In life, you never know what is coming next to you in a financial crisis. Whether you are packed with all the plans or waiting to stabilize yourself with current issues in this scenario, a $1000 loan might help. But, a bad credit score aces up the sleeve against you in the face of rejected applications via high profile sticking to rules credit check institutions. Maybe! It could be a happy or sad minute for you. But not just you; many Americans are indeed grouping this crisis.

That’s the problem, Yet we have the answers to your queries. Expert guidance is always needed when rule-based statistics are not working for you. So, be right with us to know more and gain more.

Best $1000 Loan with Bad Credit (Short-Term)

Try these lending networks where you can maximize your chances of winning the loan credit in your account with fewer efforts.

-

MoneyMutual

MoneyMutual manages the loan amount up to $5000. Not just that, if in case; you want to start with a less than $1000 loan with bad credit let’s say $300 can get it with an easy deal. Till now, the company has helped millions of applicants meet their requirement for emergency cash immediately. Meanwhile, one should consider that when you usually check several platforms or money lenders approving your loan amount, it affects your credit score and image in the market.

Contrary, these networks save your time with a single application passed over to several money lenders, and the chances are high of approval. However, the interest rates & terms and conditions vary occasionally. Be protective here.

-

Universal Credit

It is one of the partners to resolve your financial crisis with a bad credit score of 560. The loan amount range is $1000-$50000, and the estimated APR is 11.69-35.93%. Before applying for this network, read the terms and conditions properly so that you won’t miss necessary financial goodwill for the hard amount in the future.

-

Bills Happen

To beat your emergency money needs, Bills Happen can help you tremendously. You may ensure its credibility with its presence from 2018 and by managing its advertisement on CNN, Fox News, etc. The best part is its answer to the general question (how can I borrow 1000 with no credit check) of up to 35.3% of Americans, who classify 630 as a credit score and trending this bad credit loan facility.

However, you must not cease the APR check in the hope of no credit check policy because the interest rate can make you empty in many terms if not triggered efficiently in the beginning.

-

Funds Joy Loans

With no origination fees and a quick and smooth process, you can avail of up to $2000 as a personal payday loan. Not just that, it is practical for those who want to start with less and less triple-digit loan approval because the minimum amount is $200. Read all the terms and conditions! Because the APR depends on the loan type and ranges between 200% to 1386% for payday loans for a cash advance.

-

BadCreditLoans.com

You may meet any need ($1000 loan with bad credit) of your life from payday to secured credit. It is affordable for professionals and individuals for personal needs. The loan starts from $500 and goes up to $10000. The interest rate is 5.99%-35.99% with 3-60 months.

How to Get a $1000 Loan with Bad Credit?

Now, it would be good enough to reveal a mark where the TransUnion market report confirmed that the average amount for a personal loan is 7,104 dollars. Now, you may think if your credit amount is only about 10% of the average still facing issues. How are others doing well, even with the entire amount? What’s the check? The check is- their credit score, goodwill in the financial sector, and last debt payment history. You don’t have that, but you may get 1000 loan with bad credit.

It is not predictable that you can get a loan from the same high-profile institutions, yet you can counter your financial crisis by coordinating with other sources who deal with no credit check policies. That’s not all the exceptions that are there. You must be prepared for them also. Opploans and Integra Credit are such institutions you can count on for applying for loans with bad credit. Mind it! They will still check your income & professional status to fix the settlement capabilities.

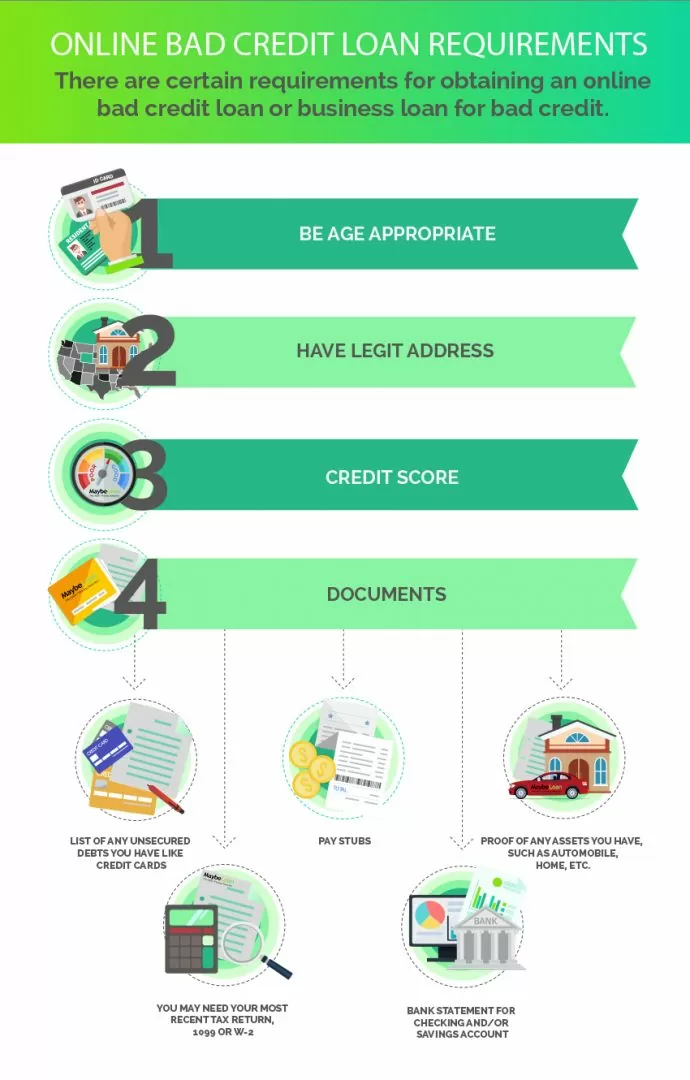

Documentation is always a necessary task for any application and its approval. Here also, you must act smartly: while simplifying your financial lifestyle. In comparison to offline lenders, online and network-based application processes are quite simple and prompt. Although some points are different, it would be good to express fundamentals to prepare yourself for the best time.

- That’s quite known to everyone. But for the confirmation especially, for document context, you must be 18 years of age to apply for any loan. (Secured, unsecured, emergency, installments)

- Income proof is compulsory as it is needed to fix the repayment confirmation on time with the principal and interest amount. Pay slips are best to convince the lenders and get the approval of the desired amount.

- Residence Proof is the next point to consider while making any application, whether for companies or a network. A document in this context or any valid ID proof with an address is perfect for the borrower.

- That’s the significant thing for any loan. A borrower should fill out the exact loan amount and its active bank account details so that if the loan gets approved, transferred directly to it even after a $1000 loan with bad credit.

Types of Loan

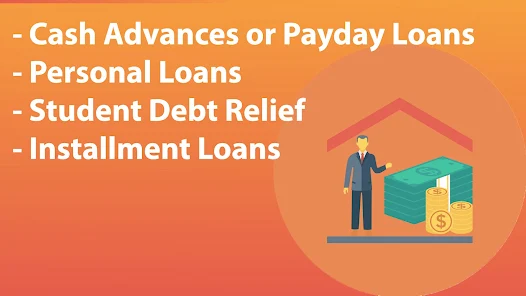

At the beginning of the article, we did explain that you should be weighty for your loan type and its reasons. The decision is crucial and varies according to the need and credit history. Every single decision is practical to fulfill different financial preferences. Let us understand them better.

-

Payday loans (1000 loan bad credit)

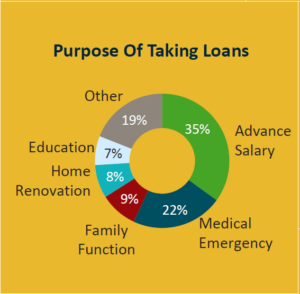

This short-term loan wonderfully curtails emergency money issues. The term is too short. Maybe! One to three weeks of the month until you receive the salary crediting message in your account. Not just that, it is possible to get within one hour or a day to throw out the undeniable expenses. The types of expenditure are unexpected tariffs, short-lived spending, accommodation pay, electricity bill, and more predicting your lifestyle.

-

Personal Loan

Nobody can define the exact meaning of a personal requirement to an extent because that is the case where you can’t predict the issue even if you are settled enough and doing good in life. The APR or annual percentage rate of personal loans for bad credit is as high as 36 percent and covers debt consolidation, title loans, medical expenses, home or ceiling renovation, tourism costs, vehicle repair, etc.

-

Installment Loans

$1000 loan in the form of Installment loans is for repayment in different time slots. One doesn’t have to pay it in one go. The duration varies between institutions and money lenders. The expenditures are like home improvement and more.

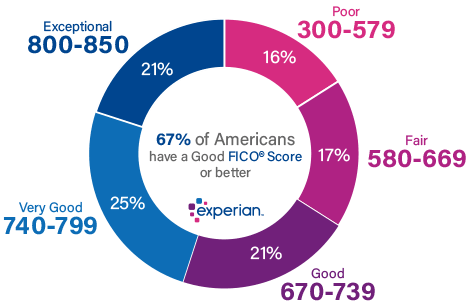

Scorecard for 1000 Loan

Like the application form details, the loan amount range, interest rate, and loan type, the scorecard can not define whether you will get the desired amount from the money lenders. In such a scenario, one must not forget that as long as they are close to the target or the highest credit score, it will be easy to get a positive response from the creditors.

But the Fair Isaac corporation or FICO has marked below 580 substandard for the borrowers. Moreover, that report Itself cannot clarify that you will get the targeted loan you planned. However, you can continue the efforts to stick to the 800-850 score. For whatever reason, if your score goes down to 300, then you are almost ineligible for credit approval. Again for this cause also, exceptions are there; you may still get a loan with preferred guidelines.

The end of the line is that there is no fixed score to get the $1000 loan with bad credit. Find the high to low grades for loan approval. (FICO Score)

- Exceptional (850-800)

- Very Good (799-740)

- Good (739-670)

- Fair (669-580)

- Very Poor (579-300)

Functions of 1000 Loan Bad Credit

The loan type determines the functionality of any credit.

You can finalize the $200 or $1000 loan for your expenditures. The main difference is between a personal loan, payday loan, or installment loan and credit score. The person- planning to take a loan needs to have a good score with perfect debt payment history to get approval for the new credit from traditional and high-class credit checking authorities.

On the other hand, you should find another network; that has less strict rules and credit checking policies and believes you while reviewing your credit application. For documents and details, we have given detailed descriptions in the same article related to age, documents, payment proof, and more.

Institutions to Getting 1000 Loan Bad Credit

In today’s time, everything is fast and quickly available for most people around the globe. That situation makes us happy, but that includes risks also. It is just because we are not ready for it in a positive way. We find a stone’s throw from achieving anything. The case is similar to the $1000 loan with bad credit. We have types to get the loan, but they depend on your credibility for that amount. Let’s see the spaces where you can apply for credit for a financial emergency.

- Banks are the primary spaces; most borrowers visit when they need to restrain their financial difficulties. But the question is regarding the $1000 loan. The task is simple and almost practical with this institution. Nonetheless, if you don’t have a good credit score, you can not cover the services of any bank nearby or at a distance from your residence.

They will strictly check your credit score because they want to assure the payback guarantee from any borrower they deal with.

- Crediting Organizations stand for their members only. To get- Instant or less processed loan approval, you must be part of that organization or union. However, fewer fees can make you comfortable in the group.

- Online and Alternative Money Lenders differ from the above money lenders. They are affordable for various borrowers- who have; a bad credit score or no credit history. Payday loans are in the tradition because of the current financial state of most Americans.

Ways to Choose the Best Emergency Loan

- Repayment Calculation: Repayment is the fact of any loan or credit. Whether an emergency loan or any Personal long-term loan, one has to repay it by wish or compulsion. Now, you have to determine how you will be Paying it and what sources you have to make the repayment. Better! Calculate it using the Personal Loan Calculator to see the impact on your monthly budget and choose the conclusive emergency loan from the institution or the network.

- Compare the Repayment Time and Interest: When you have applied to more than one or two financial institutions, go to check their APR or Annual Percentage Rate and the time frame given by the institution for the loan repayment. It is advisable to fix a long time for the principal amount return and interest: if your monthly budget doesn’t allow you for a large-scale amount.

- Down Payment Amount: It is the next point to be treated by every borrower while finalizing any institution to secure your financial needs. It applies to the personal. The down payment amount or origination fee means when the amount got approved by the lenders, they will deduct some amount from it before transferring it to your bank account or handing it over in cash.

Some Mindfulness Practices while Deciding and Applying for a $1000 Loan

Nobody can predict your financial status better than you. Because no documents can reveal your original identity, Right? So, It is always better to think seriously before asking for a $1000 loan, less or more, because financial debt can ruin a man badly with no settlement. The present unplanned expenses with this short amount can ignore your original need in the future. It is conditional that you should mark your goal, so never indulge in the bad score credit check again.

Furthermore, some mindful practices are necessary; if you know that no conventional and local bank will allow or approve the loan for you, then why waste time on it? Most four steps are considerable, like payday loan/debt consolidation loan/title loan/installment loan. Whatever your choice, be ready to pay it on time if somehow it gets approved by the money lenders. You may be well acquainted with the online services of every money lender- choose them first instead of going behind those who don’t even care for you, whether family, friends, relatives, or traditional banks & credit unions.

Family, friends, and relatives can’t help you gain your credit score to manage life-size financial practices in the coming time.

What are the Risks There for Advancing Money via Payday Loans?

The loan is a term that itself creates doubt in the mind of the person who thinks about securing it, and somebody else comes to know about others for this term. Risk is the synonym for a loan when not paid on time or used without repayment capability. However, you can take it, or most people prefer it when they meet with any financial emergency in their life. Here, the thing is riskier when you don’t have a good credit score- and you have taken a payday loan where you need to pay the entire amount in one go.

Bad credit loan approval means they may or may not check your history with strict rules and impose high interest rates with certainty. A report says that on Payday Loans- you may have to pay up to 600% interest for your approved and transferred loan amount.

Frequently Asked Questions (FAQs)

Q1: How Can I Borrow a $1000 loan with no Credit Check?

No credit check loan approval is possible except for the online network, particularly for these bad credit scores Americans. They are less strict in comparison to other traditional banks and credit unions.

Q2: How to Get $1000 Today?

One can get $1000 the same day by signing in on apps, like Uber Eats, fetch Rewards, Stash, Survey Junke, Index Dollars, and more.

The Final Note

How to get a $ 1,000 loan approval includes several crucial points to be remembered by the borrower. The article has handed over everything to you to make you eligible to get your loan approved with a bad credit record or no record in the past. Moreover, One may say-after studying the entire content; that nothing is separable from any context. You need to merge the things according to your requirements and apply them to the fullest to restrain the financial crisis of the time. They are helpful not just for this time; they suggest you do better for the large-scale amount for a bigger picture of life.

Author Profile

- Meet our Author of Our Editorial Team, Susan Anderson. She is an experienced writer and financial expert who has been writing about credit cards, card offers, services, and other related topics for more than twenty years. With her in-depth knowledge on the matter and her ability to distill complex topics into useful information for readers, Susan has become a go-to source for reliable credit card advice. In addition to her work at the editorial team, she also contributes to major publications such as The Wall Street Journal and CreditCards.com. With her expertise and industry experience, she is able to provide sound advice on all aspects of credit responsibly while helping people save money in the process.

Latest entries

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick)

LoanMarch 16, 2023Bad Credit Personal Loans Guaranteed Approval $5 000 (Experts Pick) LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide

LoanMarch 16, 2023How to Get Approved for a Cell Phone with Bad Credit: Guide LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions

LoanMarch 16, 2023Need a Loan Been Refused Everywhere – Some Effective Solutions LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders

LoanMarch 16, 2023No Credit Check Loans Guaranteed Approval : Top 10 Lenders