Are you facing some financial issues? You don’t have money to pay your rent? Did you go out of budget while shopping? And now you need some extra money to survive till your next paycheck? If you have any such issues then instant money apps are there to help you until your next paycheck.

Though these money apps can help you with a small sum of money, you should not make it a habit to use these all the time. You should always have at least $5000 in your emergency funds so that you don’t have to take out a loan, even a small one and you can pay all your expenses with your own money.

Earnin is one of the most famous apps for instant money in America. This app not only provides loans but also has budgeting tools so that you can plan your budget. It has a very simple application process and you can get a loan of up to $250 within one or two days of your loan approval.

There are many other apps like Earnin which provide instant loans. Some examples are Dave, Brigit, PayDaySay, and MoneyLion. We’ll cover all these apps in this article so that you can choose from apps similar to Earnin.

How Does Earnin Work?

Earnin is one of the leading personal loan providers. They are known for their high trustability, good customer support, and fast money deposit. This app would be the best option for you if you have a regular stable income.

To get an instant loan from Earnin, you need an active bank account, a stable regular income, and your mobile or laptop and you get a loan from Earnin from the comfort of your home

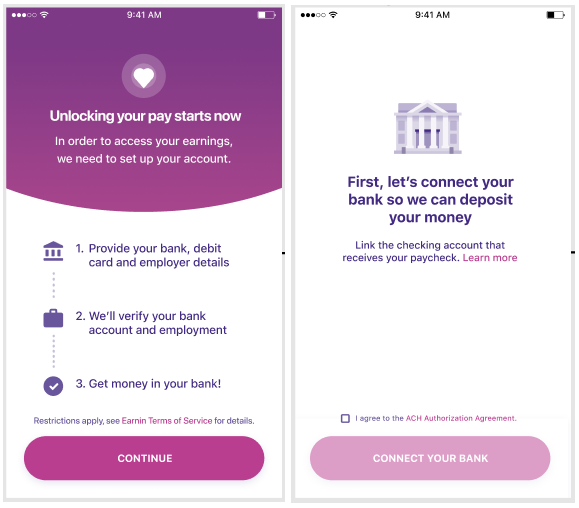

Get Money From Earnin: Step-by-Step Procedure

If you’re ready with your active bank account, regular income, and a laptop or mobile then we can move ahead with the step-by-step procedure to get money from Earnin.

Step 1: Make a profile on the App

First, you need to download the Earnin app and then make your account on it. Once you have your profile ready, link it to your active bank account.

Step 2: Mention your Income

Once you are ready with your profile, mention your monthly income on the app, don’t try to cheat them on this, they’re going to track your work. You can also mention your daily working hours. You can share your location, pictures, and pay slips as well.

Step 3: Apply for a Loan

The application process is very simple, they’ll tell you about the amount you can withdraw according to your income. You can request the sum you want to be deposited into your account.

Step 4: The Money is in your Account

After the loan application, the requested money will be deposited into your account within one or two days of application, as soon as your request gets approved.

Money Apps Like Earnin

Earning is one of the best apps but there are many other apps like Earnin which can provide you with an instant personal loan for your needs. These apps have many additional benefits as well. Here is a list of the best instant money borrowing apps of 2024, you can choose any app from these given options.

1. Dave

If you are looking for apps like Earnin that have budgeting tools then Dave can be the best option for you. Be it rent, groceries, or some extra shopping, Dave will provide you with a loan for everything. It has a subscription fee of just $1 monthly and it provides you a loan of up to $100. To get a loan, you need to link your active bank account to your Dave account and apply for a loan, as soon as your loan application is approved, you will get the loan.

Perks

- It does not check your credit before giving you a loan.

- Flexible repayment terms

- Only a $1 subscription fee

- No interest charges

2. Speedy Cash

This is another app like Earnin which provides loans to its customers. It gives a loan from $50-$26,000. It has certain criteria and if the applicant qualifies those criteria then Speedy Cash approves their loan and deposits the money into the applicant’s bank account mostly within 15 minutes of application completion.

Perks

- Provides loans of up to $26,000.

- Deposits money within 15 minutes of application completion on the instant funding option.

- You can take multiple loans from them.

- No hidden charges.

3. PayDaySay

This is also one of the apps like Earnin. Instead of being a direct lender, this app acts as a link between lenders and borrowers. This app has a database of all the potential lenders and borrowers and they can choose each other if their terms match.

Perks

- Provides options to the borrowers.

- Trustable because it has complete details of lenders and borrowers.

- Some lenders also provide same-day funding.

- It does not check your credit.

4. Brigit

This app provides you with a loan of up to $250. All you need to do is make your profile and apply for a loan, if your loan is approved then it will be deposited into your bank account within one to two working days or so. This app also has a budgeting tool that can help you plan your budget.

Perks

- It does not have any hidden charges.

- Budgeting tools.

- It sends pre-notifications so that you do not miss a repayment.

- It deposits the money within 8 hours of loan approval.

5. MoneyLion

MoneyLion is one of the apps like Earnin which provides a loan of up to $250. This app comes with two types of subscription, Core, and Plus. The Core membership is free whereas the Plus membership comes with a $28 fee. The best part about this app is that it helps in building your credit.

Perks

- Core membership is free of cost.

- Helps in building credit.

- No interest rate

- You can delay repayment up to 14 days

6. SoLo Funds

This is our last app like Earnin which helps its customers by providing them some additional money whenever needed. This app does not have any registration fee, and the amount of maximum transferable money depends from customer to customer based on their credit history.

Perks

- This app has investment opportunities as well.

- Lower subscription fees.

- Transparency.

- Additional tools.

Frequently Asked Questions (FAQs)

Q1- What apps are like Earnin?

There are many apps like Earnin which provide you instant money through small loans just like Earnin. Some of these apps are PayDaySay, MoneyLion, Brigit, and Dave. All these apps provide instant money within one or two days or even faster and their procedure is very simple.

Q2- How to borrow money from Earnin?

To borrow money from Earnin, you need to make a profile on Earnin and then link your active bank account to that profile. Once this is done, you need to add details of your income and then apply for the loan. The requested amount will be deposited in your bank account within one or two business days.

Q3- How much does Earnin Charge?

Earnin is free to download and use and does not charge any money on the withdrawn money so it’s completely free. But you can leave a tip of up to $14 if you found the app useful and are happy with its services.

Final Say

There are many apps like Earnin where you can get instant money for all your emergency cash requirement. Most of these apps do not check your credit and have low-interest rates. You can choose any of these apps whichever meets all your needs.

Though you can get money from these apps instantly, you should not make it a habit to use these apps regularly and you should always have at least $1000 in your emergency funds to meet all your urgent needs. It’s always better to use your own money instead of taking a loan.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders