There are several applications available that can help with budgeting and salary advances, however, Dave is one of the most well-known. Numerous other applications provide an identical capability as well, easily and frequently with a few minor differences in terminology and capabilities.

Hence, in this article, we will discuss some of the top and best cash advance applications that really make excellent Dave substitutes. Similar to Dave, the majority of the applications offer relatively modest payday cash advances, but some of them also give specific personal loans if you have more significant financial requirements.

Overview

Well, you are not required to hurry to the bank or register for legitimate payday loan online lenders when you need extra income or desire to obtain a cash advance. For anyone looking for a speedy remedy, there is a better choice available: cash advance applications like Dave money application.

When comparing personal loans or registering for a new credit card, these particular applications could serve as simpler alternatives for you. They enable consumers to get more funds for meeting their emergency cash requirements. Therefore, there is no need to travel to actual lending locations or stand in line for hours.

Top Level Loan Money Apps Like Dave

Here are the top cash advance apps like Dave that consumers may use to obtain immediate cash.

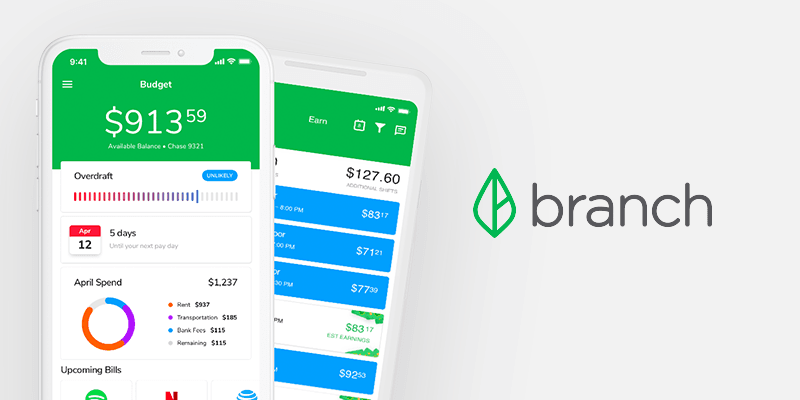

1. Branch

The Branch is one of the greatest cash advance apps like Dave. This particular application also provides personal loans in the majority of the nations where it conducts business. Also, this application provides a cash advance for you up to $150 each day or up to $500 of your salary in the United States of America. Hence, in excess of 40,000 locations across the US, it provides fee-free checking, a debit card, and free ATM access. This particular application “Branch” also allows you to send and receive money as well as pay bills and transfer money. Although ordinary advances to your bank account are free and take up to three working days, instantaneous advances to your debit card, which charges $2.99 to $4.99.

Here, the first requirement is that you must have received your wage from the same job for two consecutive months. Hence, you ought to transfer it to a bank that accepts it, open a checking account there, and get a debit card for it.

Note: The app’s functions are regrettably not available to remote employees, which implies that you won’t likely be able to utilize the app if your employer doesn’t have a physical workplace.

Hence, the application Branch provides its services outside of the United States in a number of different nations. Also, important info about this application is that it provides personal loans with interest rates as high as 360% in the majority of these markets and all you have is a range of options for payback terms, from 60 days to 336 days, depending on the size of your loan.

Here are some pros and cons you need to look at :

Pros-

- Free FICO ratings per month.

- Cash advance of up to $150 per day is free for normal transactions.

Cons-

- Restrictive criteria for cash advances, including interest rates as high as 360% in some regions.

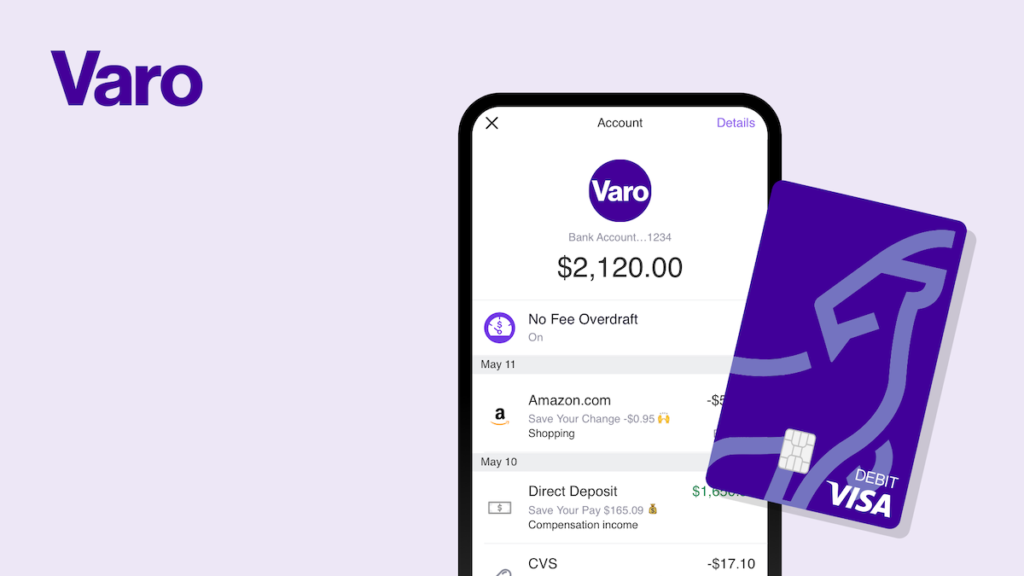

2. Varo

The services of cash advance apps like Dave are also available from Varo, although the qualifying standards are more strict in this application. A valid account that has been open for at least 30 days is necessary for the Varo Advance service. here the user must have a current Varo debit card connected to a Varo bank account, and $1,000 in direct deposits must have been made in the last 30 days.

A cash advance of $20 or less can be obtained by Varo members without incurring any costs, while advances beyond $20 will incur fees based on the amount borrowed.

Note: The most you may borrow from Varo is $100.

Varo users may benefit from Varo’s two-day early payday after setting up direct deposit with the company and here, early tax refund payments are also included in this advantage for you.

Pros-

- Early payday of two days and there are no fees for cash advances under $20.

Cons-

-

High fees expressed as a percentage and limited cash advance amount

3. Albert

Albert is one of the best money-borrowing apps like Dave for you. With no interest or late fees, Albert provides cash advances up to $250. As soon as the user receives payment, the negative sum will be taken out of their subsequent paycheck. Here, one advantage is that cash advances can be accessed by users without having to subscribe to Albert’s premium subscription tier.

The $4.99 charge for fast access to cash is one restriction to take into account, though. In any other case, the cash transaction will take 2 to 3 days to reach a customer’s/user’s account. Here, the Paychecks that are sent two days ahead of schedule and cash advances that have no negative effects on the credit are other advantages.

Pros-

- Early payout by two days

- There is no cost for regular delivery.

- There is no impact on credit ratings

- Money advance of up to $250

Cons-

-

For immediate cash advances, you need to pay $4.99.

4. SoFi

Also, SoFi is another cash advance app like Dave for you. SoFi is referred to as a bank, hence the restrictions are substantially larger in comparison to the other firms included on this list. By using its credit card, SoFi provides cash advance services. Here, the users may spend up to $1,000 in cash advance credit per day, with a minimum cash advance of $40.

Here, standard costs are applied due to the greater range of cash advance choices. The interest rate is greater than either $10 or 5%, with $10 being the default value. Hence, the Payroll claims can be made up to two days early for the respective SoFi users or subscribers.

Pros-

-

Large cash advance payments are permitted and early payout by two days.

Cons-

-

Users should own a SoFi credit card and it more costs than usual.

5. Chime

Chime is defined as a separate cash advance app like Dave, that gives users access to Earned Income information. Use of Chime is free, and there are no minimum balance fees, international transaction fees, or monthly maintenance costs. In Chime, you may access your salary two days before the payment date using this system, which functions similarly to Even and Daily Pay. Hence in contrast to Dave, it does not provide you a cash advance.

Also, you may send money to friends, relatives, or roommates using the Chime app without paying any transfer costs. With the help of Moneypass and the Visa Plus Alliance, consumers have access to more than 38,000 ATMs in the US. Where appropriate, you must pay a charge for making an out-of-network ATM withdrawal.

Pros-

- Early payout by two days

- No fees required

- $200 maximum cash advance

Cons-

-

Limits are based on user behavior and direct deposit and a valid debit card are required.

Why are Dave and Other Money Applications Preferable to Payday Loans?

As per reports, most Americans frequently borrow $500 because they do not have enough money to pay for unforeseen expenses or other bills for their living. Also, consumers feel stressed and unprepared to handle a financial emergency when it occurs to them.

Fortunately, you may now use a cash advance application to profit from the payday advance option. Hence, compared to conventional payday loans, similar apps like Dave are preferable because the procedures of the applications are really fast and safe. Your loan request may be made quickly from your smartphone in a short amount of time. Also, the money transfer is quick and easy as the money will be put into the borrower’s bank account within the same workday day.

Frequently Asked Questions (FAQs)

Q1: How does Dave work?

The Dave application is for Apple and Android devices and offers banking and financial services. To pay for basic things like gas or groceries, the Dave application offers users an advance on their paychecks. Additionally, a “spending account” is available with no overdraft or low-balance fees.

Dave charges a monthly membership fee rather than interest. A voluntary “tip” for the service is also accepted. The paycheck advance option requires you to pay a fee in order to access your money, therefore this can be considered a recommendation.

Q2: How long does the Dave app take to deposit money?

Depending on the kind of deposit, you can calculate how long the Dave application takes to deposit money. This application allows the users to get the money up to two days ahead of schedule if they create an account for direct deposit. On the other hand, payments made before 3 PM on a working day should be accessible the same day.

Q3: What are some of the money apps like Dave?

There are top-level applications for you all like Dave. Take a look at it –

- MoneyLion

- Earnin

- Brigit

- PayDay Say

- DailyPay

- Chime

- Branch

- Empower

- Floatme

Bottom Line

For a little additional cash in case of a crisis, there are various financial aid cash advance apps like Dave that provide small cash advances and personal loans. Numerous more capabilities, such as access to financial instruments, banking, investing, stock trading, and others are also provided by some of the applications on this list. Hence, this article is just intended for general informative reasons, even though we did our best to assure accurate, current information for every application on our list.

We hope this article helps you to find answers to “Cash advance apps like Dave”.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders