Buy Now, Pay Later is their motto. You are at Shoppers Stop and you liked something so much that you cannot stop yourself from having it but you are short of some cash. Affirm app can help you to get that with interest as low as 0% to 30% APR having your repayment split for 48 months that too without any late fee.

Of course, Affirm App is a reliable option for digital financing on account of yourself not having enough funds due to one or other reasons. However, it is a good practice to check and research before you go on using this financial app. And when we say financial apps, we should always be careful while using any digital financial app not just Affirm but any other. Therefore, this Affirm App Review will put forth the reviews and some pros and cons along with some other important points to remember as users and consumers.

Features, Fees, and Efficiency of Affirm App

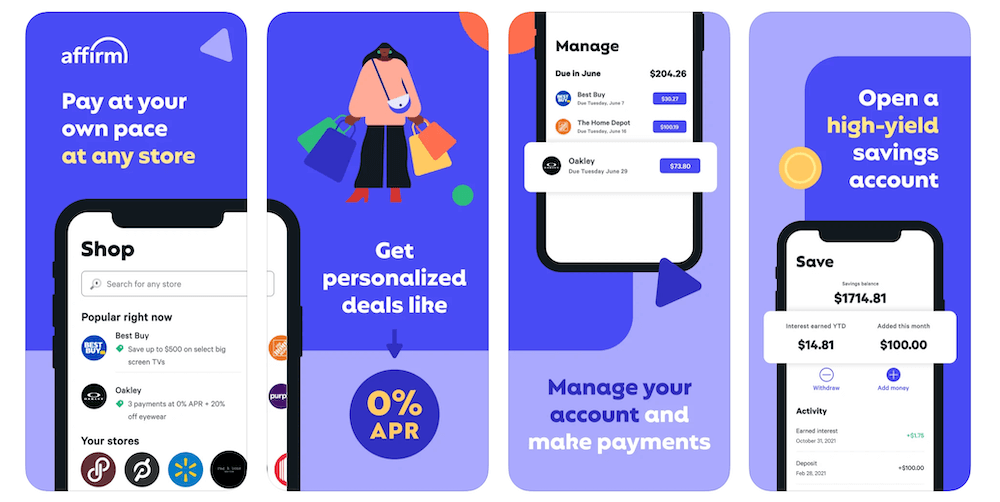

When it comes to features of Affirm, it is really suitable for every kind of situation you might be in relating to your purchasing willingness. Hence, some of the features most relevant to nowadays consumers are as follows, along with its fees and how efficient it is:

Virtual Card

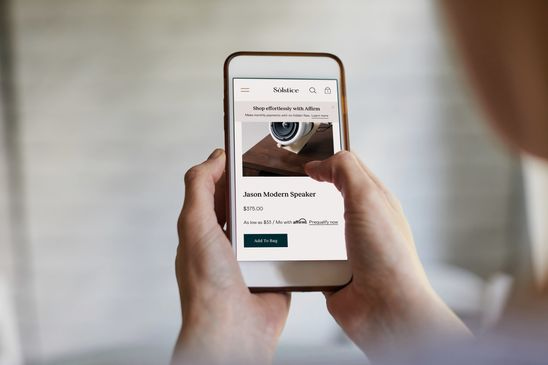

How does Affirm virtual card work? Affirm provides a virtual card to shop online for which you need to register on the platform and thereby apply for a virtual card after agreeing to the terms and conditions. Once they assign you a virtual card, you can now add it to your Apple Pay or Google Pay and use it as a regular card.

Interest-free Term Based Purchase

This is one good for those who are looking to get no interest for the purchase. Your purchase amount is divided into four parts where the first one you pay right away and three parts every two weeks. There are no extra fees or any interest.

Fees and Rates Involved Purchase

Affirm’s partnered retailers charge as close as 0% interest. These Affirm-associated retailers host brands like Ring, Casper, Room & Board, and Figs.

Outside these retailers, you might end up having to pay as high as 10% to 30% for your purchases depending on your credit history.

Trustworthiness & BBB Rating

Despite its great service and products, Affirm does not hold a good rating from its clients. This is because of the poor satisfaction arising out of the way its returns and cancellation are handled.

Hence, per the BBB website, its rating is 1.88/5 given by 564 users. Sitejabber.com reflects 1.5/5 based on 142 ratings. And on Trustpilot, 4500 consumers, and clients have provided ratings of 3.7 which is the only average rating in comparison to the above rating agency.

Affirm Deployability and Accessibility

This is the best part of Affirm. You can use and deploy it on any smartphone you can think of — iOS as well as Android platforms. You can also install it on iPad and Tablets. And you can also use it on your desktop.

Customer Support

This is again another bad part of Affirm apart from the returns and cancellations we discussed above. They are not as handy in getting the issues resolved as also their operation time is set from Monday through Sunday, 7:00 a.m. – 10:00 p.m., not live 24/7 though.

Merits and Demerits of Affirm

As for what is Affirm App, it allows you to have an entitlement to pay later for the purchases you make. In other words, you can call it their hallmark i.e. buy now, pay later, acronymed as BNPL.

You can finance your purchases using the Affirm mobile app while enjoying some great services like zero fees, no application, or down payments. Apart from these, you don’t even have to care about the late fee as a penalty as they do not charge any late fees. Conditional points to remember: you purchase at Affirm participating retailers to make use of 0% or very fewer rates while at other third-party retailers rates might be higher.

As for its pros and cons, there are many pros as well as cons. You can find the explanation of both in the following manner:

Merits

- When you purchase from Affirm retailers, you will get as low as 0% rates on your articles or products. You will pay only for the price of the products you are going to buy, no more than that.

- Affirm does not charge any late fees or hidden fees, so you do not have to worry about any penalty on account of not being able to pay before the due date.

- Affirm accommodates your large purchase. You can purchase as large as something amounting to $17,500.00. However, such a large purchase requires you to maintain good credit and a down payment too.

Demerits

- If you do not buy from Affirm-associated retailers, your rates may be as high as 30%. You might try to buy from other retailers because it suits your payment option. But you might get charged high-interest rates.

- Affirm will perform your soft credit in order to ascertain our prequalification and future spending limit.

- It doesn’t mean you have passed the prequalification check, you are now ready to complete the transaction. Every purchase you make has to get approval in order for you to complete the transaction.

- You did not like some of the products and you want to return them but you might face issues getting it canceled and having your money returned.

- Customer support isn’t that standard.

How Does Affirm Work?

Well, it works just the same as any other financial app like the Dave app, Earnin app, etc. If you purchase online, visit the eCommerce website or retailer/shopper website and check if it is Affirm associated retailer or not. After that, you need to check the credit option available for you. You need to enter your personal information along with your SSN and it will show up what credit option is open for you. The next thing you will do is select loan terms and interest charges. Two options are available there. First, you can select 4-12 month terms, and the second one is where you get interest-free loans for 2 months.

The final thing you will do is link your existing bank account and its related information. Affirm will directly withdraw the loan amount from your bank account.

Frequently Asked Questions (FAQs)

Q1. Is using Affirm worth it?

It is good for those who want to buy and pay later. It is developed because of the present trend going on in the market and due to the revolution in the online market. And it is worth giving yourself a try if you wish to buy products without any extra fees and interest, depending on some terms and conditions.

Q2. Is it hard to get approved by Affirm?

Getting approval is not a hard matter. Affirm will perform a soft credit check on your credit file in order to review your credit. However, they won’t post it on the credit report. Once you have qualified based on your credit, you will get a spending limit.

Conclusion

The features and services of Affirm are quite applicable for consumers of current generations because this is the era of eCommerce where you buy stuff online. Affirm issues Virtual cards keeping in mind all these requirements. This reliable financial tool is for those who want to buy something instantly without waiting for a paycheck.

However, you should be mindful that its return and cancellation option is not helpful as also its customer service people. Both these aspects would make you disheartened in the Affirm app.

Hence, if you are okay to tackle both these issues on your own, Affirm app would be a great choice for you.

Author Profile

- John Davis is a nationally recognized expert on credit reporting, credit scoring, and identity theft. He has written four books about his expertise in the field and has been featured extensively in numerous media outlets such as The Wall Street Journal, The Washington Post, CNN, CBS News, CNBC, Fox Business, and many more. With over 20 years of experience helping consumers understand their credit and identity protection rights, John is passionate about empowering people to take control of their finances. He works with financial institutions to develop consumer-friendly policies that promote financial literacy and responsible borrowing habits.

Latest entries

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide

Low Income GrantsSeptember 25, 2023How to Get a Free Government Phone: A Step-by-Step Guide Low Income GrantsSeptember 25, 2023Dental Charities That Help With Dental Costs

Low Income GrantsSeptember 25, 2023Dental Charities That Help With Dental Costs Low Income GrantsSeptember 25, 2023Low-Cost Hearing Aids for Seniors: A Comprehensive Guide

Low Income GrantsSeptember 25, 2023Low-Cost Hearing Aids for Seniors: A Comprehensive Guide Low Income GrantsSeptember 25, 2023Second Chance Apartments that Accept Evictions: A Comprehensive Guide

Low Income GrantsSeptember 25, 2023Second Chance Apartments that Accept Evictions: A Comprehensive Guide