over time, so has the way money is lent, borrowed, and paid back. Since the MoneyLion apps came out, consumers’ lives have transformed substantially.

There are many money-borrowing apps like MoneyLion that help consumers or clients deal with budget deficits or problems with how their money flows. So, if you’re one of the people who need to catch up on your finances, the apps below will definitely help you. Because after reading the following lines, you will end up choosing the Best App out of the three.

Cash Apps for Financial Freedom: User-Friendly Loan Apps

1. Klover

Klover is the first app on the list that we’ll talk about. It’s a data-driven, advanced cash app. It is one of the best apps similar to MoneyLion. It is capable of getting you $100 cash in advance in a fraction of a moment. Apart from having a seamless process of advance-cash delivery, it also offers you an additional amount.

However, your additional amount of cash depends on the task of completing questions and answers awarded to you during the application process for an additional amount.

Features:

- You can earn points enabling you to apply an additional amount.

- There is no interest rate accumulating to APR

- There are no hidden fees.

Counting on these features, you would notice that Klover is one of the best tools to meet your financial crunch.

2. Affirm

Affirm is the next one among the instant loan apps like money lion which focuses on helping with shopping and payment through its multiple. It can help to purchase almost everything from apparel, beauty, health, home and furniture, travel packages, and many more.

You just need to follow a few simple steps and you are there using its platform.

Features:

- There are no fines for backlog amounts or overdue amounts.

- There are no hidden charges.

- There are no late fees or due fees.

So, if you’re looking for loans like Money Lion, the Affirm app might be a good option for you. Because there are no fines or late fees added to the money you pay back.

3. Avant

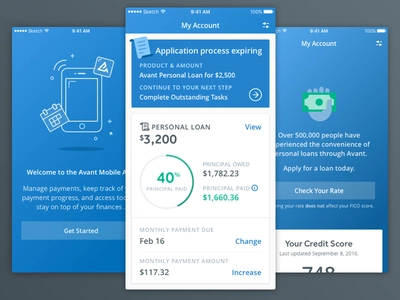

Avant is the most dynamic solution for those people who look for loans, credit card options, or advance cash flows. In other words, it presents you with three-pronged financial assistance through its loan, credit card, and advances cash.

With these three options, it is one of the most user-friendly loan-based financial solutions. It can be purely considered one of the loans like Moneylion i.e. it is best suitable for those who are more comfortable with loanable financial solutions.

Features:

- Its credit card facility will help you to buy anything ranging from $300 – $2,000. In other words, you have a credit limit ranging from $300 – $2,000.

- You can realize your personal goals such as purchasing homes or vehicles. It stands out among other sources because you can borrow from a base amount of $2,000 – $35,000.

- Avanta can help you if you need a cash advance to make up for a shortfall in cash right away. You are waiting to get paid in two days, but you need money now. This is where Avanta comes in to help you with your flat wallet.

- It has an interface for mobile banking, so you don’t have to worry about keeping track of your transactions while you’re on the go.

Because it has multiple benefits to offer, it is one of the best loan apps like Moneylion.

Aside from the main features we’ve talked about, there are some other things that make it a unique and dynamic platform for getting loans and cash advances. You can use the points you get from buying things to get prizes. You can apply for different kinds of loans, such as consolidation loans, emergency loans, loans for home improvements, and loans that are paid back over time. So, there are many options to choose from in order to minimize budget constraints or maximize the fulfillment of financial dreams.

Frequently Asked Questions (FAQs)

Q1. How long does MoneyLion Instacash take to process?

Upon approval, MoneyLion Instacash one to two days to deliver the cash to the account of the MoneyLion account holder. However, at a $3.99 turbo fee for the MoneyLion account holder, the funds are delivered as early as in minutes. For external account holders it takes around two to five business days whereas, at a fee of $4.99, the external account holder can get the money within four hours.

Q2. Does MoneyLion work with Cash App?

MoneyLion works with all major apps and web applications such as Venmo, Cash App, Zelle, PayPal, and similar kinds of platforms. In order to make the best use of its feature, all you need to do is to link your MoneyLion account to the cash app and there you are. You can follow the steps given on the platform of the cash app to link your MoneyLion account.

Q3. How does the MoneyLion credit builder loan work?

At just one time fee, MoneyLion can help you to create credit. MoneyLion sends your financial report to all three credit bureaus. At MoneyLion you get a credit builder loan amounting to as much as $1000. It will review all your financial transactions, and linked checking accounts. After that, it finds the report if you are eligible for the loan and how much it is.

Conclusion

Advance cash loans or cash flows are great ways to deal with financial problems and problems that might arise. As the world changes in many ways, so does the financial world. Recently, there have been a lot of changes in the financial world, and there will be more to help consumers and clients.

The above-mentioned advanced cash apps Like MoneyLion like Klover, Affirm, and Avant are great resources for many people nowadays as they offer opportunities to solve financial difficulties with advanced cash through apps similar to Moneylion or loans like Money lion.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders