Do you frequently carry cash? People are depending on their cards more and less and carrying less cash. Many people have strayed away from cards and more towards apps. Countless applications exist that are designed to safely and rapidly send money to friends. Even payment options have been integrated into the services of several of the main social media networks. The highest-paid transfer applications offer a fast and simple approach to receiving and sending money to and from members of the family or from anywhere else. Your preferred transfer app as well as a phone or other personal devices are the only things needed. In this article, let’s hunt for the best and most popular app to pay back friends. Start reading.

What Actually is a Money Transfer Application?

A cashless transaction application is a software application that allows users to start banking transactions online without the requirement for any actual money exchange. Both the sender and the recipient of the payment buying capacity use online technology.

Best & Popular Apps to Pay Back Friends

We are privileged to have a broad range of options for transferring funds to someone using anything more than a little device you may keep in your wallet. The list of the most prominent applications for Apple, as well as Android for global transfers of money across various nations, is presented below-

Venmo

The most frequently used method for sending money between pals is still Venmo. In addition to being sleek overall, a vast number of individuals already have Venmo accounts. There is a decent chance your friend already has a Venmo account and is ready to accept payments if you need to provide them with cash. The cost of sending money from your bank account, debit card, or current Venmo balance is nothing.

There is a three percent charge associated with sending a Venmo payment via your credit card. In a related manner, while a conventional transfer from the Venmo account to your savings account is complimentary, an instant transfer is susceptible to a one % charge. The cost ranges from $0.25 to $10 at the low end of the scale.

PayPal

PayPal is a sophisticated curriculum that makes it simple to send money to friends and family. When sending money using a connected savings account or PayPal Cash, there aren’t any transaction fees. To use a credit card, debit card, or PayPal Credit carries a 2.9% fee.

Additionally, users have the choice of transferring cash overseas, which is a helpful function if they have close friends or professional colleagues who don’t reside in or have banking connections to the United States.

Apple Pay Cash

Amongst some of the top payment applications available is Apple Pay Cash. Cash may be sent and received by anybody, but only by iOS users. On the other hand, it’s absolutely worth looking into if you frequently send money to iOS customers and use an iPhone. It effortlessly interacts with everything iOS and Apple, as well as the Apple Pay Cash app, offers a good amount of extra functionality.

You may add your shop loyalty cards for convenient access, use Siri to transfer and receive money, etc. Payments made with your debit card or from an iOS device to another iOS device are free. Payments made with a credit card, however, incur a three percent charge.

Google Pay/ GPay

The money-transfer application Google Pay likewise absolutely works for transferring cash to family members and friends. Money may be swiftly transferred across the whole nation via the Google Pay app, sometimes known as “GPay.” You may send money to an individual who utilizes GPay with merely an email account and a mobile number. You can use your Google Wallet Card at ATMs and other designated places, as well as transfer the money from and to your savings account.

They provide a user-friendly interface that also enables bill splitting, the import of loyalty cards, and the usage of discount codes. Additionally, sending and receiving money are both totally free. In addition to the possibility of exchanging money, Google Pay also offers promotional offers and discounts. This is applicable in both iOS & Android.

Azimo

An easy and clean operation that offers quick and easy transfers, with instant or one-hour options. There are around 80 different currencies on offer from the service, and customers can choose from a variety of methods to transfer funds. First-time users also get the benefit of two transfers fee-free, and 24/7 delivery to selected countries.

A further recent improvement for Azimo is the launch of its Azimo Business function, which targets small and medium-sized enterprises that may profit from transactions that are frequently more expensive than those done via their bank.

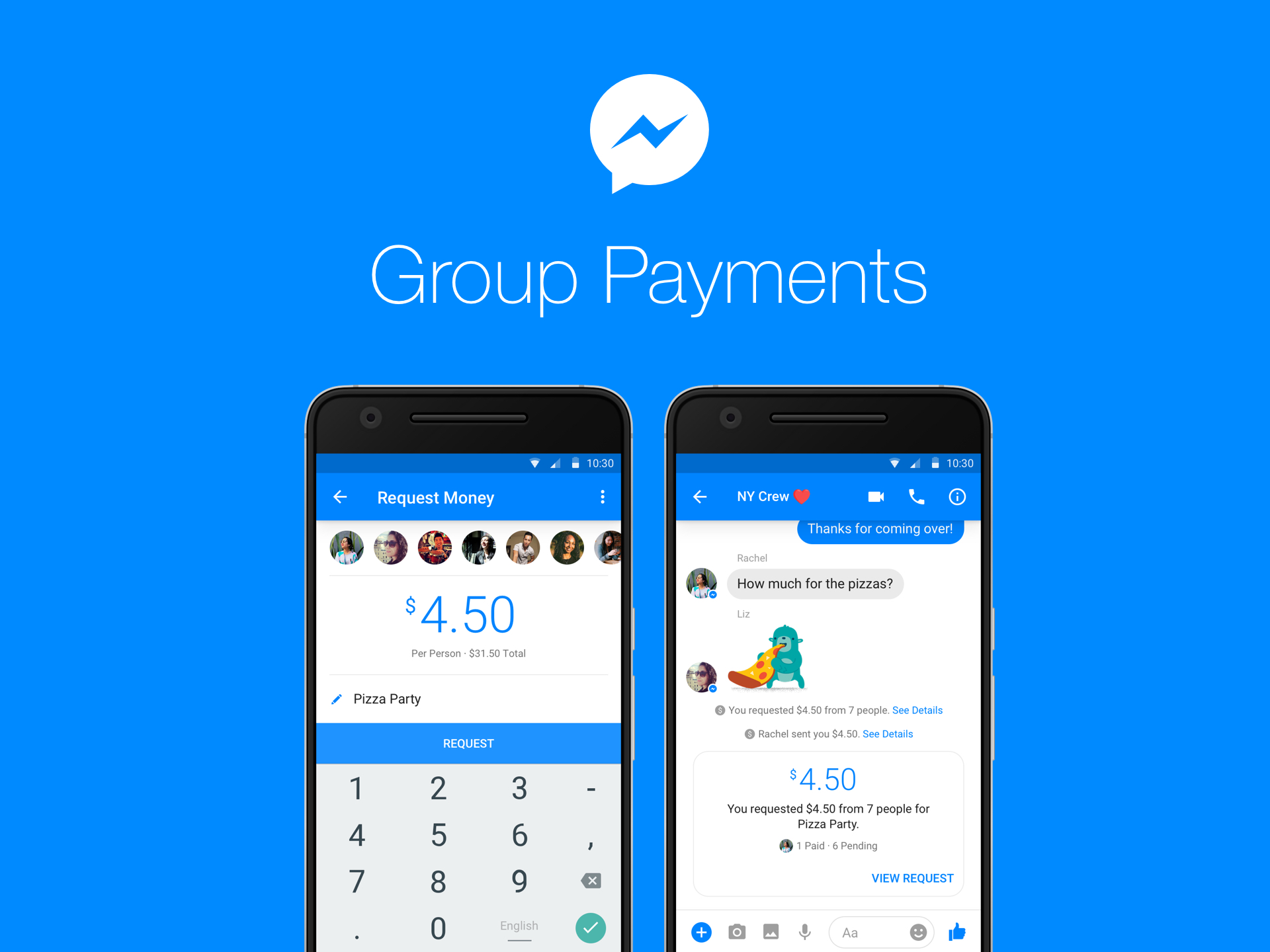

Facebook Messenger Payments

Through Facebook Messenger, the social networking site giant can accept payments. There are no costs associated with direct money transfers to acquaintances. Simple to use and perfectly integrated with Messenger, the purchase and transaction options are also available. There’s a good possibility your friend has a Facebook profile already.

Simply search for them in Messenger, select the Dollar sign, and enter your credit card information. Sometimes better, because Facebook has other sources of income, it is not necessary to commercialize its payment platform; thus, payments are made via debit cards and money transfers are entirely free.

Why is Using the App to Pay Back Friends Essential?

Since banks took their time embracing the internet, numerous developers were able to develop services that enabled transfers of money between people simple and rapid. Money transfers are still difficult to complete without a third-party money transfer service, despite banks having recently made money transfers internet easier. With the help of transfer apps, it is now cheap and simple to move money across the world in many countries. Anyone can simply use these apps to pay back friends.

Frequently Asked Questions (FAQs)

Q1: Is Venmo or PayPal more secure?

Despite the fact that PayPal is the proprietor of both services. PayPal is considered the most trustworthy, secure, and secure option for conducting online payments. However, Venmo is a better alternative for sending money fast and securely to friends and relatives.

Q2: For sending money, does PayPal impose a fee?

You may send money without paying a transaction charge through PayPal if you use your connected bank account, the PayPal Cash app, or your online PayPal account. However, whether you pay using your PayPal credit, debit, or credit card, you’ll be charged a 2.9% fee plus a set transaction cost of $0.30.

Q3: What type of wallet doesn’t require a bank account?

The use of prepaid debit cards is not a bank account obligatory. Without the requirement for a bank account, debit cards are offered by banks and other financial institutions. The receiver may use these prepaid cards exactly like such a debit card since they are loaded with a predetermined amount.

Q4: What are some of the best apps to pay back friends?

Some of the best apps to Pay Back Friends are listed below-

- Google Pay/ GPay.

- Venmo.

- PayPal.

- Azimo.

- Facebook Messenger Payments.

Closing Lines

Well, we have mentioned the most popular and the best “app to pay back friends”. You can use any of the following as per your choice. If you know of any other applications for money transfers, please share them with us in the comment section below.

Author Profile

- John Davis is a nationally recognized expert on credit reporting, credit scoring, and identity theft. He has written four books about his expertise in the field and has been featured extensively in numerous media outlets such as The Wall Street Journal, The Washington Post, CNN, CBS News, CNBC, Fox Business, and many more. With over 20 years of experience helping consumers understand their credit and identity protection rights, John is passionate about empowering people to take control of their finances. He works with financial institutions to develop consumer-friendly policies that promote financial literacy and responsible borrowing habits.

Latest entries

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide Low Income GrantsSeptember 25, 2023Dental Charities That Help With Dental Costs

Low Income GrantsSeptember 25, 2023Dental Charities That Help With Dental Costs Low Income GrantsSeptember 25, 2023Low-Cost Hearing Aids for Seniors: A Comprehensive Guide

Low Income GrantsSeptember 25, 2023Low-Cost Hearing Aids for Seniors: A Comprehensive Guide Low Income GrantsSeptember 25, 2023Second Chance Apartments that Accept Evictions: A Comprehensive Guide

Low Income GrantsSeptember 25, 2023Second Chance Apartments that Accept Evictions: A Comprehensive Guide