Advance payment is a confirmation call to the service provider that the receiver is finally ready to take the product or service with entire confidence. Moreover, fewer chances of the denial of the product at the deadline or delivery time are the next point for such provision. That’s not a new term in the market.

Before the online/digital era or unsafe transaction fears, prepayment was in the trade, varying the buyer and seller perspectives.

For understanding the transparent frame of reference or complicated situation in this context, the article will do better on your behalf. Let’s get started.

Advance Payment Definition

In simple words, Advance Payment is the money that is paid for a product or a service before it is actually delivered to the final recipient. If you engage a person or entity to absolute your service or product and set a deadline. In most cases, the service provider demands prepayment for its favor. Complete, half, or a part of a payment is necessary to pay to benefit from the services or get the product delivered on time. The remaining amount gets paid to the seller! As soon as the service or the product reaches the sole or the last beneficiary.

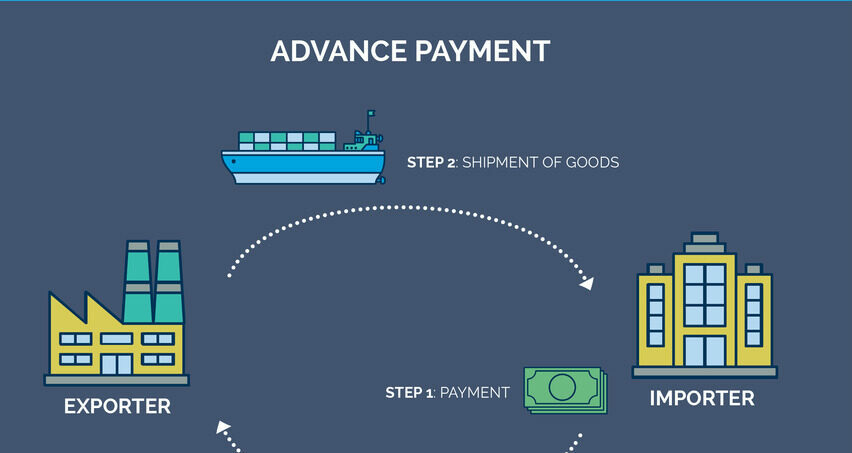

Goods and services are the criteria where two parties deal and fix the consideration with money. In the case of finished goods or products, the seller will not do shipping if advance payment is not in the seller’s bank account. For the service purpose- one can not get the intangible benefit without a pre-deposit. Deferred payment is possible if buyers and sellers agree on the point.

How Long Does an Advance Payment Take?

Making an advance payment is the agreement of the two parties and consideration of the debtor. If the sender sends the money and informs or ignores the information about its activities, then the possibilities are: the receiver can get the amount within 24 hours to 3 business days. In addition, the seller can ask for the advance amount favor from the concerned bank if the due amount didn’t transfer or received on time.

Tax Regime for Advance Payment

Buyers and sellers should be aware of the fact that advance payment includes several taxes in a monthly tax return. Find the requirements here.

- A fixed percentage is impossible on sales and use tax. (Retail sales/rents/leases/other comes under the taxation system)

- Sales and Use Tax for Marketplace Facilitators exists to collect/remit California sales and use for retail.

- Sales Tax on Meals is the further point where Massachusetts imposes a sales tax on meals at the rate of 6.25% on the restaurants recognized under Massachusetts law.

Read about- Do you know What is Debt to Income Ratio is?

- About 7% of sales tax is the Sales Tax on Telecommunications by the state government, and it is entirely free from local taxes.

- Room Occupancy Excise Tax is chargeable on the services taken for 90 days or fewer days at the rate of 6% under local tax law.

- Marijuana Retail Tax is 5% on retail services or products.

What is an Advance Payment: Examples

After the definition, an example is a perfect step to give a clear picture of this system. It is like a benefit to the receiver, covering several areas & including medical bills, rent payments, loan settlements before the term end, salary, sales tax, and more. If the buyer or service receiver doesn’t pay the advance payment, the seller has the right to stop responding to the services.

Do you know? There is the best trick to save 10k in 100 days. You can also save your money by taking a 10k challenge in 100 days.

There is no differentiation of rules; in payment based on the financial condition of the payer. Few exceptions can be there.

The Threshold for Advanced Payment

- It gets examined every year. And the taxpayers need to pay the advance payment when crossing $150,000 (one lakh fifty thousand dollars) for the taxable amount in the previous year starting from January 1 to December 31.

- The line item is practical for deciding the advance payment and threshold met.

- If; there are more than one tax return and sales return, the separate threshold is crucial to managing.

- As the limit exceeds, the threshold confirms the advance payment requirement.

Requirements for Advanced Payment

Several points can be considered to understand the requirement. Without meeting these requirements, you may lose what is not practically acceptable for the agreed terms by the payer.

- The requirement is a liability necessary to report using line items. It is divisible into two portions. The first goes from 1st day to the 21st day of the particular month, and the second one attends about eighty percent of the total liability of the last month.

- Furthermore, the payment needs to get settled via advance payment on the 25th or before the payment month.

- The advance payment is deductible for the tobacco retailer if it has paid it between the 1st day to the 21st day of the particular month.

- Other than that, if the tobacco retailer chooses the 80% method, it can subtract the last month’s total prepaid tax to calculate advance payment.

- Material man is not liable for advance payment & he can register via MassTaxConnect to acquire the benefit.

Monthly Filers Payment Due Dates

- For the prior year’s tax liability for the vendors and operators, if the taxable amount stops at $150,000 or stays less than it. No requirement for prepayment on the 25th of the month. Full payment is payable with the return at the end of the filing period. (on the 30th day)

You may have heard a lot about the Credit Karma company. But there are some other sites like Credit Karma that offer the best services related to credit scores.

- If the taxable amount limit exceeds $150,000 following the immediately preceding year, vendors and operators are liable to make advance payment from any of the two portions mentioned above. The deferred payment due date is the 30th of the month at the end of filing the tax.

What can an Advance Payment be Used for?

One has to follow the rule set forth by the tax authority for the prepayment. These are necessary to use it properly. You may face penalties imposition if not used as per the norms. See the penalties & Self-assessment down below.

Penalties & Self-Assessment

- A 5% penalty provision is there; when you pay the advance payment on the 25th day- less than the amount due for the prepayment.

OR

- It is less than 70% amount calculated under total tax liability. Underpayment is liable for penalty.

- You may use the self-assessment penalty worksheet for advance payment to check whether you become a subject of the penalty or not.

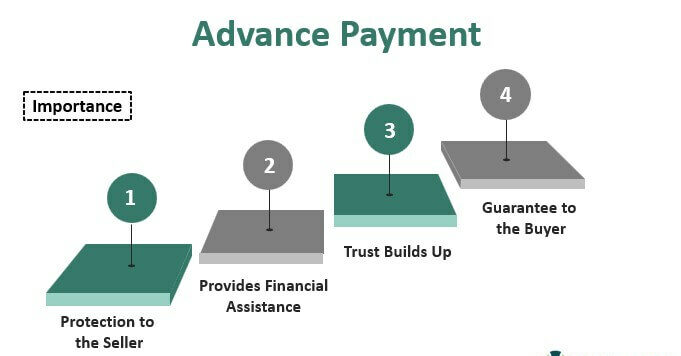

Advanced Payment Guaranteed

What is an advance payment is a question for those who now and then become part of this assignment. It is an assurance or guarantee of the seller in the context of the buyer that if it doesn’t succeed in fulfilling the promise, it will refund the amount with or without interest. Not just that, in this situation, the buyer or the service receiver can take legal action if things don’t settle on the initial level.

Considerations in the Context of Big Entities

Big entities indulge in very high-risk production. After receiving any order, they impart their full potential to complete the order on time. However, if their efforts go in vain just because the receiver has denied the acceptance of the good or the service, they can face a heavy loss. Prepayment can be a solution here because that’s a guarantee of the client that will receive the ordered consignment sent by the producer or the manufacturer.

Need money asap? Here are some best apps that loan you money for your needs.

Furthermore, the fund is the next point where prepayment should help manage the production requirements.

Consideration in the Context of Startups

Startups are prone to losses faster compared to big companies. An all-time fund is their prime requirement. It can not complete the order on time in the absence of funds. Furthermore, in case- any client has rejected the services in the middle of the project, they can get insolvent entirely. Advance payment is the solution for both parties because the service provider can get funds for the service or good production, and the receiver can impose sanctions if the startup doesn’t work on time.

Risk Involved in the Prepayment and Its Solutions

Internet threat is the prime point where one can feel doubtful about the prior payment of the goods and services. Sometimes, you may get what you didn’t expect in the transactions made via the big companies. All the entities are at high risk most of the time. Their incompetence will favor the big money lenders or payers. If you are not the part, nothing can help you here besides the long wait.

Restrain the Risk

One can counter the risk by involving thorough research of the entities or taking a recorded statement of the dealer about its promises. A piece of official evidence is good to carry while feeling any threat to your fund or money. Even though you are a small buyer, still take action against the company for a refund or its alternatives.

Frequently Asked Questions (FAQs)

Q.1 How long does an Advance Payment take?

It takes about 24 hours to 3 working days to receive advance payment from the debtor.

Q.2 What can an Advance Payment be used for?

It is useful for funding the services ordered by the buyer or for the service required.

Conclusion

Advance payment is beneficial and risky for both parties. Being a buyer, one can cheat the seller at the time of delivery of the product or the service; if he hasn’t invested in the product/service with prepayment. On the other hand, the seller can cheat if it denies the shipment, delivery, or transportation, even getting the half or part payment. It is good to take legal writing whenever making such types of transactions.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders